How To Get The Platinum American Express Card

Want the prestige and perks of the American Express Platinum Card? Getting approved isn't just about wealth; it requires understanding Amex's criteria and strategic application tactics.

This article breaks down the crucial steps to increase your chances of landing this coveted piece of metal, from credit score thresholds to maximizing your approval odds.

Amex Platinum: Key Requirements

Amex doesn't publish strict requirements, but a good to excellent credit score is essential. Aim for a FICO score of 700 or higher.

A long, positive credit history is also crucial. Amex wants to see responsible credit management over time.

Income plays a significant role. While there's no official minimum, you need to demonstrate the ability to comfortably pay the annual fee and any charges.

Credit Score: The Foundation

Your credit score is the first thing Amex assesses. Before applying, check your credit report for errors and address any issues.

A lower score might lead to immediate denial. Building your credit history before applying is crucial.

Experian, Equifax, and TransUnion are the three major credit bureaus to monitor.

Income Verification: Proof of Affordability

Amex may request income verification. Be prepared to provide documents like tax returns or pay stubs.

High income doesn't guarantee approval. However, it significantly strengthens your application.

Make sure your stated income aligns with your financial history to avoid red flags.

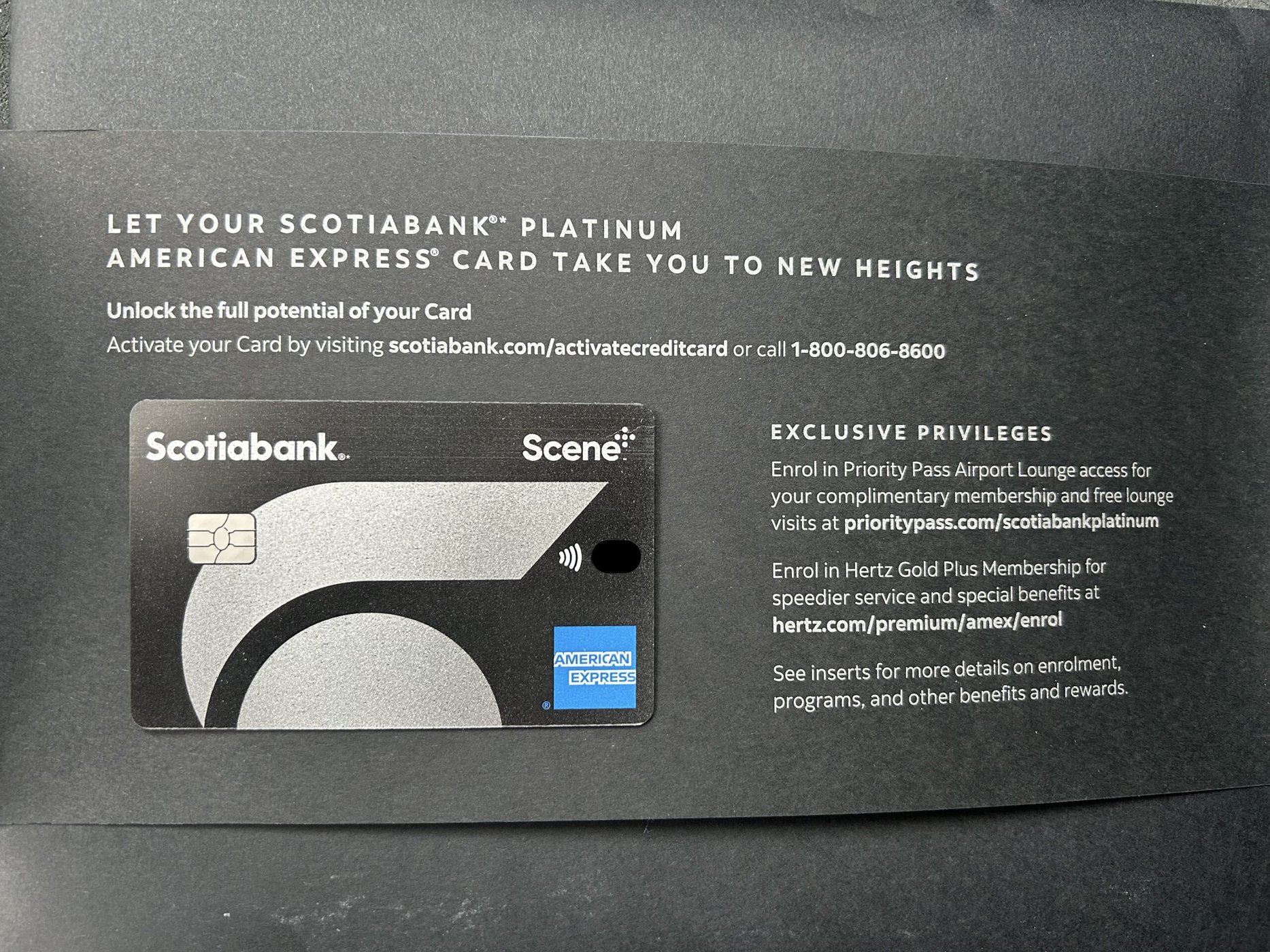

Amex Relationship: Existing Customers Have an Edge

Having existing Amex cards can improve your approval odds. Amex already has a history with you.

If you have other Amex cards, keep them in good standing. Payment history is key.

Consider applying for a lower-tier Amex card first to build a relationship.

Application Strategies

Applying online is the most common method. The Amex website provides a streamlined application process.

Be honest and accurate when filling out the application. Any discrepancies can raise suspicion.

Highlight your strengths, such as a strong credit history and stable income.

Pre-Approval Tools: Gauging Your Chances

Amex offers a pre-approval tool on its website. This allows you to see if you're pre-approved without impacting your credit score.

Pre-approval isn't a guarantee, but it's a good indicator of your approval chances.

Take advantage of this tool before submitting a formal application.

Targeted Offers: An Exclusive Path

Amex often sends targeted offers for the Platinum card. These offers may come with special incentives or higher approval odds.

Keep an eye out for mailings or email offers from Amex.

These targeted offers are often based on your spending habits and credit profile.

After Approval: Maximizing the Benefits

Once approved, familiarize yourself with the Platinum Card's benefits. These include travel credits, lounge access, and elite status with various partners.

Use the card strategically to maximize your rewards and perks.

Pay your balance in full each month to avoid interest charges.

What to Do Next

Check your credit score and address any issues. Explore the Amex pre-approval tool.

Consider building a relationship with Amex through a lower-tier card. Be prepared to provide income verification if requested.

Applying for the Amex Platinum is a strategic process. With careful planning and a strong financial profile, you can increase your chances of approval and unlock the card's premium benefits.