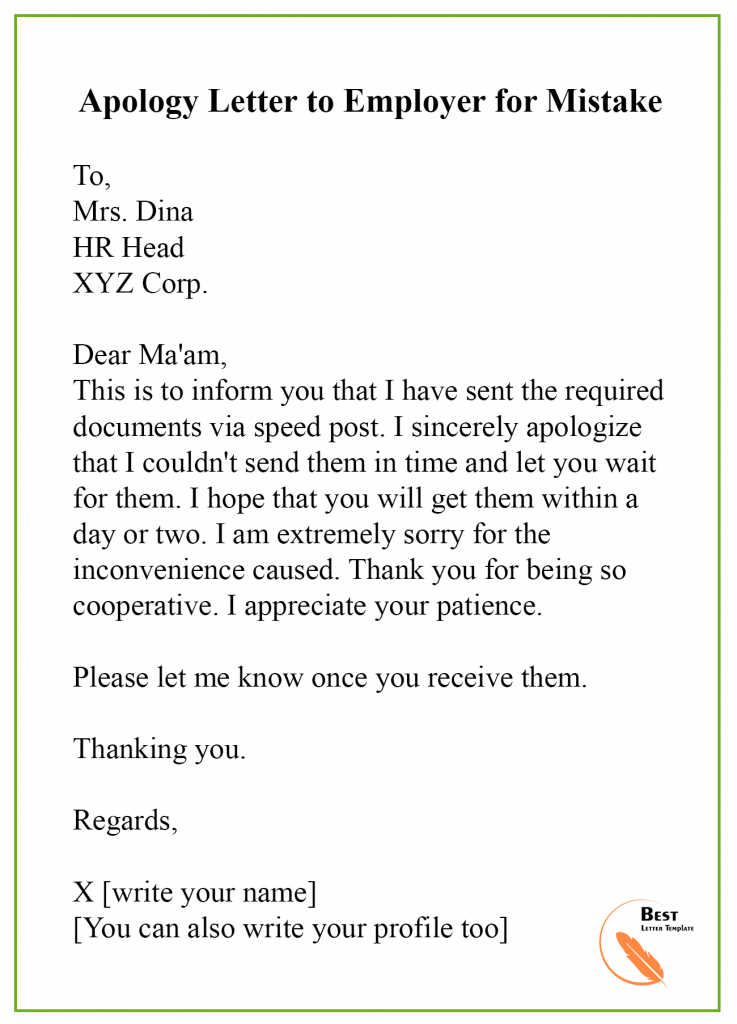

My Apologies For The Mistake And Confusion

Urgent retraction issued following widespread confusion stemming from an erroneous press release distributed earlier today. The incorrect statement concerned a major policy shift, prompting immediate and significant repercussions across various sectors.

This article clarifies the retracted information, details the source of the error, and outlines steps being taken to rectify the situation and prevent future occurrences. Immediate action is underway to mitigate the damage caused by the misinformation.

Incorrect Policy Announcement

The original press release, disseminated at approximately 9:00 AM EST, incorrectly stated that the Federal Reserve had decided to raise interest rates by 0.75% effective immediately. This information is false.

The actual decision, scheduled for announcement next week, remains undecided and is subject to ongoing review. The premature release of this erroneous information has caused considerable market volatility.

Source of the Error

Preliminary investigations indicate the error originated within the Federal Reserve's communications department. A draft version of the press release, intended for internal review only, was mistakenly sent to the media distribution list.

The individual responsible has been identified and is currently under administrative review. A full audit of internal communication protocols is being conducted.

Impact and Immediate Repercussions

The erroneous announcement triggered a sharp decline in the Dow Jones Industrial Average, with initial reports indicating a loss of over 500 points. Bond yields also experienced significant fluctuations.

Major financial institutions immediately began adjusting their strategies based on the incorrect information. Several companies temporarily suspended trading activities to assess the situation.

Official Retraction and Clarification

At 9:45 AM EST, the Federal Reserve issued an official retraction, clarifying that the previous press release contained inaccurate information. A corrected statement was promptly distributed to all media outlets.

The Federal Reserve Chair, Jerome Powell, released a brief statement personally apologizing for the mistake and reaffirming the commitment to transparency and accuracy. He stressed the Federal Reserve's dedication to maintaining market stability.

Damage Control and Corrective Measures

The Securities and Exchange Commission (SEC) has initiated an inquiry into the incident to determine if any insider trading occurred as a result of the misinformation. They are working closely with the Federal Reserve to gather relevant data.

The Federal Reserve is implementing enhanced security measures for all draft communications to prevent similar incidents in the future. This includes stricter access controls and mandatory double-checking protocols.

A public awareness campaign is being launched to reassure investors and the public that the U.S. financial system remains stable and reliable.

Ongoing Developments

The investigation into the error is ongoing, and further details will be released as they become available. The Federal Reserve will hold a press conference tomorrow at 10:00 AM EST to address the situation in detail.

The scheduled interest rate decision remains unchanged, and the Federal Open Market Committee (FOMC) will convene next week as planned. Markets are expected to remain volatile in the short term as the situation stabilizes.

The Federal Reserve emphasizes its commitment to regaining public trust and maintaining the integrity of its communications. Further updates will be provided as the situation develops.

![My Apologies For The Mistake And Confusion How to Write & Send Apology Emails to Customers [+Examples]](https://automizy.com/wp-content/uploads/our-mistake.png)

![My Apologies For The Mistake And Confusion How To Write An Apology Email: 7 Tips And Examples [2024] | Mailmunch](https://assets-global.website-files.com/5f3a33a074c2eb9e90f16437/63280e96c2acfc2447f1d3b6_3.png)