How To Send Large Amount Of Money To Pakistan

Sending money to loved ones in Pakistan is a lifeline for many families, bolstering the nation's economy and supporting livelihoods. However, transferring significant sums can be complex, requiring careful navigation of regulations and consideration of various methods. The process demands a thorough understanding of exchange rates, transfer limits, and potential fees to ensure funds arrive safely and efficiently.

This article provides a comprehensive guide on how to send large amounts of money to Pakistan legally and securely. It details the options available, including traditional wire transfers, online money transfer services, and other emerging methods. We'll explore the regulations surrounding large transfers, offering insights into minimizing costs and avoiding potential pitfalls.

Understanding the Regulatory Landscape

The State Bank of Pakistan (SBP) regulates all foreign remittances to the country. Understanding these regulations is crucial to avoid delays or complications. Individuals sending large amounts must comply with reporting requirements both in their country of origin and in Pakistan.

Generally, transfers exceeding certain thresholds (which vary by country and service) require additional documentation, such as proof of funds and the sender's identification. Banks and money transfer operators (MTOs) are obligated to report suspicious transactions to prevent money laundering and terrorist financing.

Methods for Sending Large Sums

Traditional Wire Transfers

Wire transfers through banks remain a common method for sending large amounts. While generally secure, they often involve higher fees compared to other options. Banks require detailed information about both the sender and the recipient, including account numbers, bank addresses, and SWIFT codes.

Exchange rates offered by banks may not always be the most favorable, so it's wise to compare rates across different institutions. Inquire about all associated fees upfront to accurately calculate the total cost of the transfer.

Online Money Transfer Services

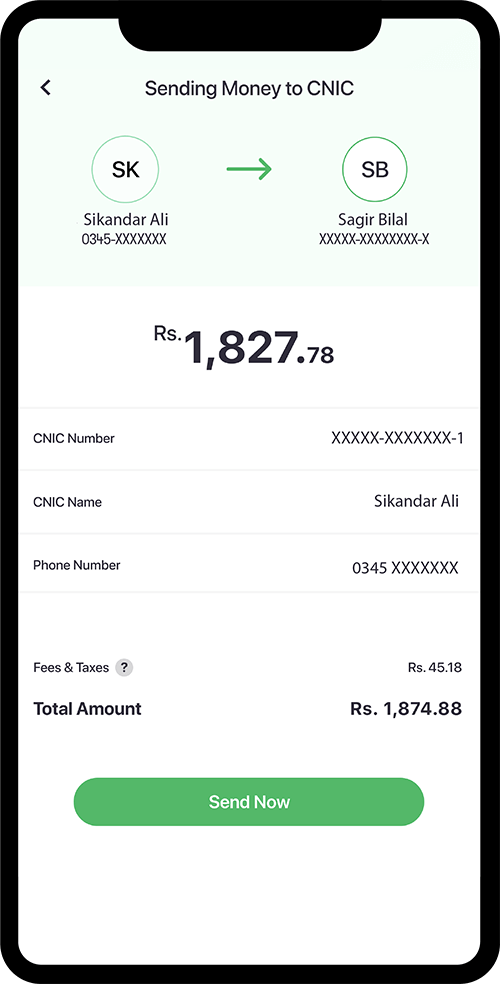

Online platforms like Wise (formerly TransferWise), Remitly, and Xoom offer convenient and often more cost-effective alternatives to traditional wire transfers. These services typically provide competitive exchange rates and lower fees. These platforms are known for transparency, clearly displaying fees and exchange rates before the transaction is finalized.

Most online services allow transfers directly to Pakistani bank accounts or offer cash pickup options at designated locations. Maximum transfer limits vary depending on the service and the sender's location, so it is important to review these limits before initiating a large transfer.

Other Options

Other options like international money orders or specialized remittance services catering specifically to the Pakistani diaspora may also be available. Research and compare the fees, exchange rates, and security measures of each option before making a decision. Cryptocurrency transfers are increasingly discussed, but they come with inherent risks due to price volatility and regulatory uncertainties in Pakistan.

Minimizing Costs and Maximizing Value

Compare exchange rates and fees across multiple providers before initiating the transfer. Even small differences in exchange rates can significantly impact the final amount received.

Consider sending money in smaller increments if it allows you to take advantage of promotional rates or avoid triggering higher transaction fees. Be mindful of daily or weekly transfer limits imposed by some services.

"Always prioritize security when sending money internationally," advises a financial analyst at The World Bank. "Ensure the service you use is reputable and licensed, and be wary of unsolicited offers or requests for money."

Potential Challenges and Solutions

Delays can occur due to compliance checks or discrepancies in the information provided. Double-check all details, including account numbers and recipient information, to avoid processing errors.

Some banks in Pakistan may require additional documentation from the recipient to release the funds, especially for large transfers. Communicate with the recipient beforehand to ensure they are prepared to provide any necessary paperwork. It is recommended to keep a record of all transactions, including confirmation numbers and receipts, for future reference.

Looking Ahead

The landscape of international money transfers is constantly evolving, with new technologies and services emerging regularly. Staying informed about the latest developments is crucial for finding the most efficient and cost-effective ways to send money to Pakistan. As financial technology continues to advance, expect to see even more innovative and user-friendly options become available, further simplifying the process of international remittances.

As regulations around money transfers continue to evolve in both sending and receiving countries, it is important to consult with financial advisors or institutions. Seek professional advice to understand the specific regulations in both jurisdictions. This ensures compliance and avoid potential legal or financial repercussions when sending large sums of money to Pakistan.