How To Remove My Name From A Business Partnership

Navigating the complexities of a business partnership can be challenging, particularly when it's time to move on. The process of removing your name from a business partnership requires careful planning, legal compliance, and clear communication to avoid future disputes.

Understanding the steps involved is crucial for ensuring a smooth transition and protecting your personal and professional interests. This article outlines the key aspects of dissolving a partnership and legally separating yourself from the business.

Understanding Your Partnership Agreement

The first step is always to consult your partnership agreement. This document, ideally drafted with legal counsel, outlines the procedures for partner withdrawal, including required notice periods, valuation methods for your share, and dispute resolution mechanisms.

Without a clearly defined agreement, the process can become significantly more complicated and potentially lead to costly legal battles. Consulting with an attorney to interpret the agreement is highly recommended.

Formal Notice and Valuation

Most partnership agreements require a formal written notice of your intent to withdraw. This notice should be delivered according to the specifications outlined in the agreement, typically to all remaining partners.

The valuation of your share in the partnership is another critical aspect. The agreement should detail how your share will be calculated, whether through an independent appraisal, a predetermined formula, or a negotiated settlement.

Disagreements over valuation are common, emphasizing the importance of a fair and transparent process. Third-party mediation can sometimes help resolve these disputes.

Legal and Financial Considerations

Withdrawing from a partnership doesn't just involve internal agreements; it also has significant legal and financial implications. You need to address issues such as liability for existing debts and obligations.

A key concern is ensuring that creditors and other third parties are formally notified of your withdrawal. This step is crucial to limit your future liability for partnership debts incurred after your departure. Failure to properly notify relevant parties can result in continued legal and financial responsibility.

Furthermore, you need to consider tax implications, which vary depending on the type of partnership and the structure of the withdrawal agreement. Seeking advice from a qualified tax professional is crucial.

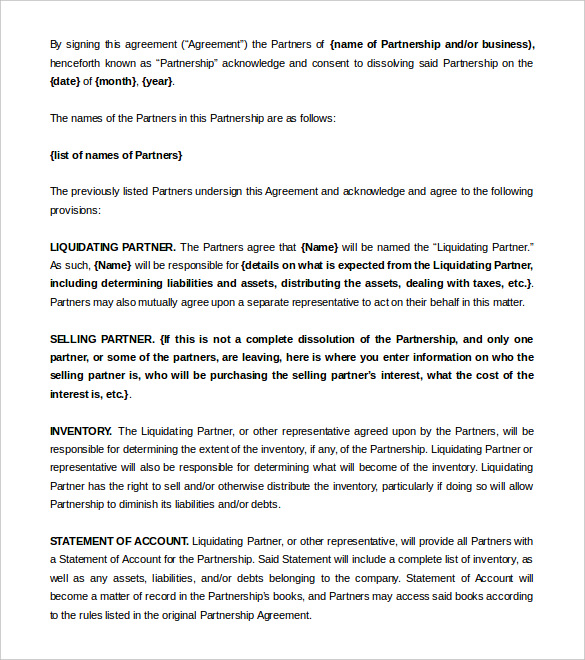

Documentation and Formal Dissolution

Several documents are required to formalize your withdrawal. This typically includes a written agreement between you and the remaining partners, formally dissolving your involvement.

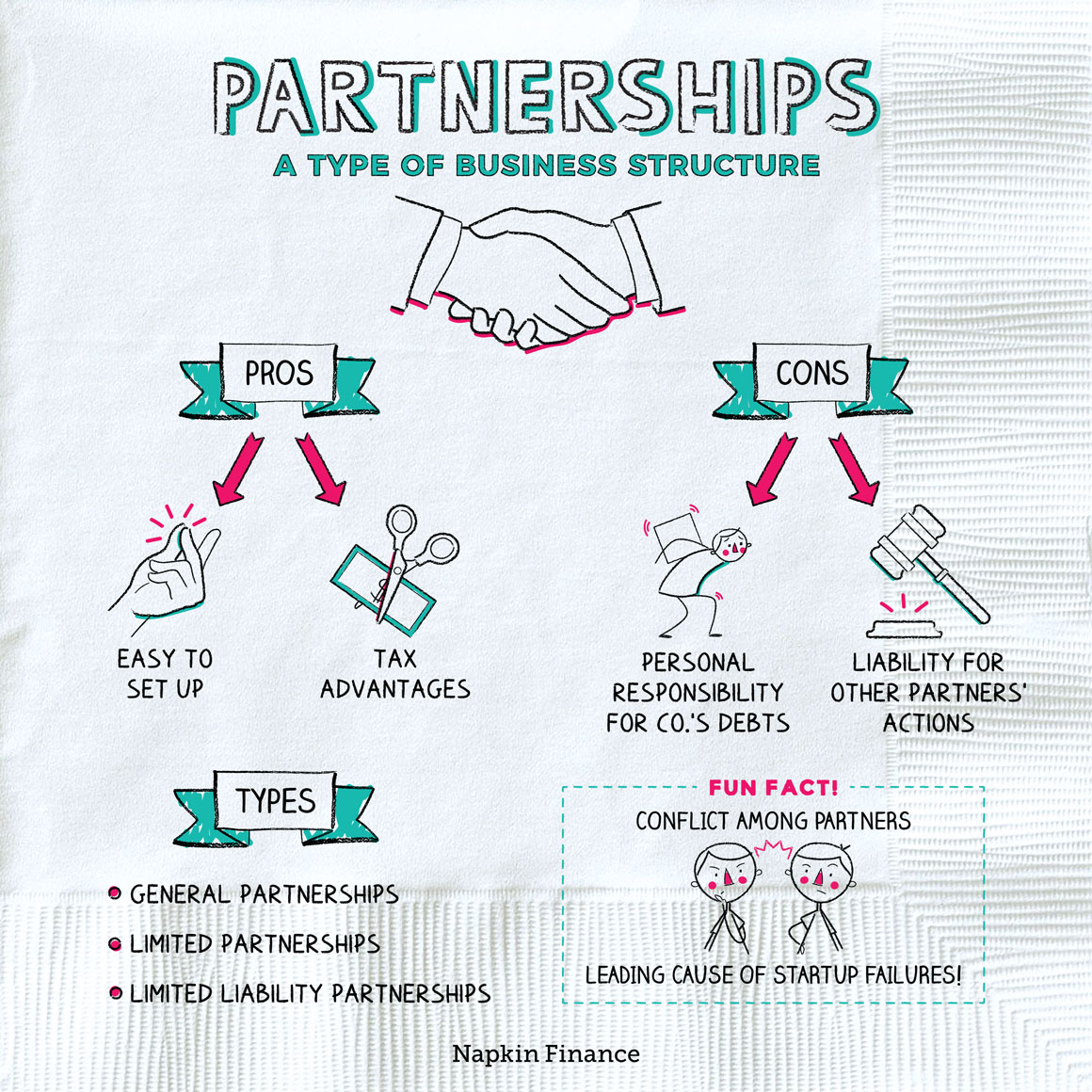

This agreement should explicitly state the terms of your departure, the agreed-upon valuation of your share, and any ongoing obligations or responsibilities. Filing the necessary paperwork with relevant state agencies is also essential. The specific requirements vary depending on the jurisdiction and the type of partnership, be it a general partnership, limited partnership, or limited liability partnership.

Ensuring that all necessary documentation is accurate and complete helps avoid future legal challenges and confirms your official separation from the business. Keeping copies of all filed documents for your records is also advisable.

The Impact on the Business and Your Reputation

Leaving a partnership can affect the business, especially if you were a key player. The remaining partners need to adjust to the change, which may involve restructuring or finding a replacement.

Maintaining professionalism throughout the process is crucial, even if disagreements arise. Preserving your reputation and relationships with former partners can be beneficial in the long run.

Consider the long-term implications and prioritize clear communication and ethical conduct. Remember, how you leave can be just as important as how you entered the partnership.

In conclusion, removing your name from a business partnership is a multifaceted process that demands careful attention to legal, financial, and interpersonal considerations. Consulting with legal and financial professionals is paramount to ensure a smooth and legally sound transition, safeguarding your interests and minimizing potential future liabilities.