How To Raise Money For My Business

The entrepreneurial spirit is alive and well, but even the most innovative ideas can wither without the lifeblood of funding. Securing capital to launch or expand a business remains a daunting challenge, a hurdle that separates dreamers from doers. Navigating the complex landscape of investment options, from venture capital to crowdfunding, requires careful planning and a strategic approach.

This article dissects the various avenues available to entrepreneurs seeking financial backing. Understanding the nuances of each option, and tailoring your approach to your specific business needs, is crucial for success. We'll explore everything from the foundational elements of crafting a compelling business plan to the intricacies of negotiating with investors.

Crafting a Compelling Business Plan

A robust business plan is the cornerstone of any successful fundraising effort. It serves as a roadmap for your business and a persuasive tool for potential investors. Neglecting this critical step can severely hinder your chances of securing funding.

Your plan should clearly articulate your business model, target market, and competitive advantage. It also needs to showcase your financial projections, demonstrating the potential for return on investment.

Key Components of a Business Plan:

- Executive Summary: A concise overview of your business.

- Company Description: Details about your mission, vision, and values.

- Market Analysis: Research on your target market and competitive landscape.

- Products and Services: A clear explanation of what you offer.

- Marketing and Sales Strategy: How you plan to reach and acquire customers.

- Management Team: Information about the key personnel and their expertise.

- Financial Projections: Revenue forecasts, expense budgets, and cash flow statements.

Exploring Funding Options

The fundraising landscape offers a variety of options, each with its own advantages and disadvantages. Choosing the right path depends on your business stage, funding needs, and risk tolerance. Let's examine some of the most common avenues.

Bootstrapping

Bootstrapping, or self-funding, involves using personal savings, revenue from early sales, and credit cards to finance your business. This approach allows you to retain complete control and avoid diluting equity. However, it can limit your growth potential due to resource constraints.

Loans and Grants

Traditional bank loans and government grants are another source of funding. These options often require collateral and a strong credit history. Grants, while highly competitive, offer the advantage of being non-repayable.

Angel Investors

Angel investors are high-net-worth individuals who invest in early-stage companies. They often provide not only capital but also valuable mentorship and industry connections. Securing angel investment typically involves pitching your business to a network of potential investors.

Venture Capital

Venture capital (VC) firms invest in high-growth potential companies in exchange for equity. VC funding can provide significant capital for rapid expansion, but it also comes with increased scrutiny and pressure to perform.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise small amounts of money from a large number of people. This approach is often used to validate a product or service before scaling up. It also can serve as a marketing tool.

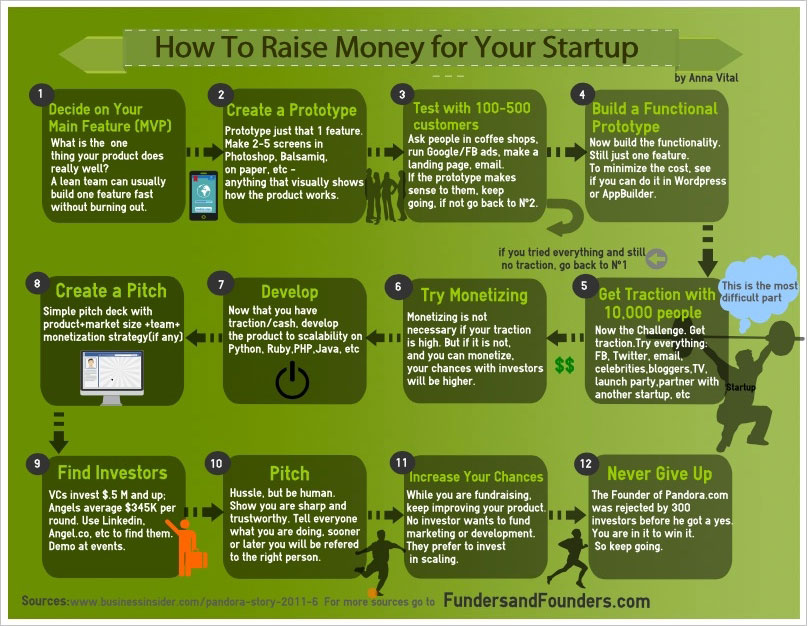

Preparing Your Pitch

Regardless of the funding source you pursue, a compelling pitch is essential. Your pitch should be clear, concise, and persuasive, highlighting the key aspects of your business and its investment potential.

Practice your pitch thoroughly and be prepared to answer tough questions from investors. Knowing your numbers, articulating your vision, and demonstrating your passion are critical for success.

According to the Small Business Administration (SBA), a well-prepared pitch deck is a key element in attracting investors.

Navigating Due Diligence

Once you've attracted interest from investors, the due diligence process begins. This involves a thorough examination of your business, financials, and legal documents.

Be transparent and responsive to investor requests during due diligence. A smooth and efficient process can build trust and increase the likelihood of securing funding.

Honesty and integrity are paramount throughout the fundraising process.

Conclusion

Raising money for your business is a challenging but essential step toward realizing your entrepreneurial vision. By crafting a compelling business plan, exploring various funding options, and preparing a persuasive pitch, you can significantly increase your chances of success.

The fundraising landscape is constantly evolving, with new platforms and investment trends emerging regularly. Staying informed, adapting your approach, and persisting through challenges are key to securing the capital you need to grow your business.

The future of entrepreneurship hinges on access to capital and the ability of founders to articulate their vision. The journey may be arduous, but the rewards of building a successful business are immeasurable.