How To Pull Money From A Credit Card

Imagine standing at the precipice of a financial need, a bridge between a present challenge and a future aspiration. Perhaps it's an unexpected car repair, a crucial home improvement, or even a once-in-a-lifetime opportunity knocking on your door. Credit cards, those ubiquitous pieces of plastic, often feel like a safety net, but accessing their cash value isn't always straightforward. It's a landscape with paths less traveled, each with its own set of considerations.

This article illuminates the various avenues for accessing cash from your credit card, explaining the intricacies of cash advances, balance transfers, and alternative strategies, while highlighting the associated fees and interest rates, enabling readers to make informed decisions for their financial well-being.

Understanding Cash Advances

A cash advance is essentially borrowing cash directly from your credit card's available credit line. Think of it as a short-term loan, but with terms that often differ significantly from standard purchases.

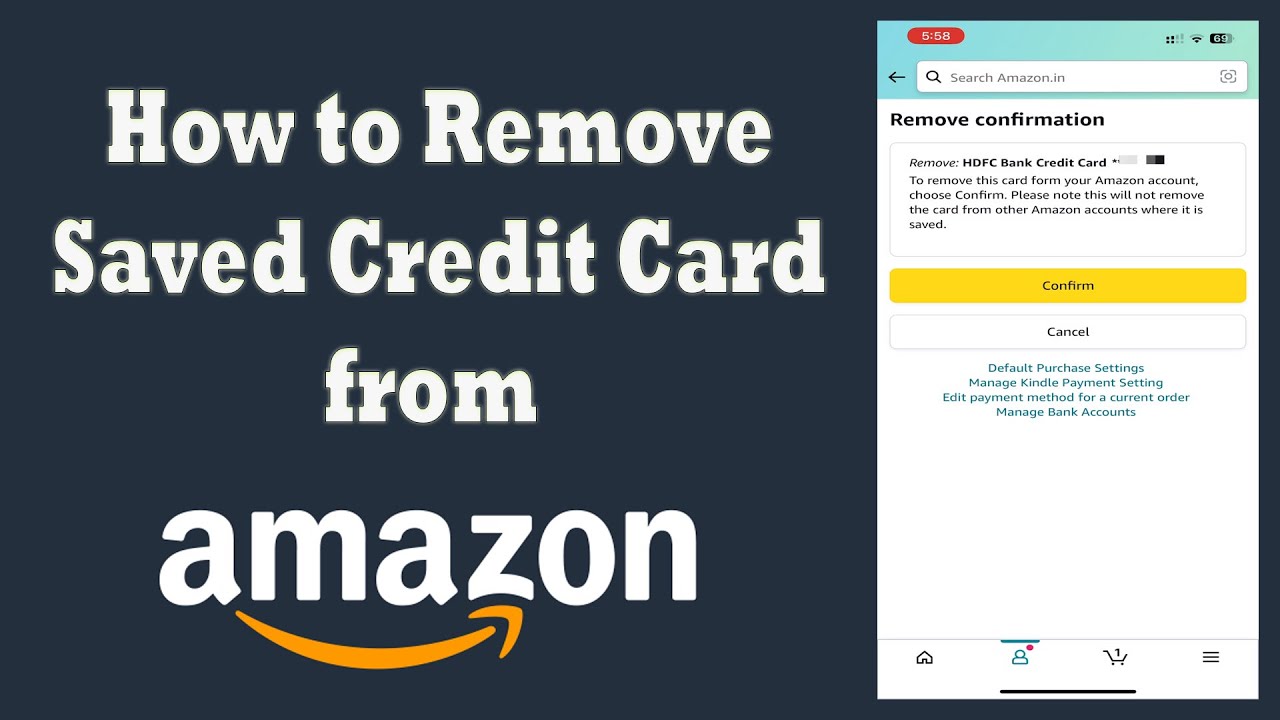

Typically, accessing a cash advance involves using your credit card at an ATM. You can also withdraw funds at a bank branch that partners with your credit card issuer. Some providers might even offer convenience checks linked to your credit card account.

Fees and Interest: A Closer Look

Cash advances usually come with higher interest rates than regular purchases. According to a report by the Consumer Financial Protection Bureau (CFPB), the APR for cash advances can be significantly higher. These rates also often kick in immediately, meaning there’s no grace period like with standard purchases.

Expect to pay a fee for each cash advance. This is usually a percentage of the amount withdrawn, or a flat fee, whichever is greater. These fees, coupled with the elevated interest rates, can make cash advances an expensive option.

Balance Transfers: An Indirect Route

While not a direct withdrawal, a balance transfer offers an indirect way to free up cash. This strategy involves transferring high-interest debt from another credit card or loan to your current credit card, ideally one with a lower introductory APR.

The key here is to leverage the introductory period. If you successfully transfer a balance and pay it down aggressively during this time, you can save significantly on interest charges.

However, balance transfers usually involve a fee, often a percentage of the transferred amount. Consider this fee when evaluating the overall cost-effectiveness of a balance transfer.

Creative (and Cautious) Alternatives

Some individuals explore less conventional methods, such as using their credit card to purchase prepaid debit cards. The idea is then to withdraw cash from the prepaid card. However, it's crucial to verify if your credit card issuer allows this and to be aware of any associated fees or restrictions.

Another alternative involves using your credit card for services or purchases that can be converted to cash. For example, buying a gift card and selling it for cash.

Proceed with caution, as these methods may be viewed unfavorably by your credit card issuer and may carry additional risks. Always consider ethical implications and potential consequences.

Before You Withdraw: Essential Considerations

Before deciding to pull money from your credit card, carefully assess your financial situation. Consider whether you have explored all other options, like emergency funds or personal loans.

Compare the costs associated with each method: cash advances, balance transfers, or alternative strategies. Factor in interest rates, fees, and repayment terms.

Develop a clear repayment plan. Determine how you will pay back the borrowed funds promptly to minimize interest charges and avoid damaging your credit score.

Credit card debt, especially high-interest debt, can quickly spiral out of control. Understanding all the implications is key to making informed decisions.

Ultimately, tapping into your credit card's cash value should be a calculated move, a strategic response to a specific need. By carefully evaluating your options and understanding the associated costs, you can navigate this financial landscape with greater confidence and control. It's about empowering yourself with knowledge and making choices that align with your long-term financial well-being.