How To Pay Yourself As A Business Owner

Navigating the financial complexities of business ownership is a tightrope walk, and one of the most crucial balancing acts is determining how to pay yourself. This isn't a simple matter of transferring funds; it's a strategic decision with significant implications for your taxes, business growth, and personal financial security. Failing to approach this correctly can lead to tax penalties, cash flow problems, and even jeopardize the long-term viability of your company.

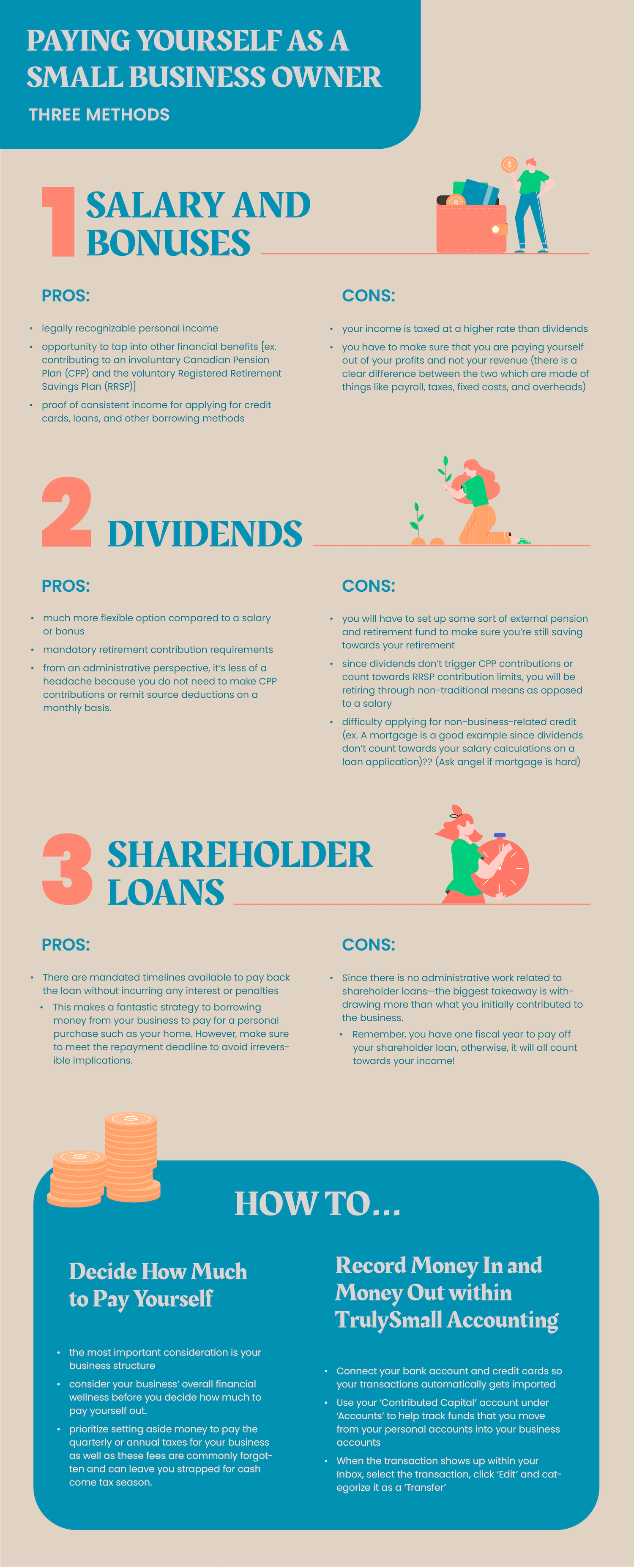

Understanding the appropriate method for compensating yourself as a business owner is paramount. This decision hinges on your business structure – sole proprietorship, partnership, LLC, or corporation – each dictating different rules and tax implications. This article will delve into the various methods, providing insights and guidance to help you navigate this critical aspect of business management, ensuring you receive fair compensation while optimizing your financial standing.

Understanding Your Business Structure

The first step in determining how to pay yourself is understanding your business's legal structure. Each structure carries distinct tax and legal ramifications that directly influence your compensation options. Let's examine the most common structures:

Sole Proprietorship and Partnerships: Owner's Draw

For sole proprietorships and partnerships, the typical method of payment is an owner's draw. This involves taking money out of the business bank account for personal use. However, these draws are not considered salary or wages; they are simply a transfer of funds.

Therefore, you won't receive a W-2 form, and you're responsible for paying self-employment taxes (Social Security and Medicare) on your share of the business's profits. The IRS provides detailed guidelines on calculating and paying these taxes.

Limited Liability Company (LLC): Flexible Options

LLCs offer more flexibility in how you can be paid. If you're a single-member LLC, you're generally treated as a sole proprietorship for tax purposes, meaning you'll use the owner's draw method and pay self-employment taxes. However, an LLC can elect to be taxed as an S corporation or C corporation.

Choosing to be taxed as an S corporation allows you to be an employee of your company. This means you can pay yourself a salary and take distributions. This strategy can potentially reduce your self-employment tax burden.

S Corporations: Salary and Distributions

S corporations require you to pay yourself a "reasonable salary" commensurate with the work you perform. This salary is subject to payroll taxes, just like any other employee's wages. Any profits remaining after paying salaries and expenses can be taken as shareholder distributions, which are not subject to self-employment taxes.

The IRS scrutinizes S corporation salaries to ensure they are reasonable. Paying yourself too low of a salary and taking excessive distributions to avoid payroll taxes can raise red flags and trigger an audit.

C Corporations: Salary and Dividends

C corporations offer two primary ways to compensate owners: salary and dividends. Similar to S corporations, you can pay yourself a salary subject to payroll taxes. Additionally, you can receive dividends from the company's profits, which are taxed at the individual dividend tax rate.

However, C corporations face "double taxation" – the corporation pays taxes on its profits, and then shareholders pay taxes again on dividends received. This is a key disadvantage compared to other business structures.

Determining a Reasonable Salary

For S corporations and C corporations, establishing a "reasonable salary" is crucial. The IRS defines a reasonable salary as the amount you would pay an independent employee for similar services under similar circumstances. Factors to consider include your skills, experience, the size and complexity of your business, and industry standards.

Researching industry benchmarks and consulting with a tax professional are essential steps. This helps ensure your salary aligns with what other professionals in your field earn.

Tracking and Reporting Your Income

Regardless of your business structure, meticulous record-keeping is essential. Accurately tracking all income and expenses is crucial for tax compliance and financial planning. Use accounting software or hire a bookkeeper to manage your finances effectively.

Depending on your business structure and payment method, you'll need to report your income on various tax forms. Sole proprietors and partnerships use Schedule C, while S corporations and C corporations use Form 1120-S and Form 1120, respectively.

Planning for Taxes

Self-employment taxes and income taxes can be a significant financial burden. Plan accordingly by setting aside funds throughout the year to cover your tax obligations. Consider making estimated tax payments quarterly to avoid penalties.

Consulting with a tax advisor is highly recommended. They can help you optimize your tax strategy and ensure you're in compliance with all applicable laws and regulations.

Looking Ahead

Paying yourself as a business owner is an ongoing process that requires careful consideration and adaptation. As your business grows and evolves, your compensation strategy may need to be adjusted. Regularly review your financial situation and consult with your tax advisor to ensure you're making informed decisions.

Staying informed about tax law changes and best practices is also vital. The Small Business Administration (SBA) and other resources can provide valuable guidance and support. By proactively managing your compensation, you can ensure both your personal financial well-being and the long-term success of your business.

![How To Pay Yourself As A Business Owner The Formula To Paying Yourself As A Business Owner [Exact Steps] - YouTube](https://i.ytimg.com/vi/lPug59I9BY0/maxresdefault.jpg)