Vanguard Mutual Fund That Tracks S&p 500

Investors are closely monitoring the Vanguard S&P 500 ETF (VOO) as market volatility persists, impacting its performance and future outlook. The fund, designed to mirror the S&P 500 index, offers broad exposure to the U.S. equity market.

This article delves into the recent performance of VOO, its holdings, and what investors should consider navigating the current economic landscape. It also discusses recent market shifts and how they might influence investment strategies related to this popular ETF.

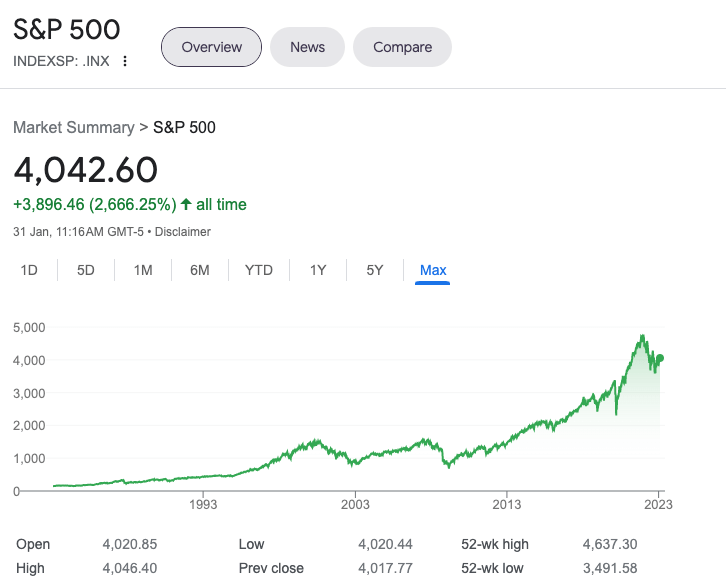

Recent Performance and Market Overview

Year-to-date, VOO has mirrored the fluctuations of the broader S&P 500. As of October 26, 2023, VOO showed a positive return, reflecting the overall upward trend in the market despite periods of uncertainty.

However, factors like rising interest rates and inflation continue to exert pressure, causing intraday swings. Investors should stay informed on these macroeconomic indicators.

Key Holdings and Sector Allocation

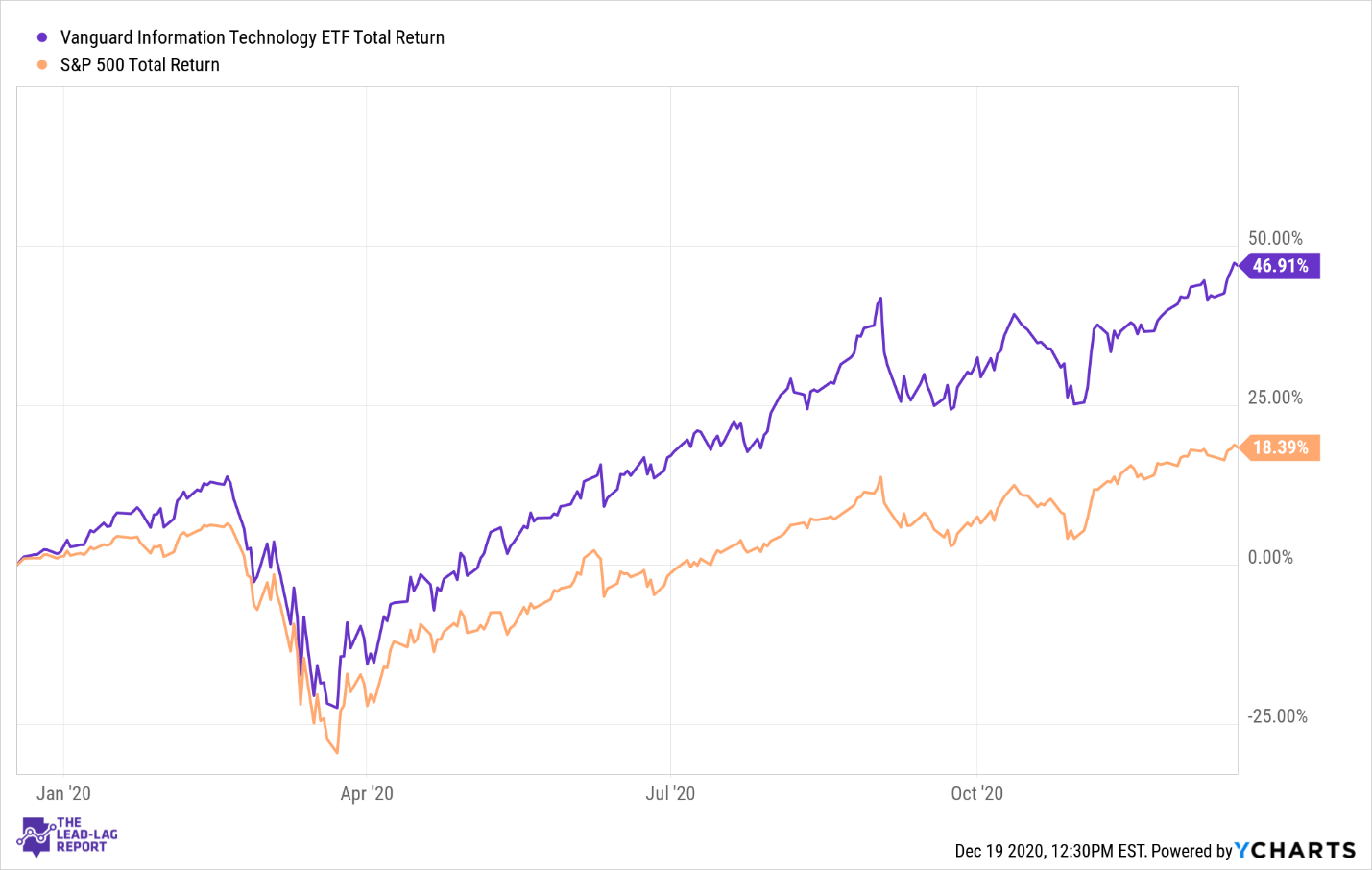

VOO's top holdings heavily feature tech giants. Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) are among the most significant positions, reflecting the substantial influence of the technology sector within the S&P 500.

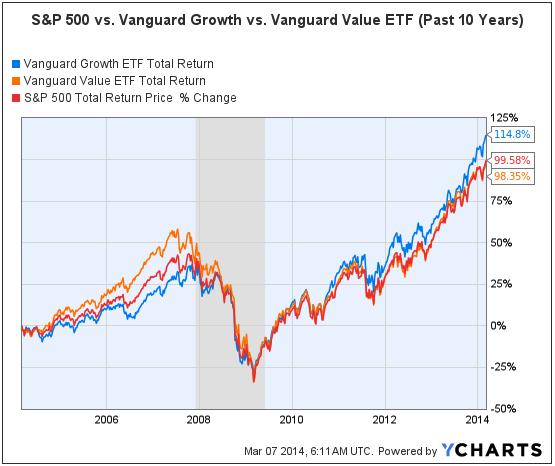

Sector allocation is predominantly in Information Technology, followed by Health Care and Financials. Diversification across these sectors helps mitigate risk.

Investment Strategy Considerations

Given the current market conditions, a long-term investment horizon remains crucial for VOO. Dollar-cost averaging is a recommended strategy for managing risk.

Consider rebalancing portfolios regularly to maintain desired asset allocation. This is especially important during volatile periods.

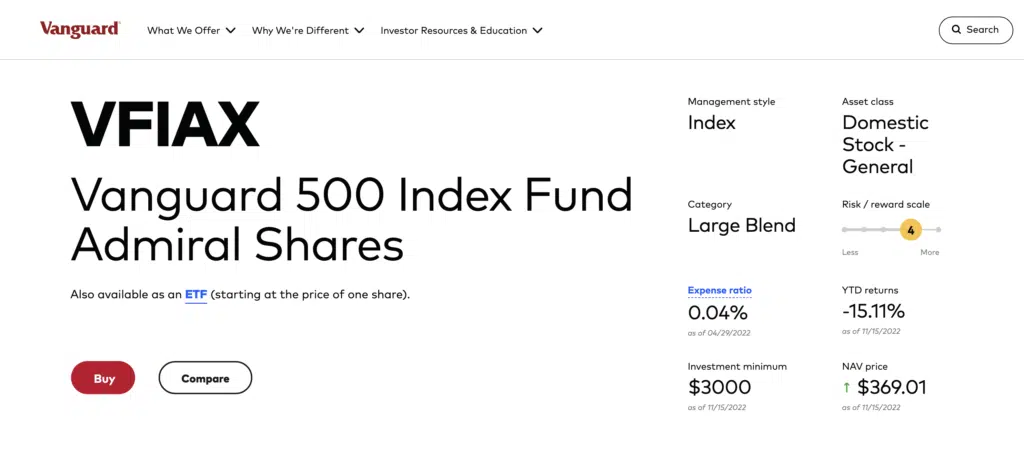

Expense Ratio and Fund Details

VOO's expense ratio is remarkably low, at approximately 0.03%. This low cost makes it an attractive option for cost-conscious investors seeking broad market exposure.

The fund's net assets are substantial, exceeding hundreds of billions of dollars. This large asset base provides liquidity and stability.

Expert Analysis and Future Outlook

Analysts recommend caution but remain optimistic about the long-term prospects of the S&P 500. Economic recovery and corporate earnings will be key drivers.

Monitor Federal Reserve policy changes and their potential impact on market valuations. This will help in making informed investment decisions.

Ongoing developments in global markets and geopolitical events could introduce volatility. Investors should stay vigilant and adapt their strategies accordingly.

Investors should consult with financial advisors to assess their individual risk tolerance and investment goals before making any decisions regarding VOO or any other investment vehicle. Due diligence is essential.

Stay tuned for further updates and analysis as the market landscape evolves. Understanding the fund's performance and market dynamics is crucial for informed investment decisions.