How To Open A Bank Account Online With Citibank

Citibank, a major player in the financial services industry, offers a streamlined process for opening bank accounts online, catering to the growing demand for convenient and accessible banking solutions.

This online account opening system provides a quick and efficient alternative to traditional branch visits, allowing individuals to manage their finances from the comfort of their own homes.

Eligibility and Required Information

To be eligible to open an account online with Citibank, applicants generally need to be at least 18 years old and a U.S. resident with a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Furthermore, prospective customers should have a U.S. address and a valid form of government-issued identification, such as a driver's license or passport.

Gathering all necessary information beforehand is crucial for a smooth application process.

The Online Application Process: A Step-by-Step Guide

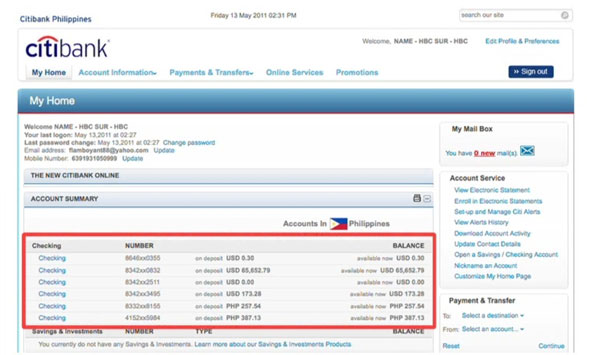

The online application process begins by visiting the official Citibank website and navigating to the "Open an Account" section. Citibank offers a variety of accounts, including checking, savings, and money market accounts.

Applicants should carefully review the terms and conditions, including any associated fees or minimum balance requirements, before proceeding.

The first step involves providing personal information, such as your name, address, date of birth, and Social Security number. This information is essential for verifying your identity and complying with federal regulations.

Next, you'll need to provide your contact details, including your phone number and email address. Citibank uses this information to communicate with you about your application and account.

You'll then be asked to verify your identity electronically. This may involve answering questions about your credit history or providing additional documentation.

After identity verification, you'll need to choose the specific type of account you wish to open. Review each option's features and benefits carefully.

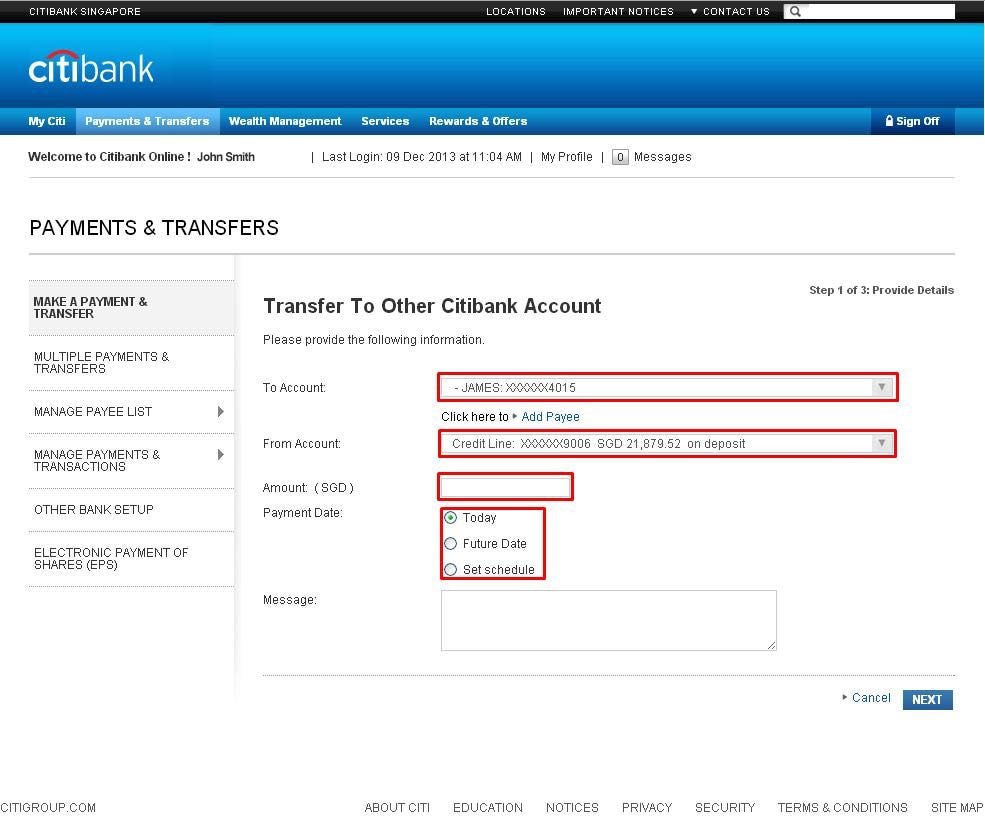

Funding your new account is the next step. Citibank typically allows you to fund your account electronically via a transfer from another bank account or by mailing a check.

Finally, review all the information you've provided and submit your application. You'll typically receive confirmation of your application status within a few business days.

Security Measures

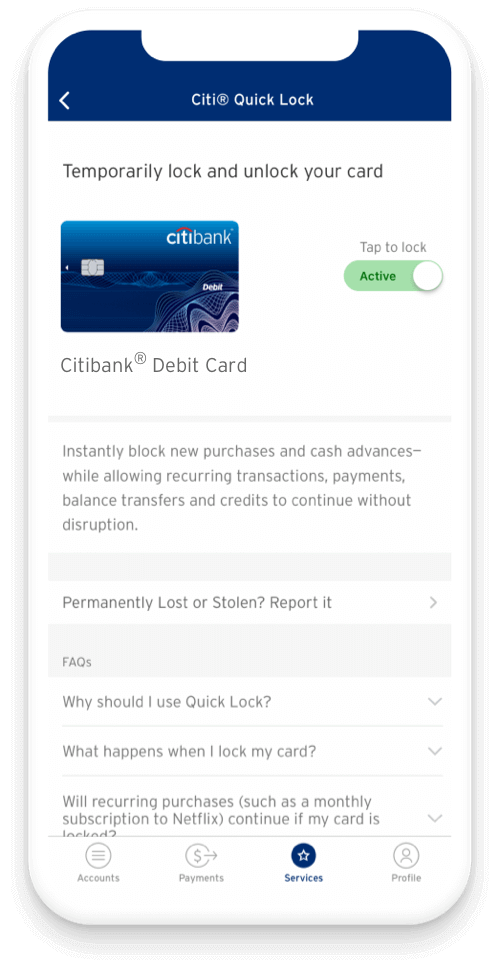

Citibank employs various security measures to protect your personal and financial information during the online account opening process. These measures include encryption technology and multi-factor authentication.

The website uses secure socket layer (SSL) encryption to protect data transmitted between your computer and Citibank's servers.

Multi-factor authentication adds an extra layer of security by requiring you to provide a unique code from your phone or email in addition to your password.

Potential Benefits and Considerations

Opening a bank account online with Citibank offers several benefits, including convenience, accessibility, and a streamlined application process. It eliminates the need to visit a physical branch.

However, it's important to be aware of potential downsides. For example, some customers may prefer the personal interaction of opening an account in person.

Technical issues, such as website outages or connectivity problems, can also hinder the online application process.

Citibank's Commitment to Digital Banking

Citibank's focus on online account opening reflects a broader trend towards digital banking. Banks are increasingly investing in technology to meet the evolving needs of their customers.

This trend is driven by factors such as increased internet access, smartphone adoption, and changing customer preferences. Banks are streamlining processes to improve customer experience.

Citibank's online account opening system allows new customers to access its services quickly and efficiently.