How To Remove A Business Partner From A Corporation

Business partnerships can sour, leading to urgent needs for separation. Navigating the legal and financial complexities requires immediate action to protect your interests and the company's future.

This article provides a concise guide on removing a business partner from a corporation, covering key considerations from buy-sell agreements to legal recourse.

Understanding Your Options

The primary method for removing a partner hinges on the existence of a buy-sell agreement. This legally binding document outlines procedures for ownership transfer in specific scenarios, such as disputes, death, or disability. 48% of business disputes arise because of disagreements between partners, according to a 2023 study by Cornell University.

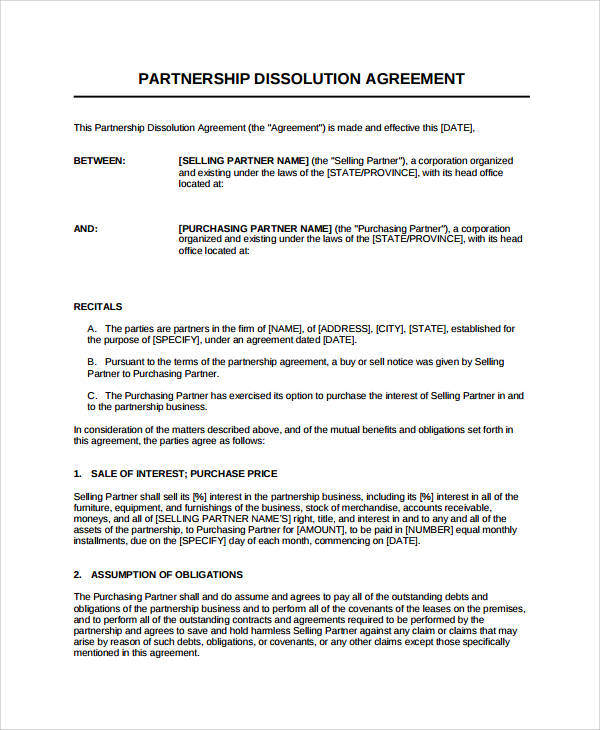

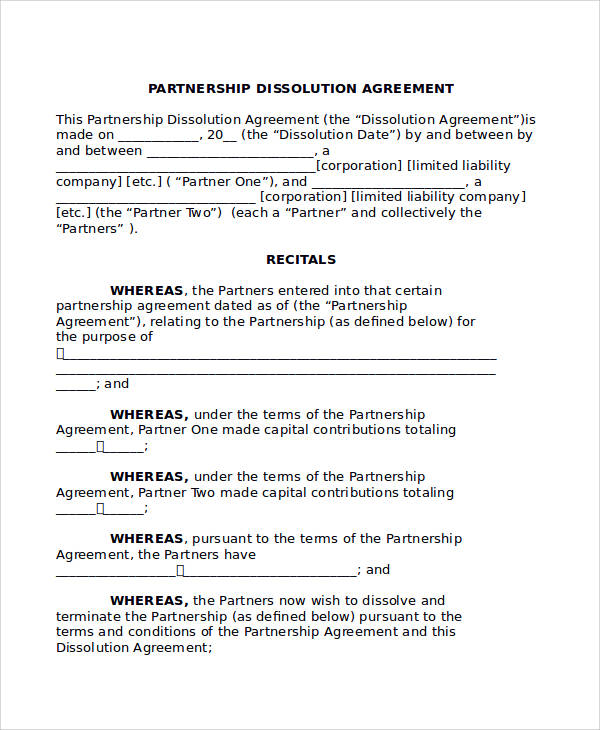

If a buy-sell agreement exists, carefully review its terms. It will detail the valuation process for the departing partner's shares and the payment schedule. Without a buy-sell agreement, the process becomes significantly more complex and potentially litigious.

Navigating a Buy-Sell Agreement

Valuation of Shares

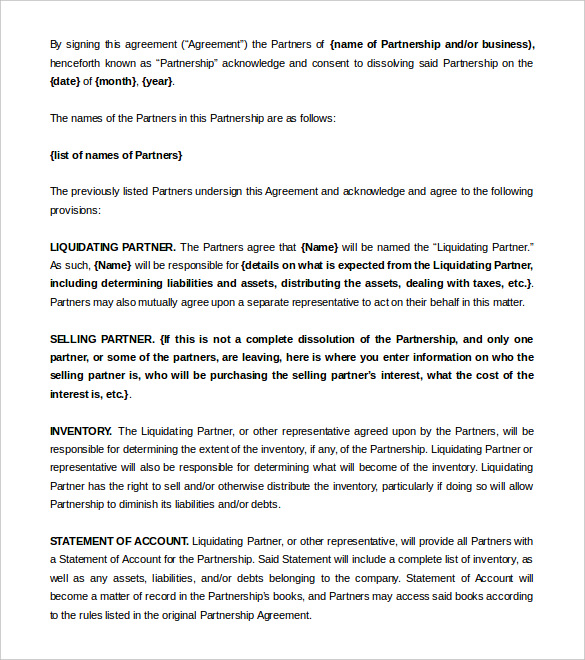

Most buy-sell agreements specify a method for valuing the departing partner's shares. This could involve an independent appraisal, a formula based on revenue or profits, or a predetermined price.

Ensure the valuation is fair and accurate. Consider hiring your own expert appraiser to counter any disputes about the value. Fair valuations can prevent protracted legal battles later.

Funding the Buyout

Determine how the corporation will fund the buyout. Options include using company profits, obtaining a loan, or offering a payment plan to the departing partner.

If financing is necessary, start exploring options early. Secure pre-approval to ensure the buyout can proceed smoothly.

When No Buy-Sell Agreement Exists

The absence of a buy-sell agreement necessitates more intricate strategies. Direct negotiation with the partner is often the first step.

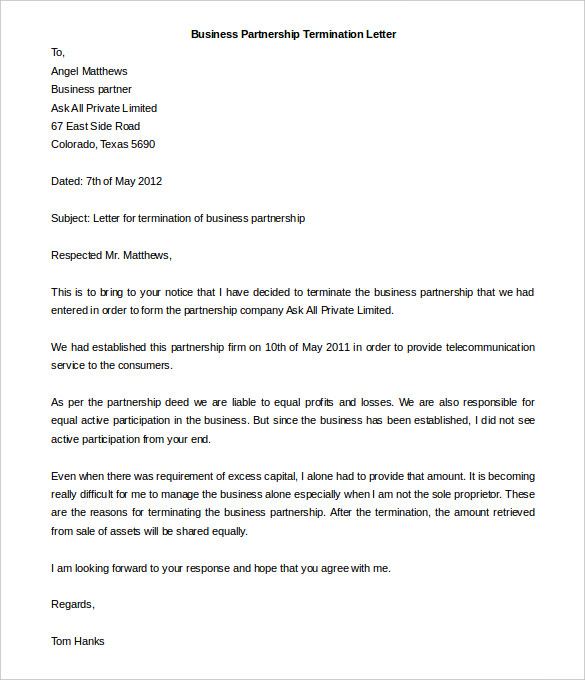

Clearly outline your reasons for wanting the partner to leave and propose a fair buyout offer. Document all communications and negotiations with legal counsel present.

Mediation and Arbitration

If direct negotiation fails, consider mediation or arbitration. These alternative dispute resolution methods can help reach a mutually acceptable agreement outside of court. Mediation involves a neutral third party facilitating discussions, while arbitration involves a neutral third party making a binding decision.

These methods are generally less expensive and time-consuming than litigation. The American Arbitration Association reports that mediated settlements are reached in approximately 85% of cases.

Legal Recourse: Dissolution or Lawsuit

As a last resort, consider legal action. This could involve petitioning for corporate dissolution or filing a lawsuit for breach of fiduciary duty, fraud, or other misconduct.

Consult with a qualified attorney to assess the strength of your case and potential outcomes. Litigation can be lengthy and expensive, so exhaust all other options first.

Protecting Company Interests

Throughout the removal process, prioritize protecting the corporation's interests. This includes safeguarding confidential information, maintaining customer relationships, and ensuring business continuity. Ensure all data is properly secured and access is restricted.

Implement a transition plan to minimize disruption. Communicate openly with employees and stakeholders to reassure them about the company's stability.

Key Considerations

Thoroughly document all actions and decisions. Maintain detailed records of negotiations, valuations, and legal proceedings. These records may be crucial if the dispute escalates.

Seek professional advice from attorneys, accountants, and business consultants. Their expertise can help you navigate the complexities of partner removal and protect your rights.

Next Steps

Immediately consult with a business attorney to review your specific situation and develop a tailored strategy. The sooner you take action, the better protected your business will be.

Gather all relevant documentation, including the corporation's articles of incorporation, partnership agreements, and financial records. This information will be essential for your legal team.