How To Pay Off 150k In Student Loans

The weight of student loan debt can feel insurmountable, a crushing burden impacting everything from homeownership to retirement savings. For those grappling with $150,000 in student loans, the path to financial freedom can seem especially daunting, but it's not an impossible journey. Strategic planning, informed decision-making, and diligent execution are crucial for navigating this complex financial landscape.

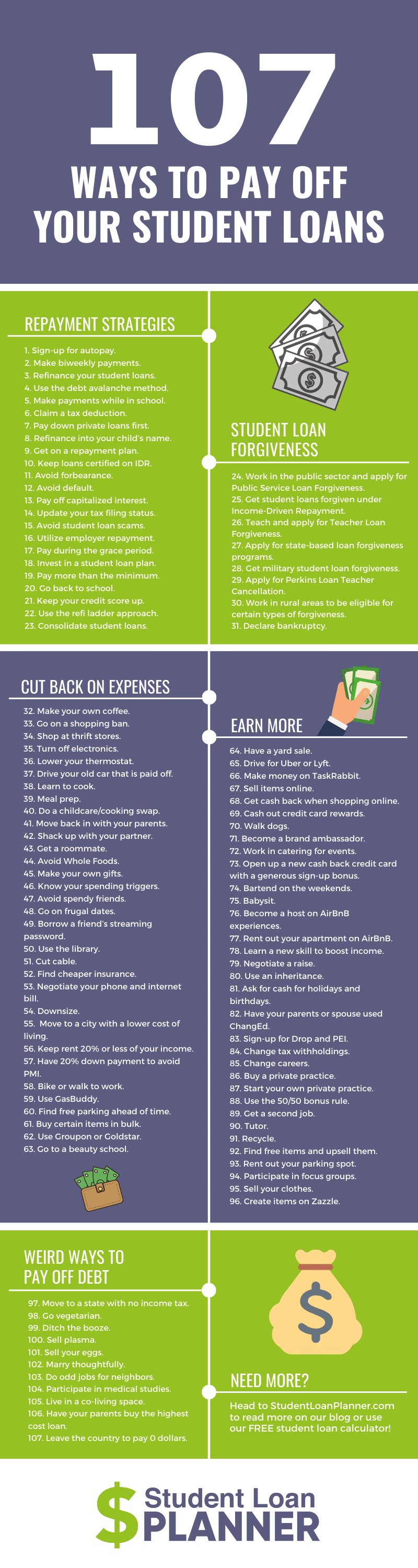

This article outlines proven strategies for tackling a $150,000 student loan burden. We will explore various repayment options, including income-driven repayment plans, aggressive debt payoff methods, and potential avenues for loan forgiveness or assistance. This guide provides a roadmap for borrowers seeking to regain control of their finances and eliminate their student loan debt.

Understanding Your Loan Portfolio

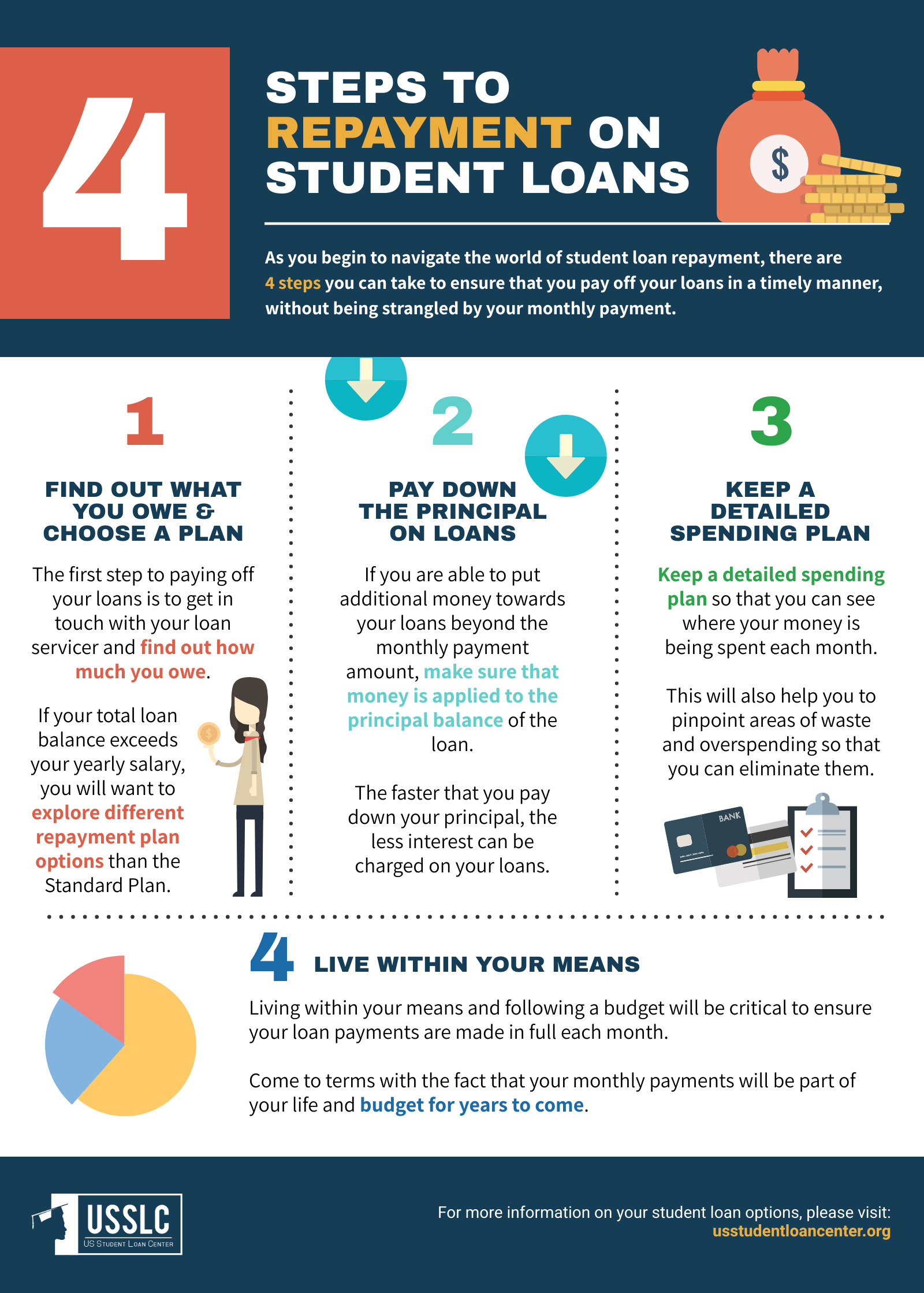

The first step is understanding the specifics of your student loans. Gather information about your loan types (federal vs. private), interest rates, and current balances for each loan. This data will serve as the foundation for creating a personalized repayment strategy.

Federal loans often offer more flexible repayment options compared to private loans. This includes income-driven repayment (IDR) plans and potential forgiveness programs. The U.S. Department of Education's website is a valuable resource for details on federal loan programs.

Federal Loan Repayment Options

Income-Driven Repayment (IDR) plans, such as SAVE (Saving on a Valuable Education), IBR (Income-Based Repayment), ICR (Income Contingent Repayment) and PAYE (Pay As You Earn), calculate your monthly payments based on your income and family size. These plans can significantly lower your monthly payments, offering immediate relief.

While IDR plans extend the repayment term (typically 20-25 years), the remaining balance may be forgiven after the repayment period. However, forgiven amounts may be subject to income tax. Carefully consider the long-term implications of forgiveness and potential tax liabilities.

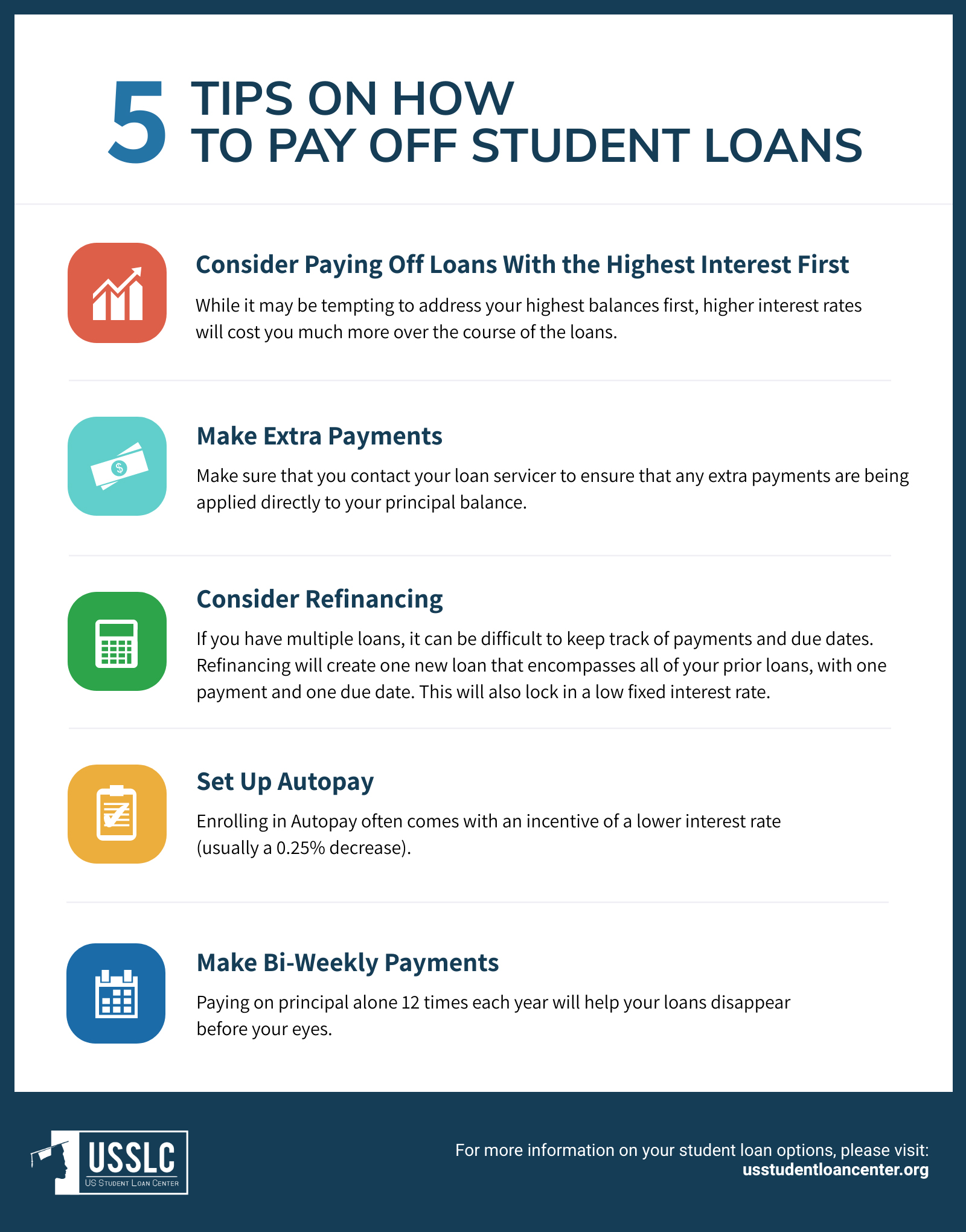

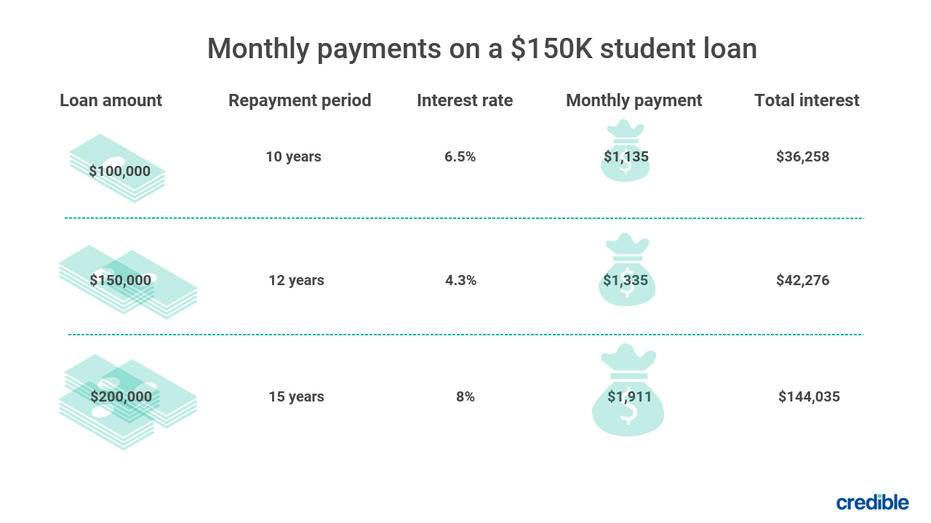

Standard repayment plans offer a fixed monthly payment over a 10-year period. This approach results in higher monthly payments but minimizes the total interest paid over the life of the loan.

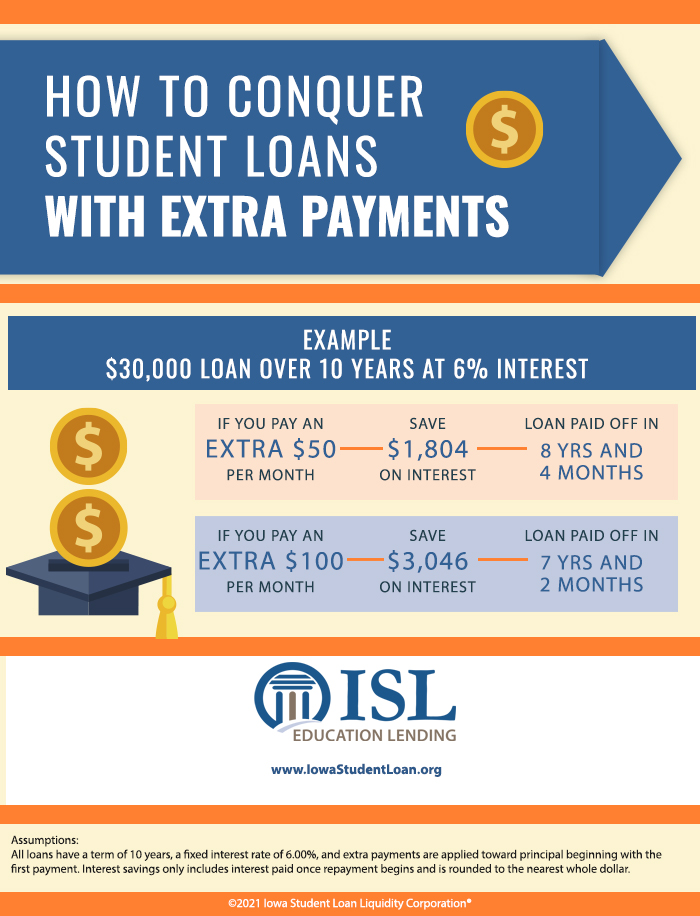

Aggressive Debt Payoff Strategies

The Debt Avalanche method prioritizes paying off the loan with the highest interest rate first, while making minimum payments on all other loans. This strategy minimizes the total interest paid over time. This strategy requires discipline and focus on high-interest debt.

The Debt Snowball method focuses on paying off the loan with the smallest balance first, regardless of the interest rate. This provides a psychological boost as you see debts disappear quickly. Seeing progress can be motivating and can help you stay on track.

Refinancing Student Loans

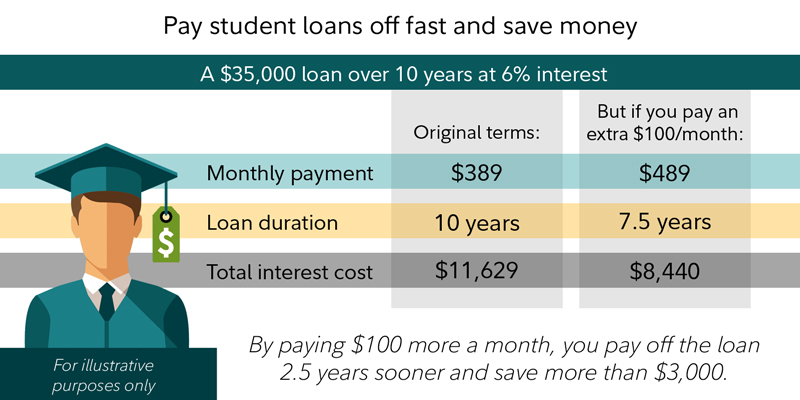

Refinancing your student loans involves taking out a new loan with a lower interest rate to pay off your existing loans. This can significantly reduce your monthly payments and overall interest costs. A lower interest rate translates directly into savings over the life of the loan.

However, refinancing federal loans into private loans means forfeiting federal loan protections such as IDR plans and potential forgiveness. Carefully weigh the pros and cons before refinancing federal loans.

Exploring Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF) is a program for borrowers employed by a qualifying non-profit or government organization. After 120 qualifying monthly payments, the remaining loan balance may be forgiven. Meeting all eligibility requirements is crucial for successful PSLF.

Teacher Loan Forgiveness offers up to $17,500 in forgiveness for teachers who work full-time for five consecutive years in a low-income school. The specific amount of forgiveness depends on the subject taught. This is an excellent program for qualifying educators.

Budgeting and Financial Planning

Creating a detailed budget is essential for managing your finances and prioritizing debt repayment. Track your income and expenses to identify areas where you can cut back and allocate more funds towards your student loans. A budget provides clarity and control over your financial situation.

Consider consulting with a financial advisor for personalized guidance and support. A financial advisor can help you develop a comprehensive financial plan that incorporates your student loan repayment goals. Their expertise can be invaluable in navigating complex financial decisions.

The Future of Student Loan Repayment

The landscape of student loan repayment is constantly evolving, with ongoing debates about loan forgiveness and reform. Staying informed about potential policy changes and new programs is essential. Monitor updates from the U.S. Department of Education and reputable financial news sources.

While tackling $150,000 in student loans requires dedication and effort, it's an achievable goal. By understanding your options, developing a strategic plan, and consistently working towards your financial goals, you can conquer your debt and build a brighter financial future. Don't be afraid to seek help and utilize available resources.