How To Report Excess Business Interest Expense From K-1

Imagine a bustling coffee shop, the aroma of roasted beans mingling with the quiet hum of laptops. Small business owners, freelancers, and entrepreneurs huddle over spreadsheets, each one navigating the intricate world of taxes. Among them is the figure of reporting excess business interest expense from a K-1 form, a detail often shrouded in complexity and confusion.

This article aims to demystify the process of reporting excess business interest expense from a K-1, offering a clear, step-by-step guide for taxpayers. Understanding this aspect of tax reporting is crucial for those involved in partnerships, S corporations, and other pass-through entities, ensuring compliance and potentially optimizing tax liabilities.

Understanding the K-1 and Business Interest Expense

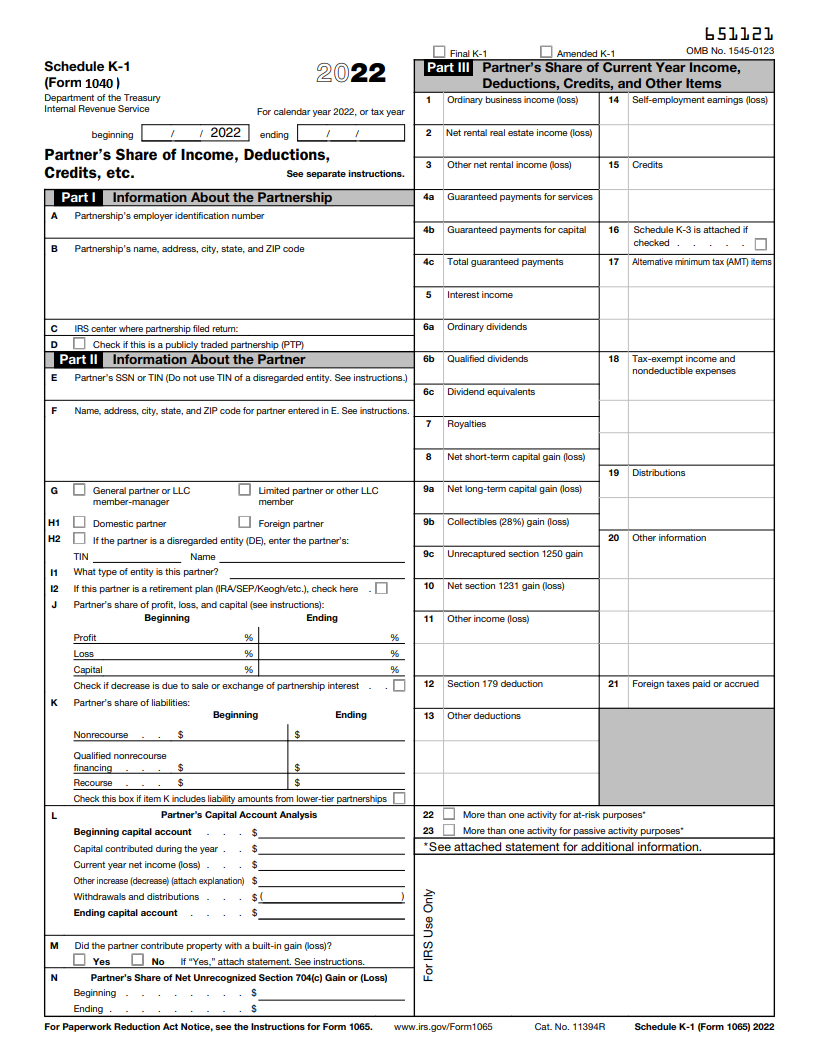

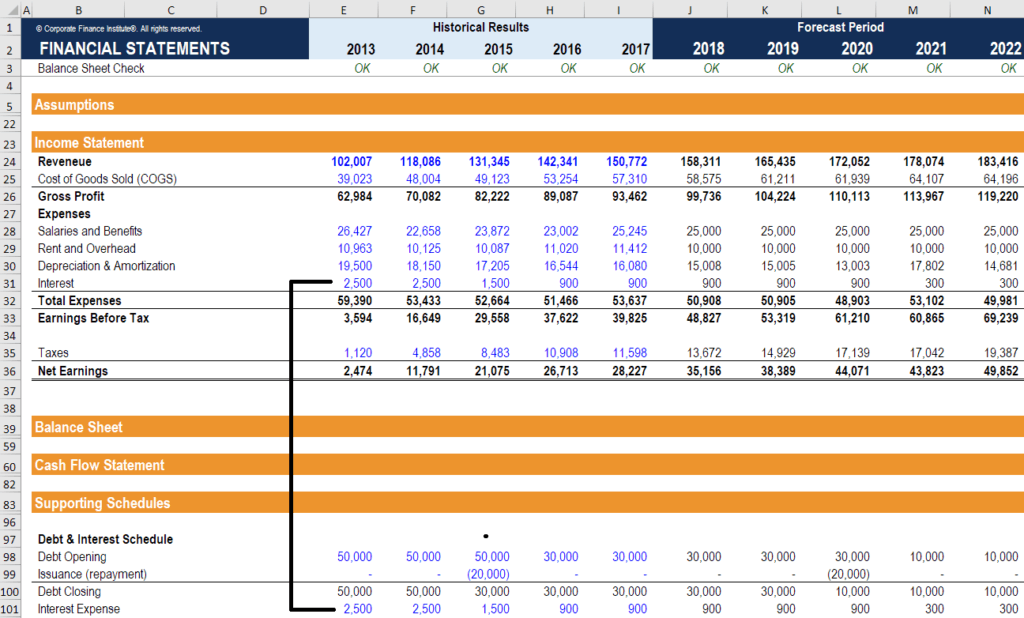

A K-1 form is an informational document provided to partners, shareholders, or beneficiaries of pass-through entities. It details their share of the entity's income, losses, deductions, and credits for the tax year.

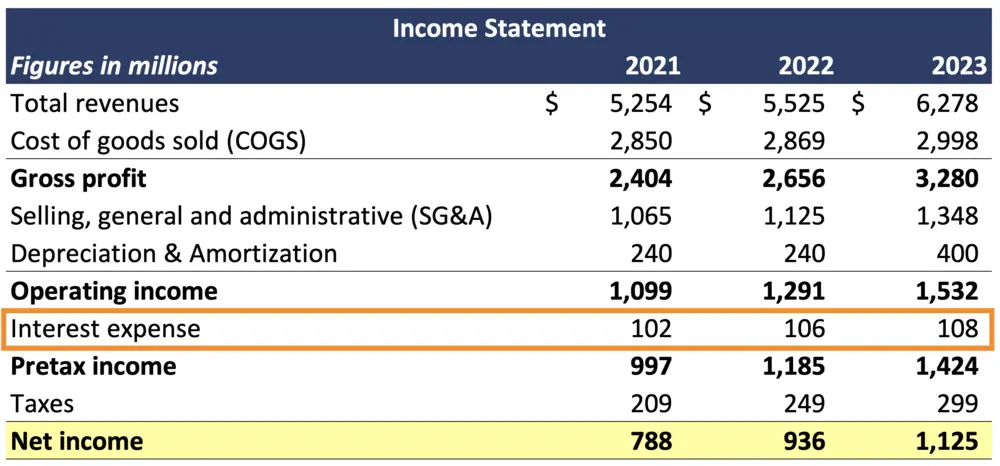

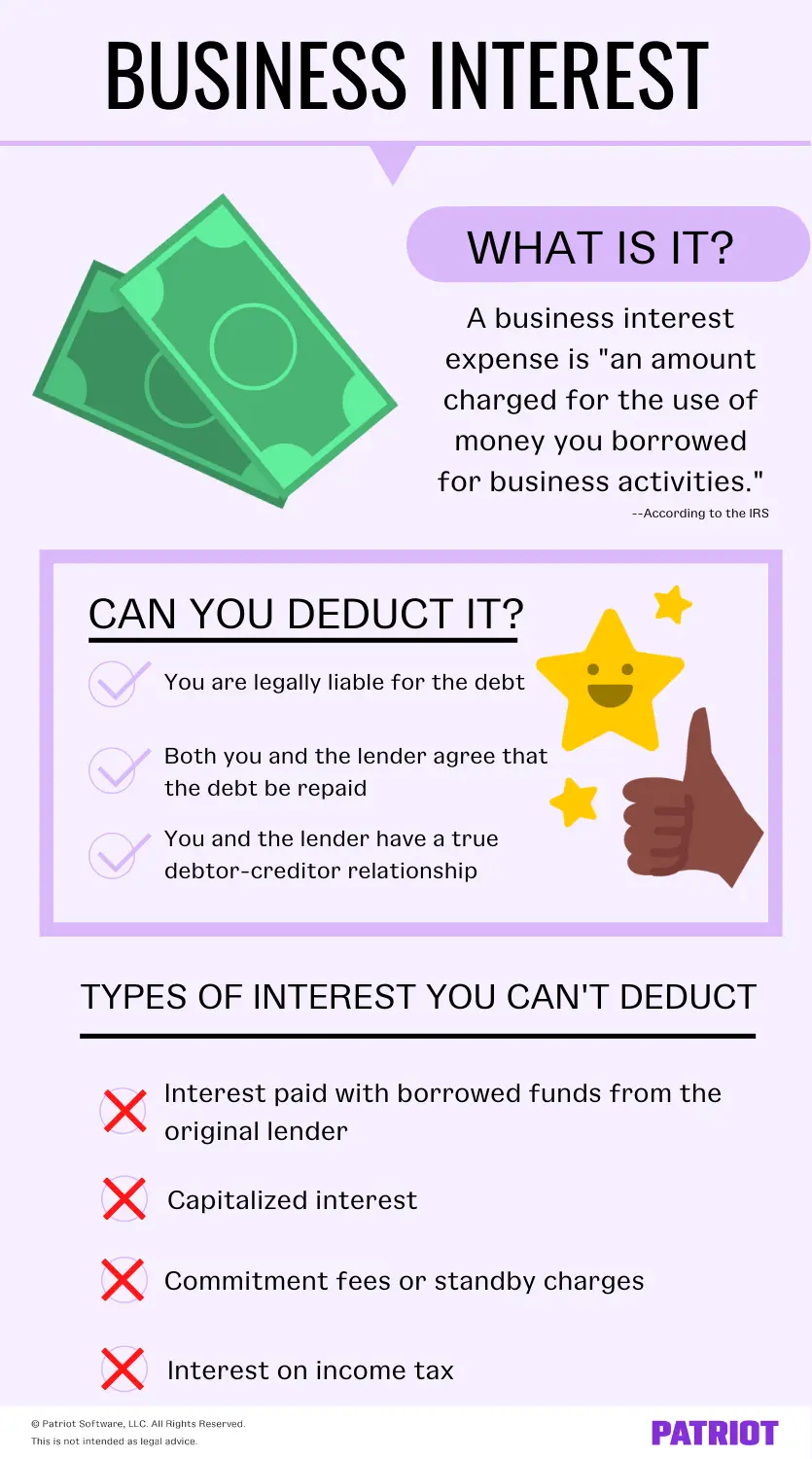

Business interest expense arises when a business incurs interest payments on debt used to finance its operations. The 2017 Tax Cuts and Jobs Act (TCJA) introduced limitations on the deductibility of business interest expense, adding complexity to tax reporting.

The TCJA and Interest Expense Limitations

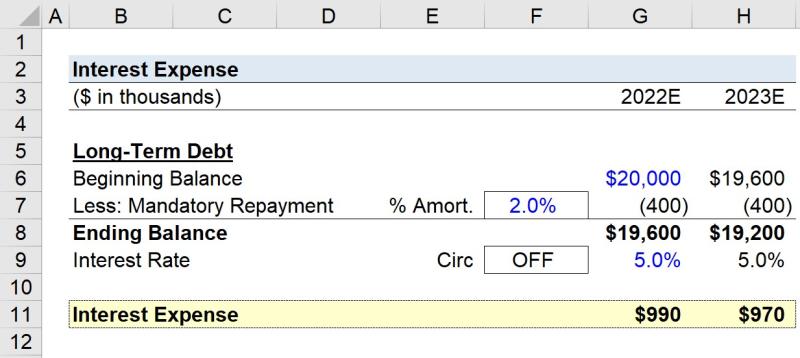

The TCJA significantly altered the landscape of business interest expense deductibility. Generally, the deduction for business interest expense is limited to the sum of business interest income, 30% of adjusted taxable income (ATI), plus floor plan financing interest (if applicable).

This limitation can result in excess business interest expense, which is the amount of interest disallowed under the 30% ATI limit. Excess business interest expense is passed on to partners or shareholders through the K-1 form.

Reporting Excess Business Interest Expense on Your Tax Return

Reporting excess business interest expense involves several steps, beginning with understanding the information provided on your K-1 form.

Step 1: Locate the Relevant Information on Your K-1

The K-1 form will typically have a section dedicated to business interest expense. This section will include your share of the entity's business interest expense, business interest income, and potentially, excess business interest expense.

Carefully review the instructions for the K-1 form, specifically focusing on the lines related to interest expense. The specific line numbers can vary depending on the type of entity (e.g., partnership vs. S corporation) providing the K-1.

Step 2: Form 8990: Limitation on Business Interest Expense

Form 8990, *Limitation on Business Interest Expense Under Section 163(j)*, is the key form for determining your deductible business interest expense. This form is typically completed at the entity level (partnership or S corporation). However, if you have excess business interest expense from a K-1, you may need to consider how the entity’s calculation affects your own tax situation.

Understanding the entity's Form 8990, even if you don't complete it yourself, helps you understand the source and nature of the excess business interest expense passed through to you.

Step 3: Determining Your Deduction of Excess Business Interest Expense

The ability to deduct the excess business interest expense passed through to you depends on several factors. One critical factor is your share of the entity's ATI (Adjusted Taxable Income).

According to the IRS, there are special rules that allow partners in partnerships to deduct excess business interest expense in certain situations. These rules often involve using your own ATI to offset the limitation.

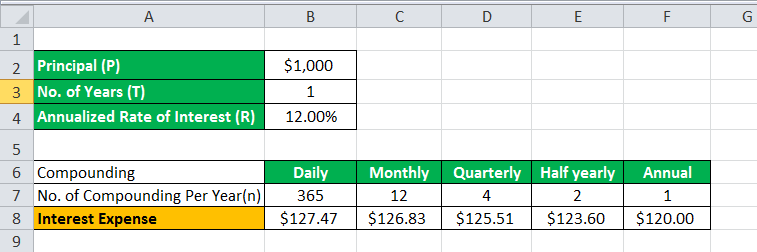

This may require additional calculations and potentially the completion of worksheets provided in the IRS instructions for Form 8990 or other relevant forms.

Step 4: Form 8990 and Schedule A

If you are able to deduct some or all of the excess business interest expense, you will generally report the deduction on Schedule A (Form 1040), Itemized Deductions. The specific line on Schedule A may vary from year to year, so it is critical to consult the current year's instructions.

You must properly document the calculation supporting the deduction. This includes retaining a copy of the K-1 form, any worksheets used to calculate the deductible amount, and the entity's Form 8990 (if available).

Note: *Some small businesses are exempt from the business interest expense limitation. Consult a tax professional to determine if your business qualifies for an exemption.*

Special Situations and Considerations

Navigating excess business interest expense can become more complex depending on your individual circumstances. Some common situations require careful attention.

Passive Activities

If the business interest expense is related to a passive activity, the deduction may be subject to the passive activity loss rules. These rules can further limit the amount of interest expense you can deduct in the current year.

It is imperative to carefully analyze whether the underlying activity generating the interest expense is considered passive. This will significantly impact how you report and deduct the expense.

Multiple K-1s

If you receive K-1 forms from multiple pass-through entities, each with excess business interest expense, you will need to aggregate the information from all K-1s to determine your overall deductible amount.

This aggregation can involve complex calculations, particularly if the entities have different tax years or operate in different industries. Seek professional guidance in these situations.

Sale of a Partnership Interest

The treatment of excess business interest expense can also be affected when you sell your interest in a partnership or S corporation. There may be special rules regarding the carryover of disallowed interest expense in these scenarios.

Consult a tax advisor to understand the implications of selling your interest on the treatment of any remaining excess business interest expense.

Seeking Professional Guidance

Tax laws are constantly evolving, and the rules surrounding business interest expense can be particularly intricate. When in doubt, seeking professional guidance from a qualified tax advisor is always the best course of action.

A tax professional can help you accurately interpret your K-1 form, navigate the complexities of Form 8990, and ensure you are taking advantage of all available deductions.

"The complexity of tax law often necessitates expert guidance. Consulting a tax professional can provide clarity and ensure compliance." - American Institute of CPAs (AICPA)

Conclusion

Reporting excess business interest expense from a K-1 form may seem daunting initially, but by understanding the underlying principles and following a systematic approach, you can navigate this aspect of tax reporting with greater confidence. Remember, staying informed and seeking professional help when needed are key to ensuring accurate and compliant tax filings.

As you navigate the complexities of business ownership, understanding your tax obligations is crucial. Taking the time to learn and seek guidance can lead to a smoother and more financially secure path forward, empowering you to focus on what truly matters: building your business and achieving your entrepreneurial dreams.