How To Measure Financial Performance

Imagine a garden, vibrant and thriving. Sun-drenched tomatoes plump on the vine, fragrant herbs bursting with flavor, and colorful blooms dancing in the breeze. But beauty alone isn't enough. A true gardener understands that underneath the surface lies a complex system of nutrients, water, and sunlight, all working in harmony to produce such abundance.

Similarly, a business might appear successful on the surface, but to truly understand its health and potential, you need to delve deeper and learn how to measure its financial performance.

This article will serve as your guide, illuminating the key metrics and methods used to assess the financial well-being of any organization, from a small startup to a large corporation. Understanding these tools empowers you to make informed decisions, steer businesses toward growth, and ultimately, cultivate financial success.

Understanding the Foundation

Before diving into specific metrics, it's crucial to understand the basic financial statements that serve as the foundation for analysis.

These include the income statement, balance sheet, and cash flow statement. Each statement provides a unique perspective on the company's financial health.

The Income Statement: A Snapshot of Profitability

The income statement, often called the profit and loss (P&L) statement, summarizes a company's revenues, costs, and expenses over a specific period.

It ultimately reveals the company's net income, also known as profit or earnings, which represents the bottom line after all expenses have been deducted from revenue.

Key line items to watch include revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income. Analyzing trends in these areas can reveal valuable insights into a company's profitability.

The Balance Sheet: A Picture of Assets, Liabilities, and Equity

The balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time.

The fundamental accounting equation states that Assets = Liabilities + Equity. This equation highlights the relationship between what a company owns (assets), what it owes to others (liabilities), and the owners' stake in the company (equity).

Analyzing the balance sheet involves examining key ratios such as the current ratio (current assets divided by current liabilities) to assess liquidity and the debt-to-equity ratio to evaluate leverage.

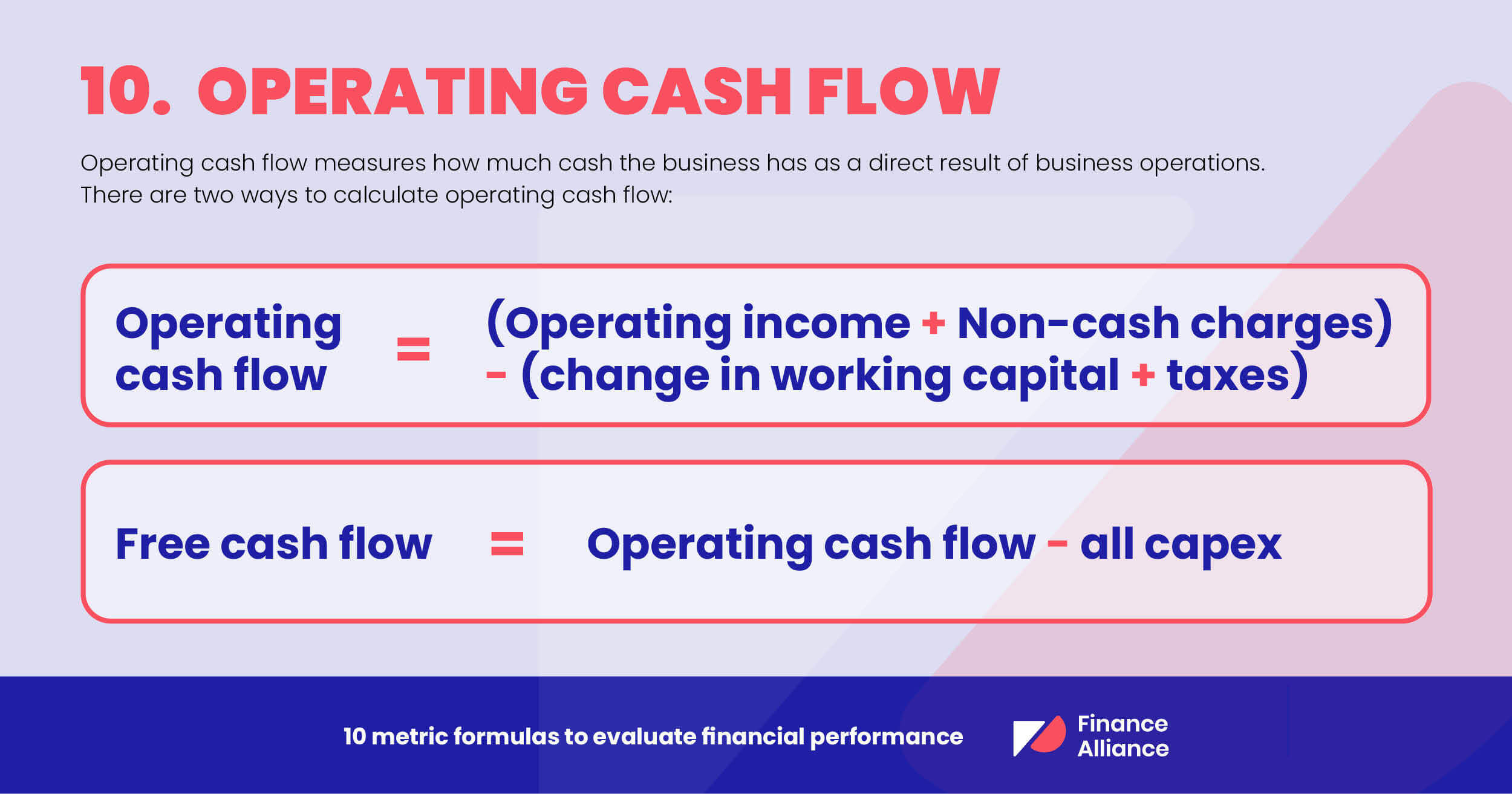

The Cash Flow Statement: Tracking the Movement of Cash

The cash flow statement tracks the movement of cash both into and out of a company over a period of time.

It categorizes cash flows into three main activities: operating activities, investing activities, and financing activities. Understanding how a company generates and uses cash is crucial for assessing its long-term viability.

A healthy cash flow statement shows positive cash flow from operating activities, indicating that the company is generating sufficient cash from its core business operations.

Key Performance Indicators (KPIs)

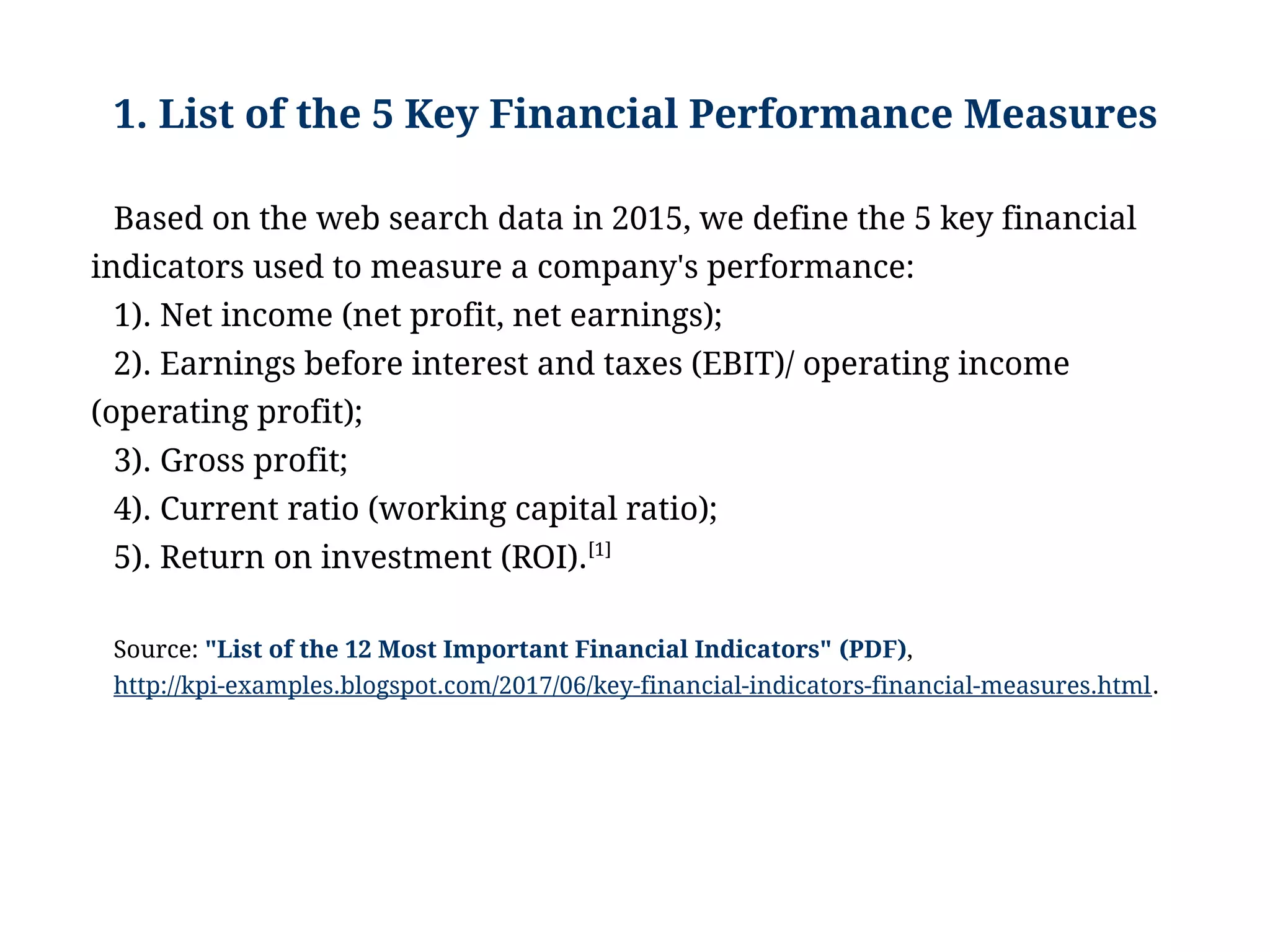

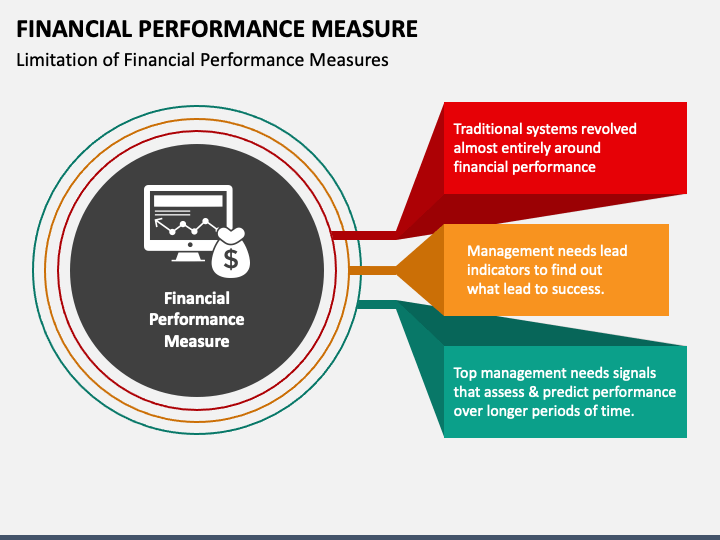

Beyond the financial statements, several key performance indicators (KPIs) provide valuable insights into a company's financial health.

These metrics vary depending on the industry and business model, but some common KPIs include: Profitability ratios, such as gross profit margin and net profit margin, assess a company's ability to generate profits from its revenues.

Liquidity ratios, such as the current ratio and quick ratio, measure a company's ability to meet its short-term obligations. Efficiency ratios, such as inventory turnover and accounts receivable turnover, assess how efficiently a company is managing its assets.

Finally, solvency ratios, such as the debt-to-equity ratio and times interest earned ratio, evaluate a company's ability to meet its long-term obligations.

"What gets measured, gets managed." - Peter Drucker

Utilizing Financial Performance Data

Once you've gathered and analyzed the financial data, it's crucial to use it to make informed decisions.

Benchmarking your company's performance against industry averages can reveal areas where you excel and areas where you need to improve. Comparing your financial performance over time can help you identify trends and track progress toward your goals.

Ultimately, understanding your financial performance allows you to make strategic decisions, optimize your operations, and drive long-term growth.

Remember, measuring financial performance isn't about chasing numbers; it's about gaining a deeper understanding of your business and making informed decisions that lead to sustainable success.