How Can You Send Money Through Paypal

Need to send money fast? PayPal offers a quick and convenient solution for transferring funds domestically and internationally.

This article provides a step-by-step guide on how to send money through PayPal, ensuring your transactions are smooth and secure.

Sending Money Through PayPal: A Step-by-Step Guide

Step 1: Access Your PayPal Account. Log in to your PayPal account via the website or the mobile app.

Step 2: Initiate the Payment. Click on the "Send & Request" tab or the "Send" button.

Step 3: Enter Recipient Information. You'll need the recipient’s email address or mobile phone number.

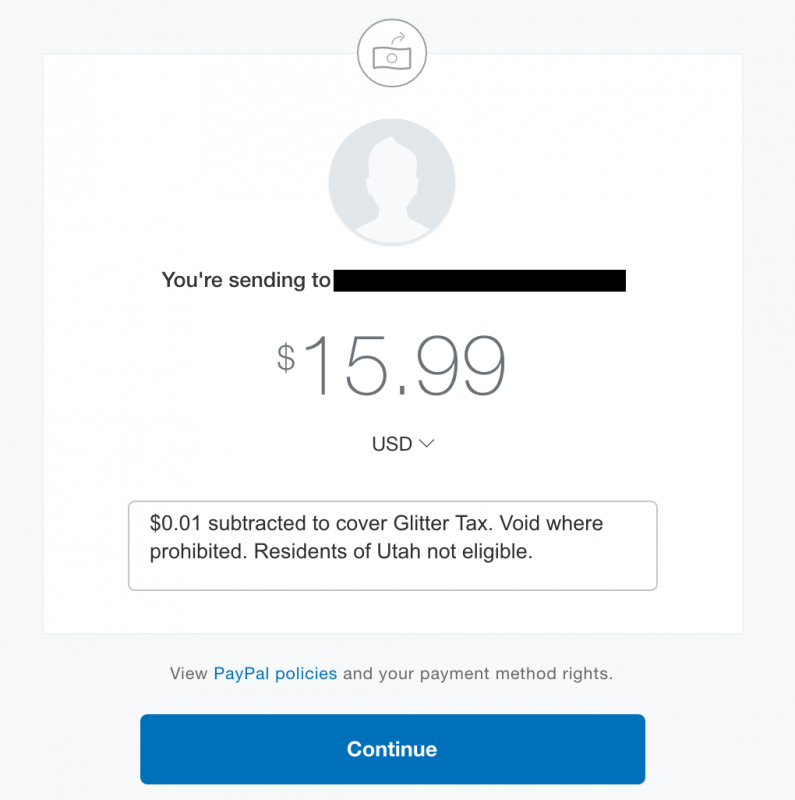

Step 4: Specify the Amount and Currency. Enter the amount you want to send. Choose the correct currency from the dropdown menu. PayPal supports sending money in over 25 currencies.

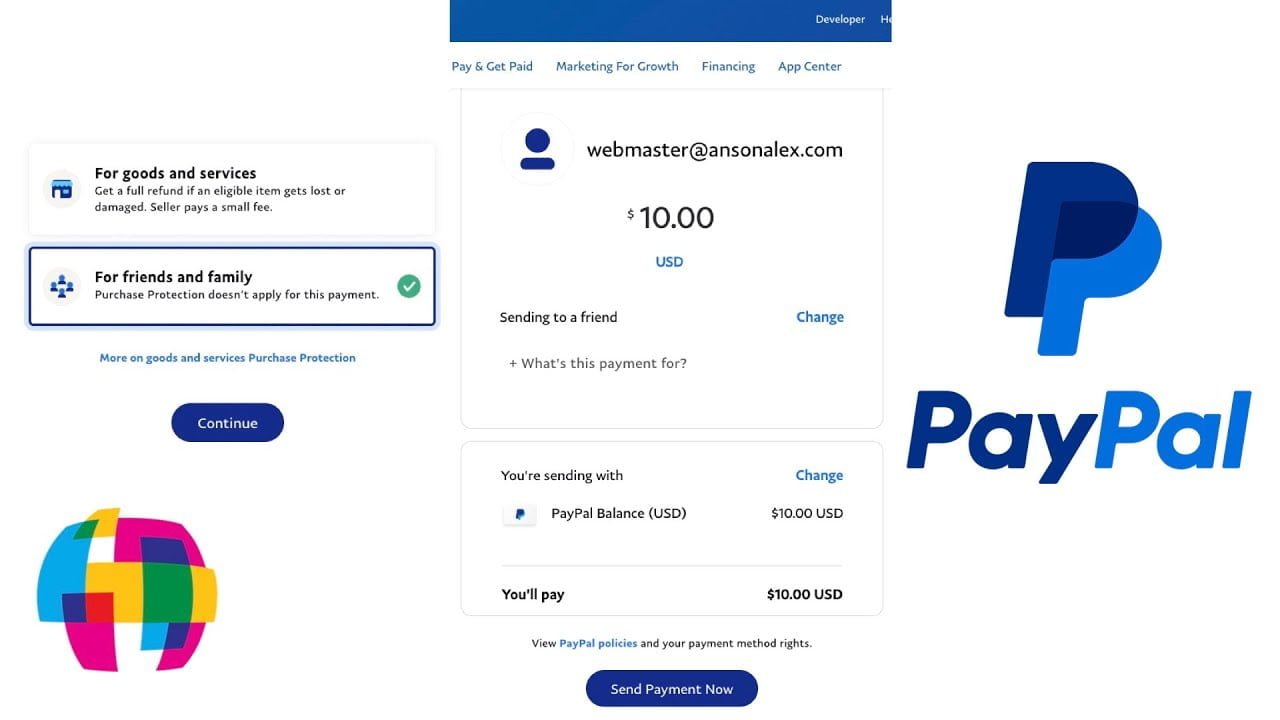

Step 5: Choose Payment Type. Select between "Sending to a friend" or "Paying for an item or service."

Choosing "Sending to a friend" is typically fee-free if funded by your PayPal balance or bank account.

Selecting "Paying for an item or service" might involve fees, but offers buyer protection in case of issues with the transaction.

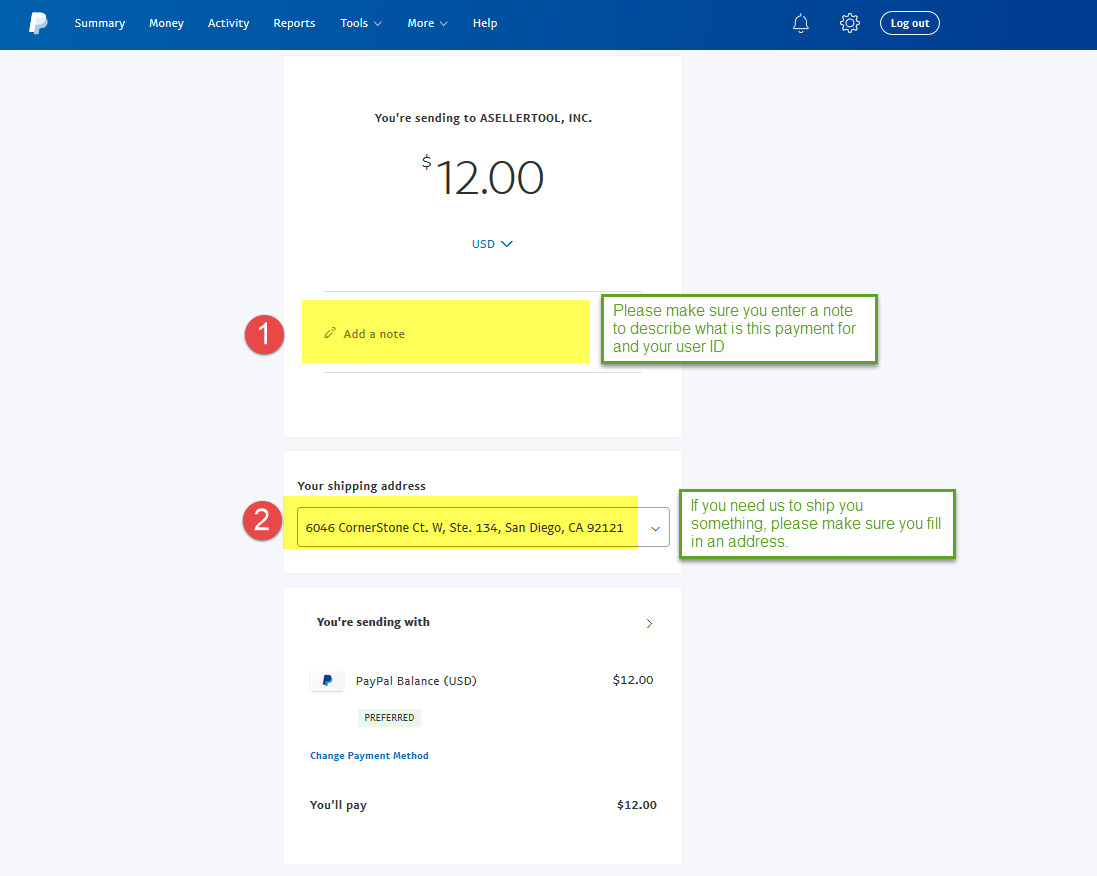

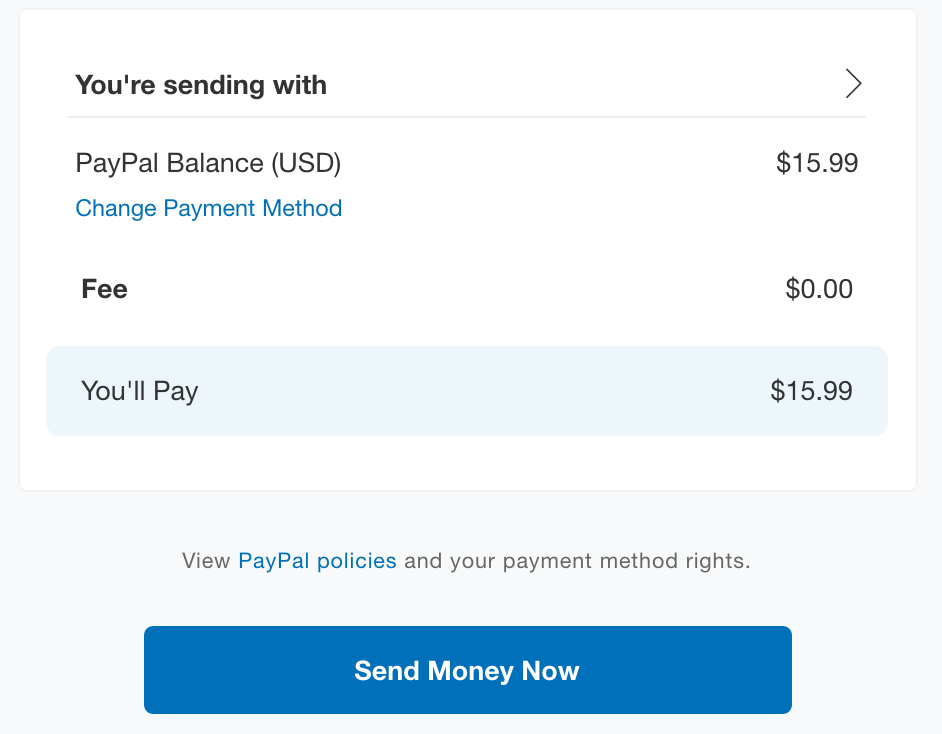

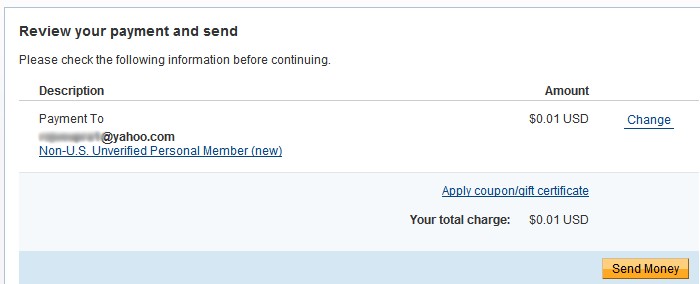

Step 6: Review and Confirm. Carefully review all the details before confirming the payment.

Pay close attention to the recipient's email, the amount, and the payment method.

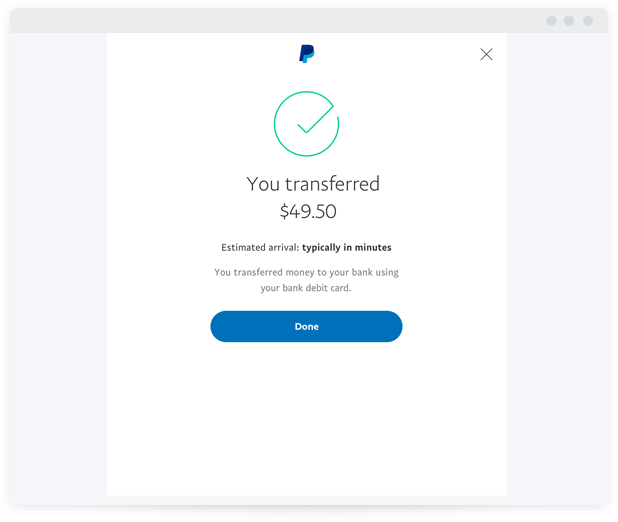

Step 7: Send the Payment. Click the "Send Payment Now" button to complete the transaction.

Funding Options: How to Pay

PayPal allows you to fund your payments through various methods. You can use your PayPal balance, a linked bank account, a debit card, or a credit card.

Using your PayPal balance or a linked bank account often results in lower fees compared to using a credit card.

Important Note: Fees vary depending on the payment method, recipient's location, and currency exchange rates.

Transaction Limits and Verification

PayPal imposes transaction limits to prevent fraud and ensure security.

These limits may vary depending on your account status and verification level. To increase your limits, you may need to verify your account by linking and confirming your bank account and card details.

According to PayPal, unverified accounts typically have lower sending limits than verified accounts.

Sending Money Internationally

Sending money internationally through PayPal is similar to domestic transfers. However, fees and currency conversion rates apply.

Be aware of the exchange rates and any additional fees associated with international transactions. PayPal provides tools to estimate these costs before you send the money.

Make sure the recipient's country is supported by PayPal for international transfers.

Security Measures

PayPal employs several security measures to protect your transactions. These include data encryption, fraud monitoring, and dispute resolution processes.

Always be cautious of phishing scams and suspicious emails requesting your PayPal login credentials. Never share your password with anyone.

Enable two-factor authentication for an extra layer of security.

Troubleshooting Common Issues

If you encounter issues sending money, such as insufficient funds or incorrect recipient information, PayPal provides resources for troubleshooting.

Visit the PayPal Help Center for assistance or contact their customer support team. The PayPal Help Center is available 24/7.

Common problems include incorrect email addresses and insufficient funds in the selected payment method.

What's Next?

Review your PayPal account settings to ensure your linked bank accounts and cards are up-to-date.

Familiarize yourself with PayPal's fee structure to understand the costs associated with different types of transactions.

Stay informed about any policy changes or updates from PayPal regarding transaction limits and security measures.

![How Can You Send Money Through Paypal How To Send Money Through PayPal — The Ultimate Guide [June] 2023 | by](https://miro.medium.com/v2/resize:fit:1200/1*Zs3h9i-ng1Uijs4u3YBMeA.jpeg)