How Much Will Insurance Be For A New Driver

Imagine the thrill of finally getting your driver's license. The open road beckons, promising freedom and adventure. But before you hit the gas, a crucial question looms: how much will insurance cost? It’s a question every new driver faces, and the answer can feel like a daunting maze of numbers and jargon.

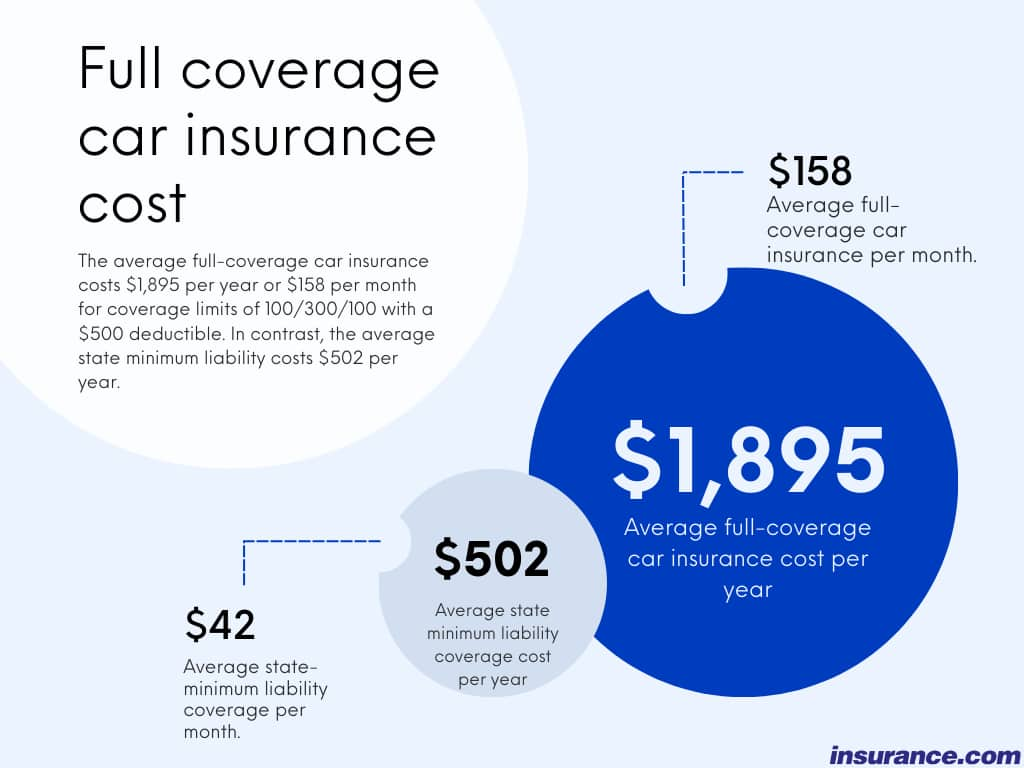

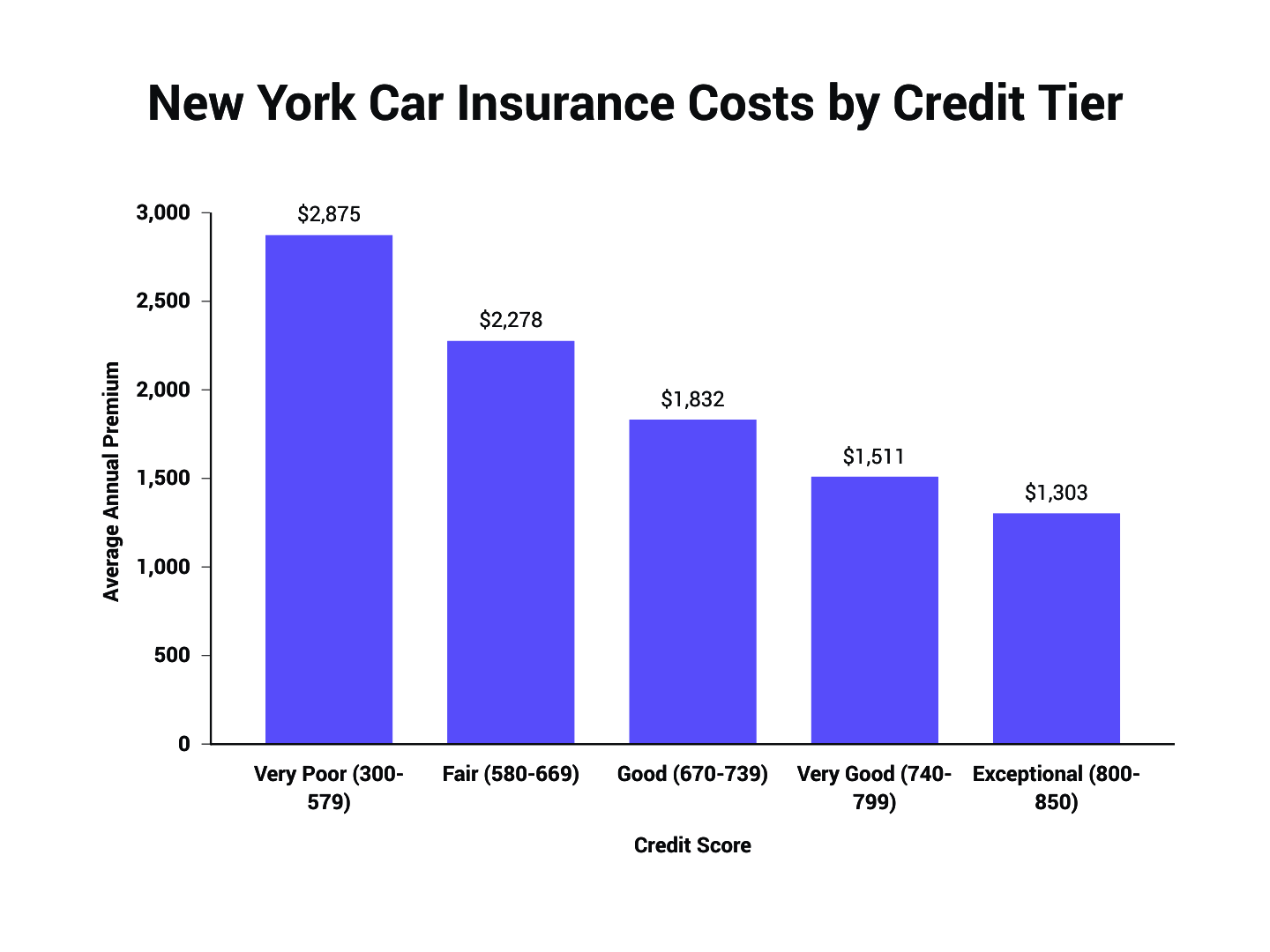

The cost of car insurance for a new driver hinges on a complex interplay of factors, making it difficult to pinpoint an exact figure. Location, age, driving record (or lack thereof), and the type of vehicle all contribute to the final premium. Understanding these elements is the first step in navigating the world of auto insurance.

The New Driver Dilemma

New drivers are statistically more likely to be involved in accidents. Insurance companies use these statistics to assess risk. This inherent risk translates to higher premiums compared to experienced drivers with clean records.

Age and Experience

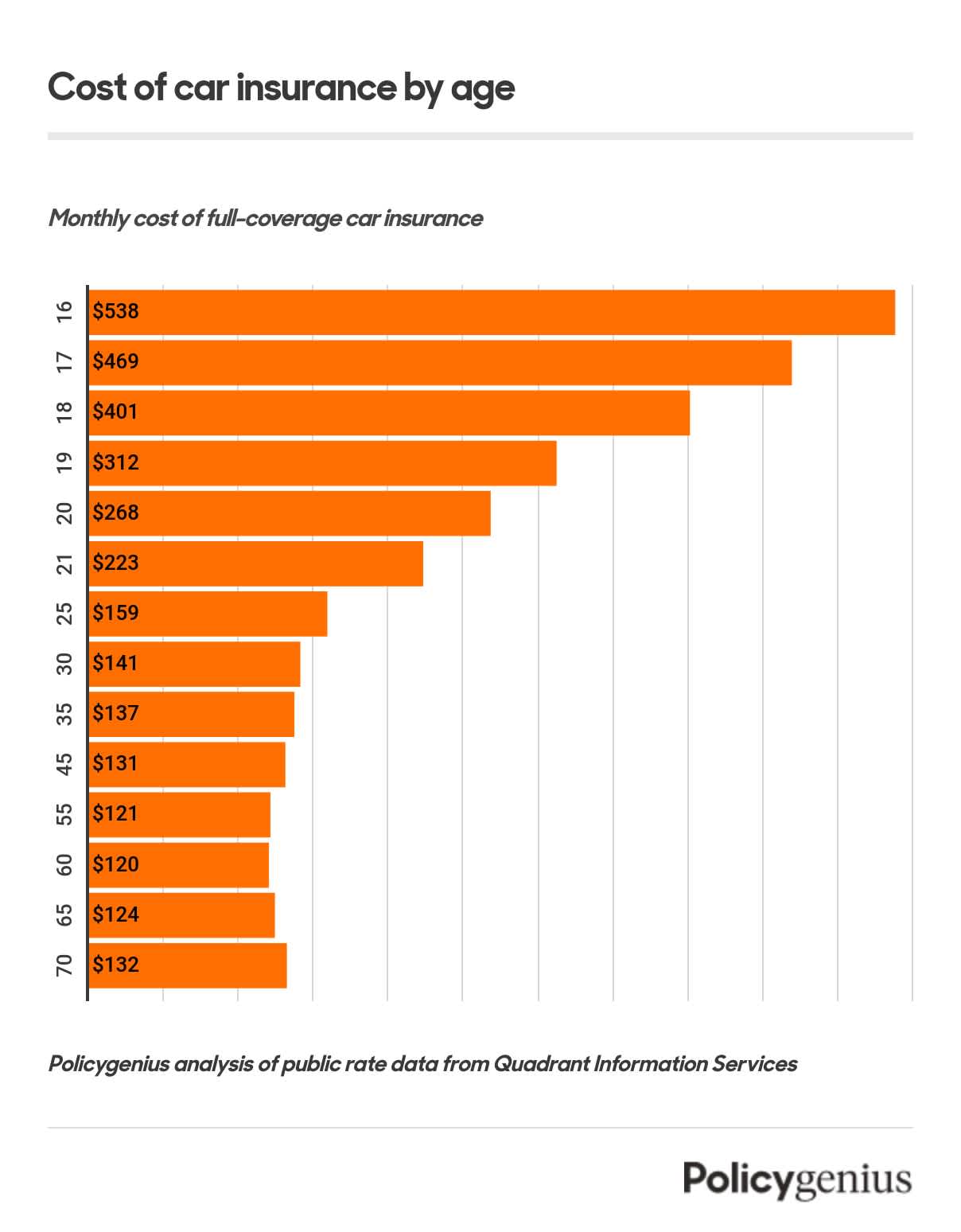

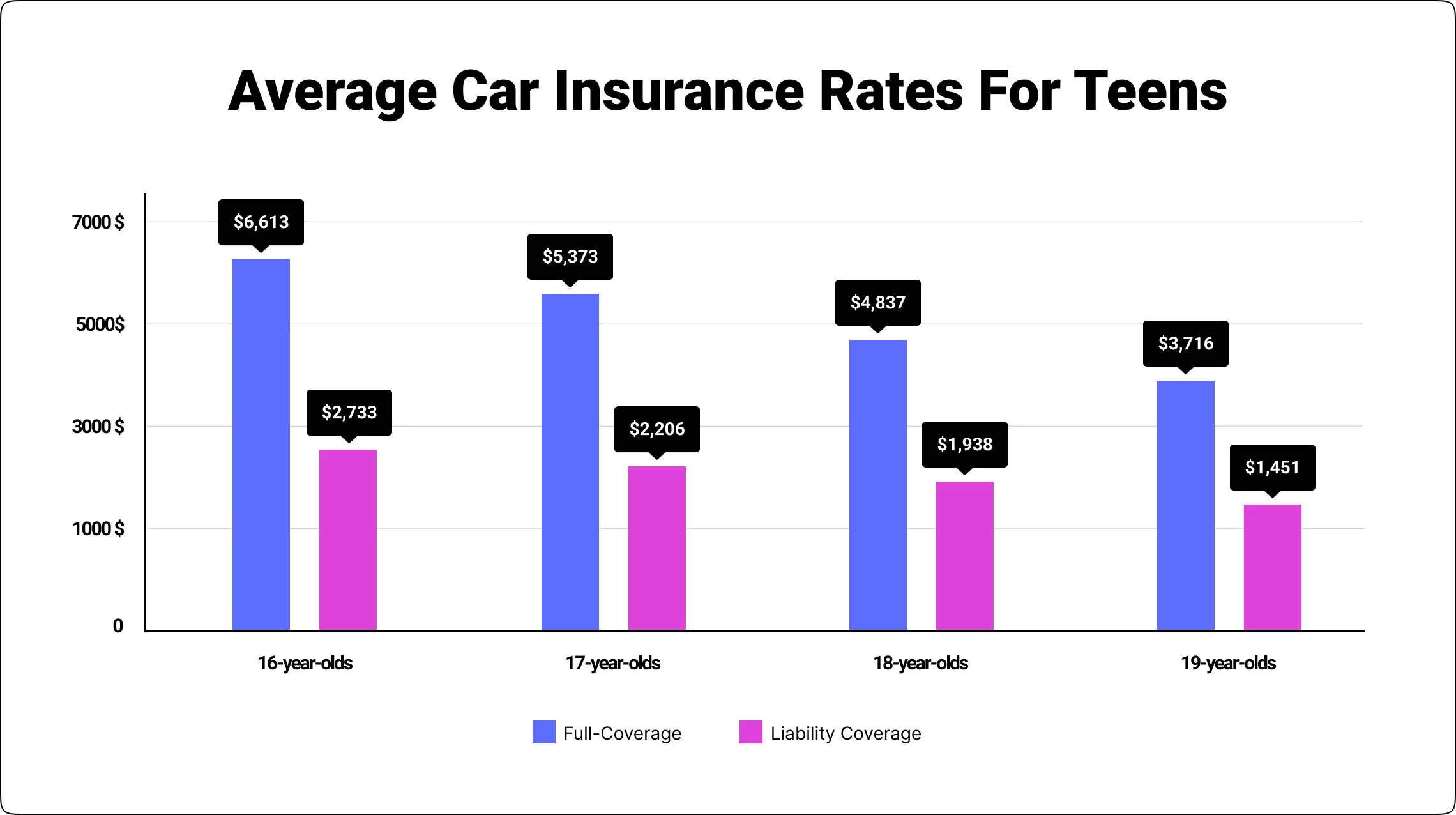

Age plays a significant role. Teenagers and young adults typically face the highest rates due to their inexperience. According to the Insurance Institute for Highway Safety (IIHS), drivers aged 16-19 are nearly three times as likely as drivers aged 20 and older to be in a crash.

As drivers gain experience, their rates tend to decrease. This is because the perceived risk to the insurance company diminishes over time.

Location, Location, Location

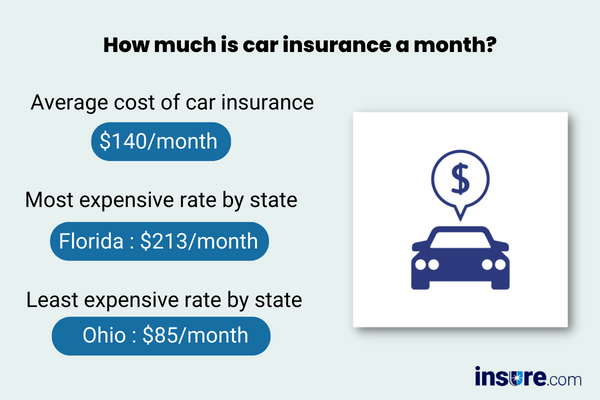

Where you live also impacts your insurance costs. Urban areas, with higher traffic density and increased risk of theft or vandalism, usually have higher premiums than rural areas. Some states have higher average insurance rates than others due to factors like weather patterns, litigation trends, and state regulations. The National Association of Insurance Commissioners (NAIC) provides data on average premiums by state.

Vehicle Choice Matters

The type of car you drive is another key factor. Sports cars and other high-performance vehicles typically come with higher insurance costs due to their increased likelihood of speeding and accidents. More practical and safer vehicles will usually have lower premiums.

Safety features can also play a role. Cars equipped with advanced safety technologies, such as automatic emergency braking and lane departure warning, may qualify for discounts.

Finding Affordable Coverage

While the initial outlook might seem expensive, there are strategies new drivers can employ to lower their insurance costs. One of the most effective is to remain on their parents' policy, if possible. Adding a new driver to an existing policy is generally cheaper than purchasing a separate policy.

Taking a defensive driving course can also lead to discounts with some insurers. These courses teach safe driving techniques and help reduce the risk of accidents.

Shopping around and comparing quotes from multiple insurance companies is crucial. Each insurer weighs risk factors differently, so premiums can vary significantly.

Consider Higher Deductibles

Choosing a higher deductible can lower your monthly premium. Just be sure you can afford to pay the deductible out-of-pocket if you need to file a claim. A higher deductible shifts more of the financial risk to you, which the insurance company rewards with a lower premium.

Discounts are often available for students with good grades. Insurance companies see good grades as an indicator of responsible behavior, which can translate to lower premiums.

Looking Ahead

The cost of insurance for a new driver is a reality, but it’s not insurmountable. By understanding the factors that influence premiums and taking proactive steps to lower costs, new drivers can navigate the insurance landscape with confidence.

Ultimately, safe driving habits are the best way to keep insurance rates down in the long run. Avoiding accidents and traffic violations will build a positive driving record. This is the foundation of affordable insurance premiums in the years to come.

:max_bytes(150000):strip_icc()/car-insurance-costs.aspFinal-67e96373fddc49dd960fbc316737ebcd.jpg)