Icici Home Loan Overdraft Facility Interest Rate

ICICI Bank has revised the interest rates on its Home Loan Overdraft facility, effective immediately. This adjustment impacts both new and existing customers utilizing this hybrid loan product.

The rate change affects the overall cost of borrowing for homeowners who rely on the flexibility of accessing funds beyond their regular home loan amount. Understanding the specific changes and their implications is crucial for borrowers to manage their finances effectively.

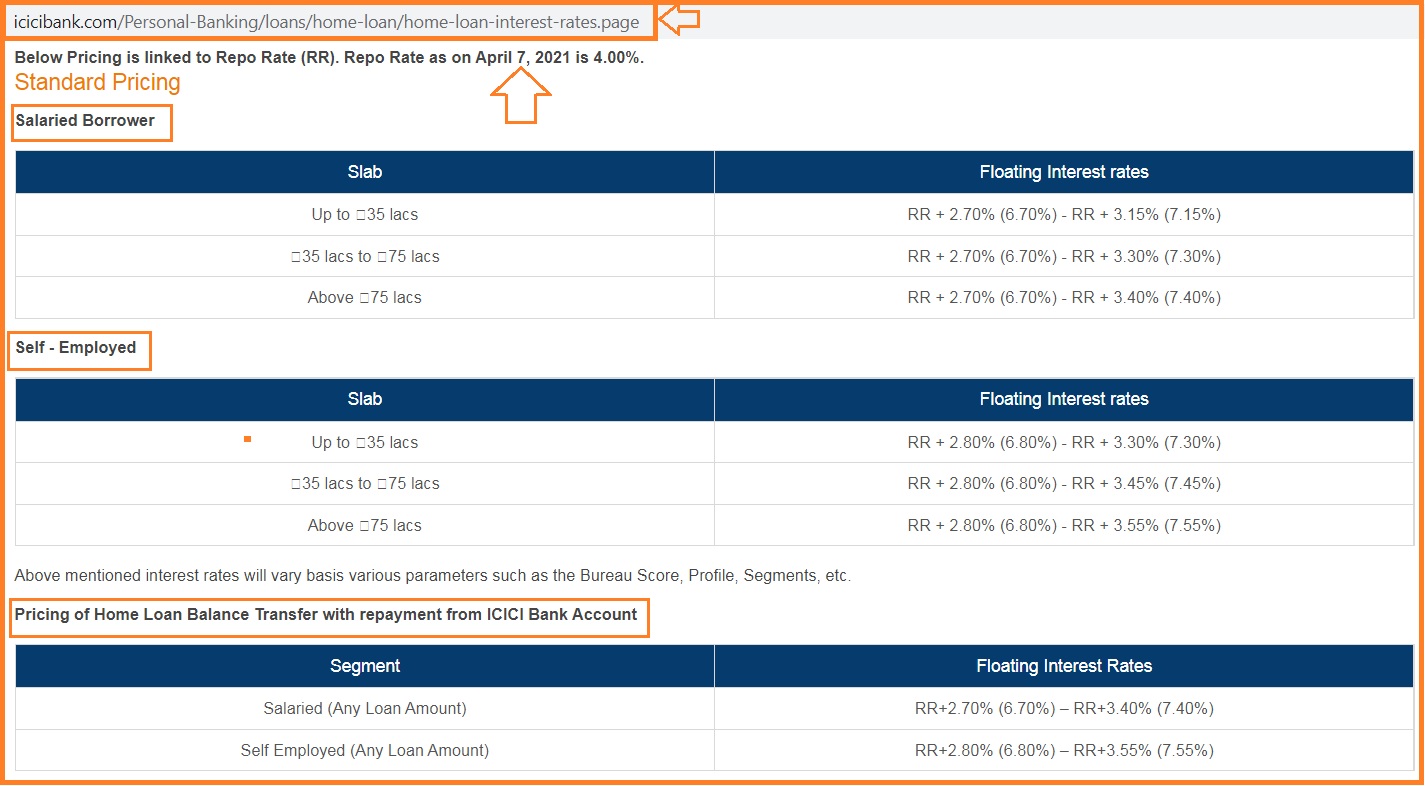

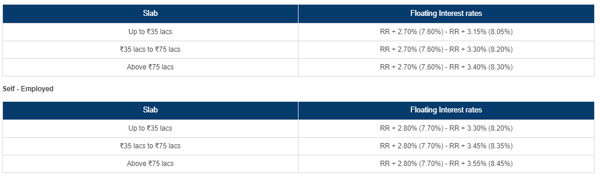

Revised Interest Rates

The revised interest rates are now linked directly to ICICI Bank's External Benchmark Lending Rate (EBLR). This EBLR is, in turn, closely tied to the Reserve Bank of India's (RBI) repo rate.

The current EBLR for ICICI Bank stands at 9.30% as of November 8, 2024. This means the effective interest rate on the Home Loan Overdraft facility will be EBLR plus a spread determined by ICICI Bank based on the borrower's risk profile, loan amount, and other factors.

Customers can access personalized interest rate details through the ICICI Bank website or by contacting their relationship manager. It is essential to review individual loan agreements for specific terms and conditions related to the applicable spread.

Impact on Borrowers

The increase in interest rates will translate to higher EMIs (Equated Monthly Installments) for some borrowers. Those with fixed interest rate components within their Home Loan Overdraft may experience a more stable payment schedule.

However, those with completely floating rates will see their EMIs fluctuate in accordance with the EBLR. Borrowers are encouraged to reassess their repayment capacity in light of these changes.

ICICI Bank encourages borrowers to utilize online tools and calculators to estimate the revised EMI amounts.

Understanding the Home Loan Overdraft Facility

The Home Loan Overdraft facility allows borrowers to access funds beyond their sanctioned home loan amount. This is particularly useful for managing unexpected expenses or short-term financial needs.

The overdraft component functions as a line of credit, where borrowers pay interest only on the amount utilized. It gives flexibility in managing liquidity, offering a blend of a traditional home loan and an overdraft facility.

This facility provides quick access to funds as needed while securing it against their property. It is popular among individuals seeking flexibility in their financial planning while owning a home.

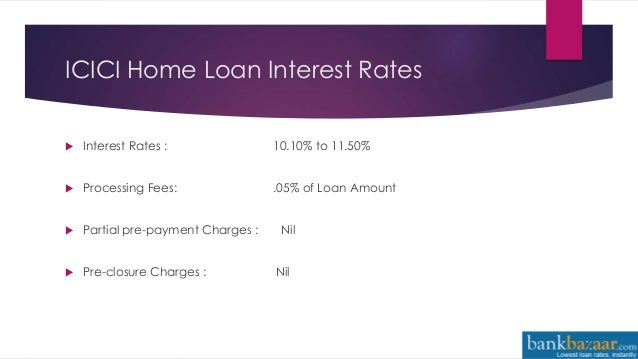

Comparison with Other Lenders

While ICICI Bank has revised its rates, other leading lenders like HDFC Bank and State Bank of India (SBI) also offer similar products.

It is advised to compare rates and features before choosing a Home Loan Overdraft facility. Borrowers should examine processing fees, repayment terms, and pre-closure charges.

Comparison between providers may help borrowers obtain the most favorable terms aligning with their specific requirements and financial circumstances.

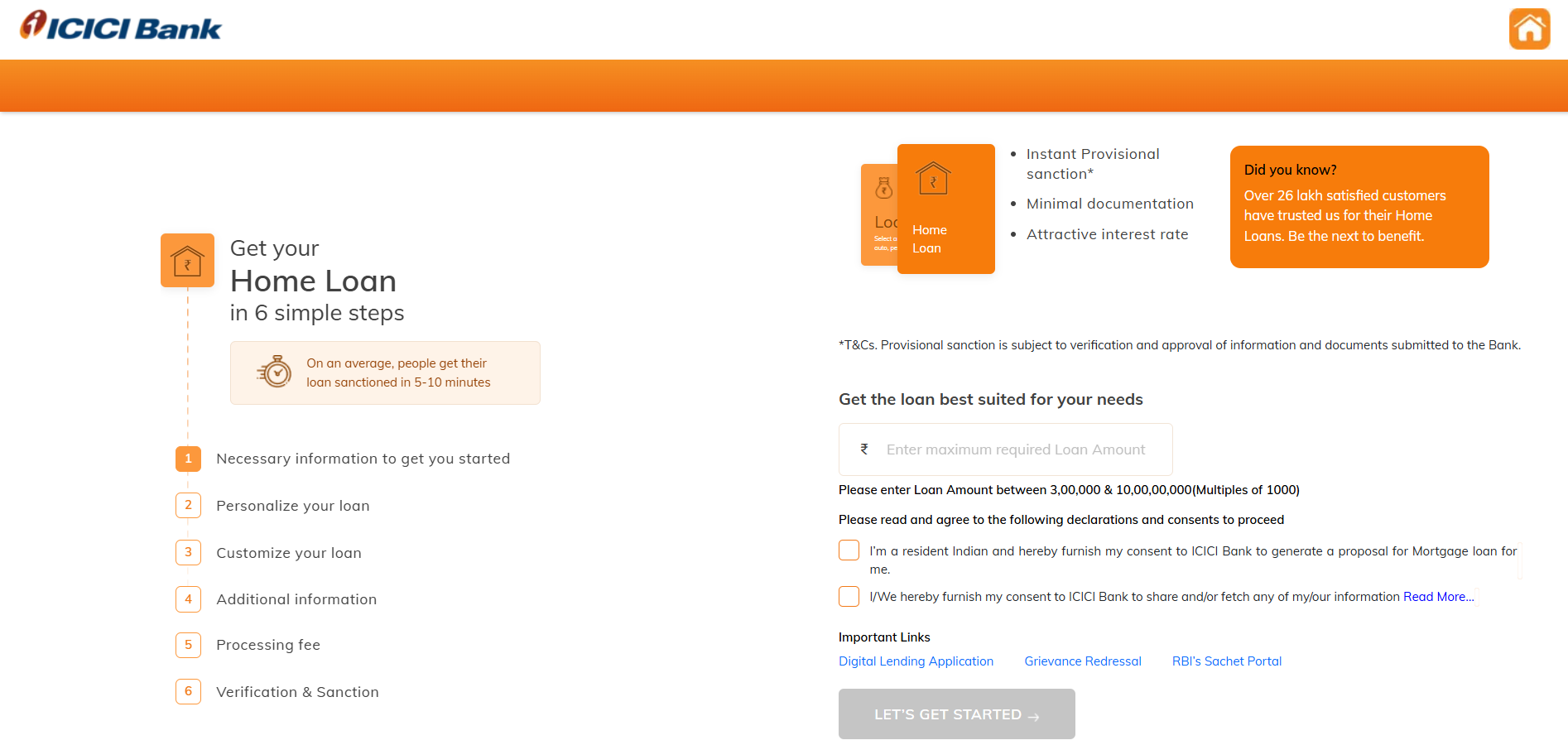

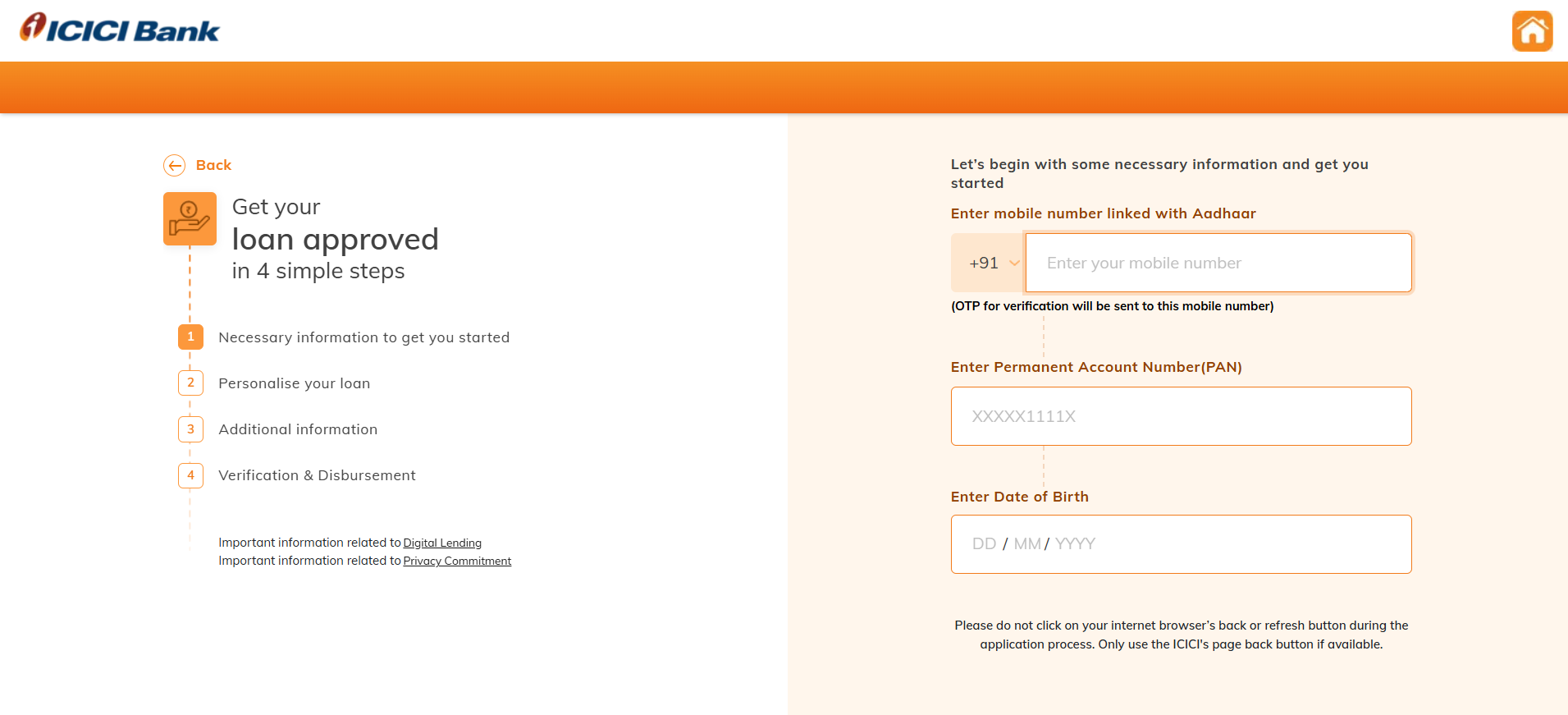

Next Steps for Borrowers

Existing borrowers should immediately review their loan statements and familiarize themselves with the revised interest rates. They should contact ICICI Bank to explore options such as adjusting their repayment tenure or making prepayments to reduce the principal amount.

New applicants are advised to carefully evaluate the current rates and their affordability before availing the Home Loan Overdraft facility. Consultation with a financial advisor is also recommended.

Monitor the RBI's policy announcements for further changes in the repo rate, as these will directly impact EBLR-linked loan products like the ICICI Bank Home Loan Overdraft.