How To Pay Michaels Credit Card

Imagine you've just completed a delightful crafting spree at Michaels, your cart brimming with colorful yarns, shimmering paints, and that perfect set of brushes you’ve been eyeing. The creative possibilities are dancing in your head, and the satisfaction of a successful shopping trip washes over you. But then comes the practical matter: settling the bill. How exactly do you navigate the payment process for your Michaels credit card?

Understanding the various methods available to pay your Michaels credit card bill is crucial for maintaining a healthy credit score and avoiding late fees. This article will guide you through each payment option, providing clear instructions and helpful tips to ensure a smooth and stress-free experience. Let's unravel the mystery and empower you to manage your account with confidence.

Understanding Your Michaels Credit Card

The Michaels credit card, offered in partnership with Comenity Capital Bank, provides various benefits to crafting enthusiasts, including rewards points on purchases, special financing options, and exclusive discounts. Familiarizing yourself with your card's terms and conditions is the first step toward responsible management.

Before diving into payment methods, it's important to know your account details. Locate your account number, which can be found on your billing statement or by logging into your online account. Knowing your due date is equally essential to avoid late fees and potential damage to your credit score.

Payment Options Available

Comenity Capital Bank offers several convenient ways to pay your Michaels credit card bill, catering to different preferences and lifestyles. These options include online payments, phone payments, mail-in payments, and in-store payments. Let's explore each method in detail.

Online Payments: The Digital Convenience

Paying online is often the quickest and easiest method. It allows you to manage your account from the comfort of your home, at any time of day or night. This is a preferred option for many due to its convenience and accessibility.

To make an online payment, navigate to the Comenity Capital Bank website dedicated to Michaels credit cardholders. You will need to create an account or log in if you already have one. The registration process typically requires your account number, date of birth, and Social Security number for verification purposes.

Once logged in, you can link your bank account to your Michaels credit card account. This involves providing your bank's routing number and your account number. After your bank account is verified, you can schedule payments for the amount you choose, whether it's the minimum payment, the full balance, or a custom amount.

Phone Payments: A Direct Line to Resolution

If you prefer a more personal touch or need assistance with your payment, paying by phone is a viable option. This allows you to speak directly with a customer service representative who can guide you through the process.

To pay by phone, call the customer service number listed on your billing statement or on the back of your credit card. Be prepared to provide your account number, the amount you wish to pay, and your bank account information. The representative will process your payment securely while you are on the line.

Note that Comenity Capital Bank may charge a fee for phone payments. It's best to confirm whether there are any associated costs before proceeding with this method. Checking this beforehand ensures you're fully aware of any charges.

Mail-In Payments: The Traditional Approach

For those who prefer a more traditional approach, mailing in your payment is a reliable option. This involves sending a check or money order to the address specified on your billing statement.

When mailing your payment, always include your account number on your check or money order. This helps ensure that your payment is properly credited to your account. Send your payment several days before the due date to allow ample time for processing and delivery.

The mailing address for payments is typically found on your billing statement. Using the correct address is critical to avoid delays or misdirected payments. Double-checking the address prevents unnecessary complications.

In-Store Payments: Combining Shopping and Payment

While less common than the other options, some Michaels stores may offer the ability to pay your credit card bill in person. This can be a convenient option if you're already at the store making a purchase.

Contact your local Michaels store to confirm whether they accept credit card payments in person. If they do, inquire about the accepted forms of payment and any specific procedures you need to follow.

Remember to bring your billing statement or credit card with you to ensure they can easily locate your account. In-store payments can be a quick and efficient option for those who frequent the store.

Tips for Managing Your Michaels Credit Card

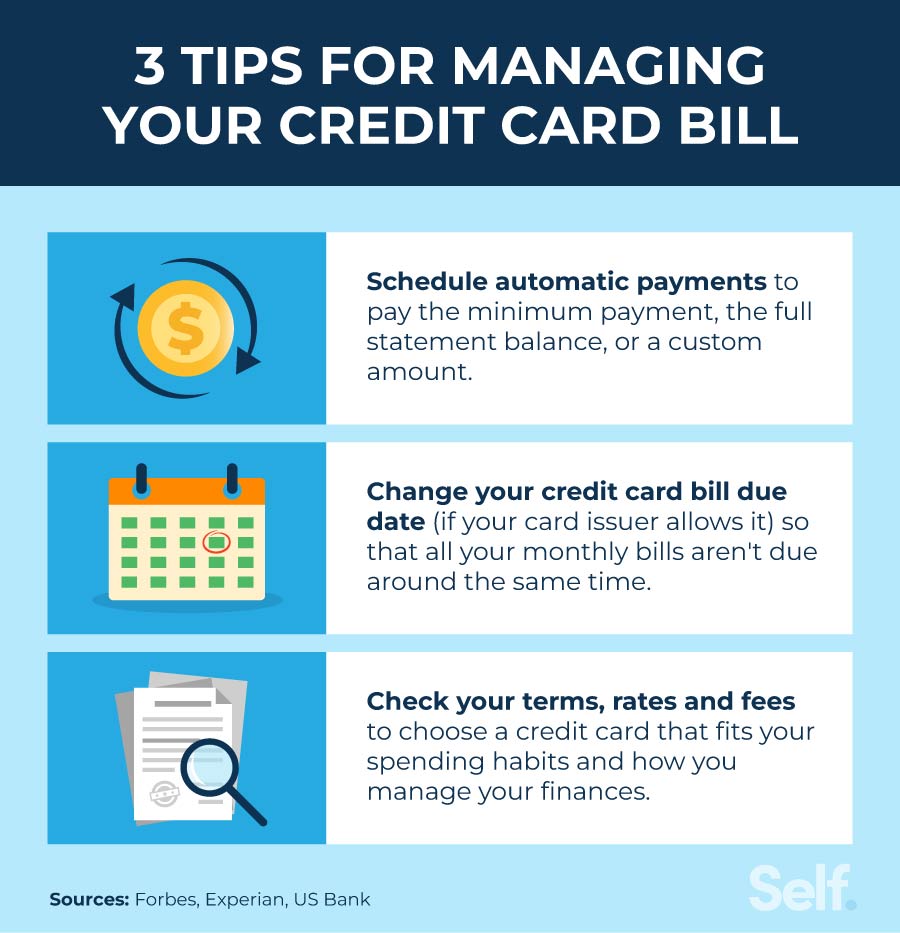

Beyond simply making payments, there are several strategies you can employ to manage your Michaels credit card effectively. These tips can help you maximize your rewards, avoid fees, and maintain a healthy credit score.

Set up payment reminders to ensure you never miss a due date. Most banks and credit card companies offer email or text message reminders that can be customized to your preferences. Taking this proactive step can prevent late fees and potential credit score damage.

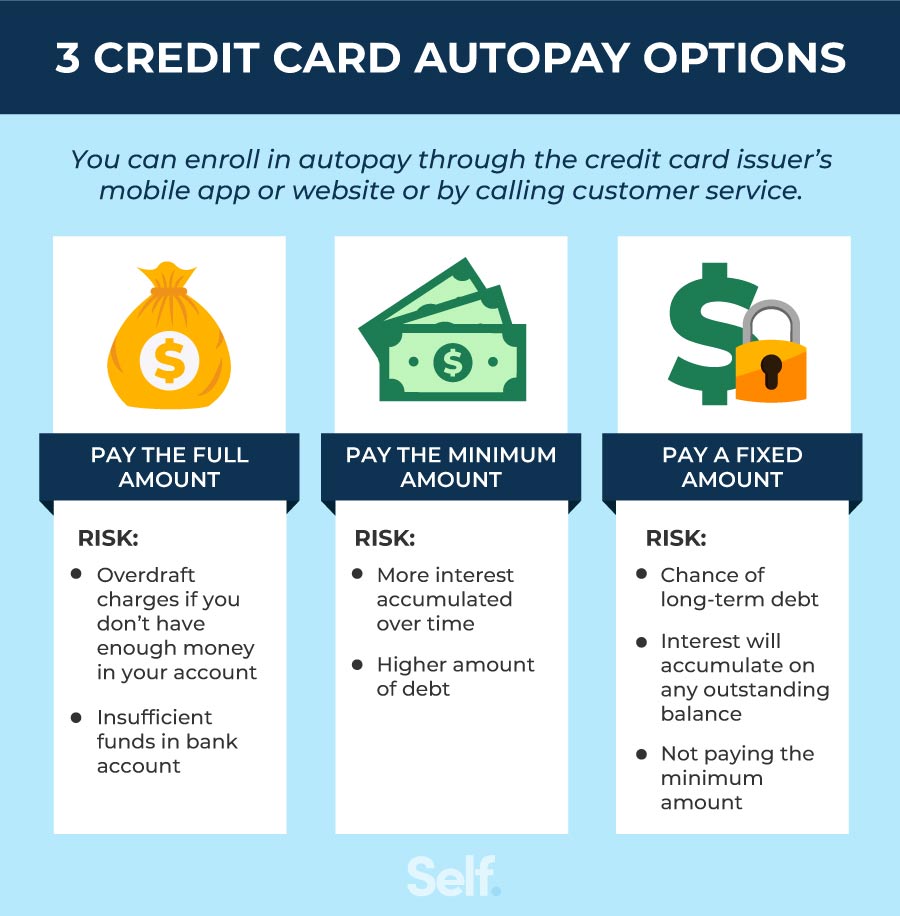

Consider enrolling in autopay to automatically pay your balance each month. This eliminates the risk of forgetting to make a payment and can help you maintain a consistent payment history. Autopay offers peace of mind and simplifies your financial management.

Review your billing statement regularly to identify any unauthorized charges or discrepancies. Addressing these issues promptly can prevent potential fraud and protect your credit. Vigilance is key to maintaining the security of your account.

Pay more than the minimum payment whenever possible to reduce your balance and save on interest charges. This helps you pay off your debt faster and improves your overall financial health. Paying down your balance reduces your financial burden.

Take advantage of the rewards program offered by the Michaels credit card. Earn points on your purchases and redeem them for discounts or other benefits. Maximizing rewards can make your crafting hobby even more affordable.

Conclusion

Paying your Michaels credit card bill doesn't have to be a daunting task. With a clear understanding of the available payment options and a proactive approach to account management, you can easily stay on top of your finances. Choosing the payment method that best suits your lifestyle and financial habits is crucial for a smooth and stress-free experience.

Whether you opt for the convenience of online payments, the personal touch of phone payments, the traditional approach of mail-in payments, or the occasional in-store payment, the key is to be consistent and mindful. By following the tips outlined in this article, you can confidently manage your Michaels credit card and continue pursuing your crafting passions without financial worries. Remember, responsible credit card management is a craft in itself – one that rewards you with financial security and peace of mind.