How To Open A Bank Account For Students

Navigating the world of finance can be daunting, especially for students embarking on their higher education journey. Opening a bank account is a crucial first step towards financial independence, but understanding the process and available options is essential. This article aims to provide a comprehensive guide for students on how to successfully open a bank account, ensuring they make informed decisions that align with their financial needs.

This guide details the steps involved in opening a bank account as a student, outlining essential documents, account types, and key considerations. Choosing the right bank account can provide students with convenient access to their funds, help manage expenses, and build a positive credit history. It aims to empower students to take control of their finances and make informed decisions.

Essential Documents and Eligibility

Opening a bank account typically requires specific documentation to verify identity and address. Most banks require a valid government-issued photo ID, such as a driver's license or passport. Some banks may also accept student IDs, but it's best to check beforehand.

Proof of address is another common requirement. This could be a utility bill, lease agreement, or official school document with the student's current address. International students may need additional documentation, such as their I-20 form or visa.

Eligibility requirements often include being at least 18 years old. Minors may be able to open a joint account with a parent or guardian. It's important to check the specific eligibility criteria of each bank before applying.

Types of Bank Accounts for Students

Several types of bank accounts cater specifically to students, each offering different features and benefits. Student checking accounts are designed for everyday transactions and often come with lower fees and minimum balance requirements.

Savings accounts are ideal for setting aside money for future goals, such as tuition or textbooks. These accounts typically offer interest on deposits, helping students grow their savings over time.

Some banks offer combination accounts that combine the features of both checking and savings accounts. Understanding the differences between these account types is crucial for selecting the one that best suits your needs.

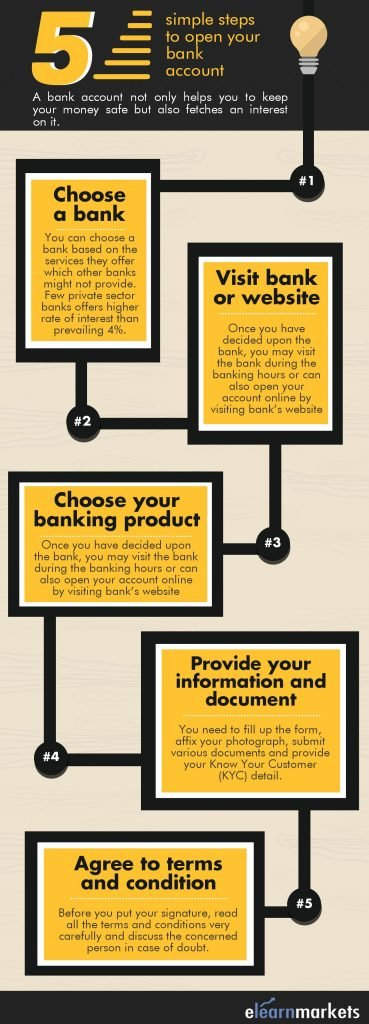

Choosing the Right Bank

Selecting the right bank is a critical step in the process. Consider factors such as fees, ATM access, online banking capabilities, and customer service. Many banks offer special promotions or incentives for students, such as bonus rewards or discounted services.

Online banks can offer lower fees and higher interest rates compared to traditional brick-and-mortar banks. However, they may not provide the same level of in-person support. Read reviews and compare offerings from different banks before making a decision.

Consider the proximity of bank branches and ATMs to your campus or residence. Easy access to your funds is essential for convenient banking.

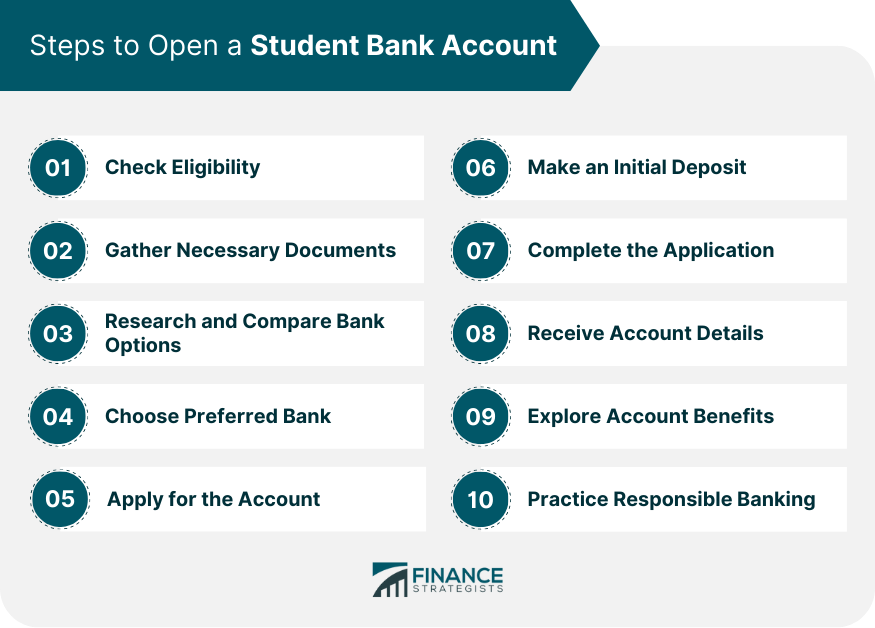

The Application Process

Once you've chosen a bank, you can begin the application process. Most banks allow you to apply online or in person at a branch.

Complete the application form accurately and honestly, providing all required information. Be prepared to answer questions about your financial history and employment status (if applicable).

After submitting your application, the bank may conduct a credit check or verify your identity. You'll typically receive a decision within a few business days.

Managing Your Account

After your account is opened, it's important to manage it responsibly. Set up online banking access to monitor your account balance and transactions.

Avoid overdraft fees by tracking your spending and setting up alerts for low balances.

Consider using budgeting tools or apps to help manage your finances effectively.

Regularly review your bank statements to identify any errors or unauthorized transactions. By taking these steps, you can maintain a healthy financial standing and build a positive banking relationship.

Opening a bank account is a significant step towards financial literacy and independence for students. By understanding the requirements, exploring available options, and managing their accounts responsibly, students can set themselves up for financial success both during and after their academic careers.

![How To Open A Bank Account For Students How To Open Student Bank Account in Lloyds Bank [EASY!] - YouTube](https://i.ytimg.com/vi/wTjIYDg0j_E/maxresdefault.jpg)