How To Sell A Business Plan To Investors

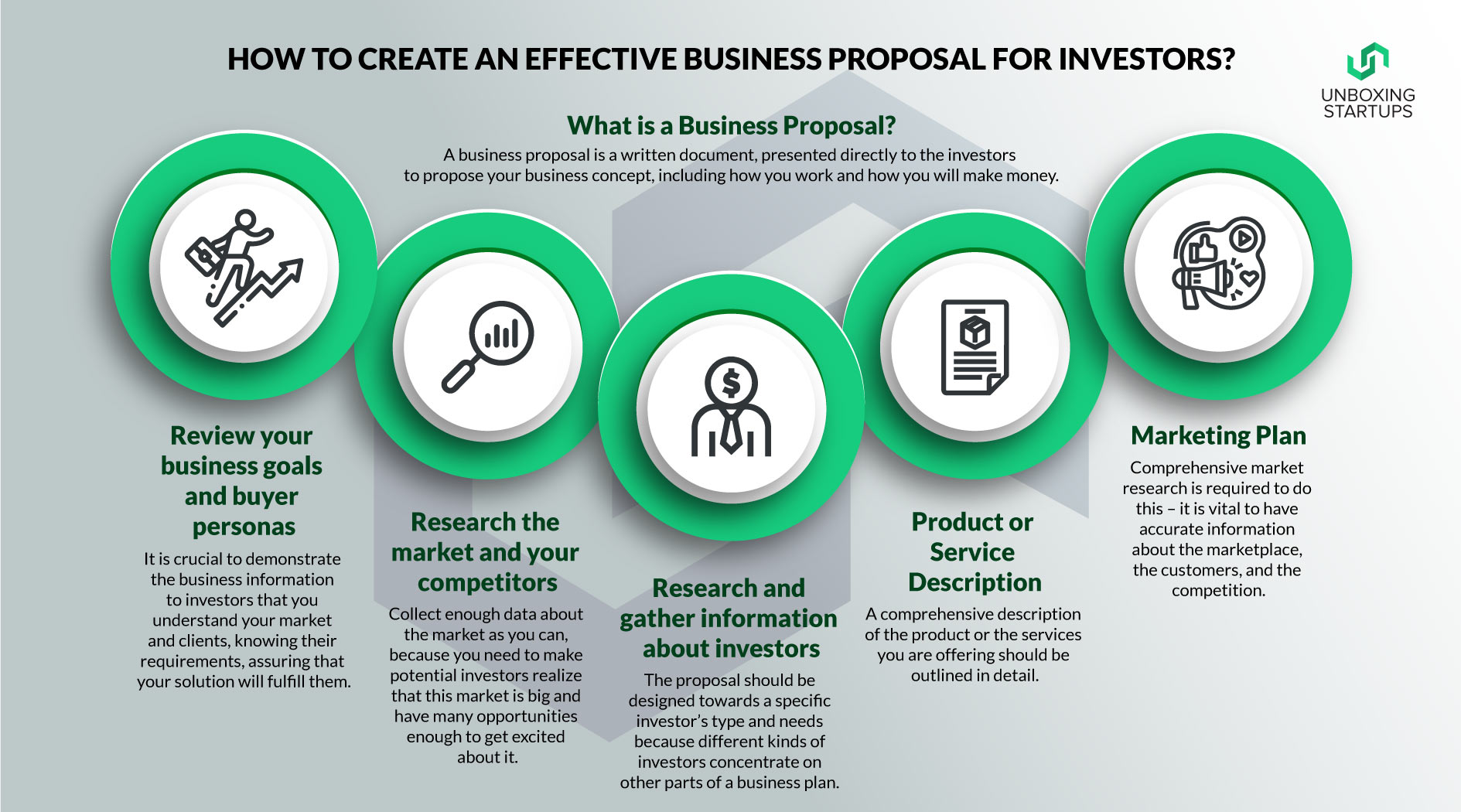

Securing funding for a new business venture or an expansion project often hinges on a well-crafted business plan. However, a brilliant plan is only as good as its presentation to potential investors. Understanding how to effectively sell that plan is paramount for entrepreneurs seeking capital.

The challenge lies in convincing investors that the venture is not only viable but also possesses a strong potential for return on investment. Mastering this art requires a deep understanding of investor psychology, meticulous preparation, and a compelling narrative.

Understanding Your Audience: Investor Types

Before presenting, entrepreneurs must identify their target investor group. Different investor types have varying priorities. Angel investors, for example, often invest smaller amounts in early-stage companies and may prioritize innovation and disruptive potential.

Venture capitalists (VCs), on the other hand, typically invest larger sums in companies with demonstrated traction and scalability. Understanding these nuances is crucial for tailoring the pitch.

Crafting a Compelling Narrative

A business plan is more than just numbers; it's a story. This narrative should clearly articulate the problem, the proposed solution, the market opportunity, and the competitive advantage.

Investors need to understand the "why" behind the business, not just the "what". A strong narrative resonates emotionally and demonstrates the entrepreneur's passion and commitment.

Key Components of a Winning Pitch

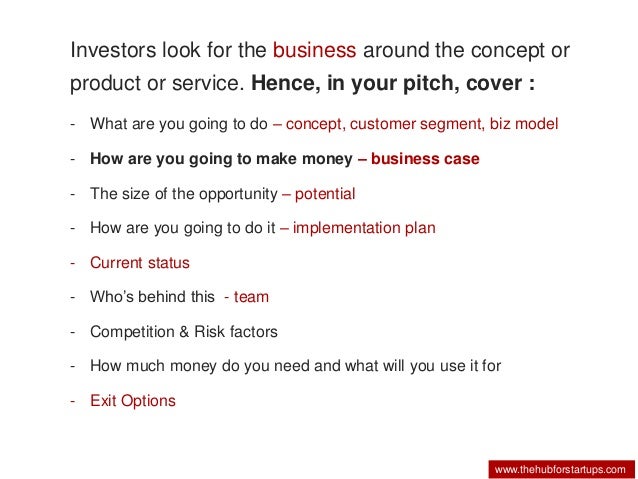

A successful pitch deck typically includes several essential elements. It starts with an executive summary that encapsulates the entire business plan in a concise and compelling manner.

It is vital to clearly define the market opportunity. Include a detailed financial projections section. These projections should be realistic and supported by well-researched assumptions.

Furthermore, highlighting the management team's expertise and experience is critical. Investors want to know that the business is in capable hands.

Presenting with Confidence and Clarity

Delivery is just as important as the content of the business plan. Entrepreneurs should practice their pitch thoroughly and be prepared to answer tough questions. Projecting confidence and enthusiasm can be highly persuasive.

According to a study by the National Venture Capital Association (NVCA), investors place a significant emphasis on the entrepreneur's presentation skills and their ability to articulate the business vision.

Using visual aids such as slides and charts can enhance the presentation and make complex information more accessible. Keep visual aids clear, concise, and visually appealing.

Addressing Potential Concerns

Anticipate potential concerns that investors may have and address them proactively. Transparency and honesty are paramount. Don't shy away from acknowledging potential challenges and outlining strategies for mitigating them.

Investors appreciate entrepreneurs who are realistic about the risks involved and have a plan to address them. By addressing these concerns head-on, you can build trust and credibility.

Be prepared to discuss the competitive landscape and how the business will differentiate itself from competitors. Explain how the venture plans to maintain its competitive edge over time.

Following Up and Maintaining Communication

The presentation is not the end of the process. Follow up with investors promptly and provide them with any additional information they may request. Maintaining open communication is crucial for building strong relationships.

Send a thank-you note after the meeting to show appreciation for their time and consideration. Be prepared to engage in ongoing discussions and negotiations as the due diligence process unfolds.

Ultimately, selling a business plan to investors is about building trust, demonstrating viability, and conveying a compelling vision for the future. By mastering these skills, entrepreneurs can significantly increase their chances of securing the funding they need to succeed.

.jpg)

.jpg)