How To Get More Credit On Capital One

For Capital One cardholders looking to increase their credit limit, several strategies can be employed to demonstrate creditworthiness and improve their chances of approval. A higher credit limit can offer increased purchasing power, lower credit utilization, and potentially boost your credit score.

This article will explore the practical steps individuals can take to successfully request and obtain a credit limit increase from Capital One, based on industry best practices and consumer finance advice.

Understanding Capital One's Credit Limit Increase Process

Capital One, like other major credit card issuers, evaluates several factors when considering a credit limit increase. These factors often include credit score, payment history, income, and overall credit utilization.

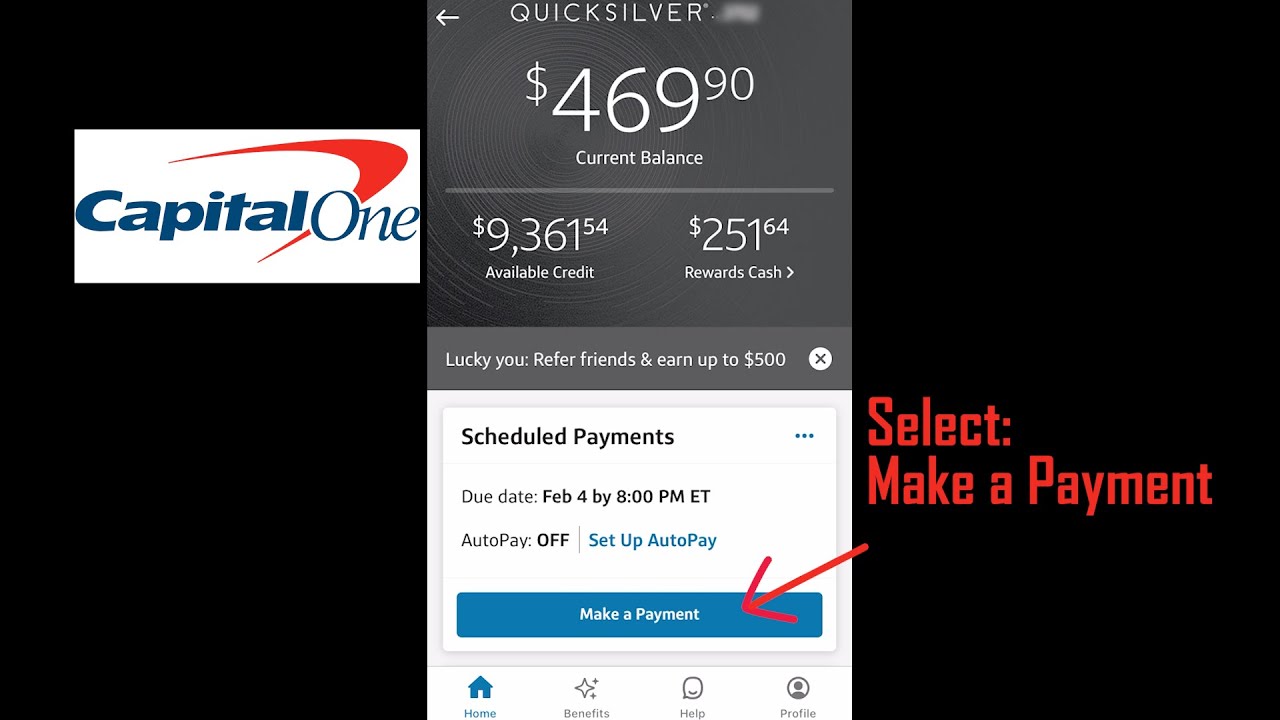

Generally, customers can request a credit limit increase online through their Capital One account or via the Capital One mobile app. There is also the option to call the customer service number on the back of the card.

Improving Your Chances of Approval

One of the most critical steps is maintaining a good credit score. According to Experian, a good credit score typically falls between 670 and 739.

Consistently paying your bills on time and in full demonstrates responsible credit management. Late or missed payments are red flags for lenders.

Keeping your credit utilization low is also vital. Credit utilization refers to the amount of credit you're using compared to your total available credit. Experts often recommend keeping it below 30%.

Regularly monitoring your credit report for any errors or inaccuracies is advisable. Errors can negatively impact your credit score, so it's essential to dispute and correct them promptly.

Requesting the Increase

When you're ready to request a credit limit increase, ensure you have the necessary information readily available. This includes your current income, employment status, and any significant changes to your financial situation.

Be prepared to explain why you need the increase. A clear and concise justification can strengthen your request.

If your income has increased since you initially applied for the card, be sure to highlight this. A higher income often translates to a greater ability to repay borrowed funds, making you a less risky borrower in the eyes of Capital One.

Requesting an increase too frequently can be detrimental. Capital One may view frequent requests as a sign of financial instability.

What To Do If You're Denied

If your credit limit increase request is denied, don't be discouraged. Capital One is legally obligated to provide you with a reason for the denial.

Carefully review the reason and address any identified issues. For example, if the denial was due to a low credit score, focus on improving your credit habits.

Consider waiting several months before requesting another increase. During this time, work on strengthening your credit profile.

You can also consider other options, such as applying for a new credit card with a higher initial credit limit. However, be mindful that applying for too many credit cards in a short period can negatively impact your credit score.

The Importance of Responsible Credit Management

Ultimately, the key to getting a credit limit increase from Capital One, or any credit card issuer, lies in demonstrating responsible credit management. This involves maintaining a good credit score, keeping your credit utilization low, and consistently paying your bills on time.

Increasing your credit limit responsibly can offer numerous benefits, from increased purchasing power to improved credit scores.

By following the steps outlined above, Capital One cardholders can significantly increase their chances of securing a higher credit limit and improving their overall financial well-being. Remember to always use credit wisely and within your means.

/images/2023/03/23/capital-one-prequalify-credit-card_03.jpg)