How To File 2019 Taxes In 2021 H&r Block

The attic dust motes danced in the single ray of sunlight, illuminating a forgotten corner. A stack of manila folders sat patiently, their faded labels whispering of years gone by. One, marked "2019 Taxes," seemed to beckon, a gentle reminder of unfinished business perhaps long overdue.

It's not uncommon to find yourself needing to file taxes from a prior year, even years later. If you're grappling with the question of how to file your 2019 taxes in 2021, or even now, H&R Block can be a helpful resource. This article will provide guidance on navigating this process and getting back on track.

Why File Late?

Life happens. Sometimes, circumstances prevent us from filing taxes on time. It could be due to illness, a natural disaster, or simply overlooking the deadline amidst other pressing priorities.

Whatever the reason, understanding the implications of filing late and knowing your options is crucial.

The Importance of Filing, Even Late

While the thought of filing late can be daunting, it’s essential to remember the benefits. You might be owed a refund. Failing to file means missing out on potentially substantial money.

Furthermore, filing late can help you avoid more severe penalties and interest charges that accrue over time. It can also prevent potential issues with future tax filings and interactions with the IRS.

H&R Block: A Helpful Resource

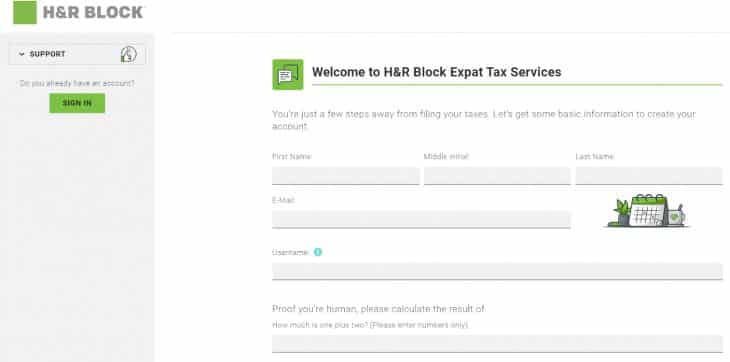

H&R Block has a long history of assisting individuals with their tax preparation needs. Their services extend beyond the current tax year, offering support for filing prior-year returns.

They provide different options to assist in filing back taxes. Options include software, in-person consultations, and virtual assistance.

Filing Options with H&R Block

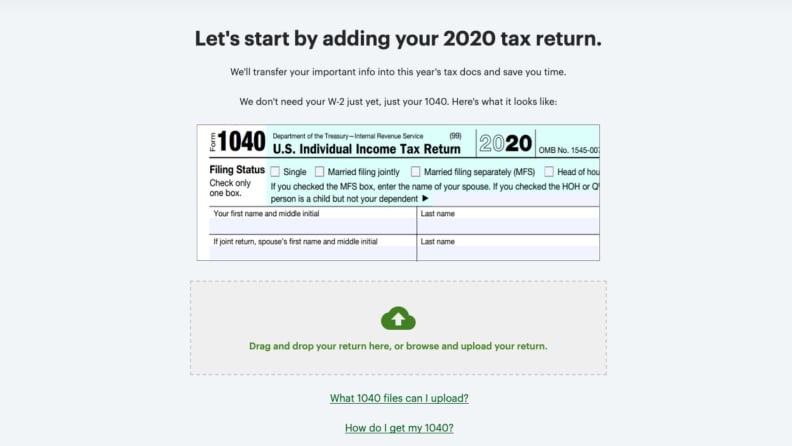

H&R Block offers several pathways for filing 2019 taxes, even in 2021 and beyond. You can use their desktop software designed for previous tax years.

For a more personalized approach, you can connect with a tax professional either in person at one of their offices or virtually. Their expertise can be invaluable in navigating the complexities of prior-year returns.

The option that is best for you depends on your specific needs and comfort level.

Gathering Your Documents

Before you begin, gather all relevant tax documents for 2019. This includes W-2s, 1099s, and any other forms that document your income and deductions.

If you’re missing any forms, you can often request copies from the issuing organizations or access them through the IRS website.

Completing the Return

Carefully complete the tax forms, ensuring accuracy. If you are using tax software, follow the prompts and instructions provided.

If you're working with a tax professional, they will guide you through the process and help you identify any applicable deductions or credits.

Take your time and double-check everything before submitting your return.

Submitting Your Return

When filing a prior-year return, you typically cannot e-file. You will need to print the completed return and mail it to the appropriate IRS address based on the state where you resided in 2019.

You can find the correct mailing address on the IRS website or within the H&R Block software.

Make sure to keep a copy of your completed return for your records.

Navigating Penalties and Interest

When filing late, it's essential to be aware of potential penalties and interest. The IRS charges penalties for both failing to file and failing to pay on time.

Interest accrues on any unpaid taxes from the original due date until the date of payment. Filing as soon as possible can minimize these charges.

In some cases, you may be able to request a penalty abatement if you have a reasonable cause for filing late. H&R Block can provide guidance on this process.

Looking Forward

Taking the step to file your 2019 taxes, even years later, is a responsible and commendable action. It allows you to resolve any outstanding obligations with the IRS and move forward with peace of mind.

While it may seem daunting, remember that resources like H&R Block are available to help guide you through the process.

Consider putting systems into place to ensure timely filing in the future. This might include setting reminders, utilizing tax preparation software, or working with a tax professional annually.