How Do You Deposit An Emailed Check

The promise of digital convenience has revolutionized many aspects of our lives, yet the persistence of checks, now delivered electronically, presents a unique challenge. While physical checks are easily deposited at banks or ATMs, the process for depositing emailed checks, often referred to as electronic checks or e-checks, can be surprisingly complex and varies significantly depending on the financial institution and the check's format.

Navigating this digital landscape requires understanding the different types of emailed checks and the deposit methods available. This article breaks down the steps involved in depositing an emailed check, examining the various technical hurdles and security considerations that consumers and businesses must navigate.

Understanding Emailed Checks: Image vs. Electronic Funds Transfer (EFT)

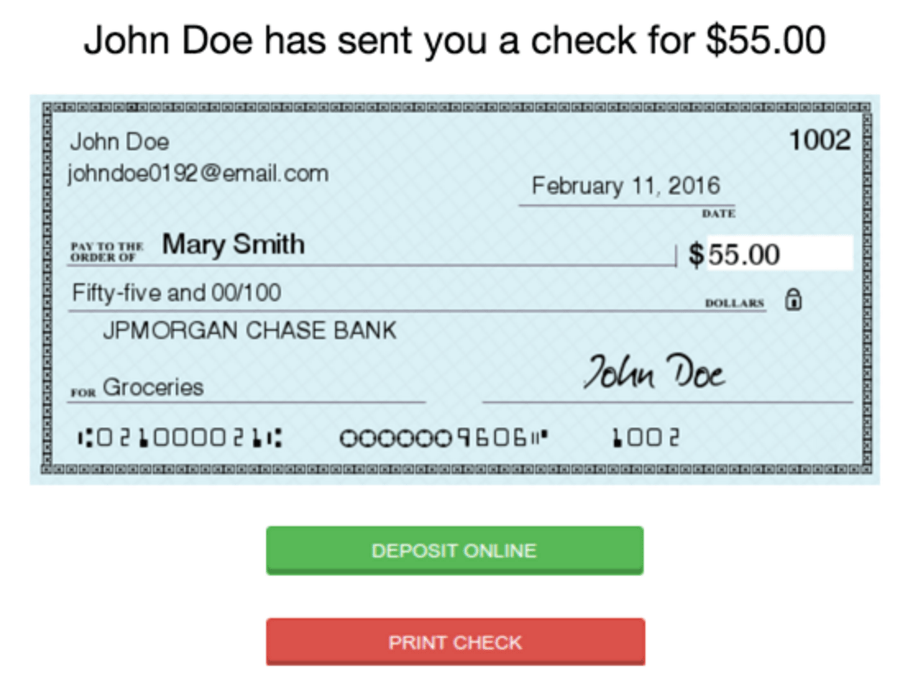

It's crucial to distinguish between a scanned image of a paper check and a true electronic check. A simple image, often sent as a PDF, is essentially a digital photograph and cannot be directly deposited through standard mobile banking apps designed for physical checks.

True electronic checks, on the other hand, involve an Electronic Funds Transfer (EFT). These are processed through the Automated Clearing House (ACH) network, a system used for electronic payments and money transfers in the United States.

Depositing Check Images via Mobile Banking Apps

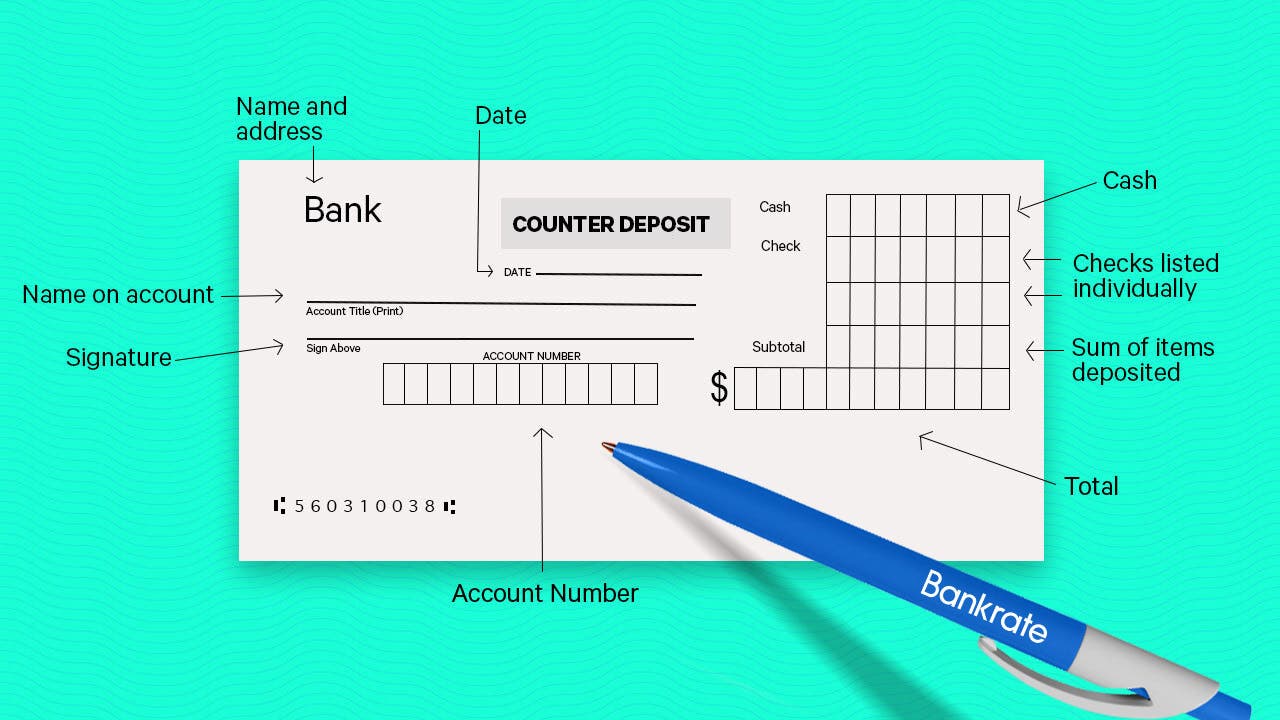

While mobile banking apps are convenient for physical checks, they typically don't accept emailed check images directly. Most apps are designed to read the MICR (Magnetic Ink Character Recognition) line at the bottom of a physical check.

However, some banks may allow you to print the emailed check image, endorse it, and then deposit it using the mobile app’s check deposit feature. Contact your bank directly to confirm whether they will accept emailed checks in this way.

Depositing Electronic Funds Transfer (EFT) Checks

If the emailed check is an EFT, the process is more streamlined. The email will usually contain specific instructions for depositing or claiming the funds.

Often, a link will direct you to a secure portal where you'll enter your bank account information. This initiates the transfer of funds from the payer's account to yours through the ACH network.

Key Steps for Depositing Emailed Checks

Regardless of the method, several steps are crucial for successfully depositing an emailed check.

- Verify the Sender's Authenticity: Scrutinize the email address and content to ensure it's legitimate. Be wary of emails with misspellings, generic greetings, or requests for personal information beyond your bank account details.

- Contact the Payer (If Possible): If you're unsure about the email's authenticity, contact the payer directly to confirm they sent the check.

- Review the Check Details: Carefully examine the check amount, payee information, and routing/account numbers (if visible).

- Follow Instructions Carefully: Adhere to the instructions provided in the email or on the linked portal.

- Secure Your Information: Ensure that any website where you enter your bank account information is secure (look for "https" in the address bar and a padlock icon).

- Keep a Record: Save a copy of the email and any transaction confirmation for your records.

Navigating Bank Policies and Limitations

Bank policies regarding emailed checks vary widely. Some banks may outright reject emailed check images, while others may offer specific services or partnerships that facilitate electronic check processing.

Contacting your bank's customer service is crucial to understand their specific policies and limitations.

Larger institutions like Bank of America and Chase may have dedicated resources or online portals for handling electronic payments, while smaller credit unions might require you to print and deposit the check. The Federal Deposit Insurance Corporation (FDIC) does not have specific regulations regarding emailed checks, leaving the policy up to the bank.

Security Considerations

Emailed checks are inherently vulnerable to fraud and scams. Phishing attempts can mimic legitimate check emails, and malicious actors can intercept and alter check images or EFT instructions.

Protecting your bank account information is paramount. Never share your password or PIN, and be cautious about clicking on links or downloading attachments from unknown senders.

According to the Federal Trade Commission (FTC), check fraud remains a significant issue, and consumers should exercise extreme caution when dealing with emailed checks. The Better Business Bureau (BBB) warns against accepting checks for more than the agreed-upon amount, as this is often a sign of a scam.

The Future of Emailed Checks

While emailing check images is not currently a sustainable deposit method for many people, true electronic checks processed through the ACH network will become more common. As technology evolves, banks are expected to integrate more seamless and secure methods for depositing emailed checks.

The move towards instant payment systems, such as Zelle and Venmo, also reduces the need for checks, both physical and electronic. However, for the foreseeable future, understanding how to handle emailed checks responsibly and securely will remain a necessary skill in the digital age.

![How Do You Deposit An Emailed Check Show a deposited check image on Chase.com [SOLVED] | J.D. Hodges](http://www.jdhodges.com/wp-content/uploads/2015/04/2015-04-01-08_23_18-Chase-Online-Deposit-Details-show-check-image-713x550.png)