How To Keep Track Of Money For Small Business

For small business owners, juggling daily operations and financial management can feel like a high-wire act. Keeping a close eye on cash flow is crucial for survival, but knowing the best strategies for tracking income and expenses can be overwhelming. Here's a look at practical methods to help small businesses maintain financial control.

Effective money tracking is the cornerstone of any successful small business, ensuring profitability and sustainability. Without a clear understanding of where money is coming from and where it's going, businesses risk overspending, mismanaging resources, and ultimately, failure.

Choosing the Right Tools

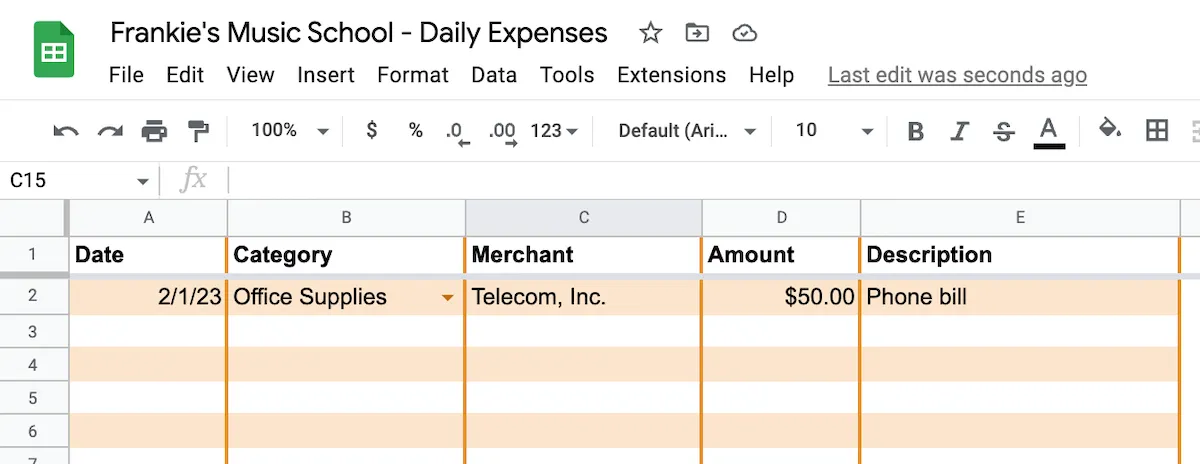

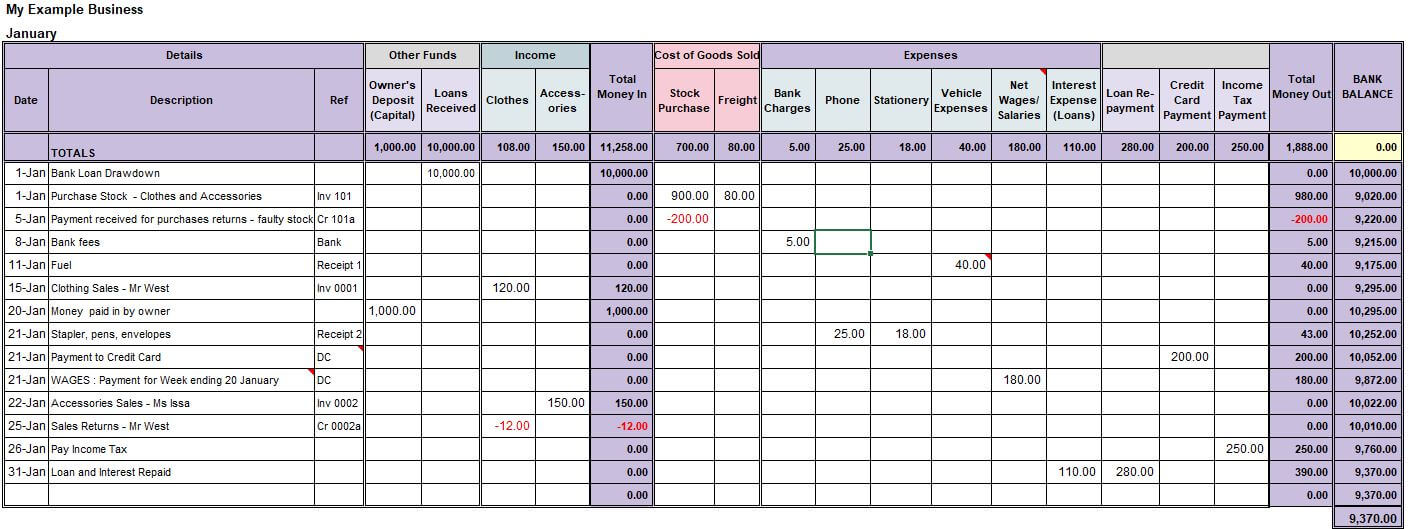

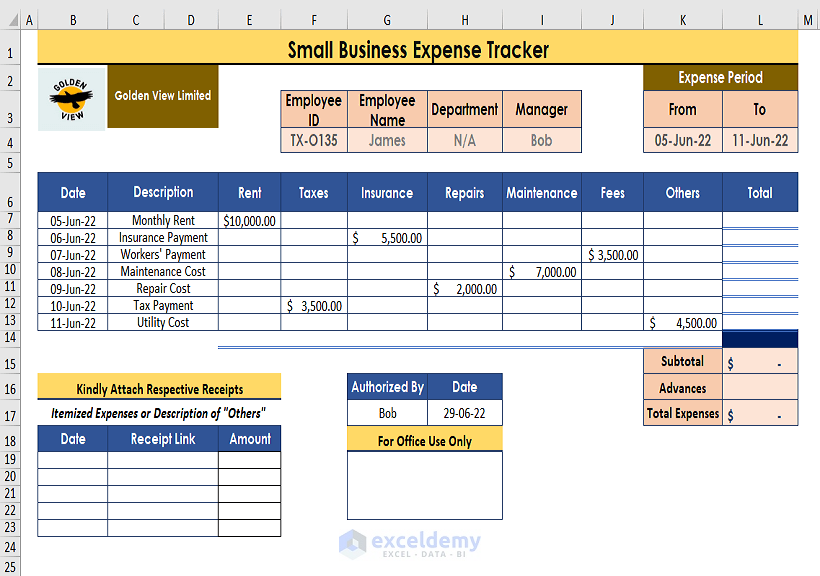

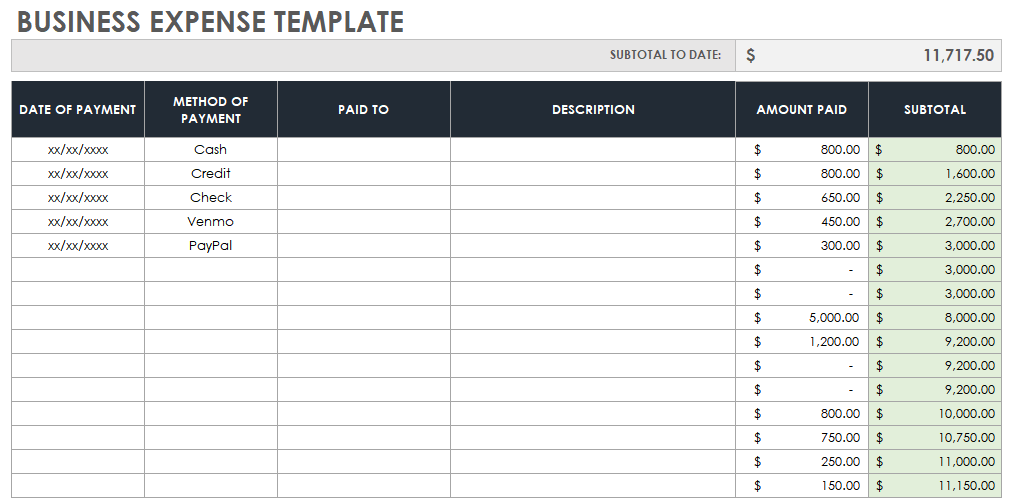

The first step is selecting a suitable accounting system. This could range from simple spreadsheets to sophisticated accounting software. Spreadsheets are often a good starting point for very small businesses with limited transactions, offering basic tracking capabilities.

However, as a business grows, accounting software like QuickBooks, Xero, or Zoho Books becomes essential. These platforms offer features like automated bank feeds, invoice creation, and detailed financial reporting.

Manual vs. Automated Tracking

While manual tracking using spreadsheets is cost-effective initially, it can be time-consuming and prone to errors. Automated systems reduce the risk of human error and free up valuable time for other business tasks.

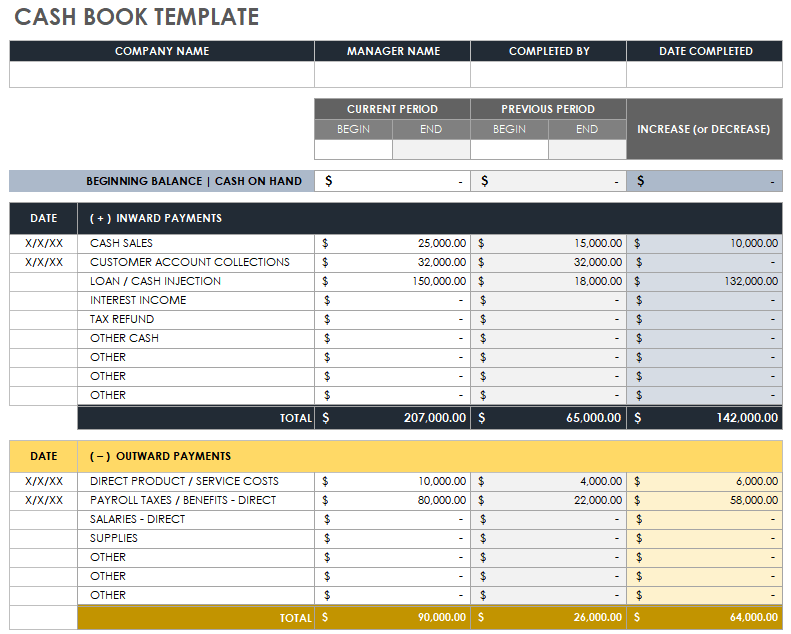

Automated bank feeds directly import transactions from bank accounts and credit cards, streamlining the reconciliation process. This automation allows for real-time monitoring of cash flow.

Implementing Best Practices

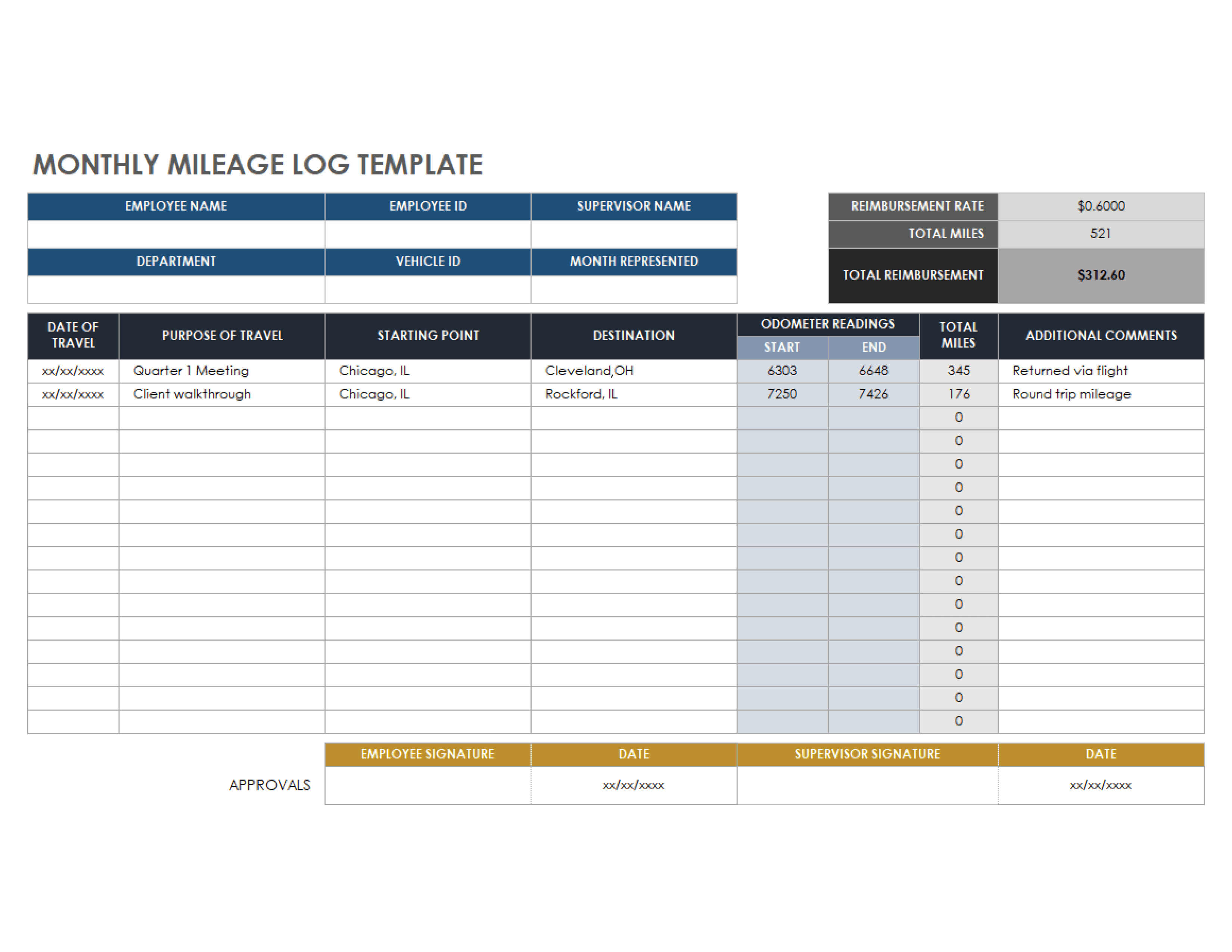

Beyond the choice of tools, implementing sound financial practices is paramount. This involves separating business and personal finances, creating a budget, and regularly reconciling accounts.

Opening a separate bank account and credit card for business transactions is crucial. This separation simplifies bookkeeping and provides a clear audit trail.

Developing a budget helps forecast income and expenses, providing a roadmap for financial planning. Regularly comparing actual performance against the budget helps identify potential problems early on.

Regular Reconciliation

Reconciling bank statements and credit card statements monthly is essential. This process involves comparing the transactions recorded in the accounting system with the transactions reported by the bank.

Reconciliation helps identify errors, fraudulent activities, and missed transactions. Addressing discrepancies promptly ensures the accuracy of financial records.

Monitoring Key Metrics

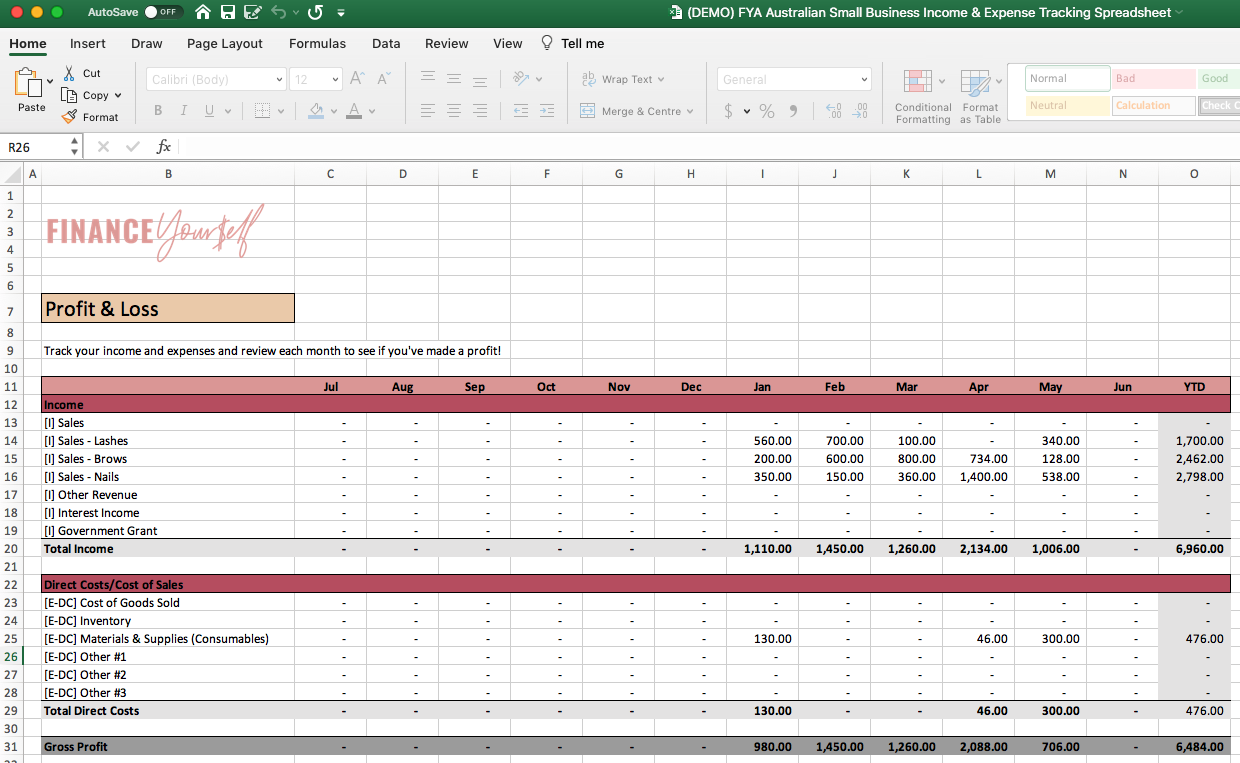

Tracking key performance indicators (KPIs) provides valuable insights into the financial health of the business. These metrics can include revenue, expenses, profit margins, and cash flow.

Monitoring revenue trends helps identify growth opportunities and potential slowdowns. Tracking expenses allows for cost control and efficient resource allocation.

Profit margins indicate the profitability of each sale, providing insights into pricing strategies. Cash flow is the lifeblood of any business, and monitoring it closely ensures sufficient funds are available to meet obligations.

Seeking Professional Advice

Many small business owners find it beneficial to consult with a qualified accountant or bookkeeper. These professionals can provide expert guidance on setting up accounting systems, developing financial strategies, and ensuring compliance with tax regulations.

An accountant can help interpret financial statements, identify areas for improvement, and provide advice on tax planning. A bookkeeper can assist with day-to-day bookkeeping tasks, freeing up the owner's time to focus on other aspects of the business.

"Accurate and timely financial information is essential for making informed business decisions," says Jane Doe, a certified public accountant specializing in small business accounting. "Small businesses should invest in the right tools and seek professional advice to ensure they have a clear understanding of their financial performance."

By adopting these strategies, small businesses can gain control of their finances, improve profitability, and build a solid foundation for long-term success. The key is to be proactive, diligent, and committed to maintaining accurate and up-to-date financial records.

![How To Keep Track Of Money For Small Business [Free] Small Business Spreadsheet for Income and Expenses](https://storage.googleapis.com/driversnote-marketing-pages/US-smallbusiness-expenses-template.png)