How To Prepare For Deflationary Depression

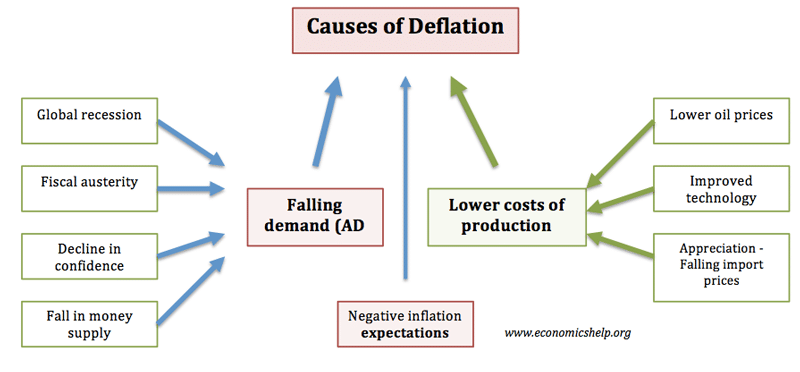

Imagine a world where prices are consistently falling. Not just temporary sales, but a persistent downward trend affecting everything from groceries to houses. While initially seeming beneficial, this scenario, known as deflation, can spiral into a deflationary depression, impacting jobs, investments, and overall economic stability.

Preparing for such an eventuality requires a strategic shift in mindset and financial planning. This article explores practical steps you can take to safeguard your financial well-being and navigate the complexities of a deflationary environment. Understanding the nature of deflation and adopting proactive measures are key to weathering the storm.

Understanding Deflationary Depression

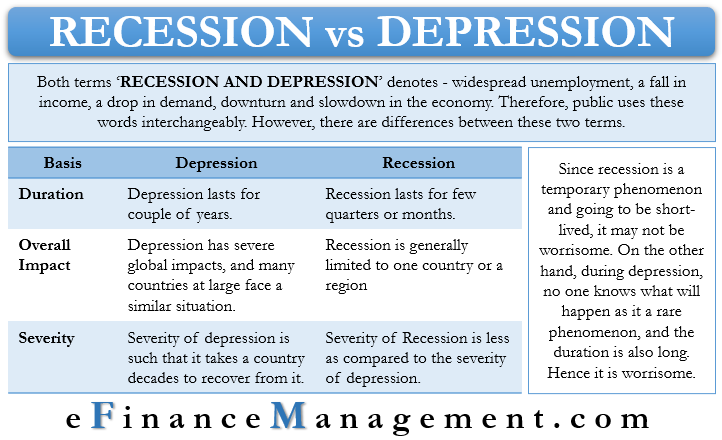

Deflationary depression is more than just falling prices. It's a sustained period of economic decline driven by a decrease in overall demand.

Businesses, facing lower prices, may reduce production and lay off workers, leading to a vicious cycle of decreased spending and further price drops. This contrasts sharply with inflation, where prices rise, and purchasing power diminishes. Deflation can create a climate of fear and uncertainty, discouraging investment and consumption.

The Significance of Debt

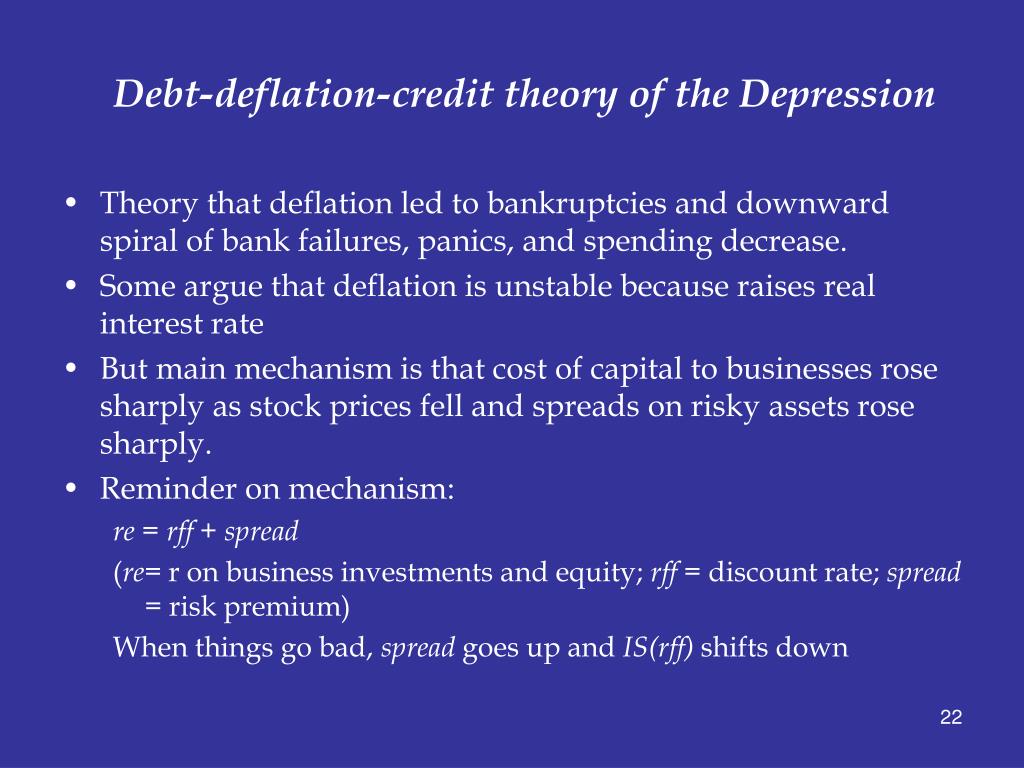

Debt becomes a significant burden during deflation. As prices fall, the real value of debt increases, making it harder to repay.

According to Investopedia, this phenomenon, known as 'debt deflation', can lead to widespread defaults and bankruptcies. Irving Fisher, a prominent economist, highlighted the devastating effects of debt deflation during the Great Depression, arguing it prolonged and intensified the economic downturn.

Strategies for Preparation

Preparing for a deflationary depression requires a multi-faceted approach, focusing on debt management, asset allocation, and career security.

Debt Management

Prioritize paying down debt, especially high-interest loans. Consider consolidating debts or negotiating lower interest rates with lenders.

A smaller debt burden provides greater financial flexibility and reduces the risk of default if income declines. Aim to become as debt-free as possible to weather the storm.

Asset Allocation

Re-evaluate your investment portfolio. While traditional wisdom favors stocks for long-term growth, deflationary environments may favor different assets.

Consider increasing your holdings in cash or cash equivalents, such as Treasury bonds or certificates of deposit. These assets tend to hold their value better during deflation. Real estate can be particularly vulnerable in deflationary environments, so assess your exposure carefully.

Career Security

Invest in skills that are in demand and less susceptible to economic downturns. Focus on acquiring expertise in areas like healthcare, technology, or essential services.

Consider additional education or certifications to enhance your marketability. Diversifying your income streams through side hustles or freelance work can also provide a safety net.

Beyond Finances: Building Resilience

Preparing for a deflationary depression isn't just about finances. It's about building overall resilience. Cultivate a strong support network of family and friends.

Community bonds can provide emotional and practical support during challenging times. Consider learning practical skills like gardening, basic repairs, or first aid to become more self-sufficient.

Stay informed but avoid excessive media consumption, which can amplify anxiety. Focus on what you can control and take proactive steps to protect your well-being.

A Hopeful Perspective

While the prospect of a deflationary depression is unsettling, preparation is empowering. By understanding the risks and taking proactive steps, you can mitigate the potential impact on your finances and well-being.

Remember that economic cycles are inevitable, and even periods of deflationary depression eventually give way to recovery and growth. The key is to navigate the downturn with prudence, resilience, and a long-term perspective.

By focusing on debt reduction, strategic asset allocation, career security, and community building, you can increase your chances of not only surviving but thriving in a challenging economic environment. Even in difficult times, opportunities for growth and innovation can emerge.