How To Increase Your Secured Credit Card Limit

Secured credit cards offer a vital pathway for individuals with limited or damaged credit histories to build or rebuild their credit scores. However, starting with a low credit limit can feel restrictive. The good news is that increasing a secured credit card limit is achievable with the right strategies and consistent financial discipline.

This article delves into actionable steps and key considerations for successfully raising your secured credit card limit. We’ll explore the importance of responsible card usage, timing your request strategically, and understanding the specific policies of your card issuer. By implementing these tactics, you can unlock a higher credit line, improve your credit utilization ratio, and ultimately graduate to an unsecured credit card.

Understanding Secured Credit Card Limits

Secured credit cards require a cash deposit, which typically serves as the credit limit. This deposit minimizes the risk for the card issuer, making it easier for applicants with less-than-perfect credit to get approved. Increasing the credit limit on a secured card usually involves adding to this initial deposit.

Consistent and Responsible Card Usage

One of the most crucial steps is demonstrating responsible credit card usage. This means making on-time payments every month and keeping your balance well below your credit limit. Payment history is the biggest factor in your credit score, accounting for about 35% of your FICO score, according to Experian.

Aim to use no more than 30% of your available credit. This is known as your credit utilization ratio, and a low ratio signals to lenders that you manage credit wisely. Exceeding this threshold can negatively impact your credit score.

Adding to Your Security Deposit

The most direct way to increase your secured credit card limit is by adding funds to your security deposit. Contact your card issuer to inquire about their specific procedures for increasing your deposit.

Some issuers may allow you to add funds online, while others may require you to mail a check or money order. Before adding to your deposit, make sure you have the financial means to do so without jeopardizing your other financial obligations.

Timing Your Request Strategically

The timing of your request to increase your credit limit can significantly impact your chances of success. It's generally advisable to wait at least six months after opening your secured credit card before requesting an increase.

This allows sufficient time to establish a positive payment history. Furthermore, requesting an increase shortly after a missed payment or a large purchase is likely to be unsuccessful.

Communicating with Your Card Issuer

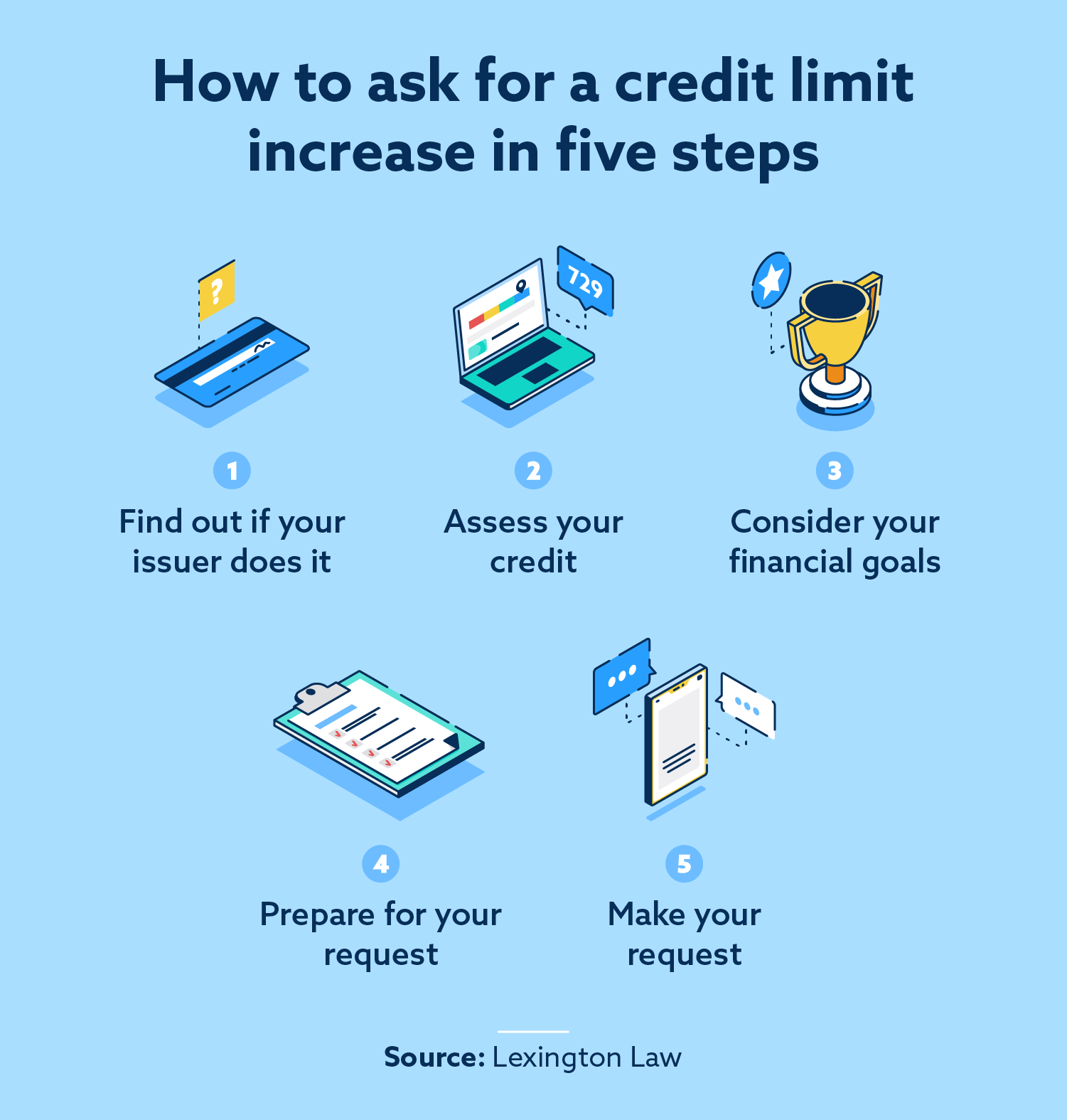

Open communication with your card issuer is key. Call or email them to inquire about their specific policies and procedures for increasing credit limits on secured cards.

Some issuers may have a formal application process, while others may consider increases on a case-by-case basis. Be prepared to explain why you're requesting the increase and highlight your responsible card usage.

"Building a strong relationship with your credit card issuer can improve your chances of getting a credit limit increase," says Ted Rossman, Senior Industry Analyst at CreditCards.com.

Consider a Credit Limit Increase Request

Some secured credit card issuers allow you to formally request a credit limit increase. This typically involves submitting an application similar to the one you completed when you first applied for the card.

This application will likely require you to provide updated information about your income and employment status. Be truthful and accurate when completing the application.

Graduating to an Unsecured Card

The ultimate goal for many secured credit card holders is to graduate to an unsecured credit card. This typically involves the card issuer returning your security deposit and converting your account to an unsecured line of credit.

To qualify for graduation, you'll need to demonstrate a consistent history of responsible card usage and a significant improvement in your credit score. Check with your card issuer to understand their specific criteria for graduation.

Alternative Options and Considerations

If your secured credit card issuer is unwilling to increase your credit limit or graduate you to an unsecured card, consider exploring other options. You could apply for a second secured credit card with a different issuer that offers more favorable terms.

Another option is to apply for a credit-builder loan. These loans are designed to help individuals with limited credit histories establish a positive credit profile.

Ultimately, raising your secured credit card limit is a journey that requires patience, discipline, and strategic planning. By consistently practicing responsible credit card habits and proactively communicating with your card issuer, you can increase your credit line, improve your credit score, and unlock greater financial opportunities.