How To Join Class Action Lawsuit Credit One Bank

For millions of Americans, credit cards are a necessity, but sometimes, those cards come with strings attached that feel more like shackles. Credit One Bank, a well-known issuer, has faced numerous allegations regarding its fees, interest rates, and marketing practices. Now, individuals who feel wronged are seeking recourse through class action lawsuits.

This article provides information on how to determine if you are eligible to join a class action lawsuit against Credit One Bank and the steps involved in participating. It will delve into the legal landscape surrounding these cases and offer resources to help navigate the process. Understanding your rights and the potential avenues for redress is crucial in situations where financial institutions may have acted unfairly.

Understanding Class Action Lawsuits Against Credit One Bank

A class action lawsuit is a legal mechanism that allows a large group of people with similar grievances to bring a single claim against a defendant. These lawsuits are often pursued when individual damages are relatively small, making individual lawsuits impractical. They allow for collective bargaining power and can lead to significant settlements or judgments that benefit all class members.

Several class action lawsuits have been filed against Credit One Bank in recent years, alleging various violations of consumer protection laws. Common allegations include deceptive marketing practices, excessive fees, and misleading disclosures. These lawsuits often target specific practices that are perceived as unfair or unlawful.

Key Allegations in Credit One Bank Class Actions

One recurring theme in these lawsuits revolves around the bank’s fees. These fees may include annual fees, late payment fees, and over-the-limit fees, which plaintiffs argue are excessive and not clearly disclosed. Some lawsuits allege that these fees are disproportionate to the credit limits offered and contribute to a cycle of debt for cardholders.

Another significant area of contention concerns the bank’s marketing practices. Plaintiffs often claim that Credit One Bank engages in deceptive advertising, particularly regarding interest rates and rewards programs. They argue that the terms and conditions of these programs are not adequately explained, leading consumers to believe they are receiving better deals than they actually are.

Additionally, some lawsuits challenge the bank’s reporting practices to credit bureaus. Plaintiffs allege that Credit One Bank has inaccurately reported account information, which has negatively impacted their credit scores. This inaccurate reporting can have serious consequences for consumers, affecting their ability to obtain loans, mortgages, and other forms of credit.

Determining Your Eligibility to Join a Class Action

The first step in joining a class action lawsuit against Credit One Bank is to determine whether you meet the eligibility criteria. Typically, these criteria are defined by the specific allegations in the lawsuit and the time period covered. To determine eligibility, review the details of the specific class action.

You would generally need to have been a Credit One Bank cardholder during the relevant period. You will likely need to have experienced the specific issues alleged in the lawsuit, such as being charged excessive fees or being subjected to deceptive marketing practices. Holding relevant documents, such as credit card statements and marketing materials, can be helpful to show your case.

How to Find Information on Current Lawsuits

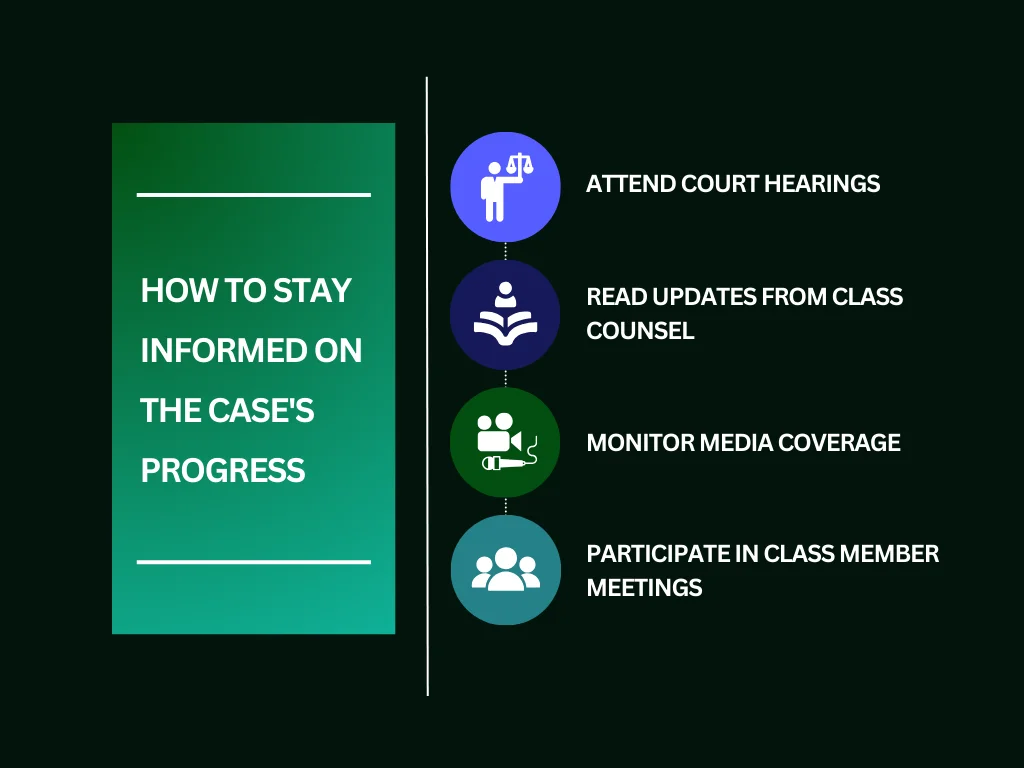

Staying informed about ongoing class action lawsuits is crucial. Several resources can help you track down relevant information, including online legal databases, consumer advocacy websites, and law firm websites. Websites such as ClassAction.org and Top Class Actions regularly post updates on new and ongoing class actions across various industries.

You can also consult with a consumer protection attorney. An attorney can provide guidance on whether you are eligible to join a specific class action and advise you on your legal options. Many law firms offer free consultations to potential clients.

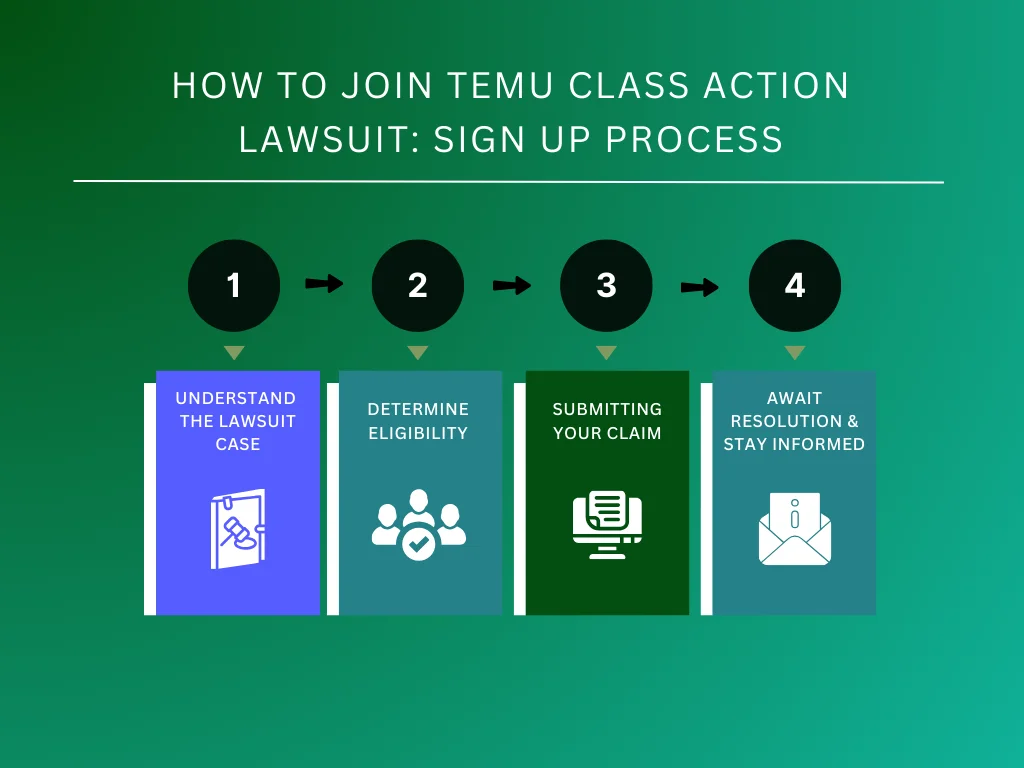

The Process of Joining a Class Action Lawsuit

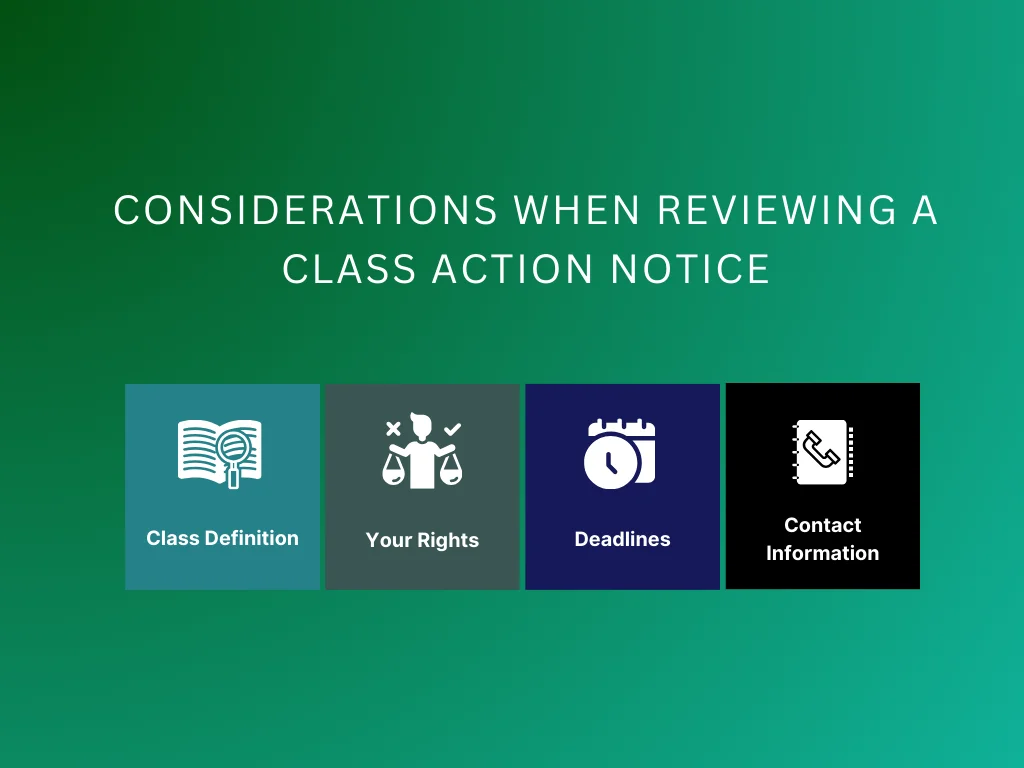

Joining a class action lawsuit typically involves a few key steps. These steps are generally straightforward, but it's essential to understand the process to ensure your interests are protected. If a class action lawsuit has already been certified by the court, you may need to file a claim form to participate in any settlement or judgment.

You may receive a notice in the mail or via email if you are identified as a potential class member. This notice will explain the details of the lawsuit, your rights as a class member, and the process for filing a claim. Read the notice carefully and follow the instructions provided.

If you do not receive a notice but believe you are eligible, you can contact the law firm representing the class. The law firm can provide you with information on how to join the lawsuit and file a claim. Keep records and documentation regarding your experience with Credit One Bank.

Weighing the Pros and Cons of Joining a Class Action

Participating in a class action lawsuit has both advantages and disadvantages. It's essential to consider these factors before deciding whether to join. By joining a class action lawsuit, you may be entitled to a portion of any settlement or judgment obtained by the class.

The primary advantage is that you can potentially recover financial compensation for the harm you have suffered without incurring significant legal fees. Class action attorneys typically work on a contingency fee basis, meaning they only get paid if they win the case. You will likely not have direct control over the litigation strategy, as the class representatives and attorneys will make decisions on behalf of the entire class.

A disadvantage is that any settlement or judgment may be smaller than what you could potentially recover in an individual lawsuit. Joining a class action may prevent you from pursuing your own individual lawsuit against Credit One Bank.

Future Outlook and Potential Outcomes

The legal landscape surrounding consumer protection and credit card practices is constantly evolving. Future class action lawsuits against Credit One Bank or other credit card issuers are possible. These lawsuits may address new issues or challenge existing practices in light of changing laws and regulations.

If the lawsuits are successful, this could lead to significant changes in Credit One Bank's business practices. The bank may be required to change its fee structures, improve its marketing practices, and enhance its disclosures to consumers. Consumers should monitor developments in consumer protection laws and be aware of their rights as cardholders.

Ultimately, class action lawsuits play an important role in holding financial institutions accountable. These lawsuits provide a mechanism for consumers to seek redress for unfair or unlawful practices and can contribute to a more transparent and equitable financial marketplace.