How To Sell Specific Shares On Fidelity

For investors navigating the complexities of stock portfolios, particularly within platforms like Fidelity Investments, selling specific shares can be a strategic maneuver with potential tax implications. Understanding the 'how' of this process is crucial for optimizing investment outcomes and maintaining control over capital gains taxes.

This article provides a detailed guide on how to sell specific shares on Fidelity, allowing investors to manage their portfolios with greater precision. We'll cover the steps involved in designating specific lots for sale, factors to consider before selling, and resources available to ensure compliance and informed decision-making.

Understanding Specific Share Identification

The ability to choose which shares to sell, known as Specific Share Identification or SpecID, can be a valuable tool for managing capital gains. Rather than automatically selling shares purchased earliest (known as FIFO, or First-In, First-Out), SpecID gives investors more control. This control can be particularly useful when shares have been acquired at different times and prices.

What is the Nut Graf? The option to sell specific shares held within a Fidelity account enables investors to potentially minimize or defer capital gains taxes by selecting shares with the highest cost basis to sell first. This guide offers a step-by-step walkthrough on how to execute this strategy within the Fidelity platform, as well as considerations to keep in mind.

Step-by-Step Guide to Selling Specific Shares on Fidelity

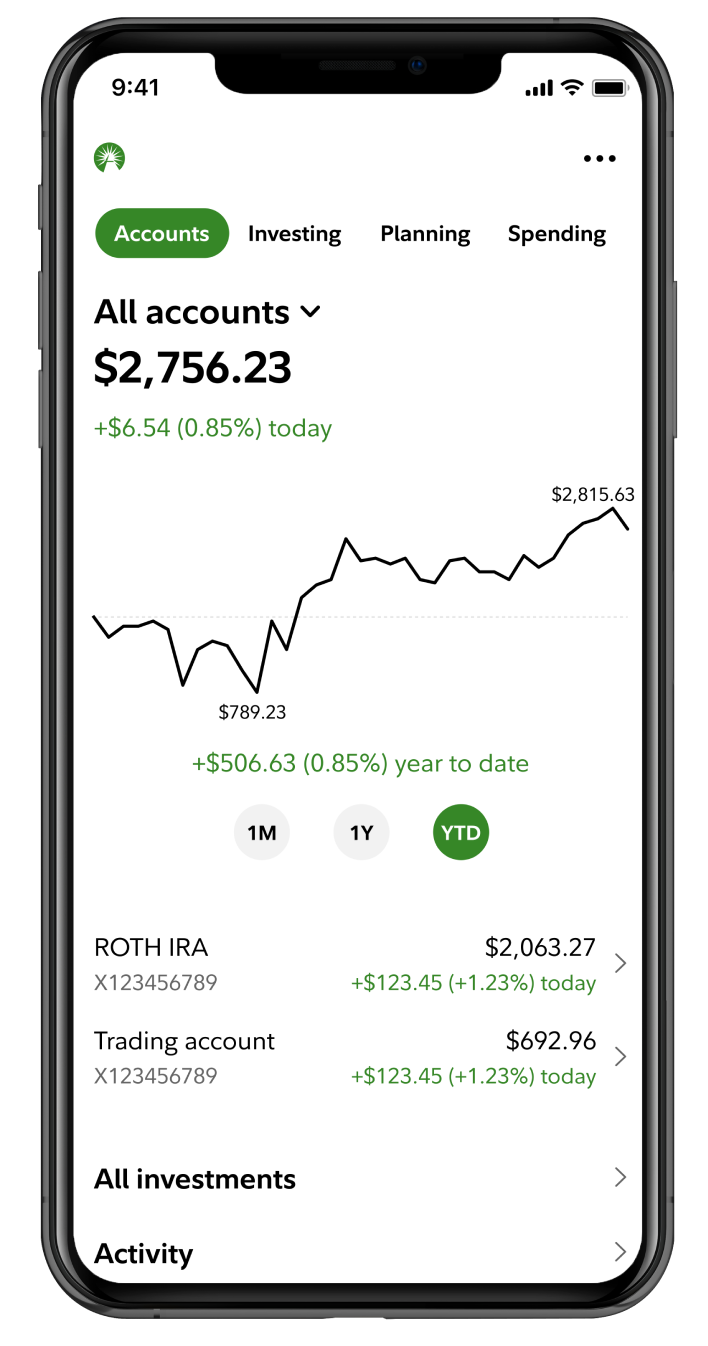

First, log in to your account on the Fidelity Investments website.

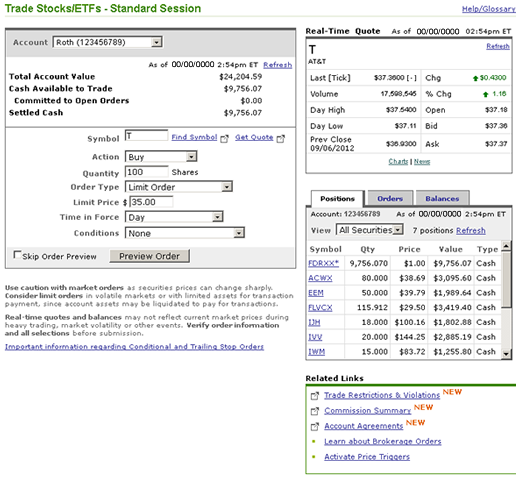

Once logged in, navigate to your portfolio summary and select the specific account holding the shares you wish to sell. This is important, especially if you have multiple accounts.

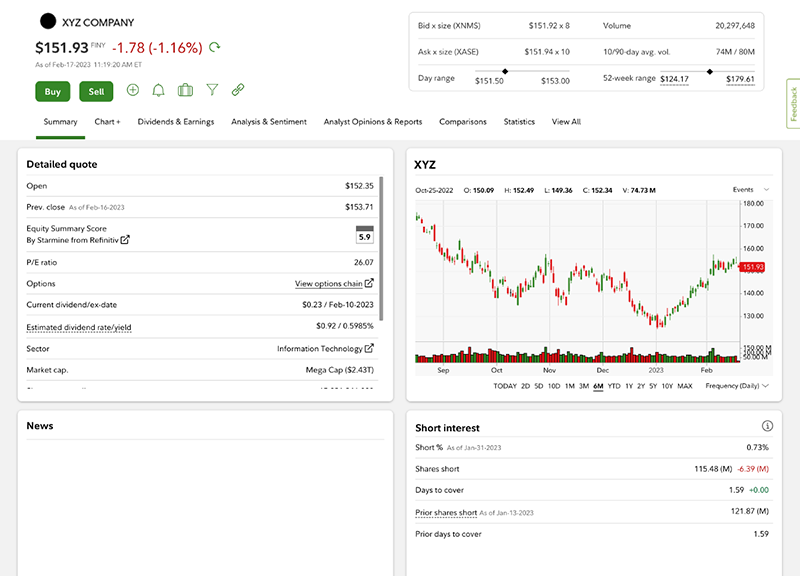

Initiate a trade for the stock you intend to sell by clicking on the 'Trade' button associated with that stock in your account summary.

Selecting the "Specific Shares" Option

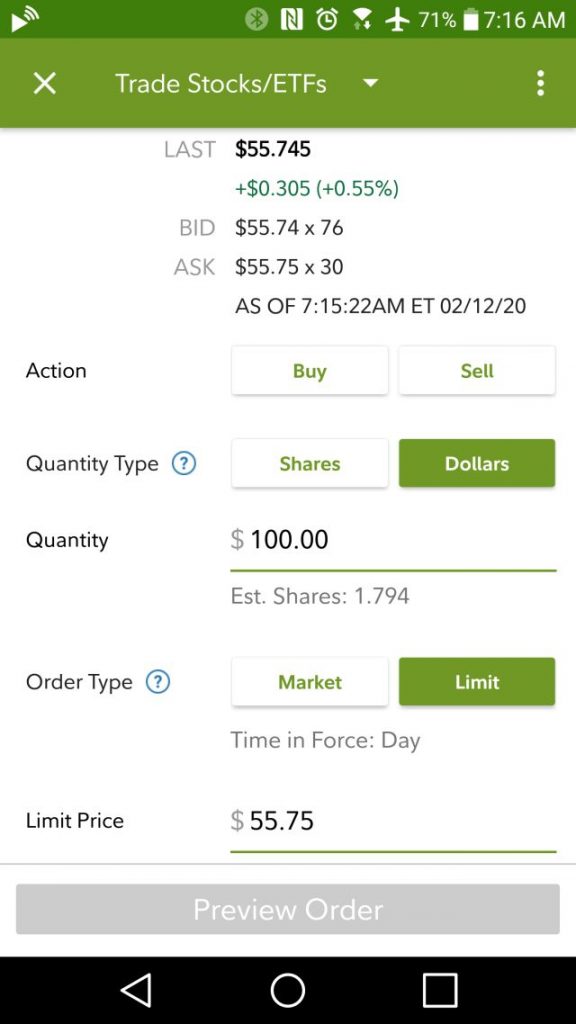

On the trade ticket, look for the order type options. You may need to expand advanced options or click "More Options" to find the "Specific Shares" option. Some interfaces use the terminology "SpecID."

Select the "Specific Shares" option, which will present you with a list of your share lots, including the purchase date and cost basis for each lot.

Carefully review the list of share lots and select the specific lots you want to sell by checking the boxes next to them. Ensure the quantity of shares selected matches the total quantity you intend to sell.

Entering the Order Details

Enter the number of shares from the chosen lots you want to sell. Double-check that the total number of shares selected matches your overall trading intention.

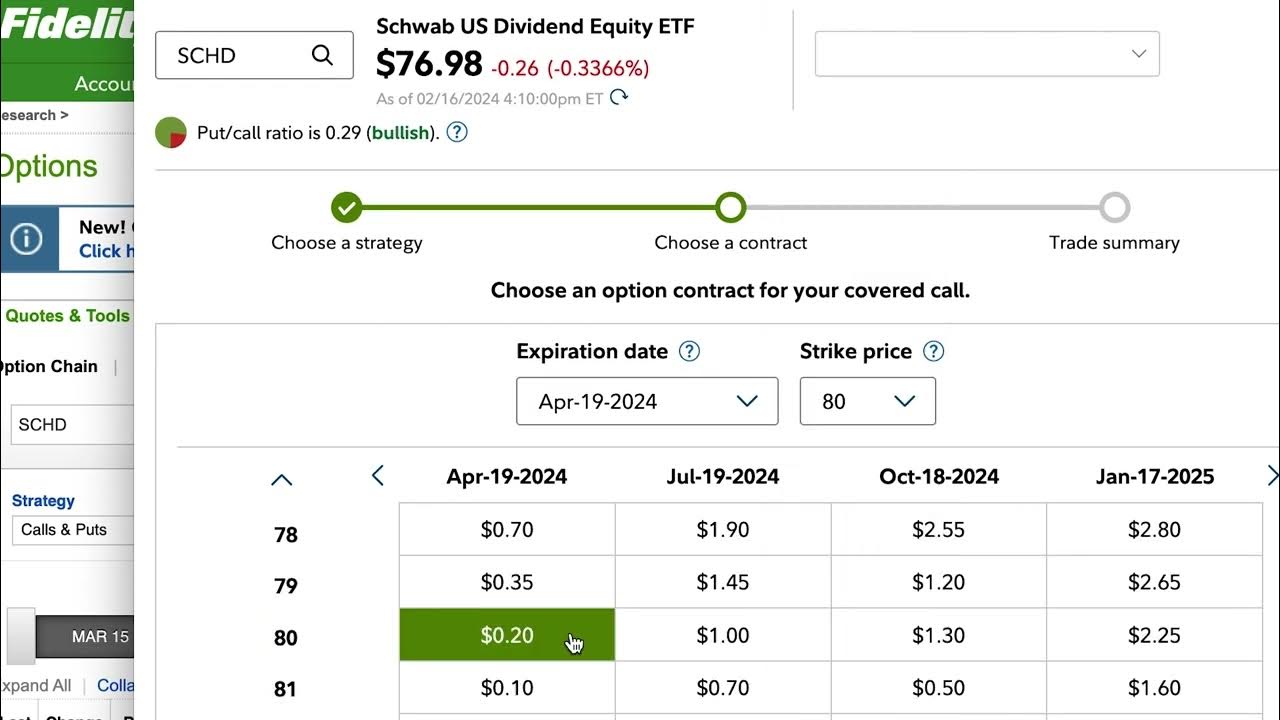

Choose your order type (market, limit, stop-loss, etc.) based on your trading strategy and risk tolerance.

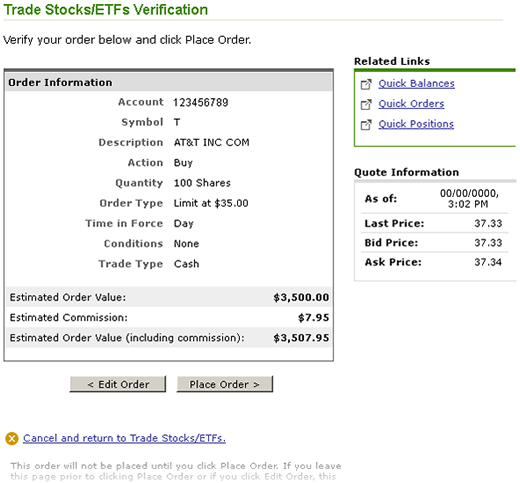

Review all details of your order, including the selected share lots, order type, and quantity, before submitting. This is a critical step to prevent errors.

Confirming and Submitting the Order

After reviewing, click "Preview Order". If you have made no errors, submit the order to complete the sell. A confirmation message should appear, detailing your completed trade.

Keep this record for your personal bookkeeping and tax purposes.

Considerations Before Selling Specific Shares

Tax Implications: Selling specific shares is most often done to minimize capital gains taxes. Consult a tax professional to understand the implications of your specific situation.

Wash Sale Rule: Be aware of the wash sale rule, which disallows claiming a loss on a sale if you repurchase the same or substantially identical securities within 30 days before or after the sale. This is crucial to avoid unintended tax consequences.

Investment Strategy: Consider your overall investment strategy before selling any shares. Ensure the sale aligns with your long-term goals and risk tolerance. Think about why you are selling the shares in the first place.

Resources Available on Fidelity

Fidelity Investments offers a range of resources to help investors understand and execute specific share identification.

The Fidelity website provides detailed guides, FAQs, and educational materials on tax-efficient investing strategies and trading tools. Fidelity's customer service representatives are available to answer questions and provide assistance with navigating the platform.

Consider consulting with a Fidelity wealth management advisor for personalized advice and guidance on portfolio management and tax planning.

Conclusion

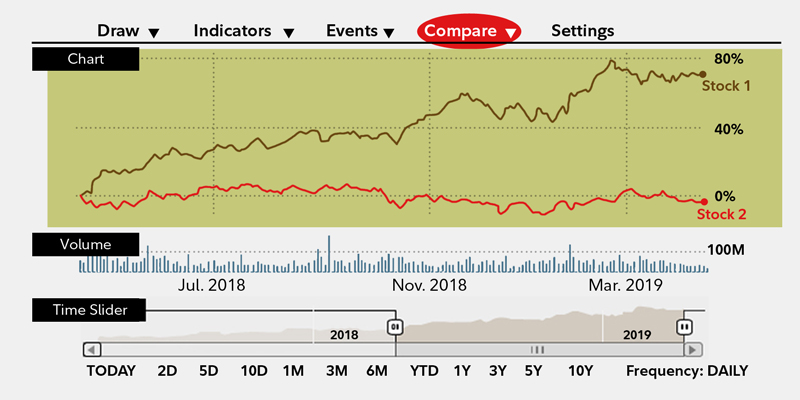

Selling specific shares on Fidelity requires careful attention to detail, but it offers a powerful tool for managing tax liabilities and optimizing investment returns. By following the steps outlined in this guide and considering the relevant tax implications, investors can make informed decisions and potentially enhance their financial outcomes. The ability to select specific shares to sell can be an advantage for investors during periods of both market volatility and growth.