How To Raise Funds For A Business Idea

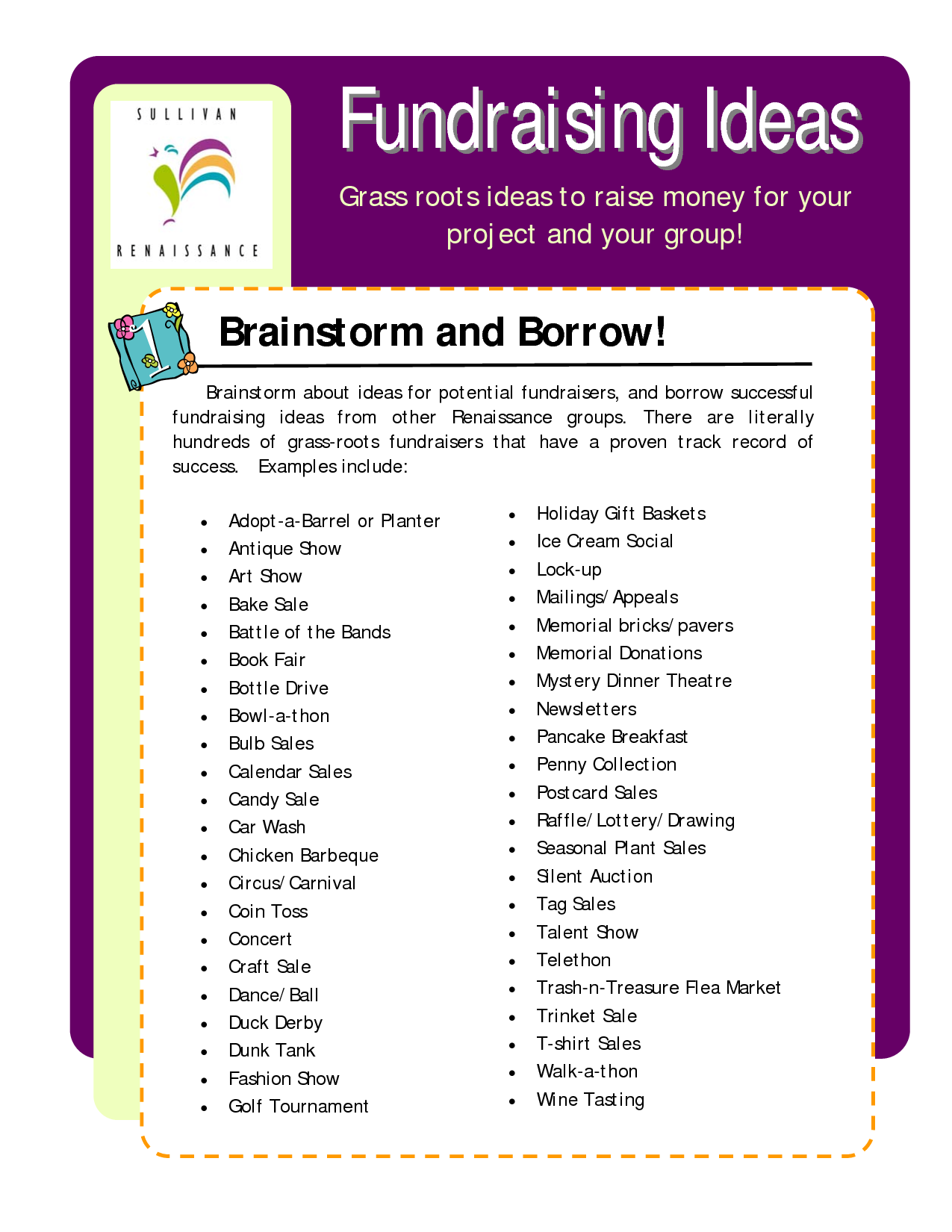

Turning a business idea into reality often hinges on securing adequate funding. For aspiring entrepreneurs, navigating the complex world of fundraising can feel like an uphill battle. However, understanding the available options and strategically approaching investors can significantly increase the chances of success.

This article explores practical strategies for raising capital, outlining key considerations and resources for individuals seeking to finance their ventures.

Understanding Your Funding Needs

Before approaching potential investors, it's crucial to accurately assess your financial requirements. This involves creating a detailed business plan that outlines projected expenses, revenue forecasts, and a clear understanding of your target market. The Small Business Administration (SBA) offers resources and templates to assist in developing comprehensive business plans.

Determine how much capital is needed to launch your business, including costs associated with product development, marketing, operations, and staffing.

Bootstrapping and Personal Savings

Many entrepreneurs start by utilizing their own savings or "bootstrapping." This demonstrates a commitment to the venture and can be a powerful signal to future investors. Bootstrapping often involves minimizing expenses and prioritizing revenue generation.

Consider delaying salary or reinvesting profits back into the business during the initial stages.

Friends and Family

Seeking financial support from friends and family can be a viable option, especially in the early stages. However, it's essential to treat these relationships with professionalism and transparency. Draw up formal loan agreements outlining repayment terms and interest rates, if applicable, to avoid potential conflicts.

Clearly communicate the risks involved and ensure your loved ones understand that there's a possibility they may not recoup their investment.

External Funding Options

Loans and Lines of Credit

Banks and credit unions offer various loan products tailored to small businesses. These often require collateral and a strong credit history.

"Securing a loan requires a solid credit score and a well-documented business plan,"according to a statement from the American Bankers Association (ABA).

Lines of credit provide access to funds as needed, offering flexibility for managing cash flow.

Angel Investors

Angel investors are individuals with high net worth who invest in early-stage companies in exchange for equity. They often provide not only capital but also valuable mentorship and industry connections. Research angel investor networks in your area to identify potential matches.

Prepare a compelling pitch deck that highlights your business's potential and the return on investment for angel investors.

Venture Capital

Venture capital firms invest in high-growth potential companies with the expectation of significant returns. Securing venture capital is a competitive process that requires a well-developed business model and a strong management team.

Venture capitalists typically seek a substantial equity stake and active involvement in the company's strategic direction.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of individuals in exchange for rewards or equity. This can be an effective way to validate your product or service and build a community of supporters. A successful crowdfunding campaign requires careful planning and a compelling story.

Consider offering early bird discounts or exclusive perks to incentivize contributions.

The Importance of Due Diligence

Regardless of the funding source, conducting thorough due diligence is paramount. Understand the terms and conditions of any loan or investment agreement, and seek legal and financial advice as needed. Failure to adequately assess the risks and obligations can have serious consequences.

Ensure you have a clear understanding of your investors' expectations and their level of involvement in your business.

Raising funds for a business idea requires careful planning, strategic execution, and a resilient attitude. By understanding the available options and tailoring your approach to each potential investor, you can increase your chances of securing the capital needed to bring your vision to life.

![How To Raise Funds For A Business Idea How To Raise Money For Your Startup [Infographic] | Bit Rebels](http://www.bitrebels.com/wp-content/uploads/2012/06/How-To-Raise-Startup-Money.jpg)