How To Sell Your Idea To Investors

Securing funding for a groundbreaking idea can feel like navigating a labyrinth. For entrepreneurs, mastering the art of pitching to investors is a crucial skill, often determining the fate of their ventures. Recent workshops and online resources have emerged, offering a roadmap for navigating this challenging terrain.

This article delves into the key strategies and essential elements that entrepreneurs need to understand when presenting their ideas to potential investors. We’ll explore how to craft a compelling narrative, demonstrate market viability, and build a credible team, all crucial for securing the necessary capital to turn a vision into reality.

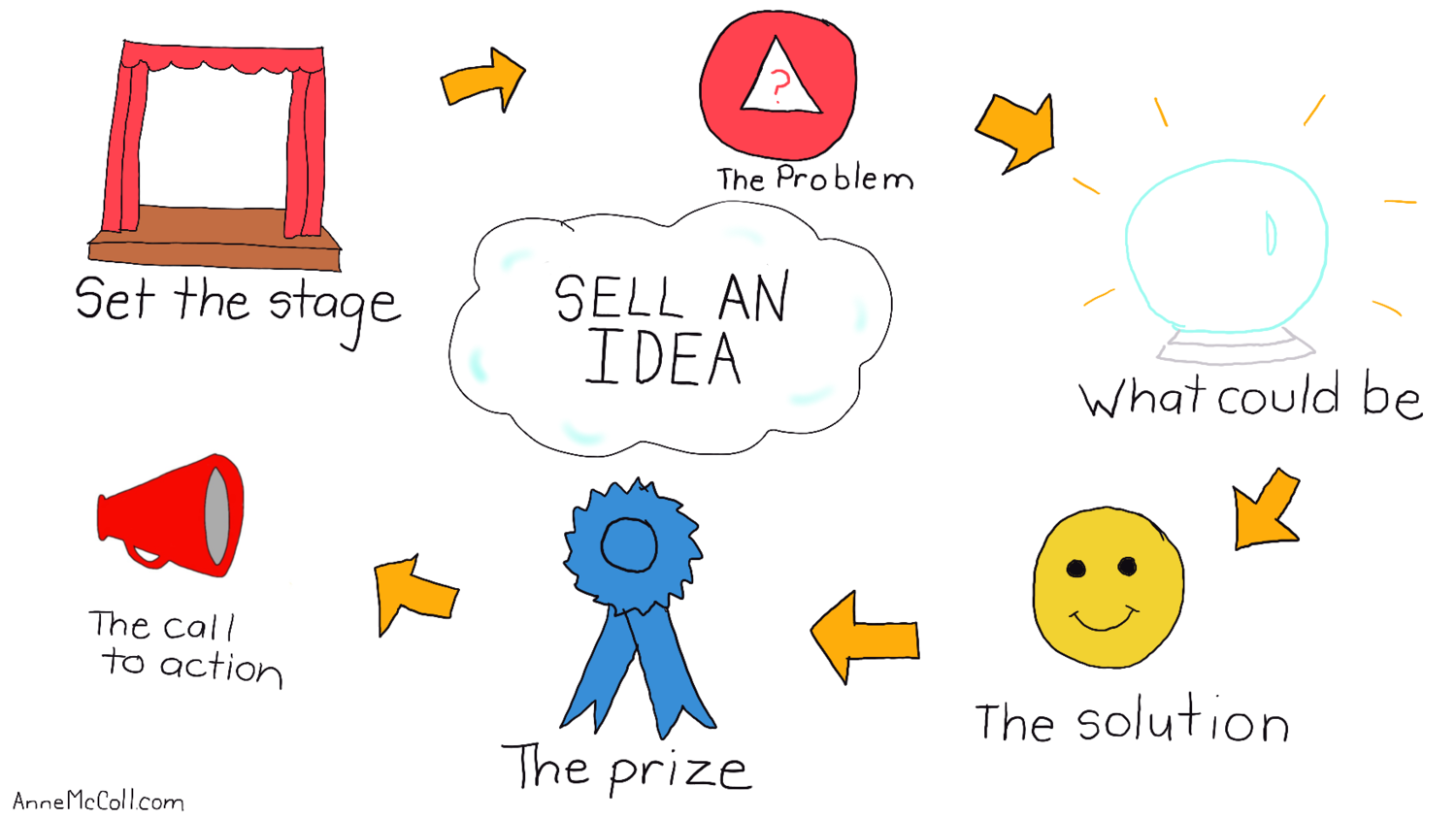

Crafting the Pitch: A Narrative That Resonates

The cornerstone of any successful pitch is a well-structured narrative. Investors aren't just looking for numbers; they're looking for a story they can believe in. This narrative should clearly articulate the problem being solved, the proposed solution, and the target market.

The pitch should be concise and engaging. Avoid jargon and focus on communicating the core value proposition in a way that is easily understood. Remember, you're not just selling a product; you're selling a vision.

Understanding Your Audience

Before even considering the content of the pitch, entrepreneurs must understand their audience. Different investors have different priorities and investment philosophies. Researching potential investors beforehand is critical.

Tailor the pitch to highlight aspects that align with the investor's interests. For example, a venture capitalist specializing in sustainable technologies will be particularly interested in the environmental impact of the solution.

Demonstrating Market Viability

Investors are primarily concerned with return on investment. Therefore, demonstrating the market viability of the idea is essential. This requires thorough market research and a clear understanding of the competitive landscape.

Provide data-backed evidence of market demand. Include market size, growth potential, and key trends. Furthermore, show how your solution differentiates itself from existing alternatives, highlighting its competitive advantages.

"Data speaks louder than words," emphasizes Maria Hernandez, a leading angel investor at VentureSpark Capital. "Investors need to see concrete evidence that the market exists and that the solution has the potential to capture a significant share."

Building a Credible Team

Investors are not just investing in an idea; they are investing in the team behind it. A strong, experienced team inspires confidence and increases the likelihood of success. Highlight the expertise and accomplishments of each team member.

Address any potential weaknesses in the team and outline plans to fill those gaps. Demonstrate a commitment to building a well-rounded and capable team.

The Importance of a Solid Business Plan

A comprehensive business plan is more than just a formality; it's a roadmap for success. The plan should outline the company's mission, vision, and values, as well as its financial projections and marketing strategies.

A well-structured business plan demonstrates that the entrepreneur has carefully considered all aspects of the business. It provides investors with the information they need to make informed decisions.

The Q&A: Handling Investor Scrutiny

The question-and-answer session is often the most crucial part of the pitch. Investors will probe the idea, challenge assumptions, and assess the entrepreneur's knowledge and preparedness. Be prepared to answer tough questions with confidence and clarity.

Don't be afraid to admit when you don't know the answer to a question. However, follow up by explaining how you plan to find the information. This demonstrates a commitment to learning and continuous improvement.

Mastering the art of pitching to investors is an ongoing process. By crafting a compelling narrative, demonstrating market viability, building a credible team, and preparing for investor scrutiny, entrepreneurs can significantly increase their chances of securing funding and bringing their ideas to life. Resources and workshops are available to help hone these skills, ensuring that innovative ventures have the best possible chance of succeeding in a competitive landscape.