How To Get Multiple Sources Of Income

In an era defined by economic uncertainty and evolving career landscapes, the pursuit of multiple income streams has transitioned from a niche strategy to a mainstream financial goal for many.

This article explores the burgeoning trend of diversifying income, offering insights into why it's gaining traction and practical steps individuals can take to build a more resilient financial future. We will delve into various avenues for income diversification, supported by expert opinions and relevant data, providing a roadmap for those seeking financial stability and independence.

The Rise of the Side Hustle Economy

The concept of relying solely on a single source of income is increasingly viewed as risky, prompting individuals to explore alternative revenue streams.

Driven by factors such as stagnant wages, rising living costs, and the gig economy's expansion, the pursuit of side hustles and passive income opportunities is on the rise.

According to a 2023 study by Bankrate, nearly 40% of Americans have a side hustle, indicating a significant shift in how people approach their financial lives.

Why Diversify?

Diversifying income offers a safety net against job loss or unexpected expenses.

It also provides opportunities for financial growth, allowing individuals to invest in their future and achieve their financial goals faster.

Beyond financial security, multiple income streams can provide greater career flexibility and personal fulfillment, allowing individuals to pursue passions and develop new skills.

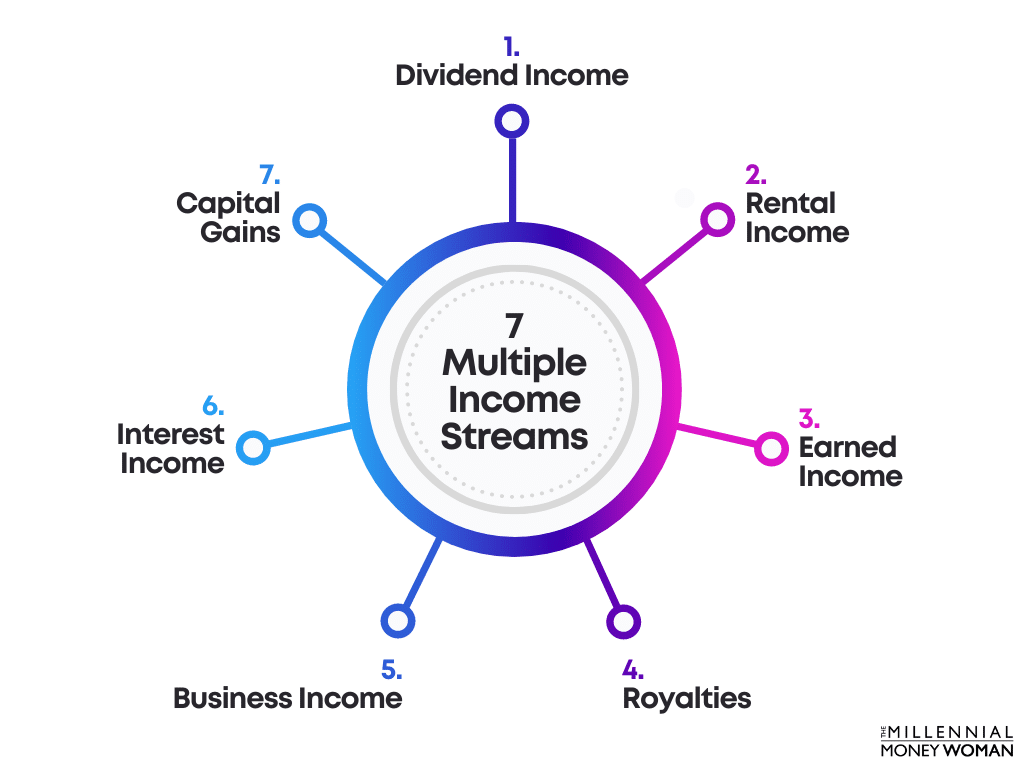

Exploring Income Avenues

The options for generating additional income are vast and varied, catering to different skill sets and interests.

Here are some popular avenues:

Freelancing

Freelancing involves offering services on a project basis, leveraging skills in areas such as writing, design, programming, or marketing. Platforms like Upwork and Fiverr connect freelancers with clients worldwide.

Investing

Investing in stocks, bonds, or real estate can generate passive income through dividends, interest, or rental income. However, it is crucial to conduct thorough research and understand the associated risks before investing.

Diversification is key to mitigate risk in any investment portfolio.

Online Courses and Content Creation

Sharing expertise through online courses or creating content on platforms like YouTube or Patreon can generate income through course sales, advertising revenue, or subscriptions.

E-commerce

Selling products online through platforms like Shopify or Etsy allows individuals to tap into the growing e-commerce market. This can involve creating and selling physical products, digital downloads, or dropshipping.

Rental Income

Renting out a spare room, a property, or even assets like cars or equipment can provide a steady stream of income.

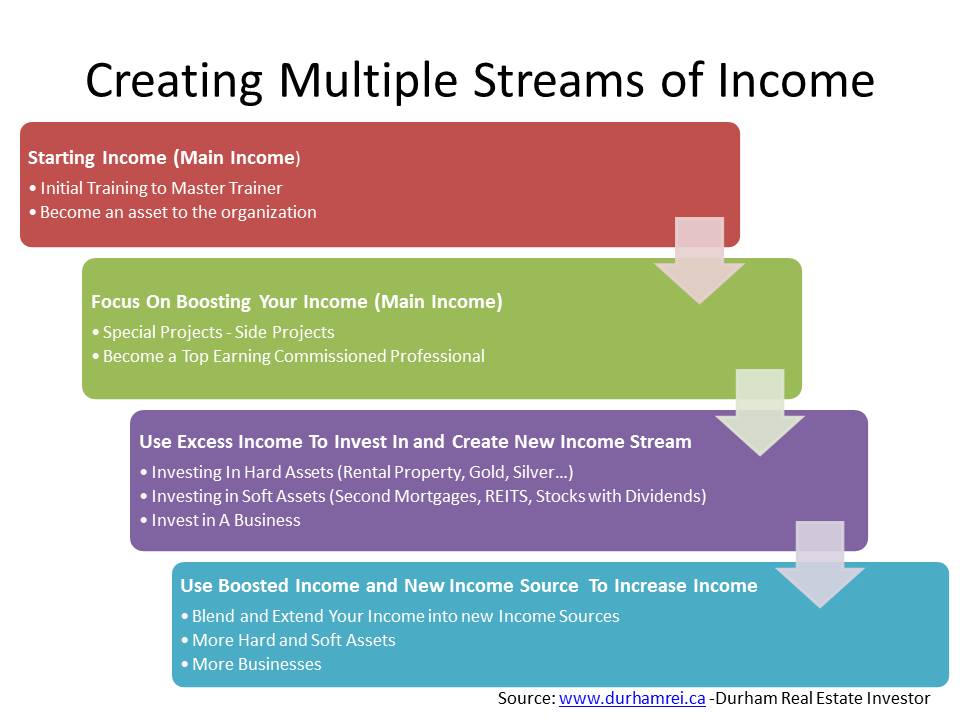

Steps to Getting Started

Embarking on the journey of diversifying income requires careful planning and execution.

Here are some key steps:

- Assess your skills and interests: Identify your strengths and passions to determine which income streams align with your capabilities.

- Research potential opportunities: Thoroughly research different income avenues to understand their earning potential, required effort, and associated risks.

- Create a plan: Develop a detailed plan outlining your goals, strategies, and timeline for implementation.

- Start small and scale up: Begin with one or two income streams and gradually expand as you gain experience and confidence.

- Manage your time and resources: Effective time management is crucial to balance multiple income streams with your existing commitments.

- Stay informed and adapt: Continuously learn and adapt to the changing economic landscape to stay ahead of the curve.

"The key to building multiple income streams is to start with something you're passionate about and that aligns with your skills," says Sarah Jones, a financial advisor at Acme Wealth Management. "Don't try to do everything at once. Focus on building one solid income stream before adding another."

The Impact on Society

The rise of multiple income streams has broader implications for society.

It can empower individuals to become more financially independent and resilient, reducing their reliance on traditional employment.

Furthermore, it can foster innovation and entrepreneurship, as people explore new ways to generate value and contribute to the economy.

However, it is also important to address potential challenges, such as the need for adequate worker protections for gig economy workers and ensuring access to financial literacy resources for all.

Conclusion

Diversifying income is no longer a luxury, but a necessity for many in today's rapidly changing world.

By exploring different income avenues and developing a strategic plan, individuals can build a more secure and fulfilling financial future.

Embracing the power of multiple income streams can pave the way for greater financial freedom and a more resilient economic future for all.