How To Withdraw Money From Skrill

Imagine this: You've just received a notification. Funds have landed in your Skrill account. Maybe it’s freelance earnings, winnings from a friendly online game, or a gift from a relative overseas. A wave of satisfaction washes over you, swiftly followed by the question: How do I get this money into my hands?

For many navigating the world of online finance, understanding how to efficiently and securely withdraw funds from platforms like Skrill is crucial. This guide aims to provide a comprehensive, step-by-step walkthrough of the various withdrawal methods available, ensuring you can access your money with ease and confidence.

Understanding Skrill and Its Withdrawal Options

Skrill, established in 2001 (formerly known as Moneybookers), has grown into a globally recognized digital wallet provider. Its widespread acceptance and user-friendly interface make it a popular choice for individuals and businesses alike, especially those involved in international transactions and online gaming.

Withdrawal Methods: A Quick Overview

Skrill offers several convenient ways to withdraw your funds. The most common include:

- Bank Transfer

- Credit/Debit Card Withdrawal

- Mobile Wallet (where available)

The availability of each method may vary depending on your country of residence and the verification status of your account. Exploring each option in detail is essential for selecting the one that best suits your needs.

Step-by-Step Guide to Withdrawing Funds

Let’s break down each withdrawal method into simple, manageable steps.

Bank Transfer: Direct to Your Account

This is often considered the most straightforward and secure method for withdrawing larger sums of money. It involves transferring funds directly from your Skrill account to your bank account.

First, log in to your Skrill account on the website or through the mobile app. Navigate to the "Withdraw" section. This is usually found in the main menu or within your account dashboard.

Select "Bank Transfer" as your withdrawal method. If you haven’t already, you'll need to link your bank account. This usually involves providing your bank name, account number, and SWIFT/BIC code.

Enter the amount you wish to withdraw. Review all the details carefully, including any applicable fees. Confirm the withdrawal. Skrill may send a verification code to your registered email or phone number for added security.

Keep in mind that bank transfers can take a few business days to process. The exact timeframe depends on your bank and location.

Credit/Debit Card Withdrawal: Convenience at a Cost

Withdrawing to your credit or debit card offers a quicker alternative, but it often comes with higher fees and potential limitations. Not all cards are eligible for withdrawals, so check with your card issuer beforehand.

Similar to the bank transfer process, log in to your Skrill account and go to the "Withdraw" section. Choose the option to withdraw to your credit or debit card. Ensure that the card has been previously registered and verified on your Skrill account.

Enter the desired withdrawal amount and double-check the transaction details, paying close attention to the fees. Confirm the withdrawal request. The funds should appear in your account within a shorter timeframe compared to bank transfers, often within 1-3 business days.

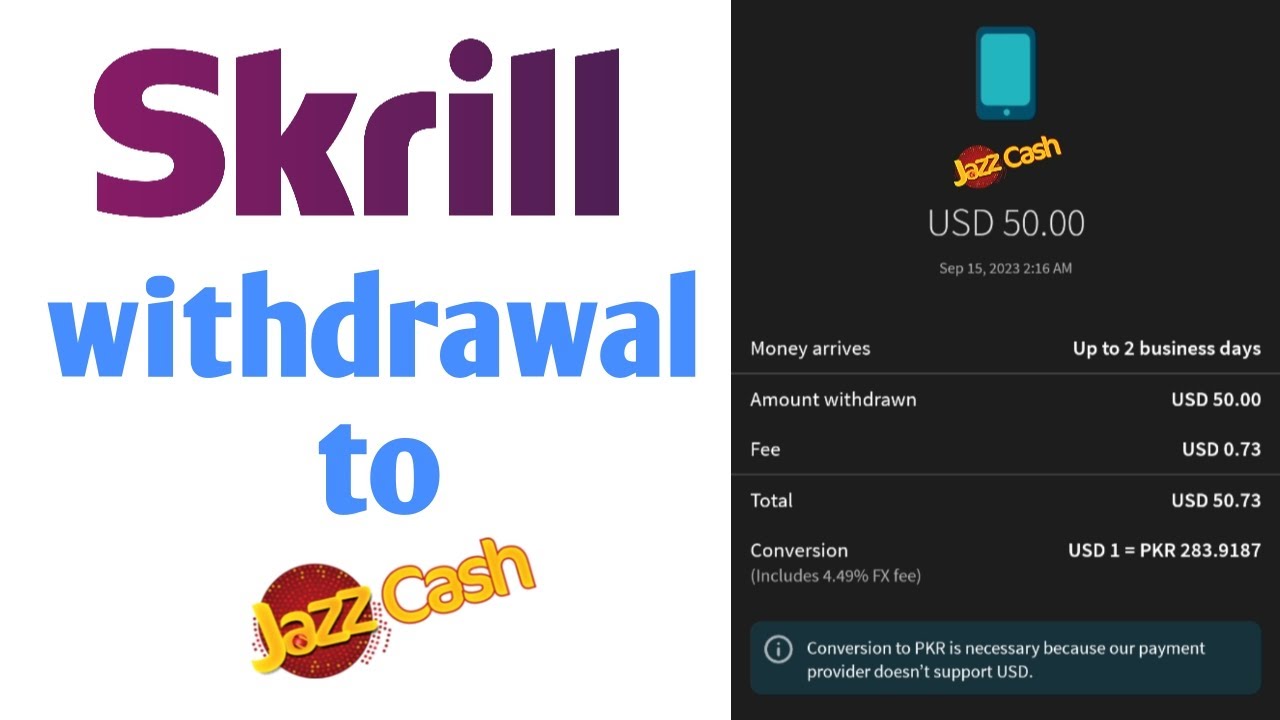

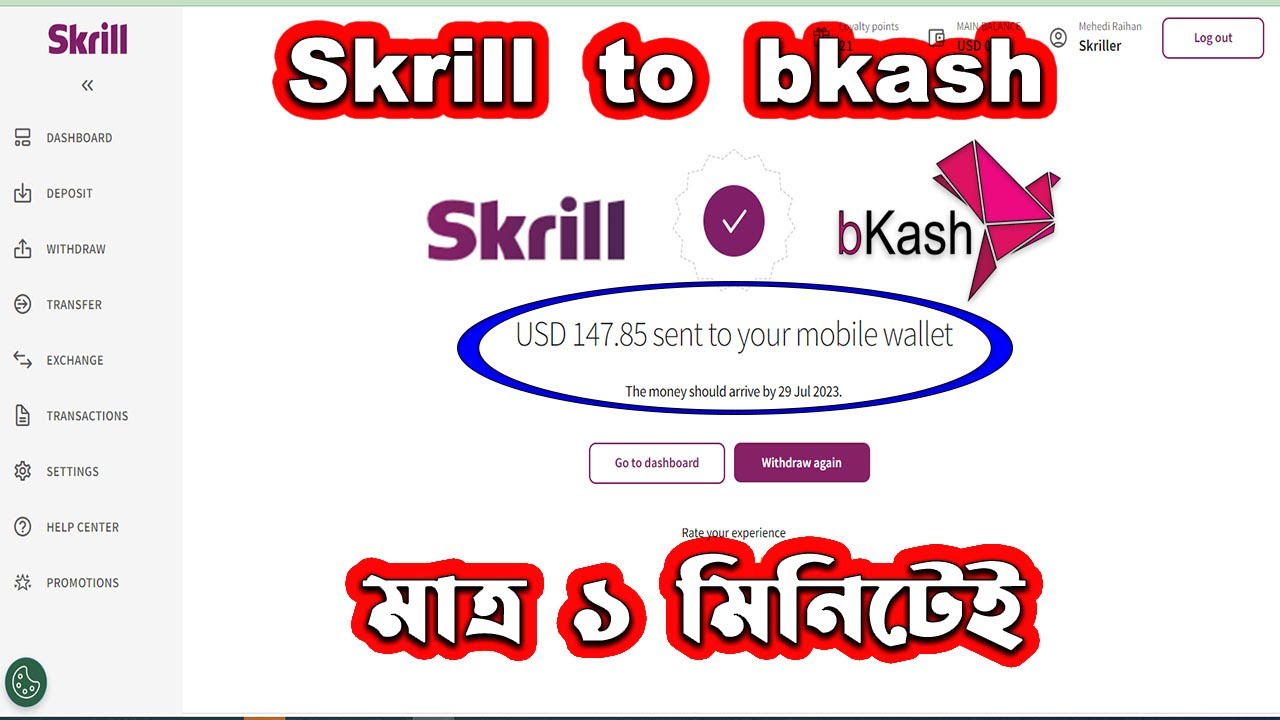

Mobile Wallet: A Region-Specific Option

In some regions, Skrill supports withdrawals to popular mobile wallets. This option can be particularly convenient for users who frequently use mobile wallets for everyday transactions.

The process mirrors the previous methods: Log in, navigate to "Withdraw," and select your mobile wallet as the destination. You'll likely need to link your mobile wallet account to your Skrill account beforehand.

Follow the on-screen prompts to complete the withdrawal. Processing times for mobile wallet withdrawals are generally faster than bank transfers, sometimes even instant.

Important Considerations Before Withdrawing

Before initiating a withdrawal, there are several crucial aspects to consider to ensure a smooth and hassle-free experience.

Account Verification: A Must-Do

Skrill requires all users to verify their accounts before they can withdraw funds. This process typically involves providing proof of identity (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

Account verification is essential for security purposes and to comply with anti-money laundering regulations. Without a verified account, your withdrawal requests may be rejected.

Fees and Limits: Understanding the Costs

Skrill charges fees for withdrawals, and these fees vary depending on the withdrawal method and your location. It's crucial to check the fee structure before initiating a transaction to avoid any surprises.

Withdrawal limits also apply, which may depend on your account level and verification status. Make sure your desired withdrawal amount falls within the allowed limits.

Security: Protecting Your Funds

Security should always be a top priority when dealing with online financial transactions. Skrill employs various security measures, but it's also your responsibility to protect your account.

Use a strong, unique password for your Skrill account. Enable two-factor authentication (2FA) for an extra layer of security. Be wary of phishing attempts and never share your login credentials with anyone.

Troubleshooting Common Withdrawal Issues

Despite careful planning, you might encounter issues during the withdrawal process. Here are some common problems and how to address them.

Insufficient Funds

This is the most obvious reason why a withdrawal might fail. Ensure that you have sufficient funds in your Skrill account to cover the withdrawal amount and any associated fees.

Incorrect Account Details

Double-check that you've entered the correct bank account number, SWIFT/BIC code, or card details. Even a small error can cause the withdrawal to fail.

Exceeded Withdrawal Limits

If you've reached your withdrawal limit, you'll need to wait until the limit resets or contact Skrill customer support to request an increase.

Account Restrictions

Your account may be restricted if Skrill suspects fraudulent activity or if you haven't completed the verification process. Contact customer support to resolve any account restrictions.

Staying Informed: Keeping Up with Skrill Updates

Skrill's policies, fees, and withdrawal methods can change over time. It's essential to stay informed about the latest updates to ensure a smooth and efficient experience.

Regularly check the Skrill website for announcements and updates. Subscribe to their newsletter to receive important notifications directly in your inbox. Follow their social media channels for real-time updates and community discussions.

Conclusion: Empowering Your Financial Transactions

Withdrawing money from Skrill doesn't have to be a daunting task. By understanding the available withdrawal methods, considering the important factors, and staying informed about updates, you can confidently access your funds whenever you need them. Remember to prioritize security and double-check all details before confirming any transaction. This way, you can navigate the world of online finance with ease and peace of mind, turning that initial wave of satisfaction into tangible reward.