Margin Interest Interactive Brokers

Imagine a seasoned trader, Sarah, eyes glued to her multi-monitor setup, a cup of coffee warming her hand. The market dances, a whirlwind of numbers and potential. She's strategically leveraging her positions, carefully considering the impact of margin interest, a crucial element in her dynamic trading strategy with Interactive Brokers.

Understanding margin interest is paramount for traders aiming to amplify their investment potential. This article delves into Interactive Brokers' margin interest rates, their significance, and how savvy investors can navigate them to optimize their trading outcomes.

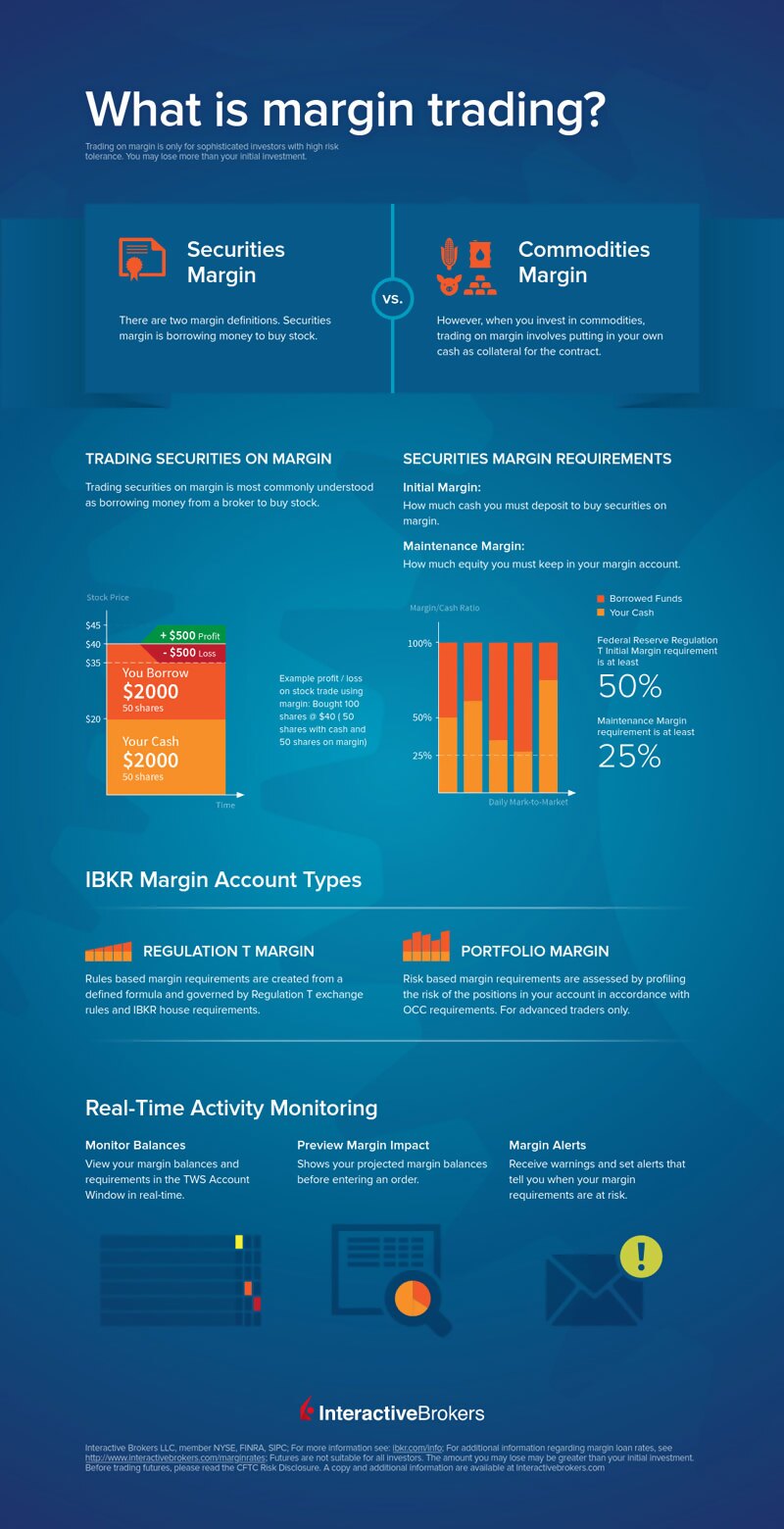

The Fundamentals of Margin Interest

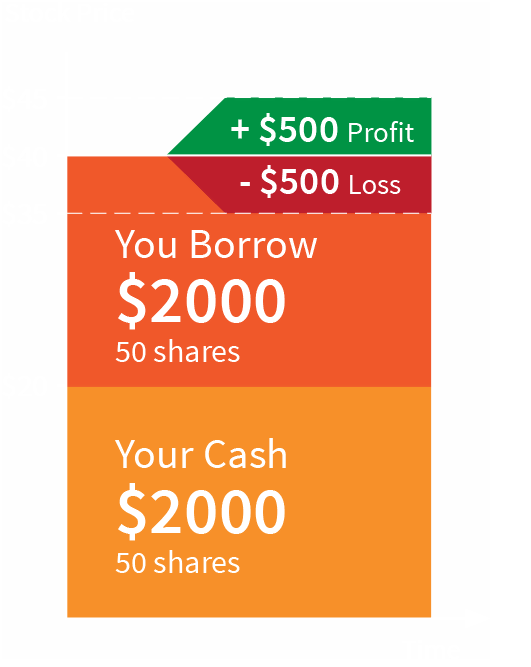

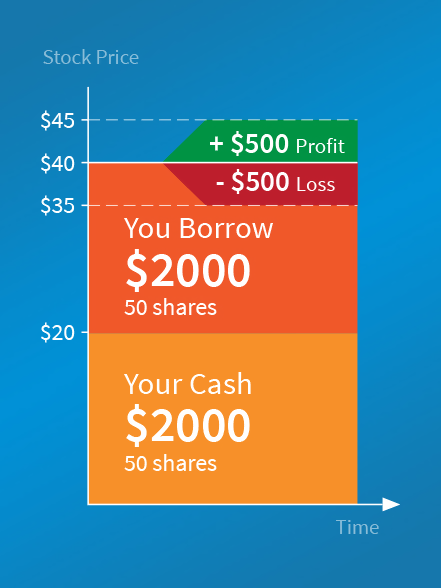

Margin interest is essentially the fee charged by a brokerage firm for lending funds to a trader. These funds enable investors to control larger positions than their cash balance would otherwise allow. Interactive Brokers, a globally recognized brokerage, offers margin accounts to qualified clients.

The interest rates are crucial. They directly impact the cost of borrowing and, therefore, the profitability of leveraged trades.

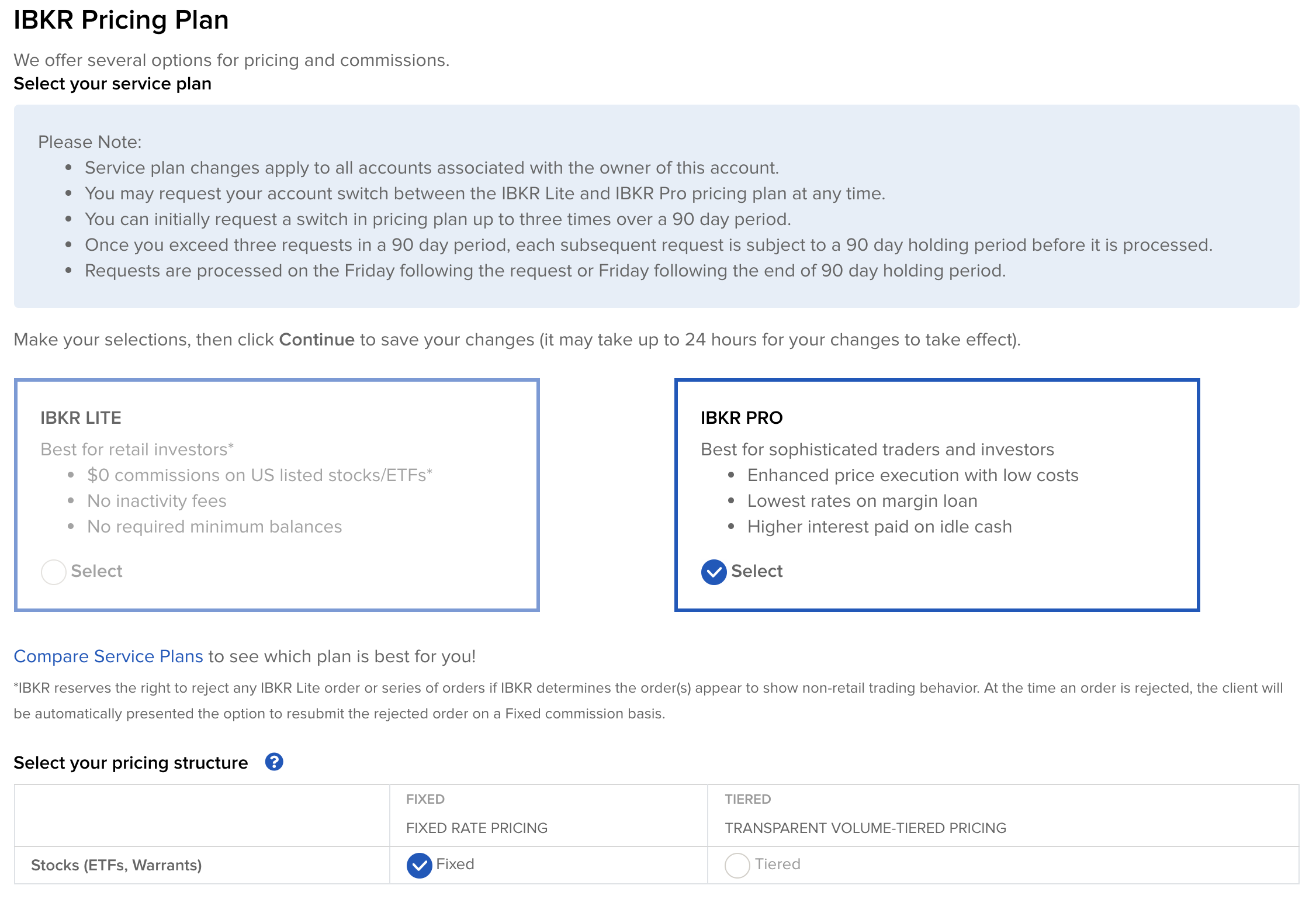

Interactive Brokers' Approach to Margin Rates

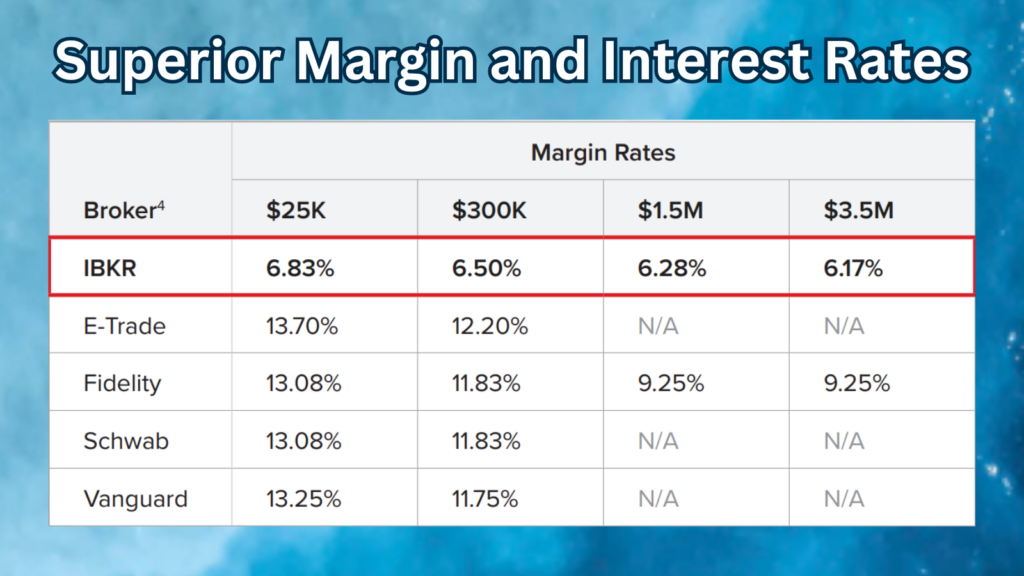

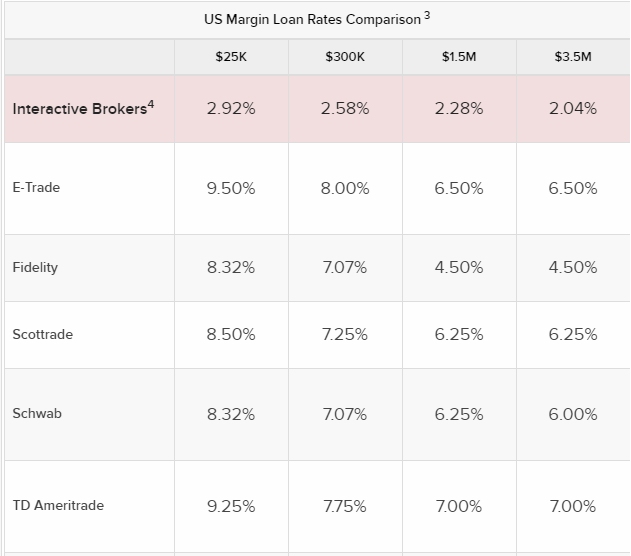

Interactive Brokers distinguishes itself through its transparent and competitive margin interest rate structure. Unlike some brokers with fixed rates, Interactive Brokers often utilizes a tiered system based on the loan size.

This tiered approach means that the interest rate decreases as the borrowed amount increases. This can be a significant advantage for larger-volume traders. Official statements from Interactive Brokers emphasize their commitment to providing clients with the lowest possible margin rates, aligning with their overall mission of cost efficiency.

Their website clearly outlines their current margin loan rates, updated regularly to reflect market conditions. Reference rates used often include benchmarks such as the Secured Overnight Financing Rate (SOFR) or other relevant interbank lending rates. Transparency is key.

Significance for Traders

Margin interest is not simply a cost; it's a strategic consideration. Experienced traders factor it into their risk-reward calculations. For example, day traders relying heavily on leverage must be acutely aware of the accruing interest charges, which can quickly erode profits if trades are held for extended periods.

Swing traders and longer-term investors also need to monitor margin rates. Changes in these rates can influence their overall investment strategy. Rising interest rates might prompt a reduction in leveraged positions to mitigate borrowing costs.

Risk management is paramount when using margin. Understanding the interplay between margin interest, potential gains, and potential losses is critical for long-term success.

Navigating Margin Interest Effectively

Traders can take proactive steps to manage margin interest costs. Firstly, monitor Interactive Brokers' rate announcements closely and understand how they align with market trends.

Secondly, optimize your trading strategy. Consider the holding period of your trades and the anticipated profit margin against the accruing interest. Strategic planning is crucial.

Thirdly, maintain adequate equity in your account to minimize the amount of borrowed funds. A higher equity ratio reduces the reliance on margin and, consequently, the interest expense.

Finally, explore Interactive Brokers' resources and educational materials on margin trading. These resources can provide valuable insights into risk management and cost optimization. They often offer webinars and detailed guides explaining the nuances of margin accounts.

A Final Thought

Margin interest, while a cost, is also a tool. When wielded with knowledge and discipline, it can significantly enhance trading potential. Sarah, like many other informed traders, understands that mastering margin interest is an integral part of navigating the complex world of finance.

By staying informed, employing sound risk management principles, and adapting to market dynamics, traders can leverage the power of margin while mitigating its associated costs. The journey to financial success often involves carefully balancing risk and reward, and understanding margin interest is a crucial element in that equation. Remember to always trade responsibly.

_1_11zon.webp)