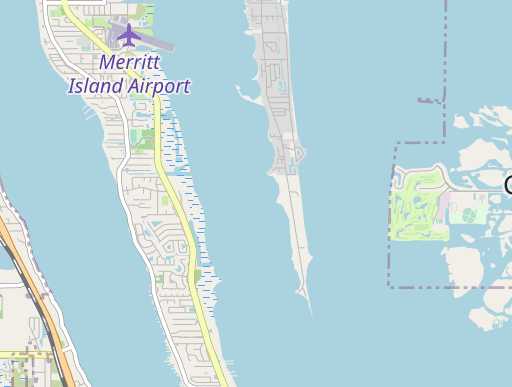

Community Bank Of The South Merritt Island Florida

Merritt Island, FL - Community Bank of the South on Merritt Island has been shut down by regulators. The FDIC has been appointed as receiver, effective immediately.

The closure, announced late Friday, sends shockwaves through the local business community. The FDIC is working to protect depositors and ensure minimal disruption to banking services.

Immediate Actions and Deposit Insurance

The Florida Office of Financial Regulation closed Community Bank of the South, citing inadequate capital and unsafe or unsound practices. The FDIC was subsequently named receiver.

All insured deposits are protected up to the standard FDIC insurance amount of $250,000 per depositor, per insured bank. This applies to individual accounts, joint accounts, and certain retirement accounts.

Depositors should contact the FDIC directly for information on accessing their insured funds. The FDIC has established a dedicated hotline and website for this purpose.

Acquisition by Seacoast National Bank

Seacoast National Bank, headquartered in Stuart, Florida, will assume all of Community Bank of the South's deposits. This acquisition is intended to stabilize the situation and provide continuity for customers.

Starting Monday, all branches of Community Bank of the South will reopen as Seacoast National Bank branches. Customers can continue to conduct their banking business as usual at these locations.

Seacoast National Bank's acquisition provides much-needed stability. Depositors should be aware that their accounts will now be managed under the Seacoast National Bank umbrella.

Impact on Local Businesses

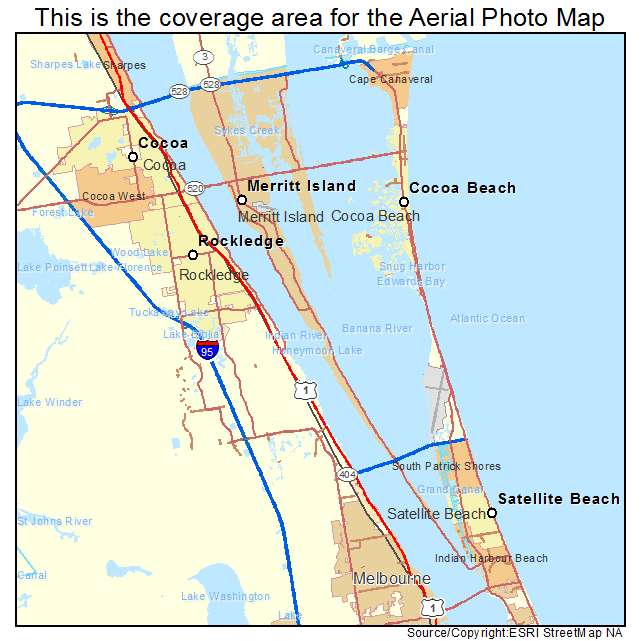

Community Bank of the South had a significant presence on Merritt Island, serving many small and medium-sized businesses. The sudden closure has raised concerns about access to credit and financial services for these businesses.

The Merritt Island Chamber of Commerce is working to provide support and resources to affected businesses. They are coordinating with Seacoast National Bank and other local financial institutions to facilitate a smooth transition.

Local business owners are urged to contact their new Seacoast National Bank representatives to discuss their specific needs. Understanding the new banking relationship is critical.

FDIC's Role and Oversight

The FDIC's role as receiver is to protect depositors and resolve the bank's failure in the least costly manner. This involves selling the bank's assets and liabilities.

The FDIC estimates that the closure of Community Bank of the South will cost the Deposit Insurance Fund approximately $28.6 million. This figure reflects the difference between the bank's assets and the value of insured deposits.

The FDIC is committed to ensuring transparency and providing timely information to depositors and the public. Their website and hotline are the primary sources for official updates.

Community Bank of the South: A Timeline

Community Bank of the South was founded in 1999 and served Brevard County for over two decades. It was known for its community-focused banking services.

In recent years, the bank faced increasing financial challenges, leading to regulatory scrutiny. The specific reasons for the closure have not been fully disclosed, but regulators cited capital inadequacy.

The closure marks a significant event in Merritt Island's banking history. It underscores the importance of sound financial management and regulatory oversight in the banking industry.

Customer Impact and Next Steps

Customers of Community Bank of the South should continue to use their existing checks and debit cards. These will remain valid until further notice from Seacoast National Bank.

Seacoast National Bank will be sending out information packets to all former Community Bank of the South customers. These packets will detail any changes to account terms, services, and contact information.

Depositors are encouraged to attend informational meetings hosted by Seacoast National Bank to address any questions or concerns. Staying informed is crucial during this transition.

The FDIC encourages all depositors to review their deposit insurance coverage to ensure they are adequately protected. Contact the FDIC directly with any coverage-related inquiries.

The closure of Community Bank of the South is a developing situation. Stay tuned to local news outlets and official FDIC and Seacoast National Bank communications for further updates.