How To Pay Yourself From Business Account

Imagine this: You've poured your heart and soul into your business. The website is live, the orders are trickling in, and you're finally seeing the fruits of your labor. But a nagging question lingers: How do you actually pay yourself? Navigating the world of business finances can feel like traversing a maze, especially when it comes to separating personal from professional.

Understanding the nuances of paying yourself from your business account is essential for both financial stability and legal compliance. This article will break down the common methods, guiding you through the process with clarity and practical advice.

Understanding Your Business Structure

The way you pay yourself heavily depends on your business structure. Are you a sole proprietor, a partner in a partnership, or an owner of a Limited Liability Company (LLC) or S-Corporation?

Sole Proprietorships and Partnerships: Owner's Draw

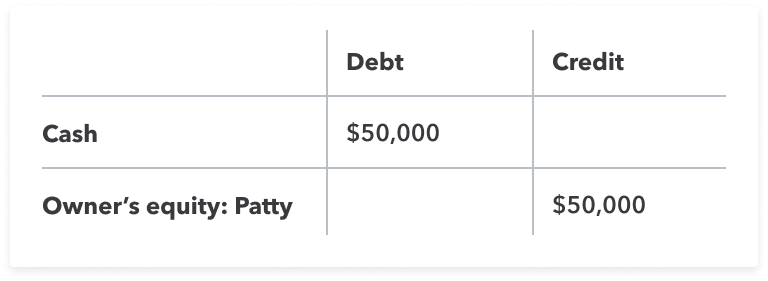

If you operate as a sole proprietorship or partnership, you'll typically pay yourself through an owner's draw. This simply involves transferring funds from your business account to your personal account. It's essentially taking a distribution of the profits you've earned.

There isn't a limit to how much you can take as an owner's draw, but remember that you'll be responsible for self-employment taxes (Social Security and Medicare) on your profits, even if you don't take a draw. Consistency is key; consider setting a regular schedule for your draws, even if the amounts fluctuate.

Keep meticulous records of all withdrawals to ensure accurate bookkeeping and tax reporting. "Maintaining accurate records is crucial for seamless tax filing and avoiding potential issues," advises a report from the Small Business Administration.

LLCs and S-Corporations: Salary and/or Distributions

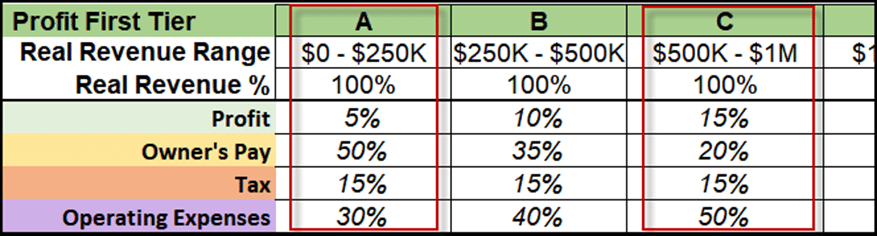

For LLCs and S-Corporations, the payment structure becomes a bit more intricate. As an owner, you're generally considered an employee of the business, meaning you should pay yourself a reasonable salary. This salary is subject to payroll taxes, including income tax, Social Security, and Medicare.

What constitutes a "reasonable salary"? The IRS defines it as what a similar professional would earn for the same work in a comparable company. Consult with a tax professional to determine an appropriate salary for your role.

In addition to a salary, you can also take distributions of profits. Distributions aren't subject to Social Security and Medicare taxes, but they are subject to income tax. It's a strategic way to extract profits from your business while minimizing your tax burden.

Practical Steps for Paying Yourself

Regardless of your business structure, there are some universal steps to follow when paying yourself.

Open separate business and personal bank accounts. This clear separation is essential for maintaining accurate financial records and avoiding commingling of funds. Commingling personal and business funds can blur the lines and create legal and tax complications.

Establish a system for tracking your payments. Whether you use accounting software like QuickBooks or a simple spreadsheet, keep a detailed record of every payment you make to yourself, including the date, amount, and purpose.

Set up a regular payment schedule. Paying yourself regularly, even if it's a small amount, provides financial stability and peace of mind. It also helps you budget and plan for future expenses.

Consult with a professional. Tax laws and business regulations can be complex. Working with a qualified accountant or tax advisor can help you navigate the complexities and ensure you're compliant with all applicable laws.

Tax Implications and Considerations

Paying yourself from your business account has significant tax implications. Understanding these implications is vital for effective tax planning.

Self-employment taxes are a major consideration for sole proprietors and partners. Remember that you're responsible for both the employer and employee portions of Social Security and Medicare taxes, which can add up to around 15.3% of your profits. Plan accordingly by setting aside a portion of your income for taxes throughout the year.

For LLCs and S-Corporations, payroll taxes are another key consideration. Ensure you're properly withholding and remitting payroll taxes to avoid penalties.

Estimated taxes are also important. As a business owner, you're typically required to pay estimated taxes quarterly to the IRS and your state. Failing to do so can result in penalties.

Paying yourself from your business is more than just a simple transaction; it's a strategic decision that requires careful planning and execution. By understanding the nuances of your business structure, following practical steps, and considering the tax implications, you can ensure that you're compensating yourself fairly and responsibly.

Remember, your business is a reflection of your hard work and dedication. Paying yourself is not just about taking money out of the business; it's about acknowledging your value and investing in your future. So, take the time to understand the process, seek professional guidance when needed, and enjoy the rewards of your entrepreneurial journey.

![How To Pay Yourself From Business Account The Formula To Paying Yourself As A Business Owner [Exact Steps] - YouTube](https://i.ytimg.com/vi/lPug59I9BY0/maxresdefault.jpg)