How To Remove Someone From Business Bank Account

/3e42e0eb-1b5c-4062-954c-09040ca73a71_1.png)

Imagine a bustling bakery, filled with the aroma of freshly baked bread and the cheerful chatter of customers. Two partners, Emily and David, had poured their hearts and souls into building this dream. But somewhere along the way, disagreements arose, and now Emily finds herself facing a daunting question: how to gracefully, yet effectively, remove David from their joint business bank account.

Navigating the complexities of removing someone from a business bank account is a process fraught with legal and financial considerations. It requires meticulous planning and adherence to specific procedures to ensure a smooth transition and avoid potential disputes. This article offers a practical guide on understanding the steps involved, empowering business owners to manage their finances effectively when partnerships evolve.

Understanding the Foundation: Account Agreements and Legal Structures

The initial step lies in revisiting the foundational documents of the business. Review the original account agreement with the bank. This document typically outlines the procedures for adding or removing signatories.

Equally important is the business's legal structure. Is it a sole proprietorship, a partnership, an LLC, or a corporation? The answer significantly impacts the process.

For instance, in a sole proprietorship, the owner has ultimate control. However, in a partnership or multi-member LLC, decisions often require consensus or adherence to the operating agreement.

Gathering the Necessary Documents and Information

Preparation is key. Start by compiling all relevant business documents, including the business's formation documents (like Articles of Incorporation or LLC Operating Agreement), the bank account agreement, and any partnership agreements.

It's also wise to gather records of any resolutions or agreements made regarding changes in signatories or ownership. This will provide a clear paper trail.

Having the other party's contact information readily available can streamline communication, even if it's through legal counsel.

The Step-by-Step Process: Informing the Bank and Initiating the Change

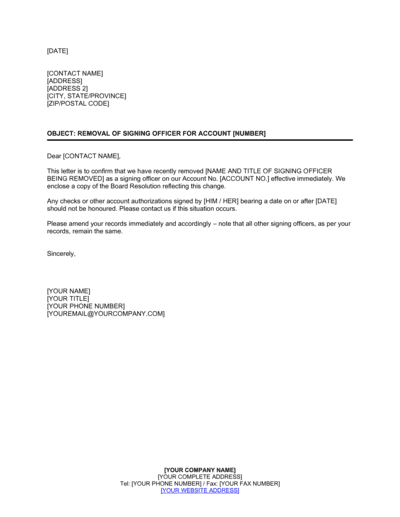

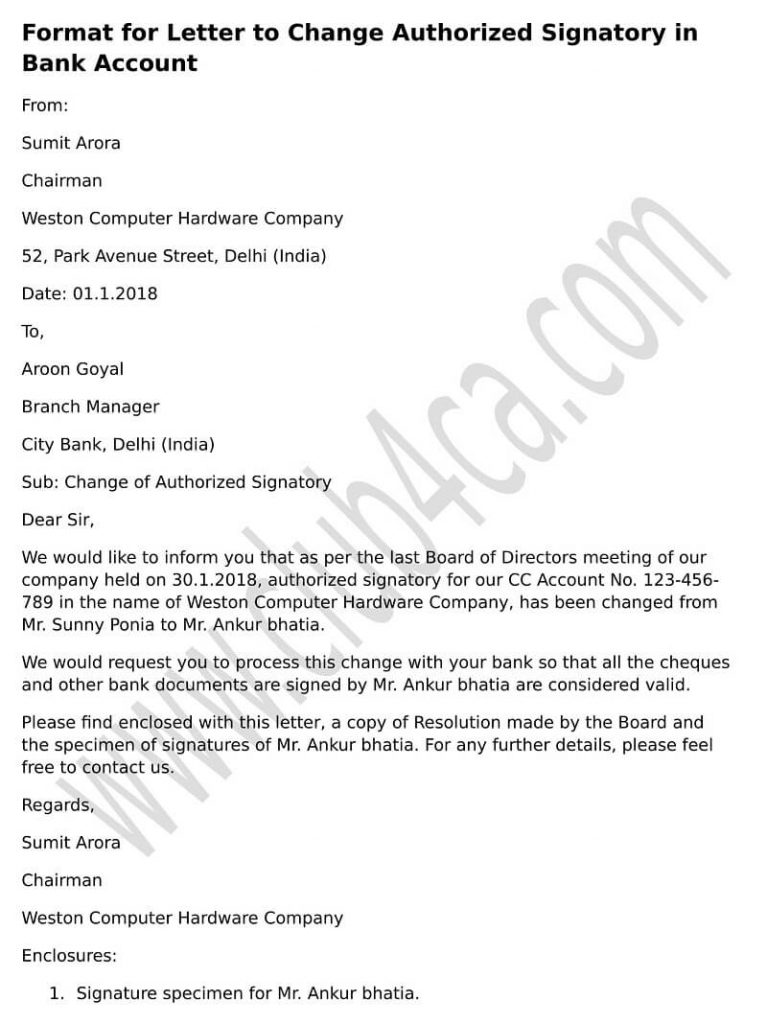

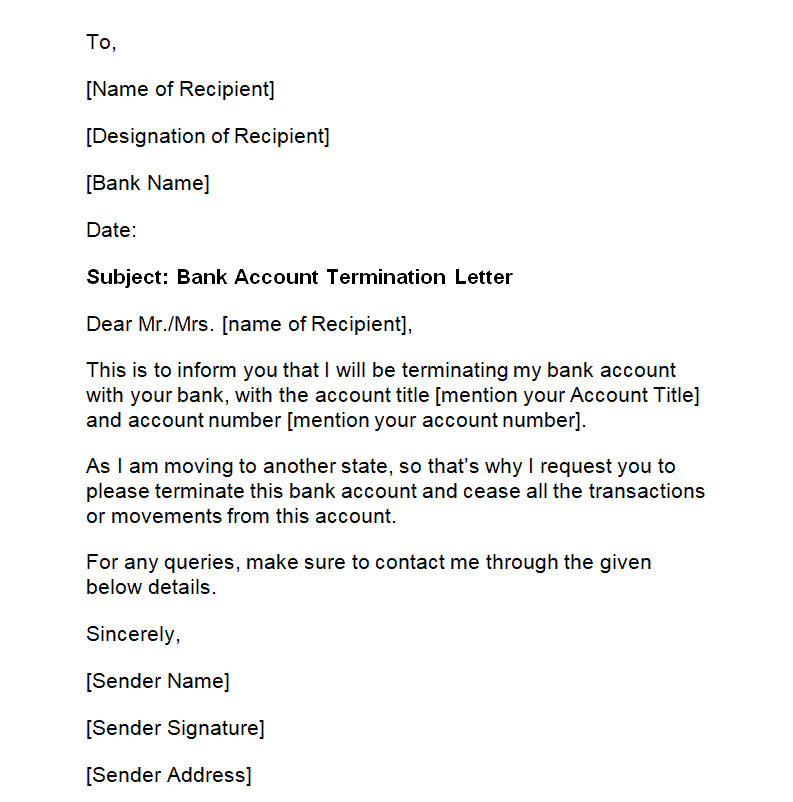

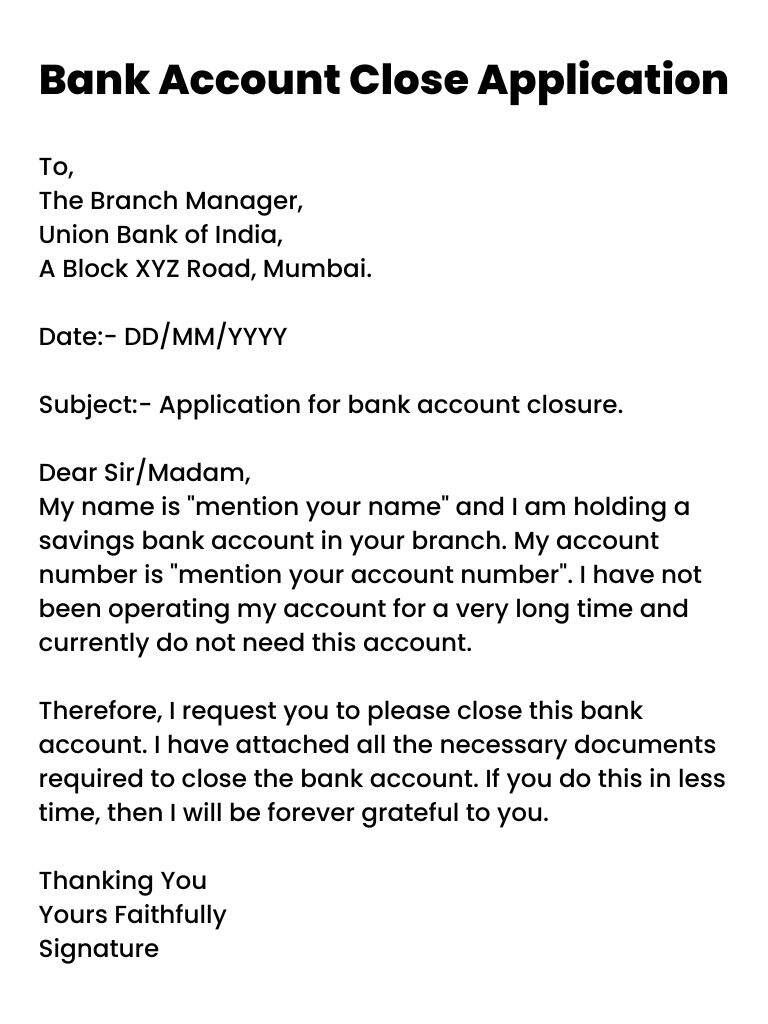

Once you've gathered your documents, contact the bank directly. Schedule a meeting with a bank representative or inquire about their specific procedures for removing a signatory from a business account.

Typically, the bank will require a written request. This request should clearly state the intention to remove David from the account and provide supporting documentation, such as a partnership dissolution agreement or a court order.

The bank will likely require signatures from all authorized signatories on the account, depending on the initial agreement and the business structure. Be prepared for this requirement.

Navigating Potential Disputes and Legal Considerations

It's not always a straightforward process. If the individual being removed disputes the decision, or if there's a disagreement among partners, legal intervention may be necessary.

Consulting with a business attorney is crucial in such situations. An attorney can advise on the legal implications, draft necessary legal documents, and represent your interests in any disputes.

Document everything. Keep detailed records of all communications with the bank, the other party, and any legal counsel. This documentation can be invaluable if disputes arise later.

Safeguarding the Business: Updating Internal Controls and Security

After removing the signatory, take proactive steps to safeguard the business's financial security. Review and update internal controls to prevent unauthorized transactions.

Change online banking passwords and security questions. Consider implementing multi-factor authentication for all authorized users.

Monitor the account closely for any unusual activity. Regularly review bank statements and transaction logs to ensure everything is in order.

Looking Ahead: Preventing Future Complications

One of the best ways to avoid future complications is to establish clear and comprehensive partnership agreements from the outset. These agreements should address procedures for resolving disputes, changing signatories, and dissolving the partnership.

Regularly review and update these agreements to reflect any changes in the business structure or ownership. A proactive approach can save significant time, money, and stress in the long run.

Open communication and transparency among partners are paramount. Foster an environment where disagreements can be addressed constructively and resolutions can be reached amicably.

Removing someone from a business bank account can be a challenging task, but with careful planning, thorough documentation, and professional guidance, it can be managed effectively. Remember, prioritizing open communication, seeking legal counsel when needed, and proactively safeguarding your business's finances are crucial steps toward a secure and successful future. Just as Emily, our baker, can navigate this process with grace and resilience, so too can any business owner facing similar circumstances.

:max_bytes(150000):strip_icc()/B3-DeleteCashAppAccount-annotated-6218e633edd94a008ff11140648d0351.jpg)