How To Generate Funds To Start A Business

Aspiring entrepreneurs often face a daunting hurdle: securing the necessary capital to launch their ventures. The path to funding a startup can seem complex, but understanding the available options and strategically pursuing them significantly increases the chances of success. This article explores various avenues for generating funds to start a business, offering practical guidance for navigating the financial landscape.

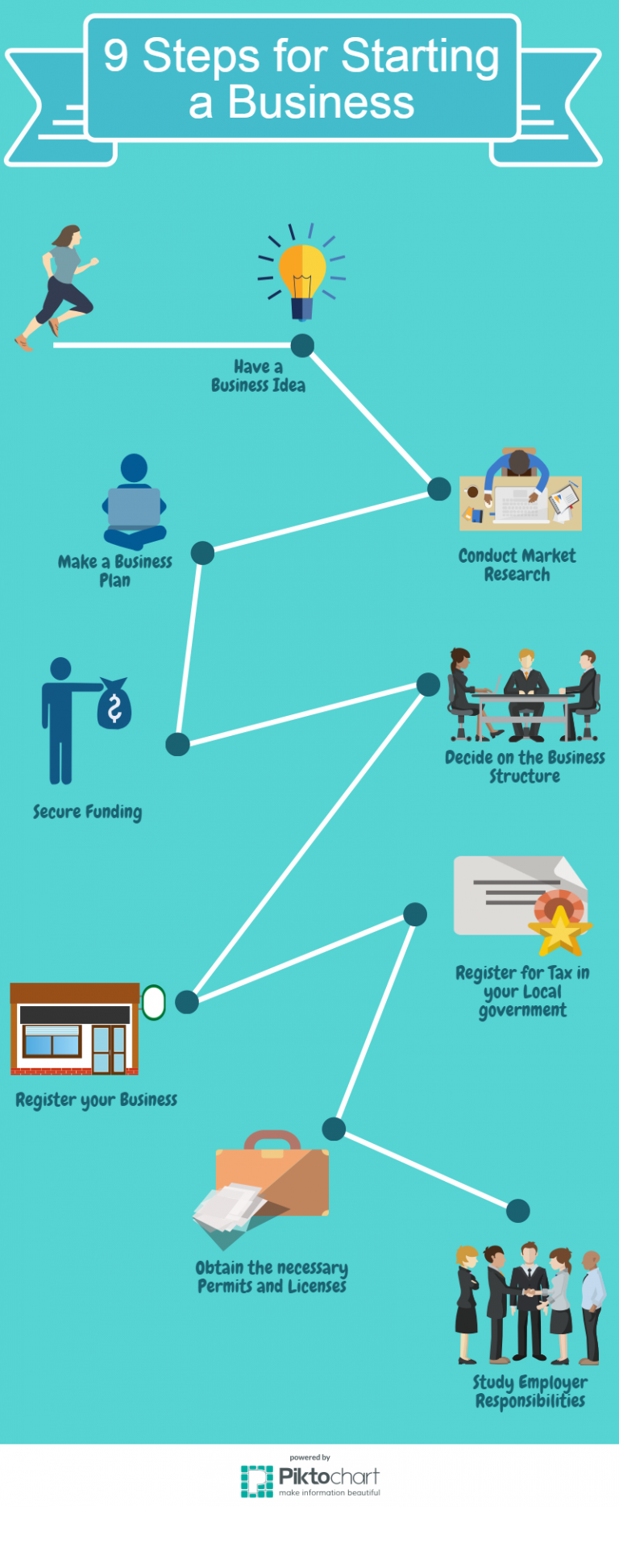

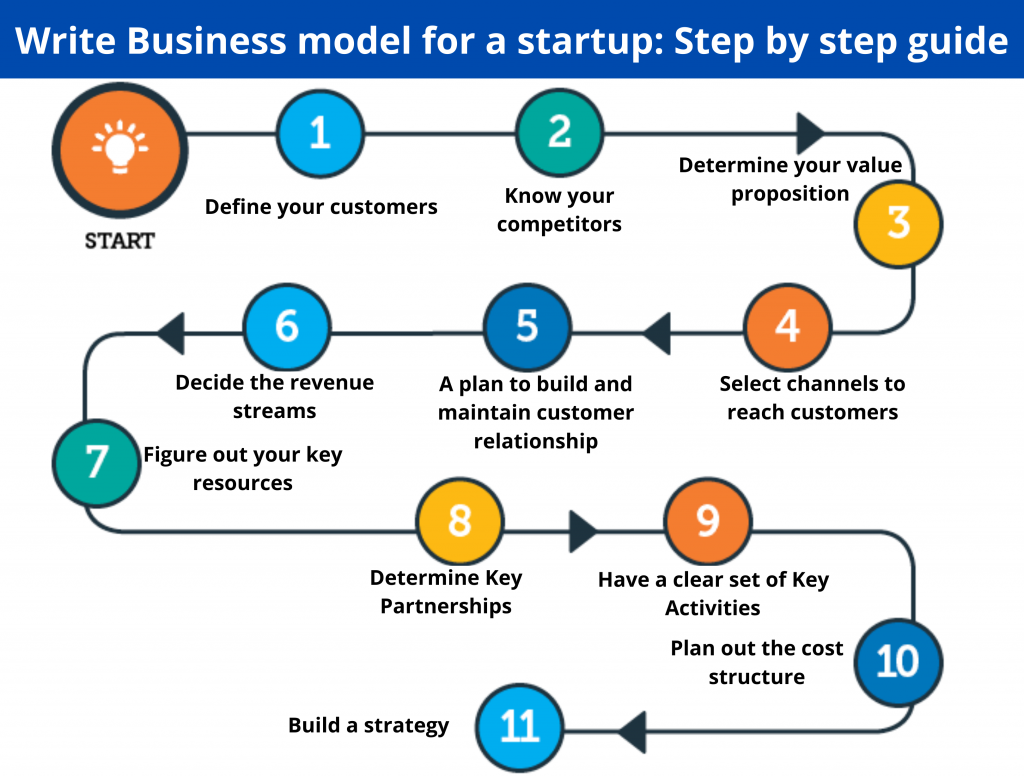

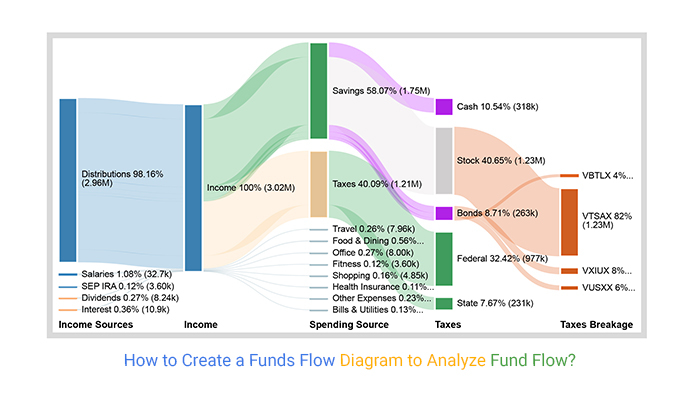

The initial challenge lies in determining the precise amount of capital required. This involves creating a detailed business plan that outlines projected expenses, revenue forecasts, and potential funding gaps. A well-structured plan serves as a roadmap for the business and a crucial tool for attracting investors.

Bootstrapping and Personal Savings

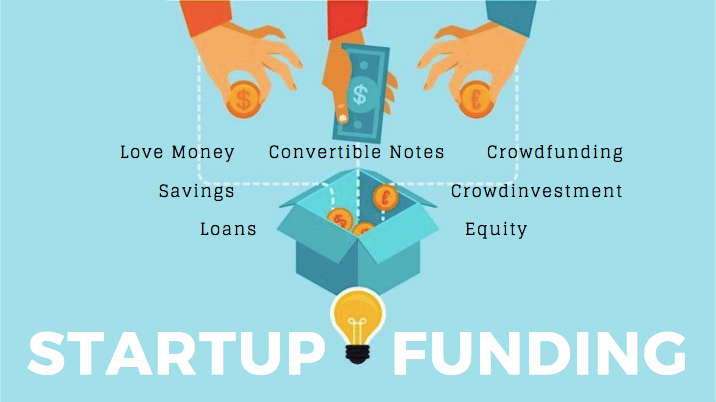

Many entrepreneurs begin by utilizing their own resources, a process known as bootstrapping. This can involve using personal savings, selling assets, or reducing personal expenses to free up capital for the business. Bootstrapping demonstrates commitment and resourcefulness, qualities that appeal to potential investors later on.

Family and friends often represent another early source of funding. While this can be a valuable option, it's crucial to treat these contributions as formal investments or loans, with clear terms and repayment schedules. This helps to avoid potential misunderstandings and maintain healthy relationships.

Small Business Loans

Traditional bank loans remain a significant source of funding for small businesses. However, securing a loan often requires a strong credit history, collateral, and a comprehensive business plan. The Small Business Administration (SBA) offers various loan programs designed to support small businesses, often with more favorable terms than traditional bank loans.

Microloans, typically ranging from a few hundred to tens of thousands of dollars, are another option, especially for startups with limited collateral. These loans are often provided by non-profit organizations and community development financial institutions (CDFIs) that focus on supporting underserved entrepreneurs.

Angel Investors and Venture Capital

Angel investors are high-net-worth individuals who invest their personal capital in early-stage companies. They often provide not only funding but also valuable mentorship and industry expertise. Securing angel investment typically involves pitching the business to potential investors and demonstrating its growth potential.

Venture capital (VC) firms invest in startups with high growth potential in exchange for equity. VCs typically look for companies that have the potential to generate significant returns on their investment. Securing VC funding often requires a compelling business plan, a strong management team, and a clear path to profitability.

Crowdfunding and Grants

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of individuals. This can be a valuable way to generate capital and validate the business idea. Successful crowdfunding campaigns require a compelling story, effective marketing, and a clear value proposition for potential backers.

Government grants and awards can provide non-dilutive funding for specific types of businesses, particularly those focused on innovation or social impact. The application process for grants can be competitive and time-consuming, but the potential rewards can be significant. The SBA and other government agencies offer resources to help entrepreneurs identify and apply for relevant grant programs.

The Human Element: Perseverance and Adaptability

Securing funding for a startup is rarely a straightforward process. It requires perseverance, adaptability, and a willingness to learn from setbacks. Successful entrepreneurs are often those who can effectively communicate their vision, build strong relationships with potential investors, and adapt their funding strategy as needed.

Consider the story of Maria Rodriguez, who started a small bakery with her savings and a microloan. Initially, she faced challenges securing additional funding, but she persevered, refining her business plan and networking with local investors. Eventually, she secured angel investment that allowed her to expand her operations and reach a wider market.

The process of securing funding is a journey that requires careful planning, strategic execution, and a strong belief in the business's potential. By understanding the various funding options available and actively pursuing them, entrepreneurs can overcome the financial hurdles and bring their vision to life. Ultimately, the success of a startup depends not only on the availability of capital, but also on the entrepreneur's determination and resilience.

![How To Generate Funds To Start A Business How To Make Money Online [6 #infographics] / Digital Information World](https://3.bp.blogspot.com/-1xeKTJcqauI/U0z14WmyM1I/AAAAAAAAa0M/pqPZJRm427s/s1600/infographic-breaking-down-the-way-an-entrepreneur-goes-from-idea-generation-through-to-initial-public-offering-How-to-Start-a-Startup-and-how-to-make-money.png)