How Much Money Will It Take To Start A Business

Aspiring entrepreneurs face a critical question: what's the real cost of launching a business? New data reveals the financial landscape, challenging assumptions and forcing a hard look at startup budgets.

The upfront investment needed to launch a business varies dramatically. However, understanding key cost drivers is essential for anyone planning to take the entrepreneurial leap.

Startup Costs Decoded

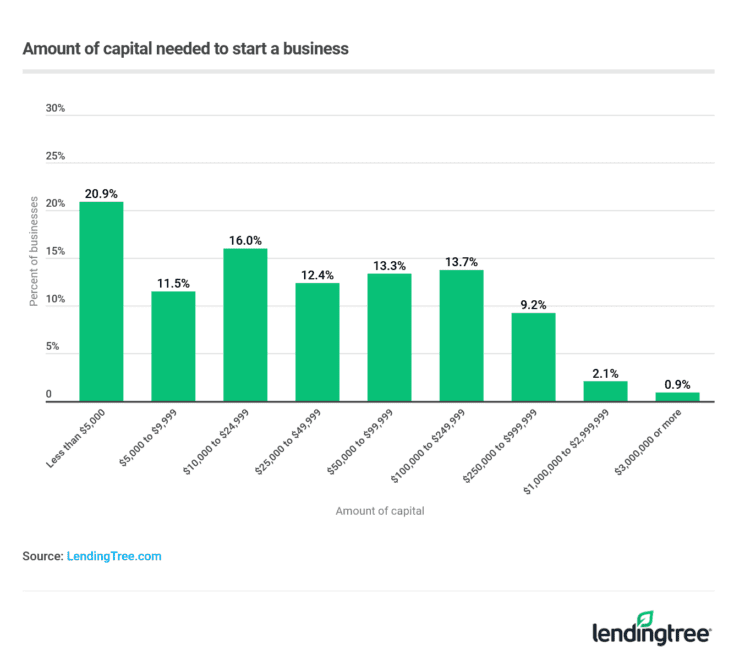

Recent studies indicate a wide range. A lean startup, particularly a home-based or online venture, could potentially launch with as little as $5,000. This contrasts sharply with brick-and-mortar businesses, demanding investments that can easily exceed $50,000 or even hundreds of thousands, depending on location and scale.

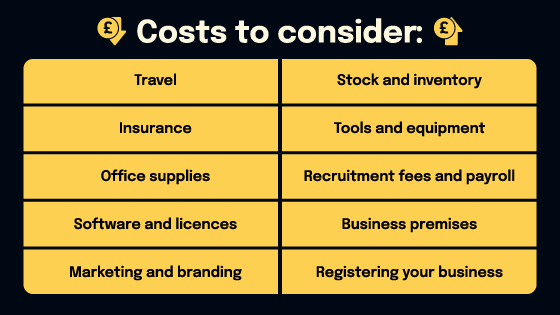

Where are these funds going? Essential expenses include legal fees, permits, licenses, website development, marketing, and initial inventory. For physical locations, factor in rent, utilities, and equipment costs.

The Lean Startup Advantage

The rise of the "lean startup" methodology emphasizes minimizing initial capital expenditure. This approach focuses on validating a business idea with a minimum viable product (MVP) before committing significant resources.

According to Fundera, the average startup cost in the US hovers around $30,000. This number is skewed by high-capital ventures; a significant portion of startups bootstrap with far less.

Online businesses often enjoy lower barriers to entry. Platforms like Shopify and Etsy provide readily available infrastructure, reducing website development and hosting costs.

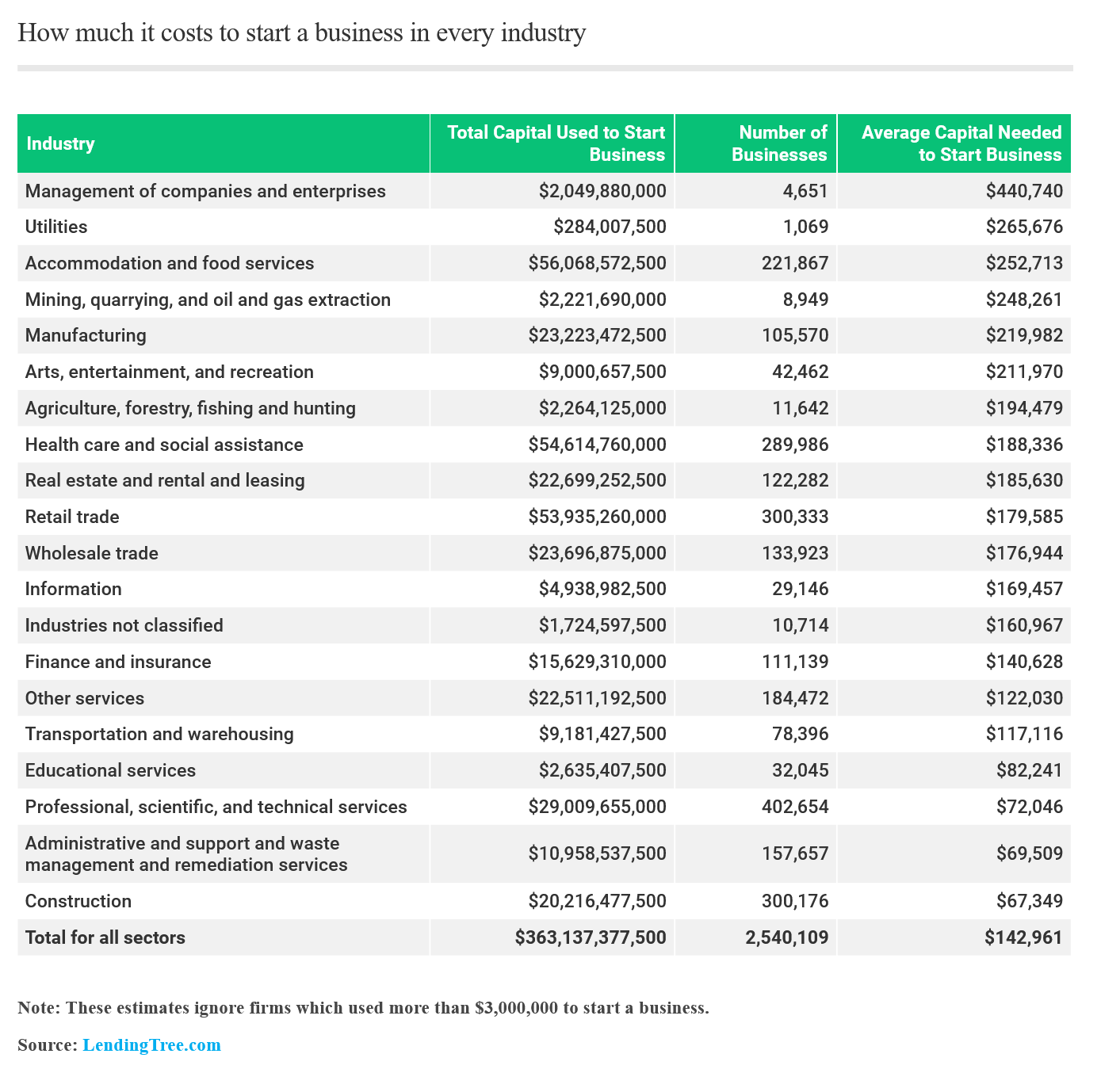

Industry Matters

The industry you choose drastically impacts initial investment. A tech startup developing a new software application will face different cost pressures than a food truck operation.

Technology businesses may require substantial investment in research and development. Food businesses will need to comply with a different sets of regulations.

A coffee shop, for example, necessitates investments in commercial-grade espresso machines, seating, and point-of-sale systems. A consultant's office needs fewer things and thus costs less.

Funding Your Dream

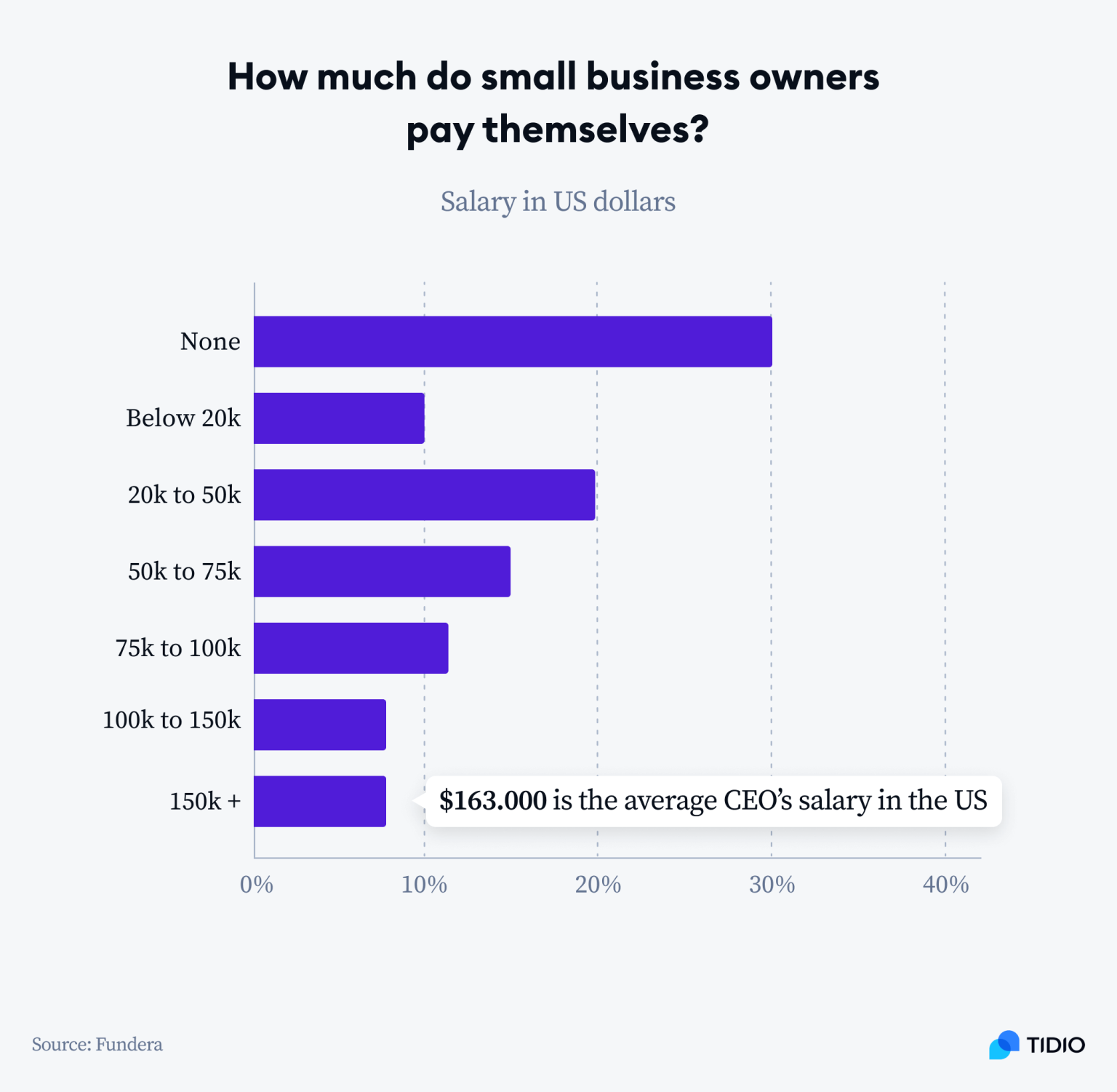

How are entrepreneurs funding these ventures? Personal savings remain a primary source. Small business loans are also important for new business ventures.

Friends and family contribute a smaller percentage. Venture capital is for high-growth tech companies only.

Crowdfunding platforms like Kickstarter and Indiegogo offer an alternative funding route. However, success hinges on a compelling product and effective marketing.

Navigating the Financial Maze

Accurate cost estimation is paramount. Develop a detailed business plan that outlines all projected expenses. This plan should consider both one-time startup costs and ongoing operational costs.

Research available grants and funding programs. Many government agencies and private organizations offer financial support to startups, particularly those in underserved communities.

Seek mentorship from experienced entrepreneurs. Their insights can help you avoid common pitfalls and identify cost-saving opportunities. The Small Business Administration (SBA) is a valuable resource.

"Starting a business is a marathon, not a sprint. Adequate preparation is key." - SBA Official

Entrepreneurs must prioritize understanding actual startup costs. Further updates on funding trends and support programs will be released by the SBA next quarter.