How To Get A Credit Increase On Capital One

Imagine this: You're browsing online, eyeing that perfect new gadget or dream vacation. You reach for your Capital One credit card, but a little voice whispers, "Is my limit high enough?" It's a common scenario. The good news is, boosting your credit limit with Capital One isn't a mystical feat; it's a strategic process.

This article serves as your friendly guide to navigating the steps involved in requesting and hopefully securing a credit limit increase with Capital One. We'll break down the process, offer practical tips, and help you understand what factors Capital One considers when making their decision.

Understanding Capital One's Perspective

Before diving into the "how," it's essential to understand the "why" behind Capital One's decisions. They aren't simply granting higher limits out of generosity.

Instead, they assess risk and potential profitability. They are evaluating you as a borrower.

Specifically, they look at a number of factors, with your creditworthiness being a prime indicator of your ability to manage debt responsibly, so let's delve deeper.

The Core Factors: Creditworthiness and Account History

Your credit score is paramount. A strong score signals responsible borrowing habits.

Beyond the score itself, Capital One scrutinizes your credit report. Look for any derogatory marks, such as missed payments or high credit utilization on other cards, which could raise red flags.

Your payment history with Capital One is equally crucial. Consistent on-time payments demonstrate reliability.

They'll also observe your spending patterns. Regularly using your card and paying off balances shows active and responsible usage.

Income and Employment: Demonstrating Ability to Repay

Capital One needs assurance you can handle the increased credit line. Verifiable income plays a major role in this determination.

Be prepared to provide updated income information during the request process. A stable employment history also reassures them about your financial stability.

How to Request a Credit Limit Increase

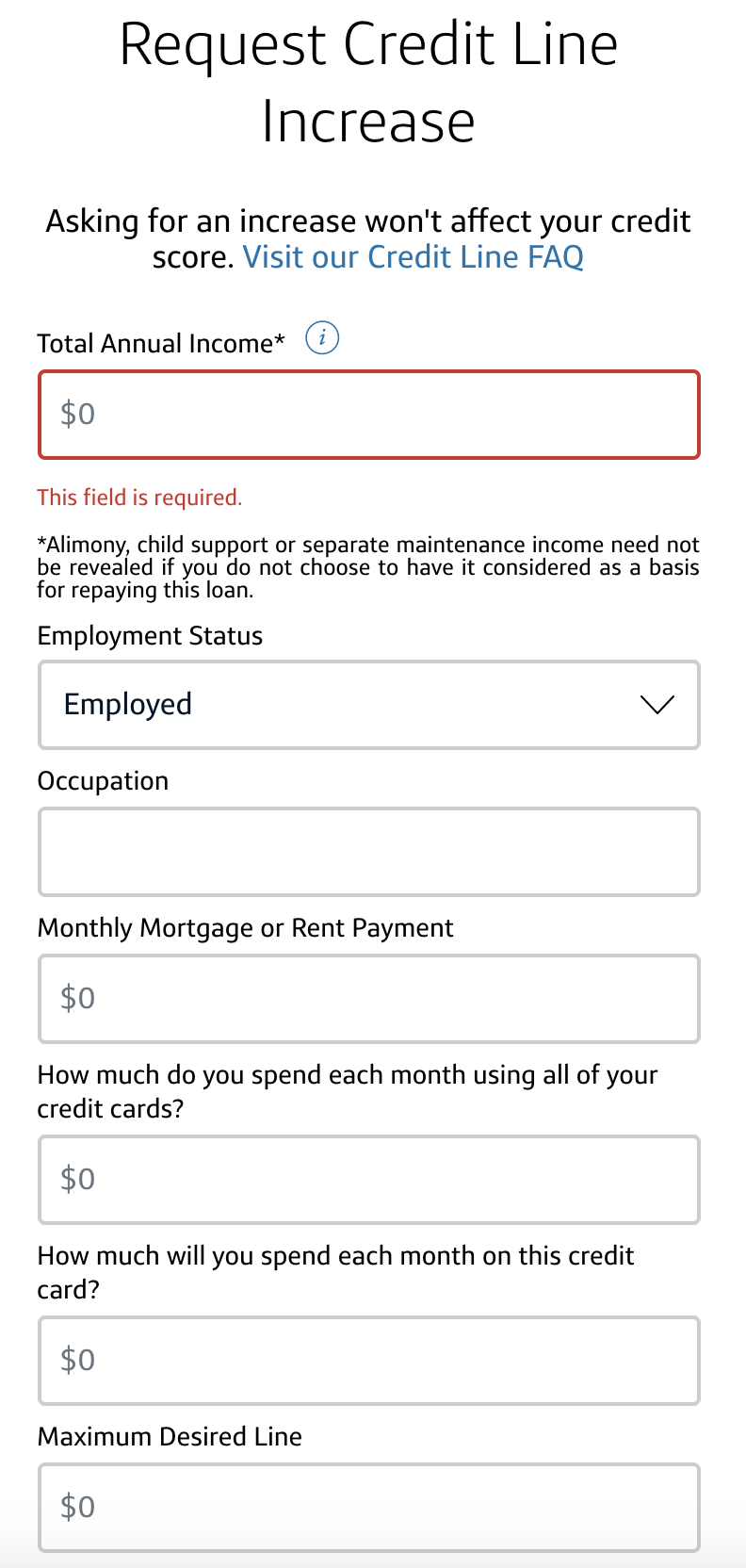

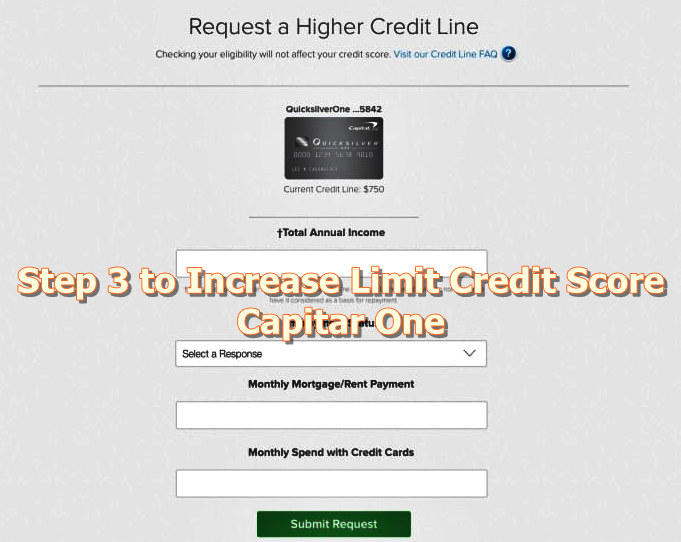

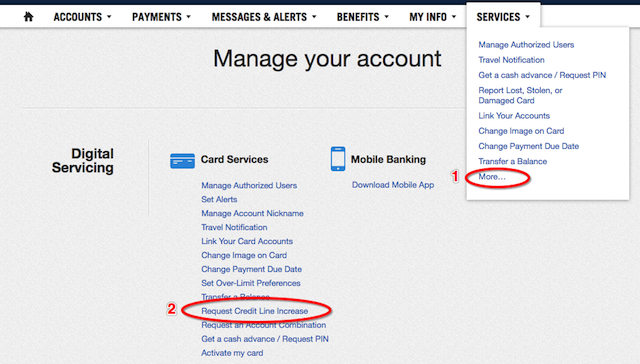

Capital One provides multiple avenues for requesting an increase. The easiest way is through their website or mobile app.

Log in to your account and navigate to the "Services" or "Account Management" section. Look for an option like "Request Credit Line Increase."

You might also be able to request an increase by calling the number on the back of your card. Regardless of the method, be prepared to provide your income, employment status, and other relevant financial details.

Timing is Everything

Don't rush the process. Waiting at least six months between requests is generally advisable.

Also, avoid requesting an increase shortly after opening the account. Let them establish a good payment history first.

"Patience and responsible card use are key,"an industry expert noted, "Capital One rewards consistency."

Tips for a Successful Request

Before requesting an increase, review your credit report for any errors and dispute them promptly. Ensure your reported income is accurate and up-to-date.

Pay down existing balances on your Capital One card to lower your credit utilization ratio. Avoid making large purchases right before submitting your request.

A low utilization rate demonstrates responsible credit management. Be prepared to explain any recent financial changes that might be relevant.

Consider adding any new sources of income or changes in employment status to the application. Finally, be polite and professional during the request process.

A courteous attitude can make a positive impression.

The Waiting Game and What to Do Next

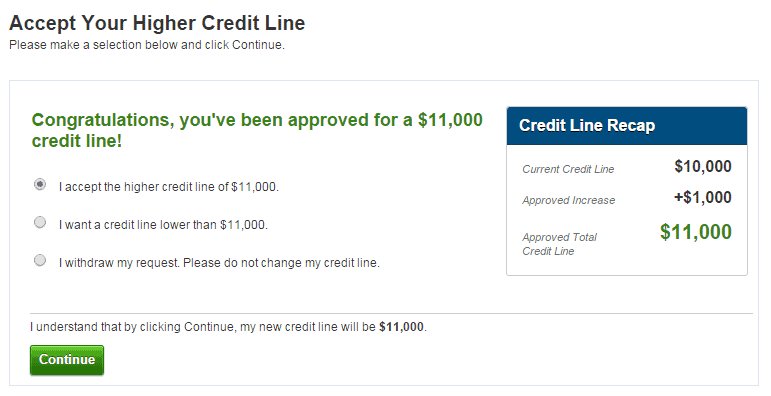

After submitting your request, Capital One will review your information. It typically takes a few business days to receive a decision.

If approved, congratulations! Use the increased credit responsibly.

If denied, don't be discouraged. Capital One will usually provide a reason for the denial. Use this information to address any weaknesses in your credit profile.

Work on improving your credit score, reducing your credit utilization, and ensuring consistent on-time payments. You can always try again in a few months after addressing the issues.

Ultimately, securing a credit limit increase with Capital One is about demonstrating financial responsibility and stability. By understanding their criteria and taking proactive steps to improve your creditworthiness, you'll increase your chances of success.

So, go forth and manage your credit wisely. That dream vacation or gadget might be closer than you think!

![How To Get A Credit Increase On Capital One How to Get A Capital One Credit Line Increase (Tips) [2020] - UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2019/09/Capital-One-Credit-limit-increase-2-960x395.png)

![How To Get A Credit Increase On Capital One How to Get A Capital One Credit Line Increase (Tips) [2022] - UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2019/09/Capital-One-Credit-limit-increase-960x203.png)