How To Get Rid Of My Hard Inquiries

Imagine this: You're finally ready to apply for that dream apartment, the one with the sun-drenched balcony overlooking the city. You've saved diligently, your credit score is looking good, and you're feeling optimistic. But then, the rental application is denied, and the reason cited is "too many recent credit inquiries." That sinking feeling? We've all been there, or know someone who has.

Navigating the world of credit scores and inquiries can feel like deciphering a secret code. Hard inquiries, those little credit report blemishes that can impact your approval odds, often seem shrouded in mystery.

Fear not, because understanding and addressing hard inquiries is within your grasp. This guide will help you understand what they are and how to manage them.

Understanding Hard Inquiries

A hard inquiry occurs when a lender checks your credit report as part of a credit application, like a loan, credit card, or even an apartment rental. These inquiries can temporarily lower your credit score, usually by a small amount.

They signal to lenders that you're actively seeking credit. Too many in a short period may suggest financial instability, making lenders hesitant.

However, it is important to understand what constitutes a hard inquiry and what does not.

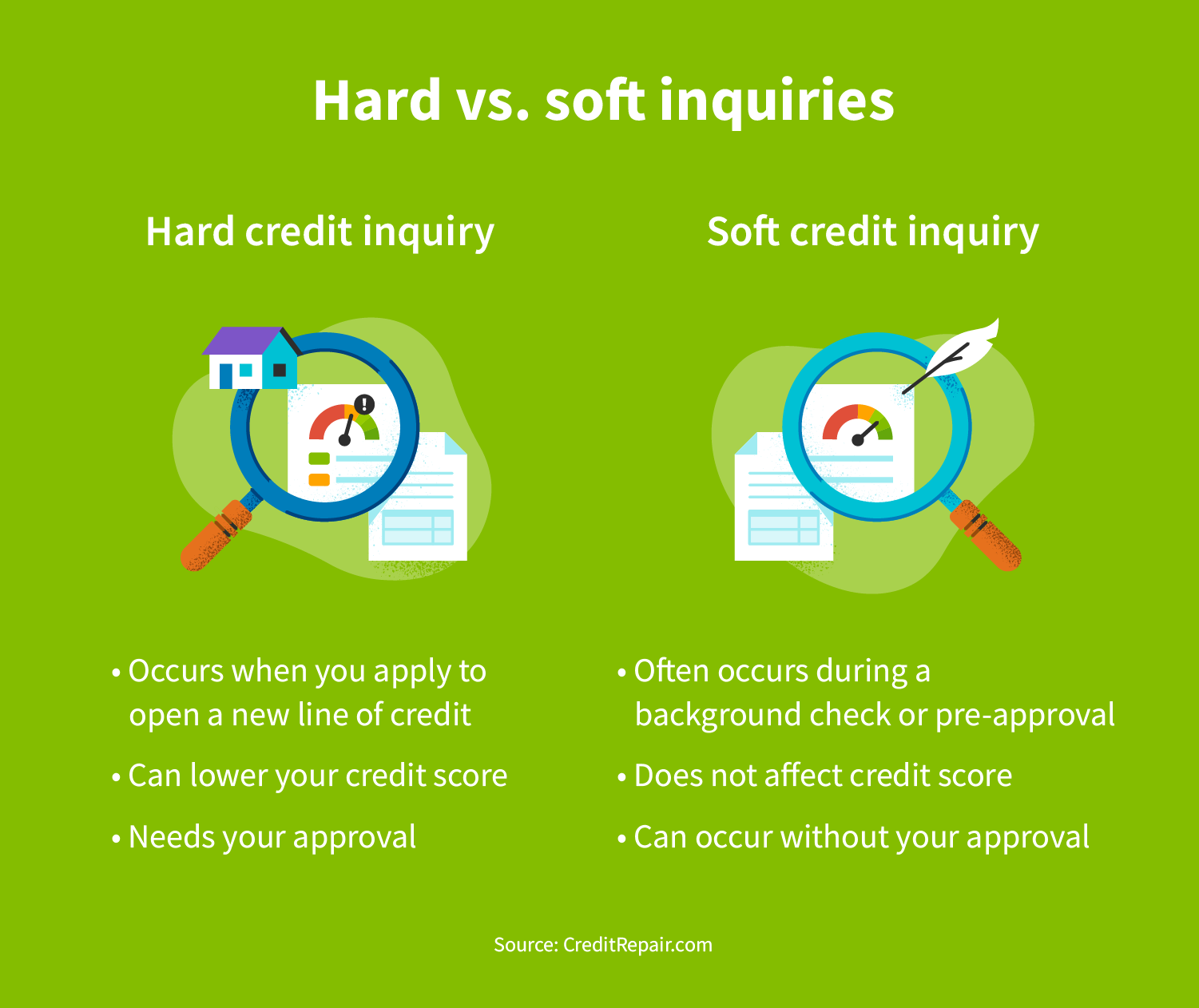

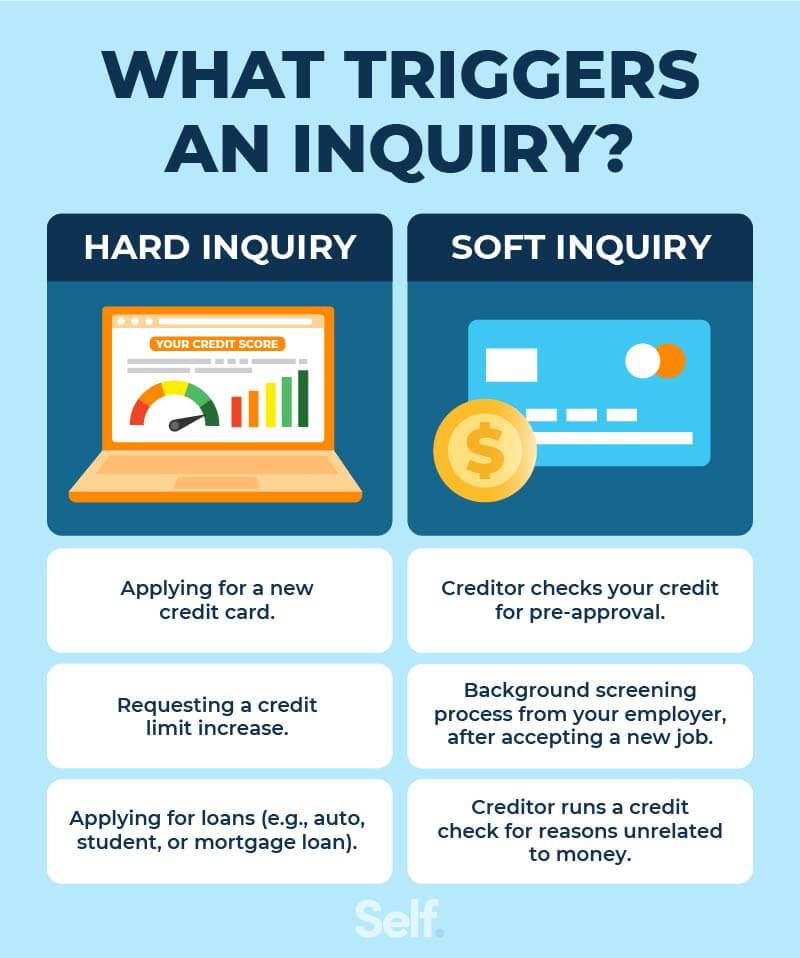

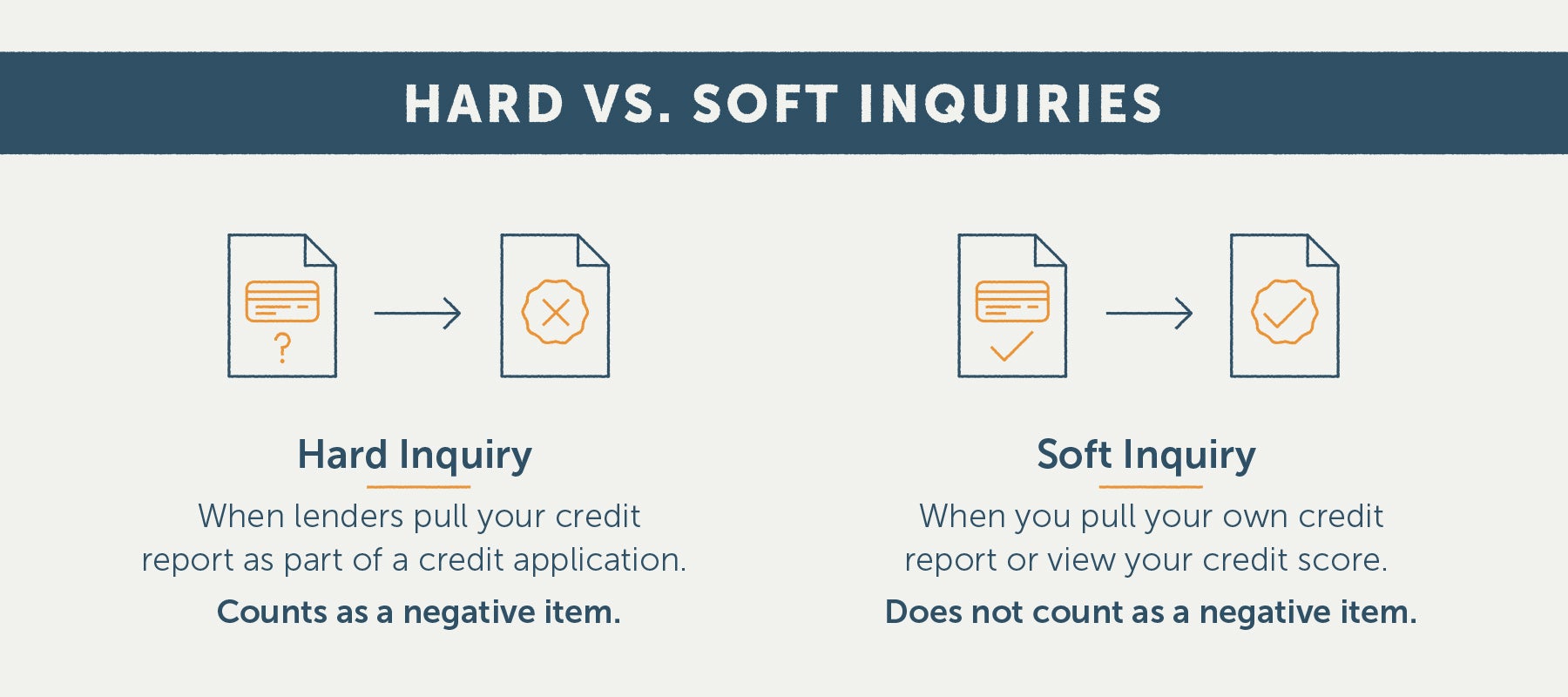

Distinguishing Hard Inquiries from Soft Inquiries

Not all credit checks are created equal. Soft inquiries, like when you check your own credit report or when a lender pre-approves you for a credit card, don't affect your credit score.

These are essentially background checks that don't indicate you're actively seeking new credit.

Knowing the difference is the first step in managing your credit health.

Strategies for Removing Hard Inquiries

While some hard inquiries will naturally fall off your credit report after two years, there are a few strategies you can employ to potentially expedite the process. Remember, results aren't guaranteed, but these steps can be helpful.

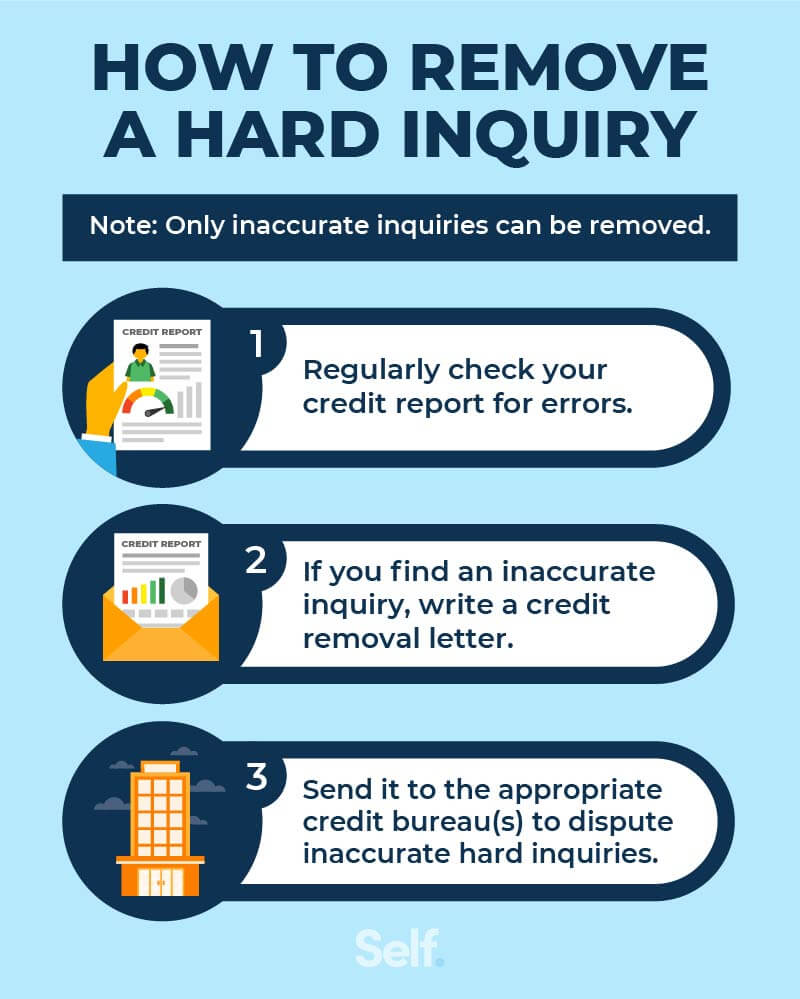

The first step is to review your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. You can access these reports for free weekly at AnnualCreditReport.com.

Carefully examine each hard inquiry. Look for any that are unfamiliar, unauthorized, or inaccurate.

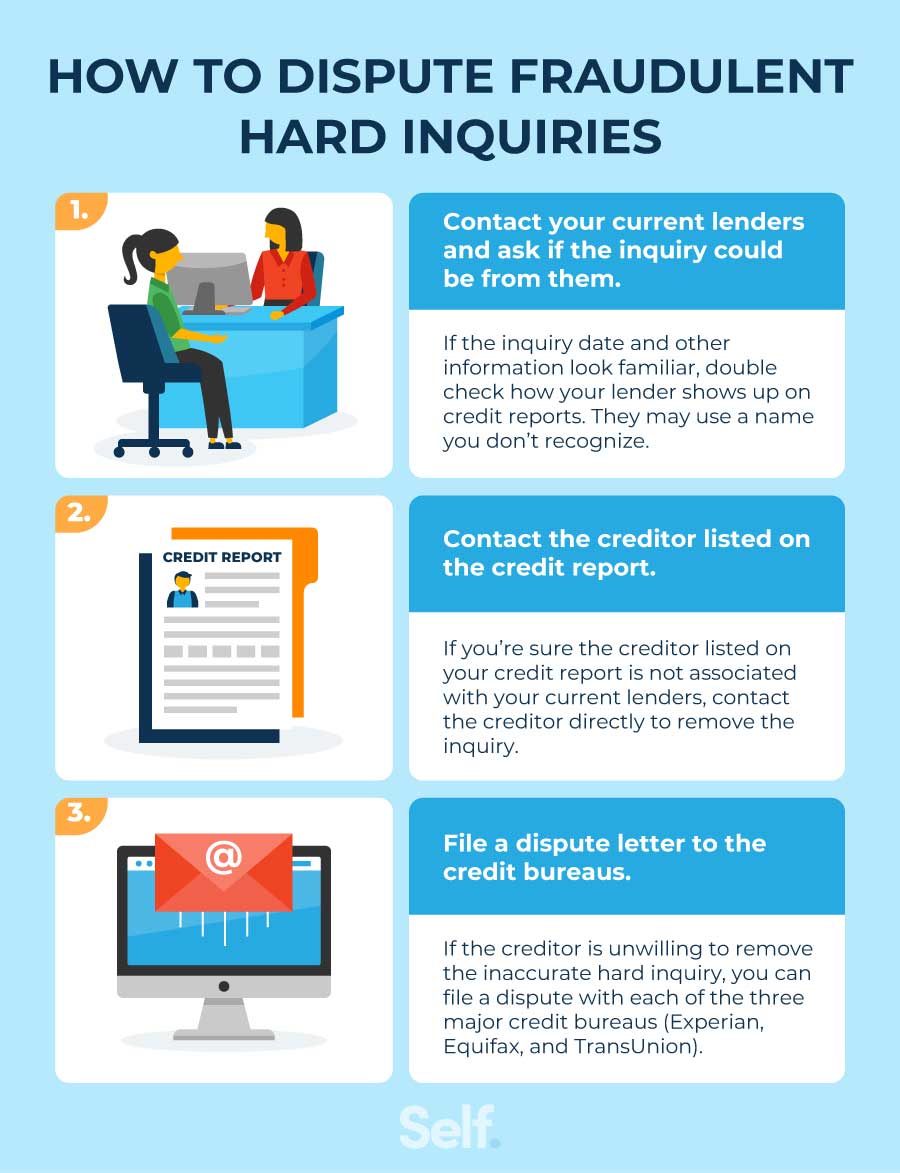

Disputing Inaccurate Inquiries

If you find an inquiry that you believe is incorrect, you have the right to dispute it with the credit bureau. This involves sending a written dispute explaining why you believe the inquiry is inaccurate.

Be sure to include any supporting documentation you may have, such as proof of identity or a statement that you never applied for the credit in question.

The credit bureau is legally obligated to investigate your claim and remove the inquiry if they cannot verify its accuracy within 30 days.

Requesting Goodwill Removals

If the inquiry is legitimate but you have a good reason for why it occurred (e.g., you were comparison shopping for a mortgage and didn't realize each application would trigger a hard inquiry), you can try writing a goodwill letter to the lender.

Explain your situation and politely request that they remove the inquiry from your credit report as a gesture of goodwill.

While there's no guarantee they'll comply, it's worth a try, especially if you've otherwise been a responsible borrower.

Preventing Future Hard Inquiries

The best approach is to prevent excessive hard inquiries in the first place. Be mindful of how often you're applying for credit. Comparison shopping is important, but try to limit your applications to a concentrated period.

For example, if you're shopping for an auto loan, get pre-approved by several lenders within a two-week window. Credit scoring models often treat multiple inquiries for the same type of loan within a short timeframe as a single inquiry.

Avoid applying for multiple credit cards simultaneously, unless you have a specific and well-thought-out strategy.

The Long Game: Credit Health is a Marathon

While removing hard inquiries can provide a quick boost to your credit score, remember that building good credit is a long-term endeavor. Focus on making timely payments, keeping your credit utilization low, and maintaining a mix of credit accounts.

According to Experian, payment history has the most influence on your credit score.

By consistently practicing responsible credit habits, you'll not only minimize the impact of hard inquiries but also lay a strong foundation for a healthy financial future.

.png)