Senior Tax Accountant Interview Questions

The stakes are high. Landing a senior tax accountant position means navigating a rigorous interview process, one that goes far beyond basic accounting principles. Interviewers are seeking candidates who possess not only technical prowess but also strategic thinking, leadership qualities, and a deep understanding of the evolving tax landscape.

This article delves into the key interview questions aspiring senior tax accountants can expect, offering insights into the rationale behind them and providing strategies for crafting compelling answers. It will explore the technical, behavioral, and scenario-based questions designed to assess a candidate's readiness for this demanding role.

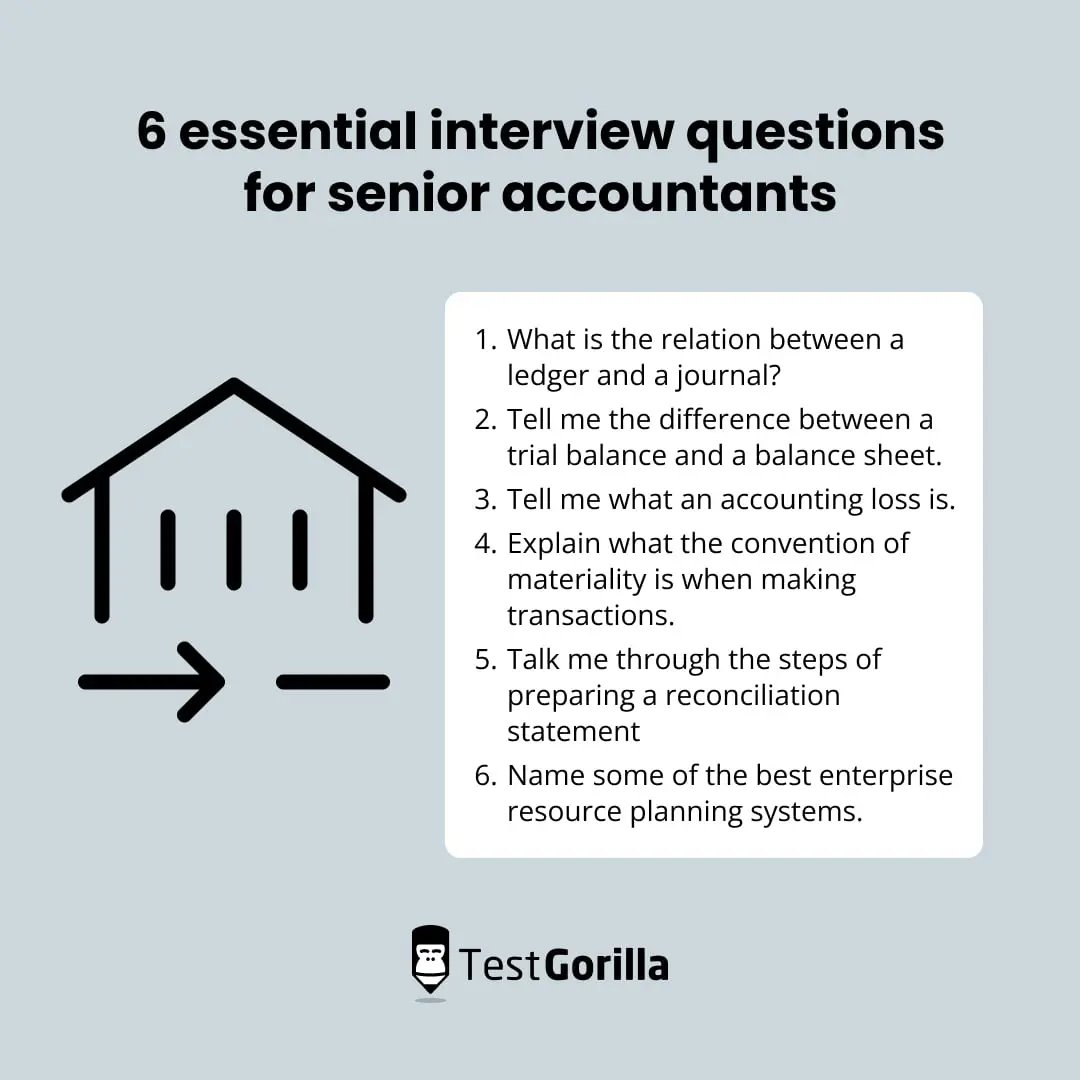

Technical Proficiency: Testing the Core Knowledge

Expect a barrage of technical questions designed to assess your in-depth knowledge of tax laws and regulations. These questions probe your understanding of specific tax codes, accounting standards, and compliance requirements.

Questions like, "Describe a time you had to research a complex tax issue. What resources did you use and what was the outcome?" are common. This tests not just knowledge but also research skills.

Common Technical Interview Questions:

- Explain the differences between US GAAP and IFRS regarding tax accounting.

- Describe your experience with tax planning for multinational corporations.

- How do you stay updated with the latest changes in tax legislation?

Interviewers want to see your grasp of tax concepts and your ability to apply them to real-world situations. Being able to articulate the nuances and implications of different tax strategies is key.

Behavioral Insights: Assessing Soft Skills

Beyond technical expertise, a senior tax accountant must possess strong soft skills. These include communication, teamwork, problem-solving, and leadership abilities.

Behavioral questions like "Tell me about a time you had to deal with a difficult client. How did you handle the situation?" are designed to reveal these skills.

Typical Behavioral Interview Questions:

- Describe a time you had to lead a tax project. What were the challenges and how did you overcome them?

- How do you handle stressful situations and tight deadlines?

- Give an example of when you had to explain a complex tax issue to a non-financial stakeholder.

Interviewers are looking for candidates who can demonstrate emotional intelligence and the ability to work effectively within a team. They want to know you can handle pressure and communicate effectively.

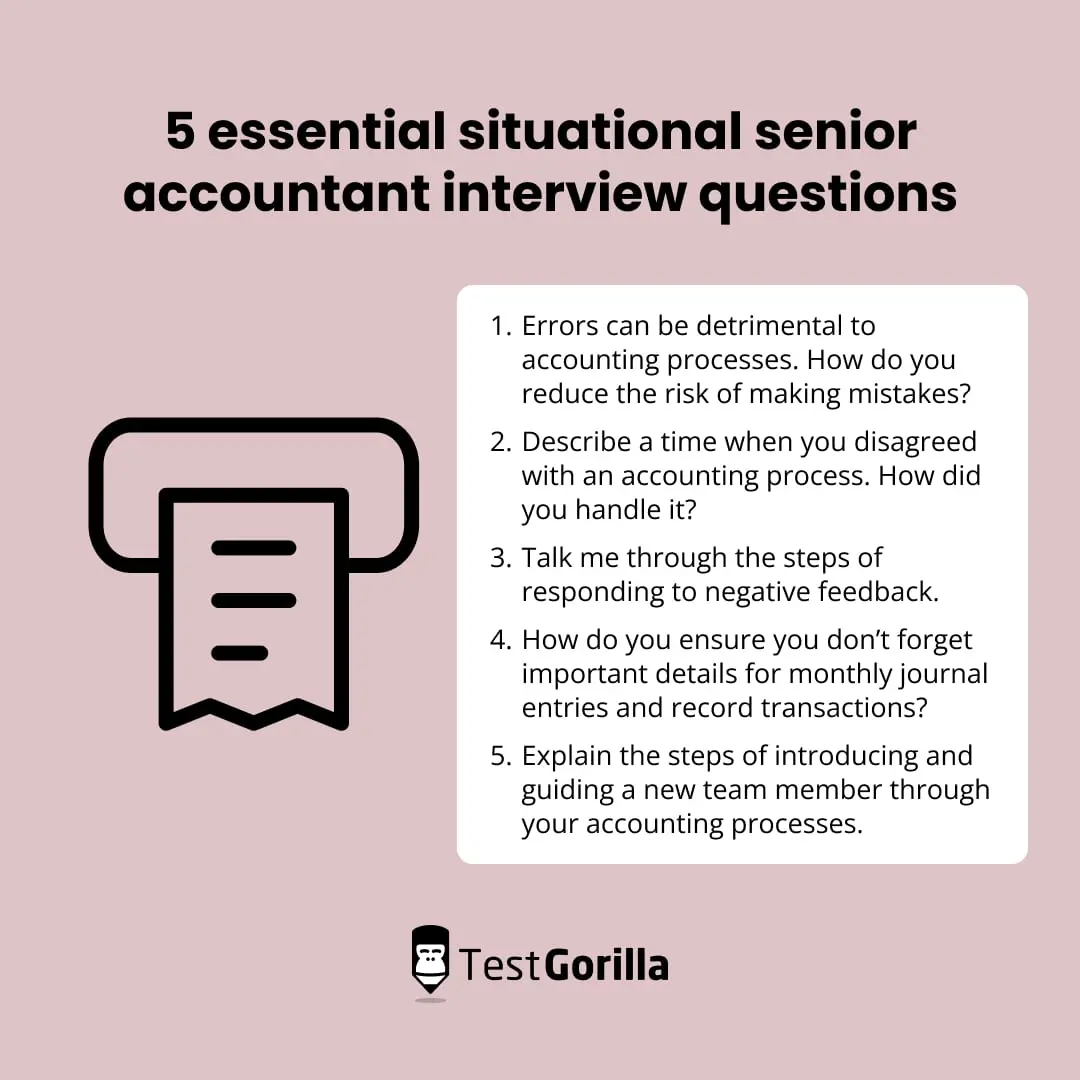

Scenario-Based Questions: Applying Knowledge to Practice

Scenario-based questions present hypothetical situations that require the candidate to apply their knowledge and skills to solve a real-world problem. These questions often mimic the challenges faced in a senior tax accountant role.

For example, "Your company is considering a major acquisition. What are the key tax considerations you would advise the management team to consider?" This tests both tax knowledge and strategic thinking.

Examples of Scenario-Based Interview Questions:

- A client is facing a tax audit. How would you prepare them and guide them through the process?

- Your team discovers a significant tax error from a previous year. How would you address the issue and what steps would you take?

- A new tax law is enacted that significantly impacts your company's operations. How would you communicate the changes to relevant stakeholders and adapt your tax strategies?

The goal is to assess your analytical skills, problem-solving abilities, and decision-making process under pressure. Demonstrating a clear and logical approach is critical.

The Importance of Staying Updated

The tax landscape is constantly evolving. New laws are enacted, regulations are updated, and accounting standards are revised. A successful senior tax accountant must stay informed about these changes.

Professional organizations like the AICPA (American Institute of Certified Public Accountants) and publications from reputable tax firms are invaluable resources. Continuous learning is not optional; it's essential.

Preparing for the Interview: A Proactive Approach

Preparation is paramount. Review your resume and identify key accomplishments and experiences that demonstrate your skills. Practice answering common interview questions aloud.

Research the company and its industry. Understand their tax challenges and opportunities. Be ready to ask insightful questions about the role and the company's tax strategy.

Looking Ahead: The Future of Senior Tax Accounting

The role of the senior tax accountant is becoming increasingly strategic. With the rise of globalization and the increasing complexity of tax laws, companies need tax professionals who can provide insightful advice and guidance.

Automation and technology are also transforming the tax function. Senior tax accountants will need to be proficient in using tax software and data analytics tools. Adapting to these changes will be crucial for career success.

![Senior Tax Accountant Interview Questions Top 10 Senior Accountant Interview Questions and Answers [Updated 2024]](https://mockinterviewpro.com/wp-content/uploads/2024/09/senior-accountant.jpg)

![Senior Tax Accountant Interview Questions 8 Accountant Interview Questions [Updated 2023]](https://d341ezm4iqaae0.cloudfront.net/assets/2017/10/22180840/Question_Ask_Accountants02.png)