How To Pay Yourself Through Your Business

Navigating the world of business ownership involves a multitude of financial decisions, and one of the most crucial is determining how to fairly and effectively compensate yourself. Many small business owners struggle with the intricacies of paying themselves, unsure of the optimal method for their specific business structure and financial situation.

This article provides a practical guide to understanding the various methods available for business owners to pay themselves, offering insights into the implications of each approach.

Understanding the Options

The method you choose to pay yourself depends heavily on your business structure. Common structures include sole proprietorships, partnerships, Limited Liability Companies (LLCs), and S or C corporations.

Each has unique tax implications and regulations affecting how you extract funds from the business. The Internal Revenue Service (IRS) provides comprehensive guidelines for each entity type.

Sole Proprietorships and Partnerships

In sole proprietorships and partnerships, owners typically pay themselves through owner's draws. This involves taking money out of the business account for personal use.

Owner's draws are not considered salary or wages; they are simply a withdrawal of profits. However, it's crucial to remember that owners are still responsible for self-employment taxes on their share of the business profits, regardless of whether or not they take a draw.

Limited Liability Companies (LLCs)

LLCs offer more flexibility in how owners can be paid. LLC members can choose to be taxed as a sole proprietorship, partnership, or corporation. If taxed as a sole proprietorship or partnership, the payment method would be similar to owner's draws.

However, an LLC can also elect to be taxed as an S corporation. This allows owners who are actively involved in the business to be considered employees and receive a salary.

S Corporations

S corporations require owner-employees to be paid a reasonable salary for their services. This salary is subject to payroll taxes, including Social Security and Medicare.

The "reasonable salary" concept is critical; the IRS scrutinizes S corporations to ensure owners are not underpaying themselves to avoid payroll taxes and then taking the remaining profits as distributions. Distributions are not subject to Social Security and Medicare taxes.

After paying a reasonable salary, owners can take the remaining profits as shareholder distributions. These distributions are not subject to self-employment or payroll taxes.

C Corporations

In a C corporation, owners who are also employees are paid a salary, just like in an S corporation. This salary is subject to payroll taxes.

Additionally, C corporations can distribute profits to shareholders as dividends. Dividends are subject to income tax at the individual level, and the corporation itself pays corporate income tax on its profits, leading to potential double taxation.

Determining a Reasonable Salary

For S corporations, defining a "reasonable salary" is essential. This is the amount that a similarly skilled professional would earn in a similar role and industry.

Several factors influence this determination, including experience, education, responsibilities, and the size and profitability of the business. Consulting with a tax professional or using salary benchmarking tools can help ensure compliance with IRS guidelines.

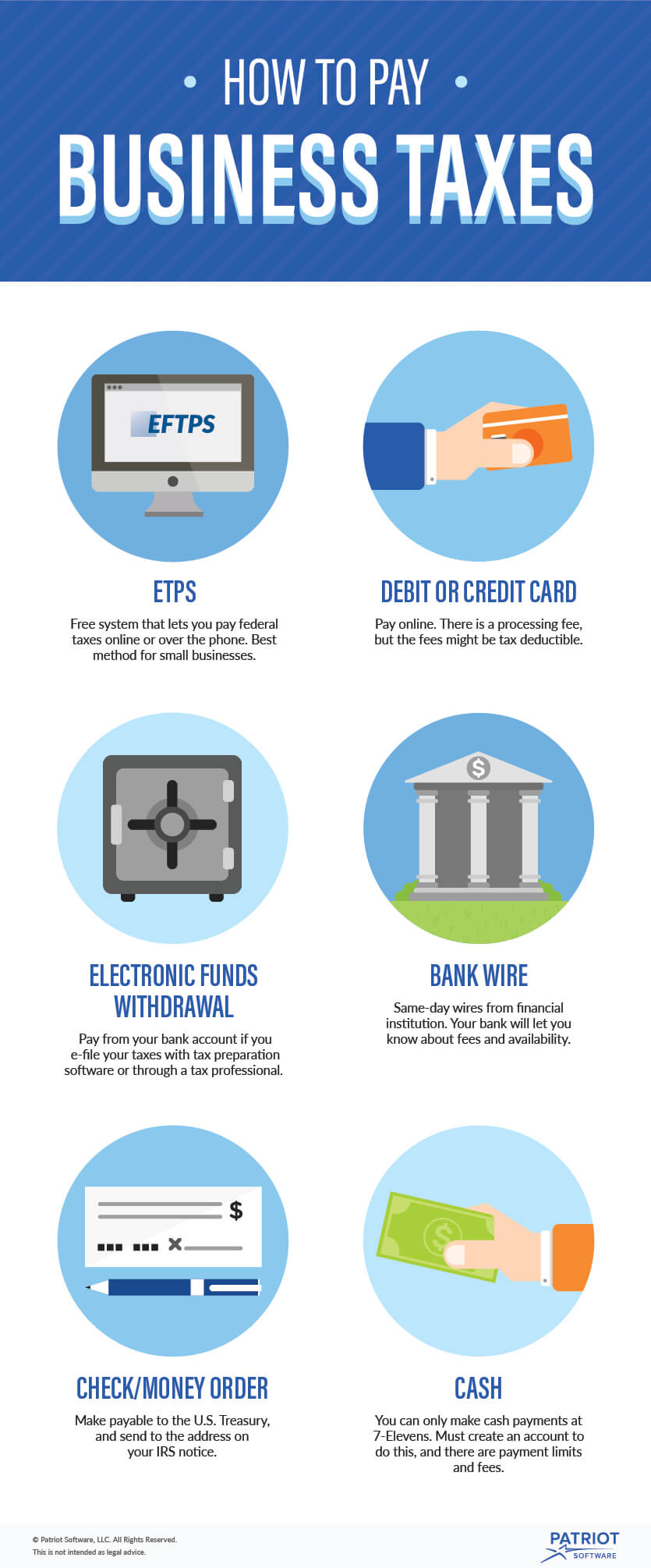

Record Keeping and Tax Implications

Regardless of the payment method, meticulous record-keeping is vital. Document all draws, salaries, and distributions, and retain all supporting documentation.

Proper accounting is crucial for accurate tax reporting and to avoid potential issues with the IRS. Consider using accounting software or hiring a professional accountant to manage your business finances.

The Importance of Professional Advice

The optimal method for paying yourself through your business depends on a variety of individual factors. Consulting with a qualified tax advisor or accountant is highly recommended.

These professionals can provide personalized guidance based on your specific business structure, financial situation, and long-term goals. They can also help you navigate the complexities of tax regulations and ensure compliance with all applicable laws.

Long-Term Financial Planning

Besides deciding how to pay yourself, ensure the business profits is enough to cover your salary. Make sure your business can generate sufficient revenue.

By understanding the different payment options and seeking professional advice, business owners can effectively manage their finances and build a sustainable foundation for long-term success.