How To Make Multiple Streams Of Income

The modern economy, marked by increasing job insecurity and evolving career landscapes, has prompted many to explore diversifying their income sources. Generating multiple streams of income, once the domain of entrepreneurs, is now becoming increasingly accessible and appealing to individuals across various professions and skillsets. But how exactly does one navigate this complex world and build a robust financial safety net?

This article delves into the practical steps and strategies for establishing multiple income streams, providing a comprehensive overview of the options available and the considerations involved. It aims to equip readers with the knowledge necessary to take control of their financial futures and mitigate risks associated with relying solely on a single source of income.

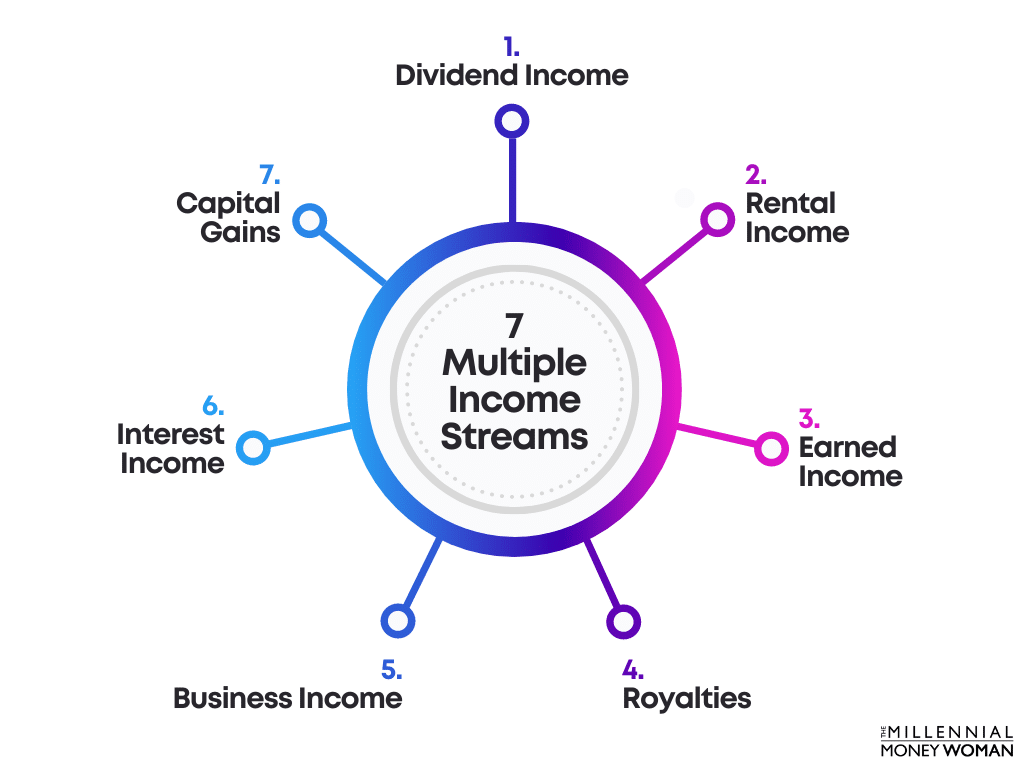

Exploring Income Stream Avenues

The foundation of building multiple income streams lies in identifying opportunities that align with your skills, interests, and available resources. These opportunities can generally be categorized into active and passive income sources.

Active Income: Trading Time for Money

Active income requires direct involvement and trading time for compensation. Examples include freelancing, consulting, or part-time employment.

Freelancing platforms like Upwork and Fiverr connect individuals with clients seeking services in writing, graphic design, web development, and more. Consulting involves leveraging expertise in a specific field to provide advice and guidance to businesses or individuals, often commanding higher hourly rates.

While requiring consistent effort, active income provides immediate financial returns and opportunities to expand skill sets and build professional networks.

Passive Income: Building Self-Sustaining Systems

Passive income, in contrast, involves creating systems that generate revenue with minimal ongoing effort. This category often requires upfront investment of time or capital.

Creating and selling online courses is a popular option, allowing individuals to share their expertise with a global audience. Platforms like Udemy and Coursera host courses on a wide range of topics, providing a marketplace for instructors to reach potential students.

Real estate investing, although requiring significant capital, can generate rental income. Investing in dividend-paying stocks or bonds is another path. Both requires careful analysis and understanding of market dynamics.

Affiliate marketing involves promoting other companies' products or services and earning a commission on sales generated through unique referral links. Similarly, creating and monetizing a blog or YouTube channel can generate advertising revenue or sponsorship opportunities.

Key Considerations and Strategies

Successfully building multiple income streams requires careful planning, discipline, and a willingness to adapt. Time management is crucial, as juggling multiple ventures can be demanding.

Prioritization and effective task management are essential for preventing burnout and ensuring that each income stream receives adequate attention.

Financial literacy is paramount. Understanding budgeting, saving, and investing principles is vital for managing income from multiple sources and making informed financial decisions.

It is also essential to invest wisely. Reinvesting a portion of earnings back into the business or pursuing further education can accelerate growth and expand income-generating potential. Learning new in-demand skill such as prompt engineering is also an option for further investment.

Networking is crucial for finding new opportunities and collaborations. Attending industry events, joining online communities, and building relationships with other professionals can open doors to new income streams.

"Diversification is key to mitigating risk in any financial endeavor," says Dr. Anya Sharma, a financial advisor at Vanguard. "Building multiple income streams is essentially diversifying your income portfolio, providing a buffer against job loss or economic downturns."

Starting small and scaling gradually is a prudent approach. Focus on establishing one or two income streams initially before expanding further. This allows for learning, adaptation, and refinement of strategies.

The Impact of Diversified Income

Generating multiple income streams offers numerous benefits beyond increased financial security. It fosters a sense of independence and control over one's financial destiny.

It provides the flexibility to pursue passions and interests that may not be financially viable as primary careers. It also mitigates the risk associated with relying solely on a single employer or industry.

In conclusion, building multiple streams of income is an achievable goal for individuals from all walks of life. By embracing a combination of active and passive income strategies, developing financial literacy, and cultivating a proactive mindset, one can build a more secure and fulfilling financial future.

![How To Make Multiple Streams Of Income How to Create Multiple Streams of Income [7 Proven Methods]](https://themillennialmoneywoman.com/wp-content/uploads/2022/02/How-to-Create-Multiple-Streams-of-Income.webp)