How To Find A Mortgage Lender

For many, buying a home represents the single largest financial transaction they will ever make. Navigating the complex world of mortgages and securing the right lender is a crucial step in this process. This article provides a guide to help potential homebuyers find the right mortgage lender to fit their individual needs.

The process of choosing a mortgage lender can seem daunting, but understanding the steps involved can empower buyers to make informed decisions. This guide outlines key strategies for researching, comparing, and selecting a lender that aligns with your financial goals and circumstances. It focuses on practical steps and considerations to help demystify the mortgage lending landscape.

Understanding Your Financial Situation

Before you even begin searching for a lender, take a close look at your finances. Credit score is a primary factor lenders consider. Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and address any errors.

Also, determine your debt-to-income ratio (DTI). This is calculated by dividing your total monthly debt payments by your gross monthly income. Lenders generally prefer a DTI of 43% or lower, though requirements may vary.

Finally, assess how much of a down payment you can comfortably afford. A larger down payment often translates to better interest rates and potentially avoids private mortgage insurance (PMI).

Researching Potential Lenders

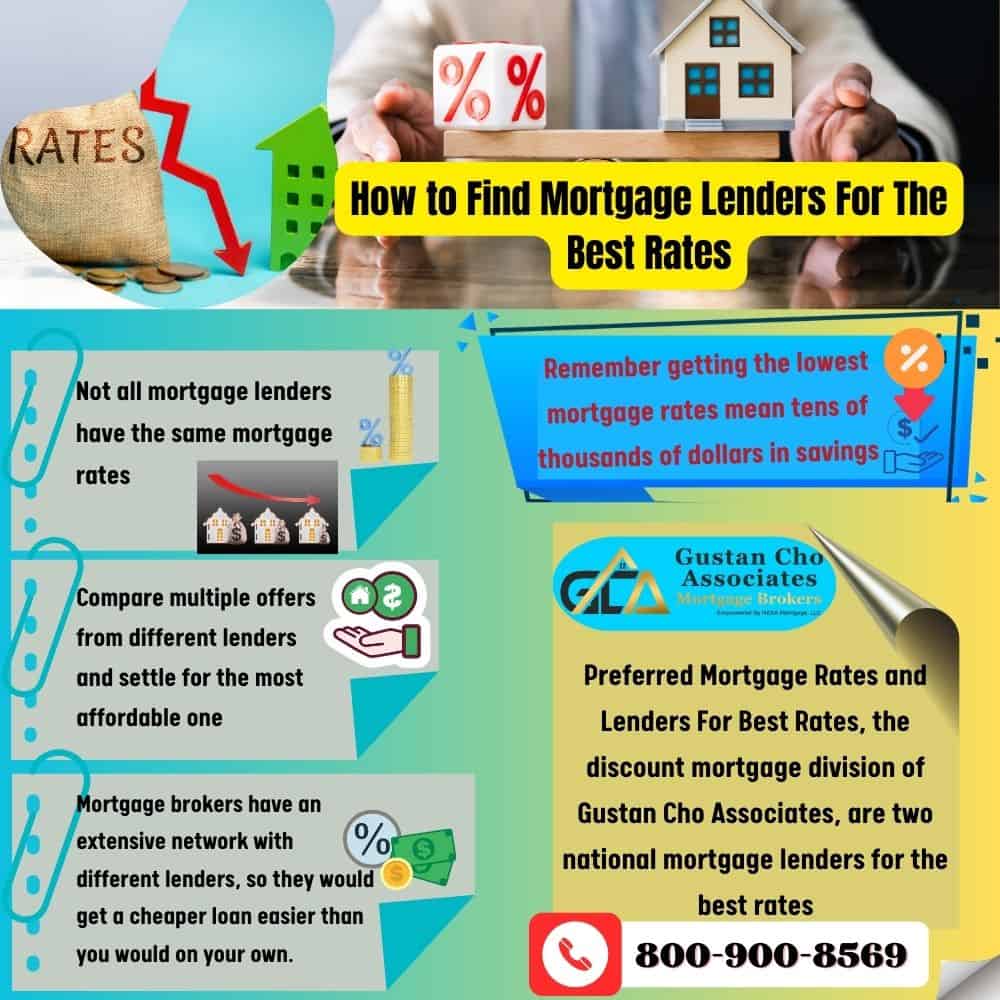

Start your search by exploring different types of mortgage lenders. Common options include banks, credit unions, mortgage brokers, and online lenders. Each has its own advantages and disadvantages.

Banks and credit unions often offer established reputations and a range of financial services. Mortgage brokers, on the other hand, work with multiple lenders, potentially giving you access to a wider array of loan options.

Online lenders can offer competitive rates and a streamlined application process. However, carefully research their reputation and ensure they are licensed in your state.

Gathering Recommendations and Reviews

Ask friends, family, and colleagues for recommendations. Real estate agents can also provide insights based on their experience with different lenders.

Read online reviews and check ratings on sites like the Better Business Bureau (BBB) and ConsumerAffairs. Pay attention to both positive and negative feedback.

Comparing Loan Options and Rates

Once you've identified several potential lenders, it's time to compare loan options and interest rates. Request a Loan Estimate from each lender.

The Loan Estimate provides a standardized overview of the loan terms, interest rate, estimated monthly payments, and closing costs. Pay close attention to the Annual Percentage Rate (APR), which includes the interest rate plus other fees associated with the loan. This provides a more accurate picture of the true cost of borrowing.

Don't just focus on the interest rate. Consider other factors, such as loan terms, points (fees paid upfront to lower the interest rate), and potential prepayment penalties. Understand all the associated fees.

Understanding Different Loan Types

Explore different types of mortgages to see which best suits your needs. Fixed-rate mortgages offer a stable interest rate over the life of the loan, providing predictable monthly payments.

Adjustable-rate mortgages (ARMs) have an initial fixed-rate period, after which the interest rate can fluctuate based on market conditions. ARMs may offer lower initial rates but carry the risk of increased payments later on.

Also, consider government-backed loans like FHA (Federal Housing Administration) and VA (Department of Veterans Affairs) loans, which may offer more flexible eligibility requirements and lower down payment options for qualified borrowers.

Making Your Decision and Applying

After carefully comparing lenders and loan options, choose the lender that offers the best combination of rates, terms, and customer service. Prepare all necessary documentation before applying.

This typically includes proof of income (pay stubs, tax returns), bank statements, and information about your assets and debts. Be prepared to answer any questions the lender may have during the application process.

Securing a mortgage is a significant financial decision. By taking the time to research your options, compare lenders, and understand your financial situation, you can increase your chances of finding the right mortgage and achieving your homeownership goals.