How To Structure Multiple Businesses

The entrepreneurial landscape is increasingly populated by individuals juggling multiple business ventures. Managing a single company presents its own challenges. Structuring several entities simultaneously demands a more sophisticated and strategic approach. This is a complex undertaking with significant legal, financial, and operational ramifications.

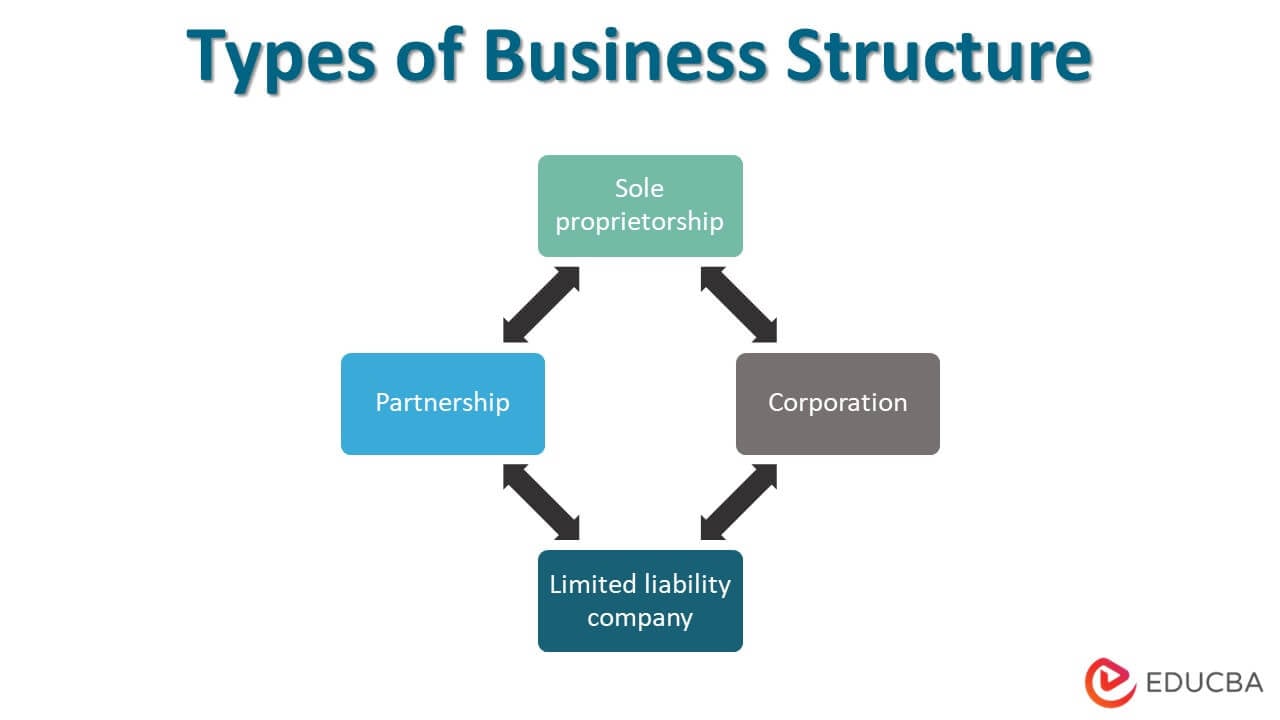

The decision of how to structure multiple businesses—whether as sole proprietorships, partnerships, limited liability companies (LLCs), or corporations—is not a one-size-fits-all solution. It hinges on factors such as risk tolerance, financial goals, operational interdependence, and long-term vision. Choosing the wrong structure can lead to unnecessary tax burdens, increased liability, and administrative nightmares. This article explores the key considerations and common strategies for effectively structuring multiple businesses to maximize efficiency and minimize risk.

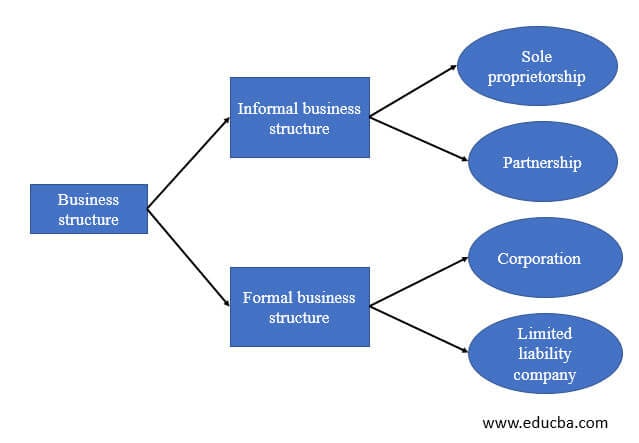

Understanding the Options

Several legal structures are available, each offering distinct advantages and disadvantages.

Sole Proprietorship

A sole proprietorship is the simplest structure, where the business and the owner are legally the same. This is easy to set up and requires minimal paperwork. However, the owner is personally liable for all business debts and obligations.

Partnership

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Like sole proprietorships, partners often face personal liability for business debts. Different types of partnerships exist, including general partnerships and limited partnerships, which offer varying degrees of liability protection.

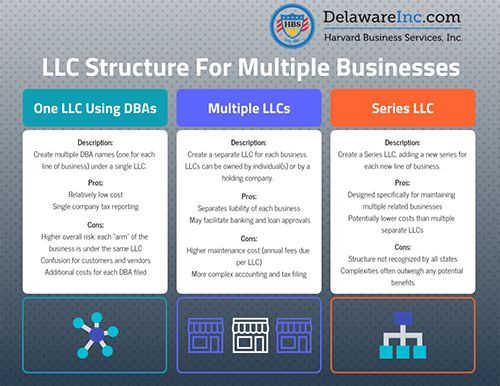

Limited Liability Company (LLC)

An LLC offers liability protection to its owners, shielding their personal assets from business debts and lawsuits. This is a popular choice for small businesses. LLCs can be structured as single-member or multi-member entities, providing flexibility in terms of ownership and management.

Corporation

A corporation is a separate legal entity from its owners, offering the strongest form of liability protection. Corporations are more complex to establish and maintain than other structures. They are subject to more stringent regulatory requirements and may face double taxation (corporate tax and individual income tax on dividends).

Strategies for Structuring Multiple Businesses

When structuring multiple businesses, several strategies can be employed, depending on the specific circumstances.

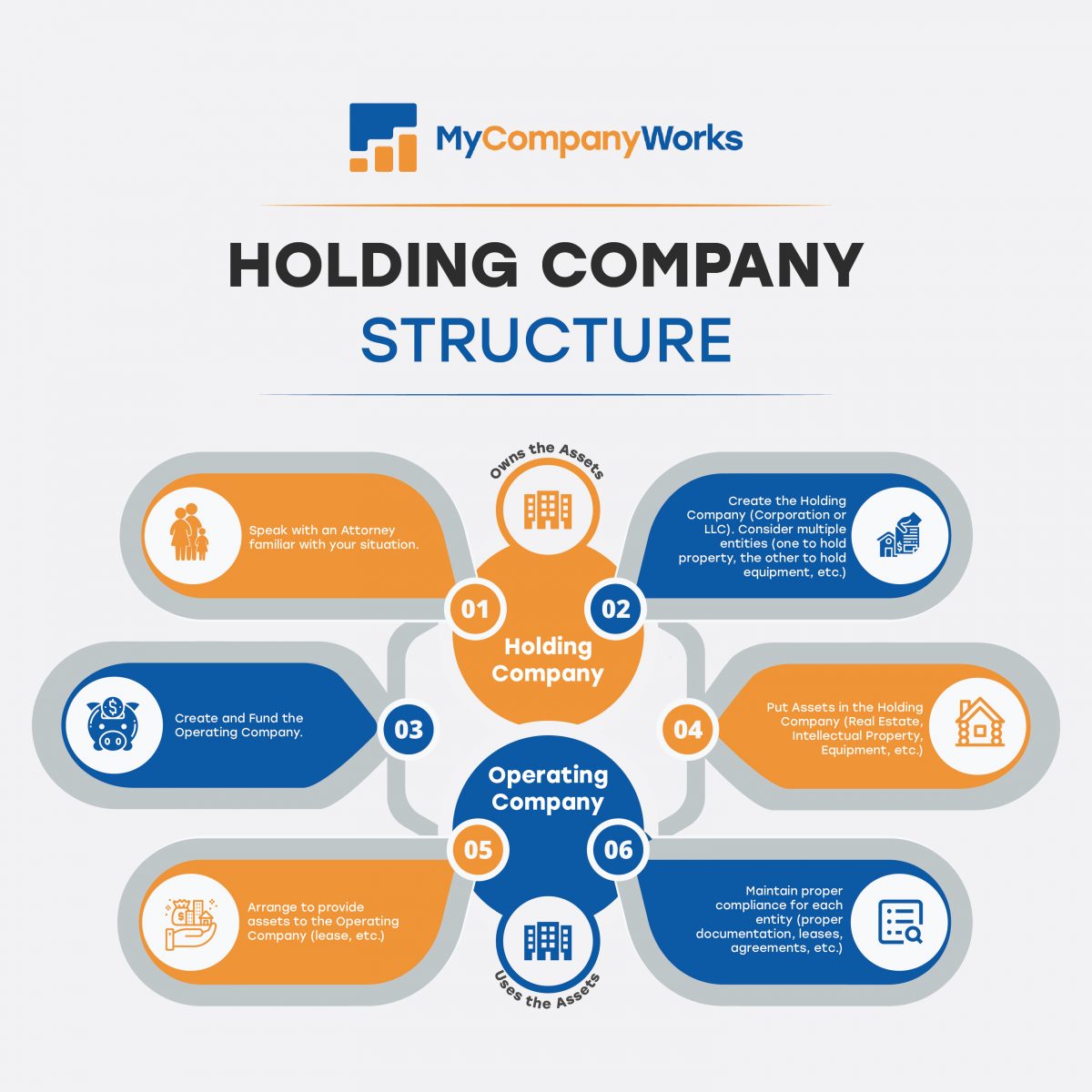

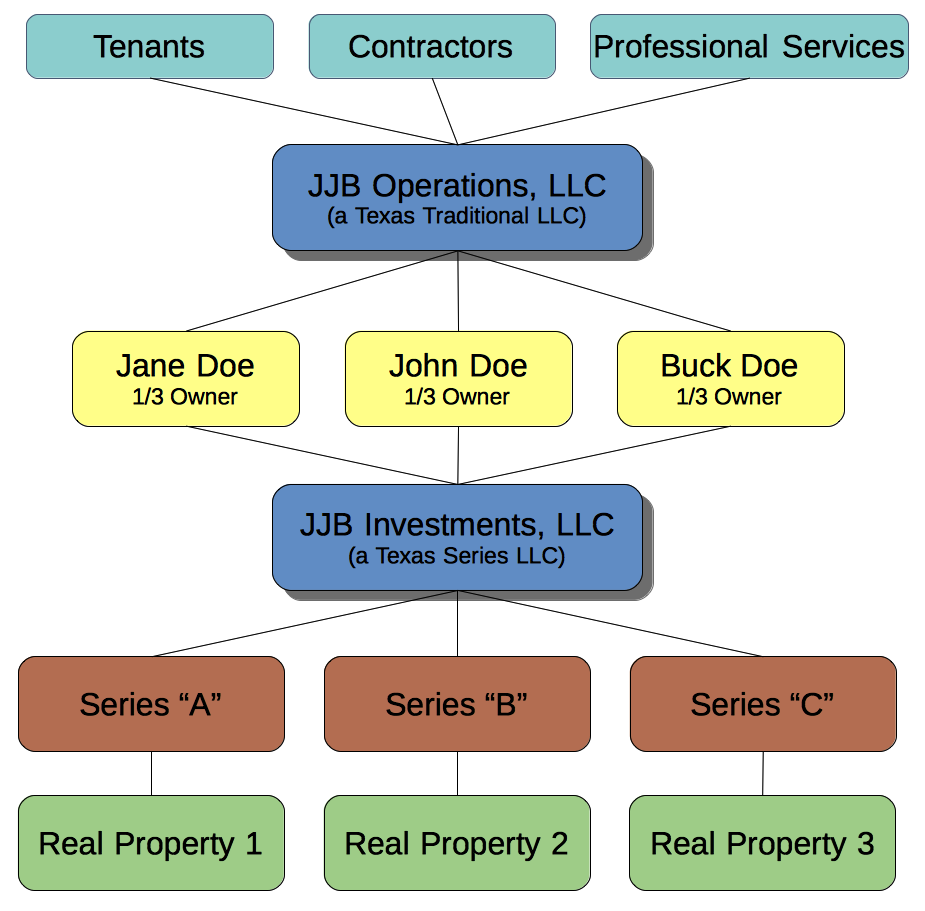

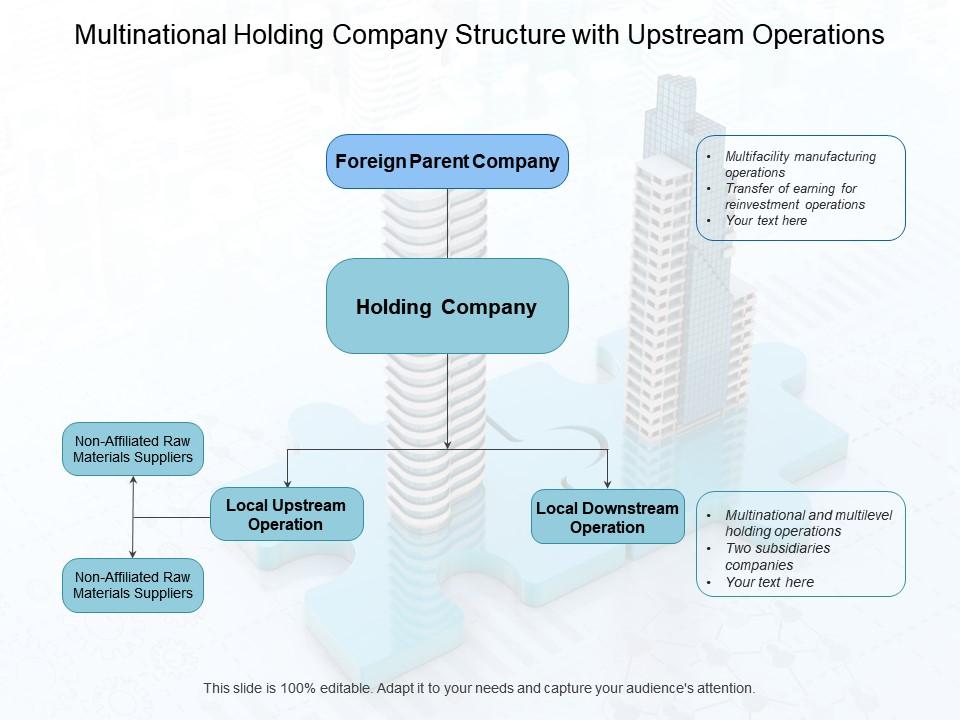

Holding Company Structure

A holding company owns and controls other companies, known as subsidiaries. This structure can be used to isolate risk, centralize management, and streamline operations. The holding company itself typically does not engage in active business operations.

Instead, it manages the subsidiaries and their assets. This separation shields the assets of one business from the liabilities of another.

Sister Company Structure

In this structure, each business operates as a separate entity, often an LLC or corporation. This approach provides individual liability protection for each venture. It avoids the complexities of a holding company while maintaining a degree of autonomy.

Each company can have its own branding, operations, and financial management. This makes each business attractive to its own individual market segment.

Centralized Services

Regardless of the chosen structure, centralizing certain services, such as accounting, human resources, and marketing, can improve efficiency and reduce costs. This can be achieved through a separate entity providing these services to all the businesses. Alternatively, one of the existing businesses can provide the services to the others under a service agreement.

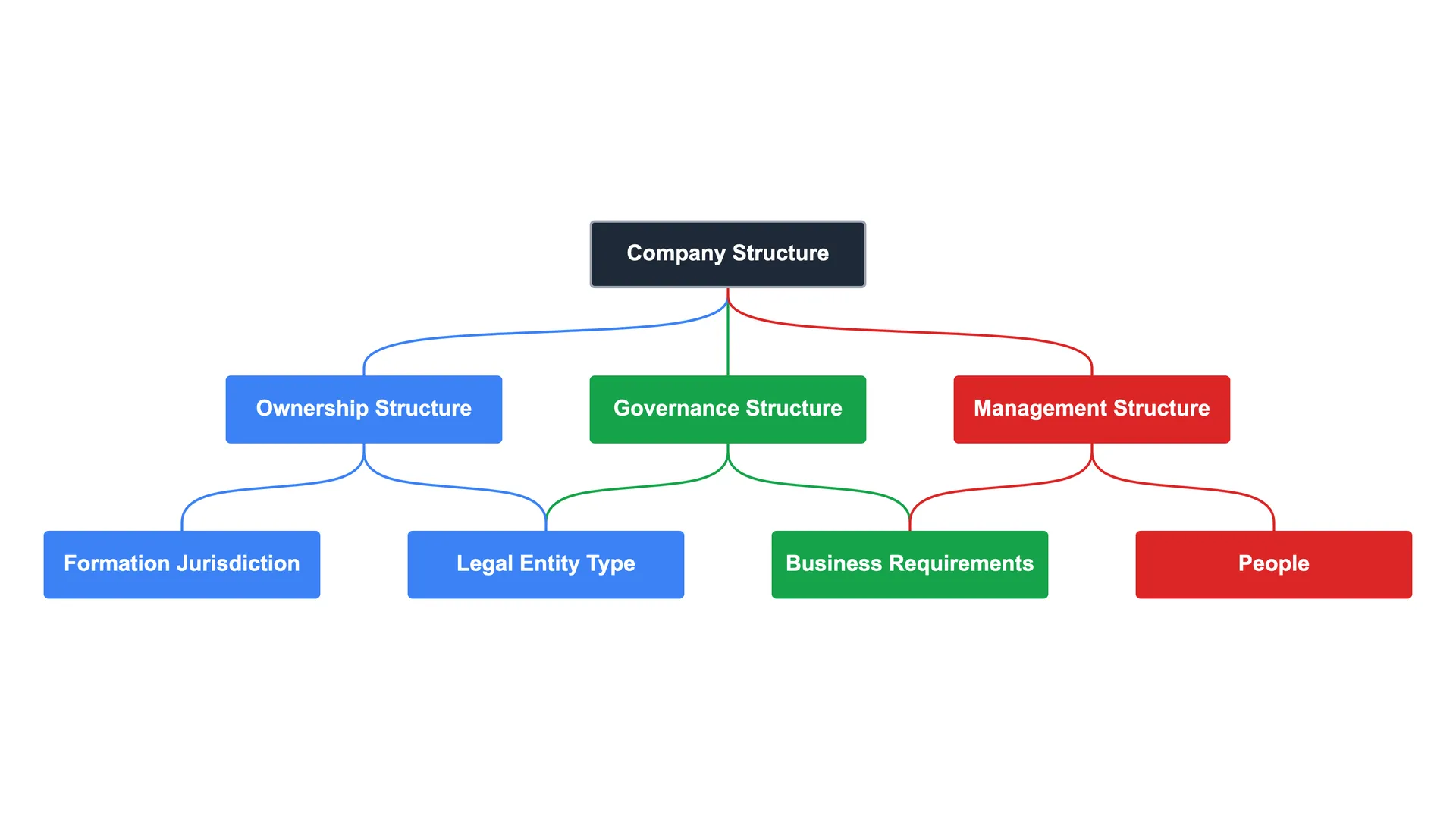

Key Considerations

Several factors should be considered when deciding how to structure multiple businesses.

Liability Protection

Protecting personal assets from business liabilities is a paramount concern. LLCs and corporations offer the strongest liability protection.

Tax Implications

Different business structures have different tax implications. Consulting with a tax advisor is crucial to minimize tax liabilities.

Administrative Complexity

Corporations generally involve more paperwork and regulatory compliance than other structures. Consider the administrative burden when making your decision.

Operational Interdependence

If the businesses are highly interconnected, a holding company structure may be beneficial. If they are largely independent, separate LLCs or corporations may be more appropriate.

Long-Term Goals

Consider your long-term goals for each business. Do you plan to sell any of them? Are you aiming for rapid growth or a steady, sustainable pace?

Expert Opinions

According to the Small Business Administration (SBA), "Choosing the right business structure is one of the most important decisions you will make as an entrepreneur." The Internal Revenue Service (IRS) provides detailed information on the tax implications of different business structures.

LegalZoom emphasizes the importance of consulting with an attorney and a tax professional. This consultation will ensure compliance with all applicable laws and regulations.

The Future of Multi-Business Management

As the gig economy and entrepreneurial spirit continue to grow, managing multiple businesses will become increasingly common. Technology and automation will play a crucial role in streamlining operations and reducing the administrative burden. Entrepreneurs should stay informed about the latest legal and financial developments. This will allow them to adapt their business structures as needed to remain competitive and compliant. Careful planning and expert advice are essential for navigating the complexities of managing multiple businesses effectively. This will set you up for success in the long run.