Things To Ask When Buying A Business

Acquiring a business is a high-stakes venture. Due diligence is paramount to avoid costly mistakes and ensure a sound investment.

This article provides a crucial checklist of questions to ask before signing on the dotted line, equipping prospective buyers with the knowledge needed to navigate this complex process effectively.

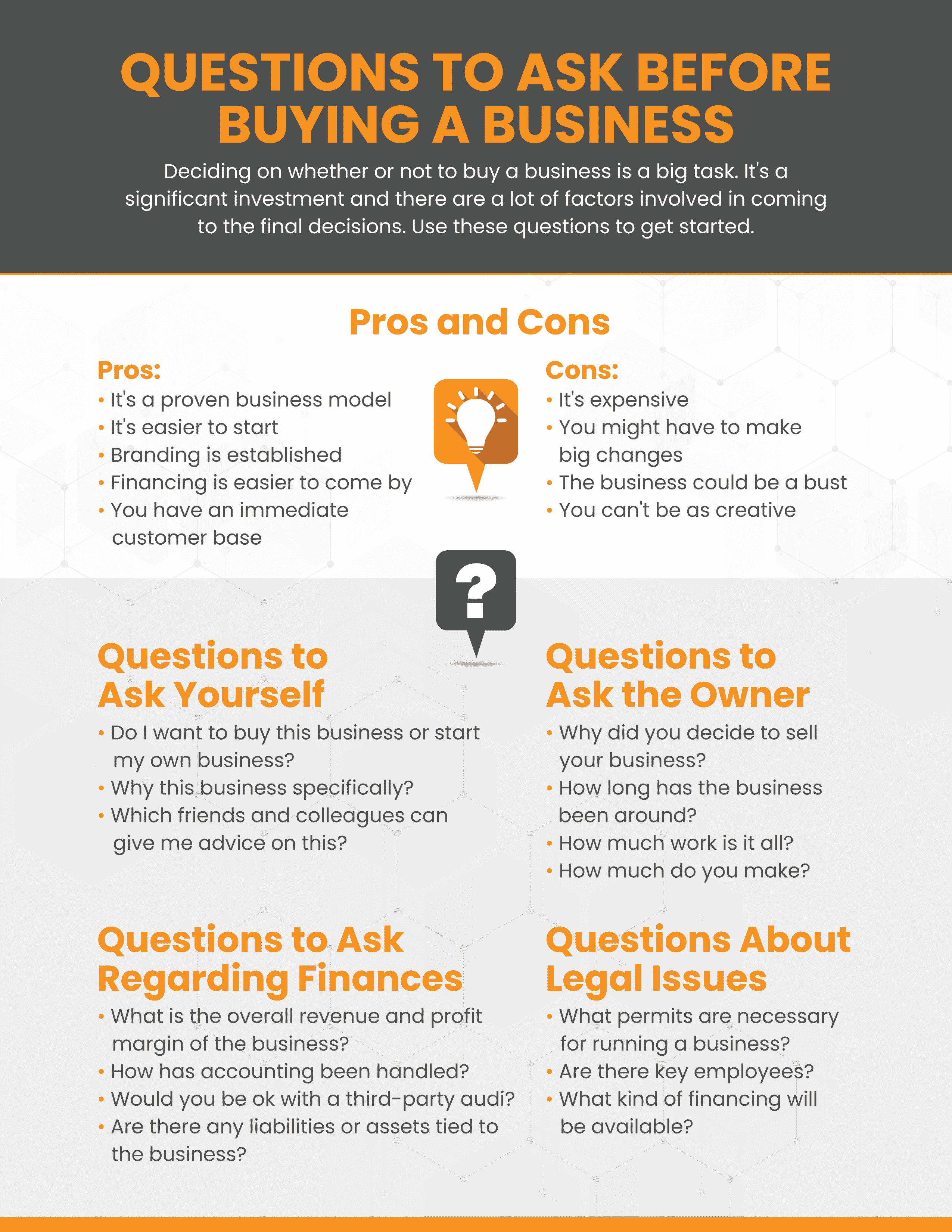

Financial Performance: Unveiling the Truth

Obtain at least 3-5 years of audited financial statements.

Analyze revenue trends. Are they consistent, growing, or declining?

Scrutinize profit margins. Understand the factors driving profitability or losses.

Investigate cash flow patterns. Is the business generating sufficient cash to cover its obligations?

Ask about owner benefits and discretionary spending. These can significantly impact the adjusted profitability of the business.

"Understanding the financial health is the cornerstone of any successful acquisition," advises Mark Thompson, a seasoned M&A advisor at Thompson Acquisitions.

Operational Efficiency: Digging Deeper

Evaluate the business's operational processes.

Assess the efficiency of the supply chain. Are there any bottlenecks or vulnerabilities?

Examine the technology infrastructure. Is it modern and scalable?

Inquire about the company's key performance indicators (KPIs).

Understand the company's dependence on specific employees, customers, or suppliers.

Legal and Compliance: Avoiding Pitfalls

Conduct a thorough legal review of all contracts and agreements.

Verify compliance with all relevant laws and regulations.

Investigate any pending or threatened litigation.

Obtain a clear understanding of the company's intellectual property assets.

Assess environmental liabilities. Ensure compliance with environmental regulations.

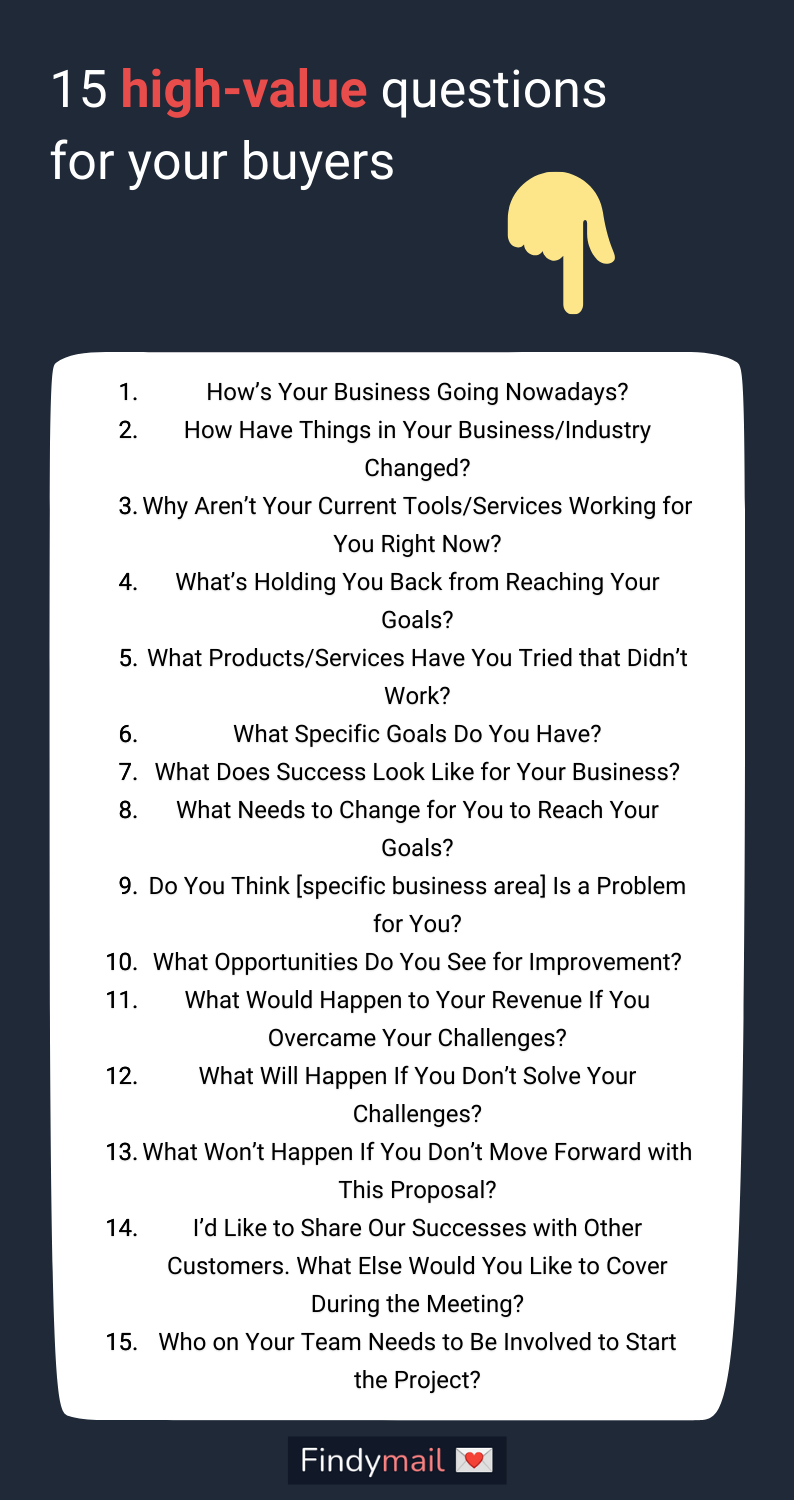

Market and Competition: Gauging the Landscape

Analyze the company's market share and competitive position.

Evaluate the industry's growth potential. Is the industry growing, stable, or declining?

Assess the barriers to entry for new competitors.

Understand the company's marketing and sales strategies.

Identify potential threats and opportunities in the market.

Customer and Employee Relations: The Human Element

Understand customer satisfaction levels. Review customer feedback and complaints.

Assess employee morale and engagement.

Evaluate the company's employee retention rates.

Review employee contracts and benefit plans.

Understand the company's management structure and key personnel.

Specific Questions to Consider:

- What are the primary drivers of revenue?

- What are the biggest challenges facing the business?

- What are the owner's reasons for selling?

- What are the company's growth opportunities?

- What are the terms of the sale?

Remember to engage experienced legal and financial advisors throughout the due diligence process. Their expertise can help you identify potential risks and negotiate favorable terms.

Further investigation into these areas will significantly improve the chances of a successful business acquisition. Don't skip this crucial step.

![Things To Ask When Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

![Things To Ask When Buying A Business The 10-step business buying process [infographic]](https://cdn2.hubspot.net/hubfs/2108706/Downloadable_Documents/Infographics/Business Buying Funnel 2.png)