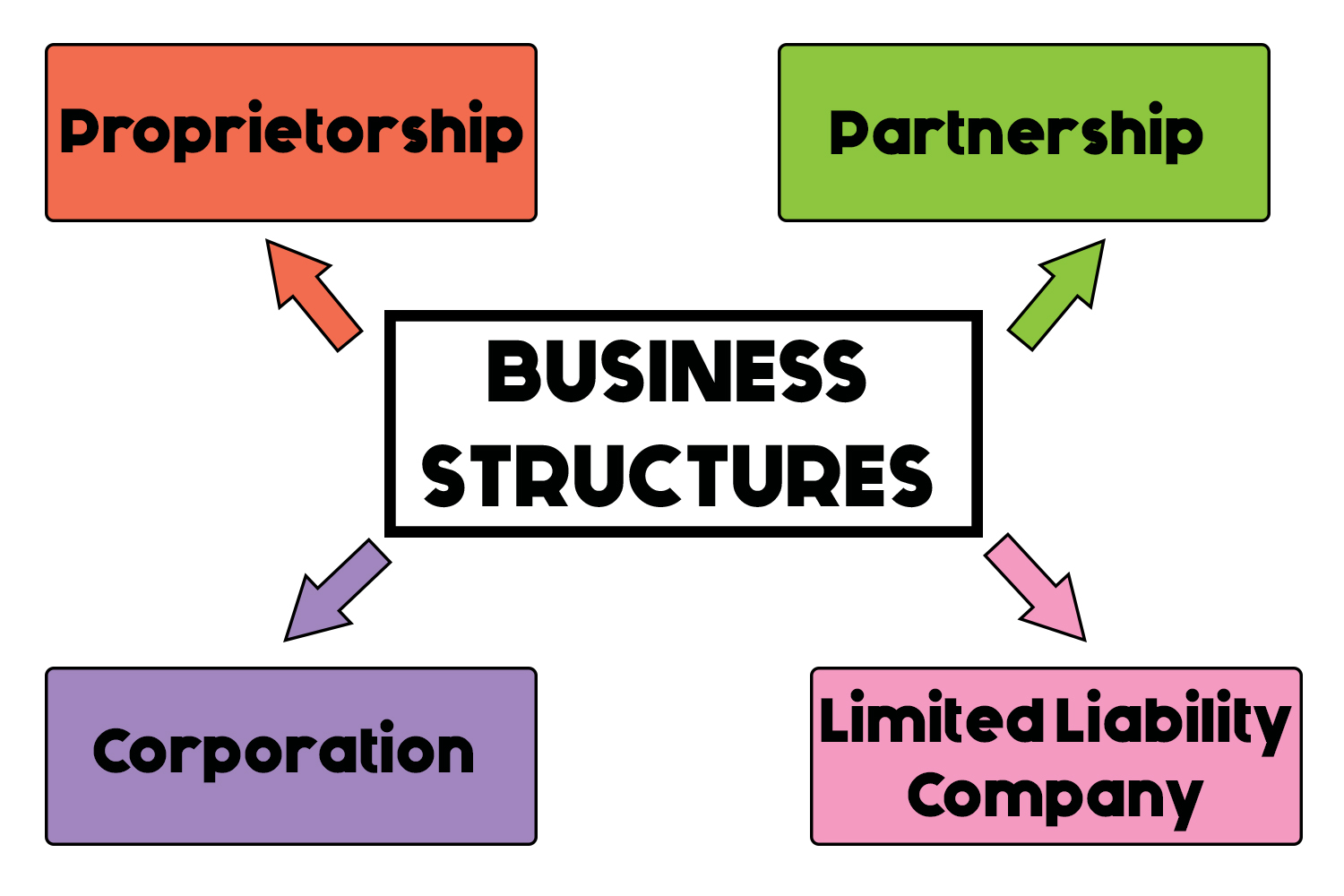

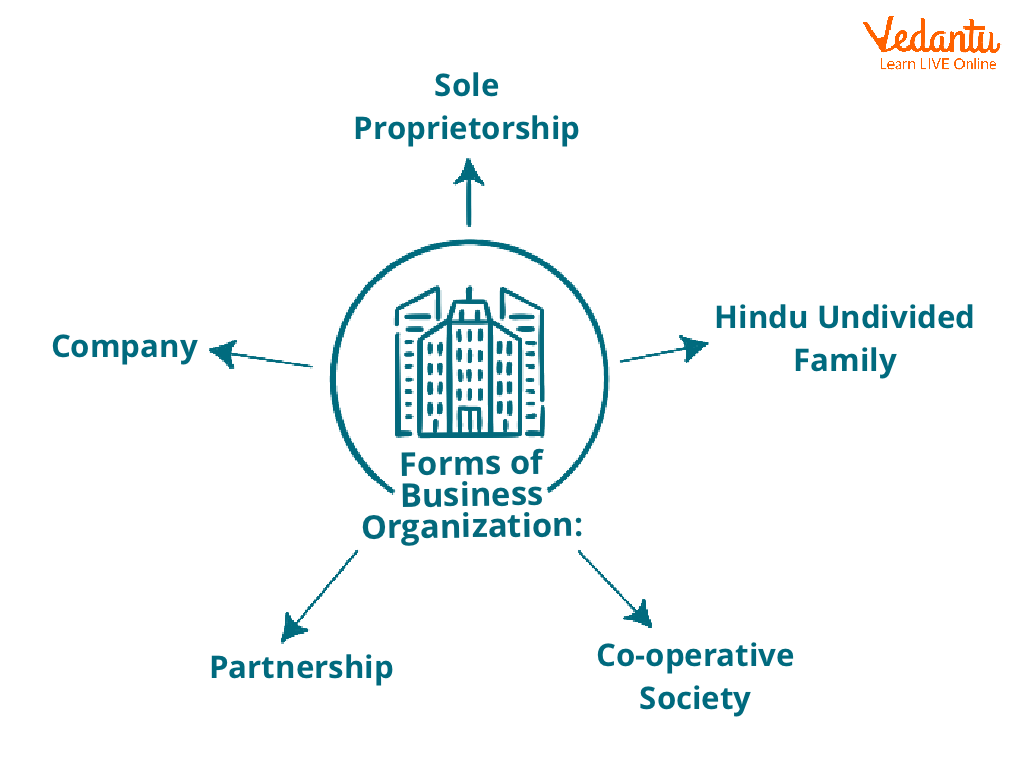

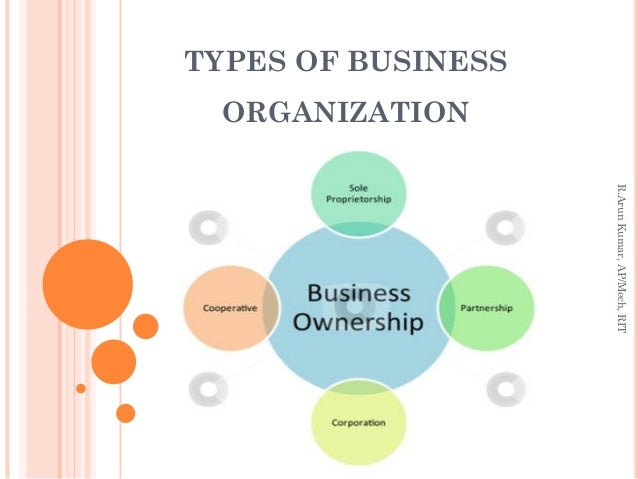

Different Types Of Business Organizations

Imagine a bustling town square, alive with the energy of entrepreneurs chasing their dreams. A quaint bakery, its aroma wafting through the air, stands next to a sleek tech startup, its windows glowing with the light of innovation. Both are businesses, but their internal structures, their legal obligations, and their potential futures can be worlds apart.

Understanding these differences, the diverse forms of business organizations, is crucial for anyone considering starting a company or investing in one. This article explores the most common types of business organizations, outlining their key features, advantages, and disadvantages, equipping you with the knowledge to navigate the complex landscape of entrepreneurship.

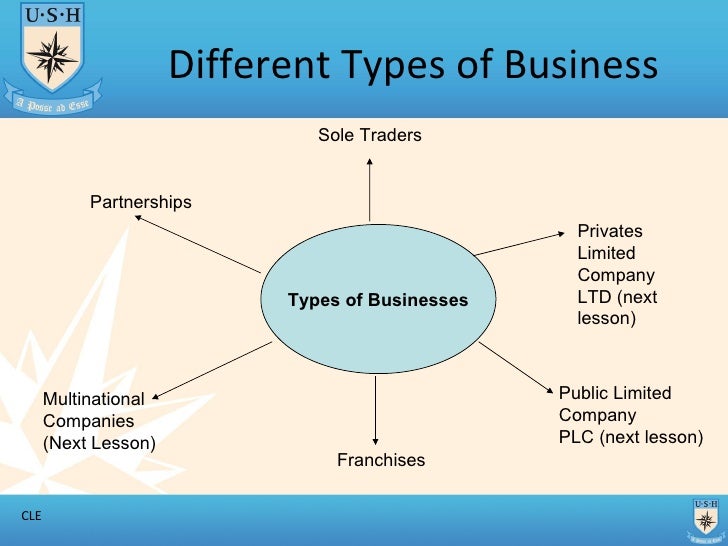

Sole Proprietorship: The One-Person Show

The simplest form is the sole proprietorship. It's where the business is owned and run by one person, and there's no legal distinction between the owner and the business entity. Think of the local artisan selling crafts at a market – that’s often a sole proprietorship in action.

The biggest advantage is ease of setup. There's minimal paperwork and relatively low costs to get started. However, the owner is personally liable for all business debts and obligations, meaning their personal assets are at risk.

This unlimited liability is a significant drawback. Securing funding can also be challenging, as lenders may be hesitant to provide loans without the security of a separate legal entity.

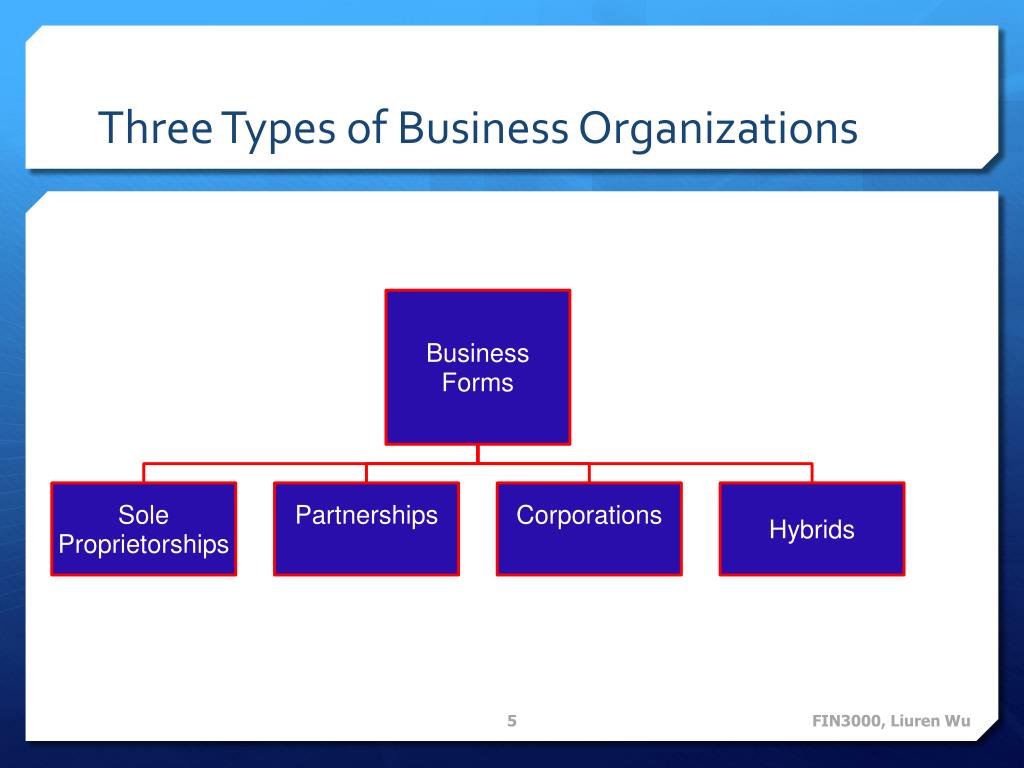

Partnerships: Sharing the Load (and the Profits)

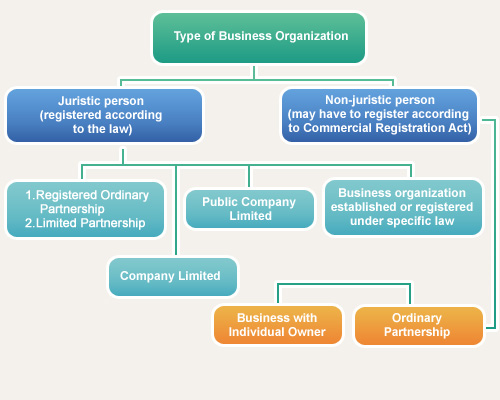

When two or more individuals decide to pool their resources and expertise, they can form a partnership. Like sole proprietorships, partnerships are relatively easy to establish.

A written agreement outlining the responsibilities, profit-sharing arrangements, and dispute resolution processes is highly recommended, if not essential. There are different types of partnerships, each with its own implications.

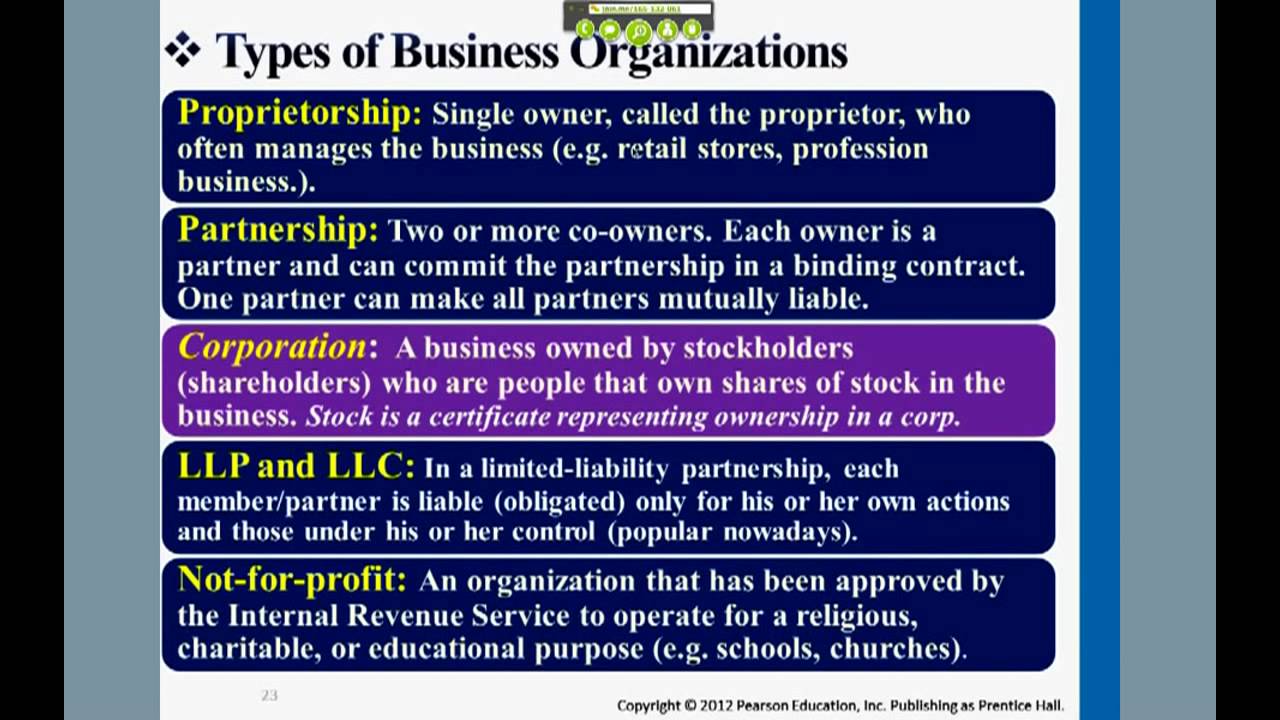

General Partnership

In a general partnership, all partners share in the business's profits or losses and also share unlimited liability. Each partner is responsible for the business's debts, even if those debts were incurred by another partner.

Limited Partnership

A limited partnership offers some partners (limited partners) limited liability and limited involvement in the business's day-to-day operations. There must be at least one general partner with unlimited liability.

Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) provides limited liability to all partners, protecting them from the negligence or malpractice of other partners. This is a popular choice for professionals like doctors and lawyers.

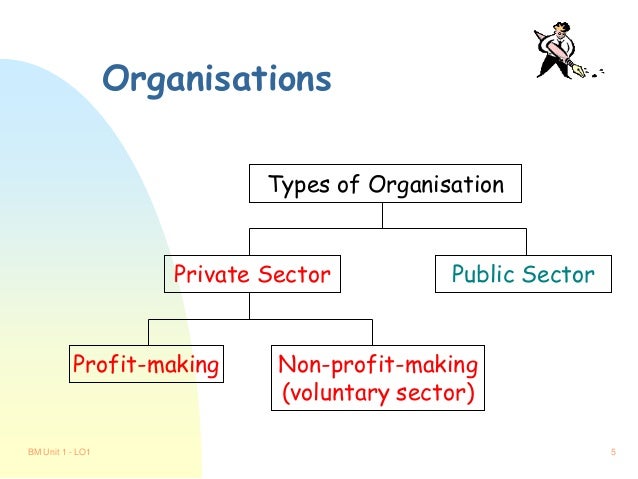

Corporations: A Separate Legal Entity

A corporation is a more complex structure, legally separate from its owners, the shareholders. This separation provides significant advantages, including limited liability.

Shareholders are only liable for the amount of their investment, protecting their personal assets from business debts. Corporations can also raise capital more easily by issuing stock.

However, corporations face more stringent regulatory requirements and higher setup and maintenance costs. They are also subject to double taxation – the corporation's profits are taxed, and then shareholders are taxed again on dividends received.

S Corporation

An S Corporation is a special type of corporation that allows profits and losses to be passed through directly to the owners' personal income without being subject to corporate tax rates. This avoids the double taxation issue of C corporations.

C Corporation

A C Corporation is the standard type of corporation and is subject to corporate income tax. It offers the strongest protection from liability but faces the double taxation problem.

Limited Liability Company (LLC): The Hybrid Approach

The Limited Liability Company (LLC) blends the benefits of a partnership and a corporation. It offers limited liability like a corporation while providing the flexibility of a partnership's pass-through taxation.

This structure has become increasingly popular for small and medium-sized businesses. It provides a good balance between liability protection and tax simplicity.

The Cooperative Model

A cooperative is a business owned and operated by its members for their mutual benefit. Members often share in the profits and participate in the organization's governance.

Cooperatives often emphasize democratic control and community benefit over profit maximization. They can be found in various sectors, from agriculture to retail.

Choosing the right business structure is a crucial decision with long-term implications. Carefully consider your specific needs, risk tolerance, and financial goals before making a choice.