How Will Marriage Affect Someones Tax Filing

Imagine the confetti raining down, the joyous cheers echoing, and the sweet taste of wedding cake lingering on your lips. As the honeymoon glow begins to fade, and you settle into married life, another reality gently nudges its way into the picture: taxes. Yes, that's right, tying the knot also means navigating the world of marital tax filings.

This article will guide you through the key changes marriage brings to your tax situation. We’ll explore the implications of filing jointly versus separately and uncover the potential benefits and drawbacks of each choice. Understanding these changes will empower you to make informed decisions and optimize your tax strategy as a newly married couple.

The Big Question: Filing Jointly or Separately?

One of the first decisions you and your spouse will face is whether to file your taxes jointly or separately. This choice significantly impacts your tax liability, so it's crucial to weigh the pros and cons carefully.

Filing Jointly: A Unified Front

Filing jointly is the most common option for married couples. It involves combining your incomes, deductions, and credits into a single tax return.

This approach often results in a lower overall tax bill for several reasons.

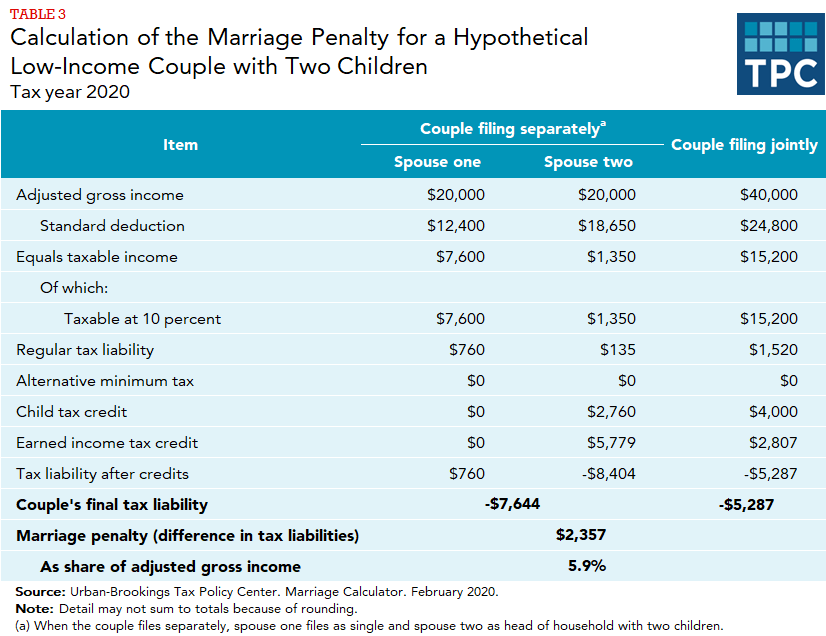

According to the IRS, many tax benefits are exclusively available to those filing jointly, such as the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, and certain education credits.

Filing Separately: Maintaining Independence

Filing separately means each spouse files their own tax return, reporting only their individual income, deductions, and credits.

While less common, this option might be beneficial in specific circumstances. For example, if one spouse has significant medical expenses, itemizing deductions separately could potentially lead to a larger deduction if their expenses exceed 7.5% of their individual adjusted gross income (AGI).

However, filing separately also means missing out on several tax benefits available to those filing jointly. The IRS generally discourages filing separately unless it provides a clear advantage.

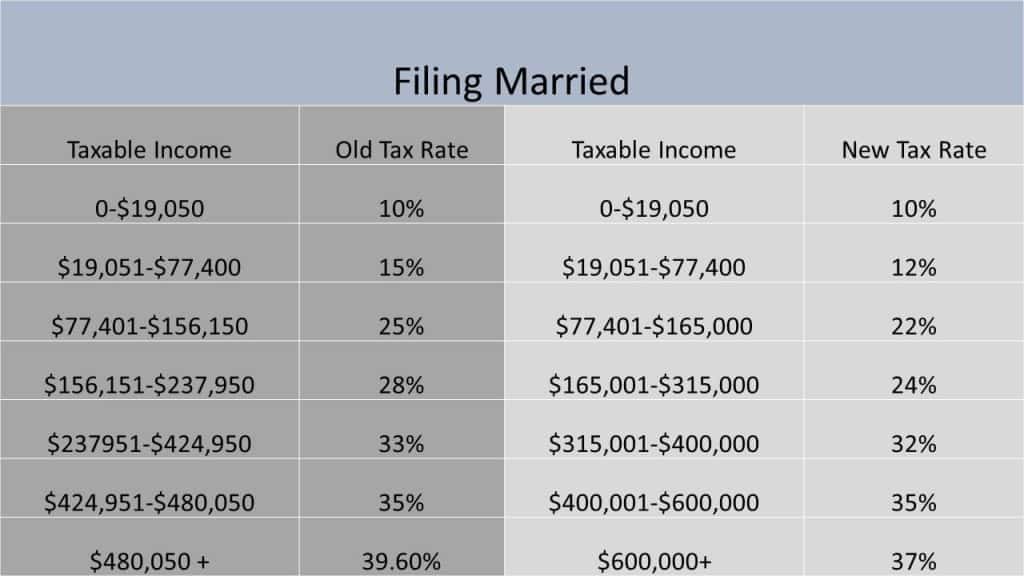

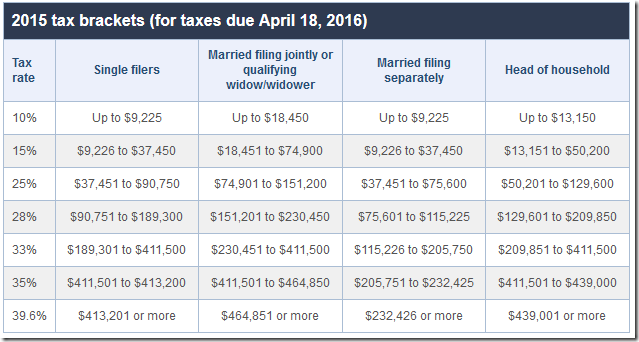

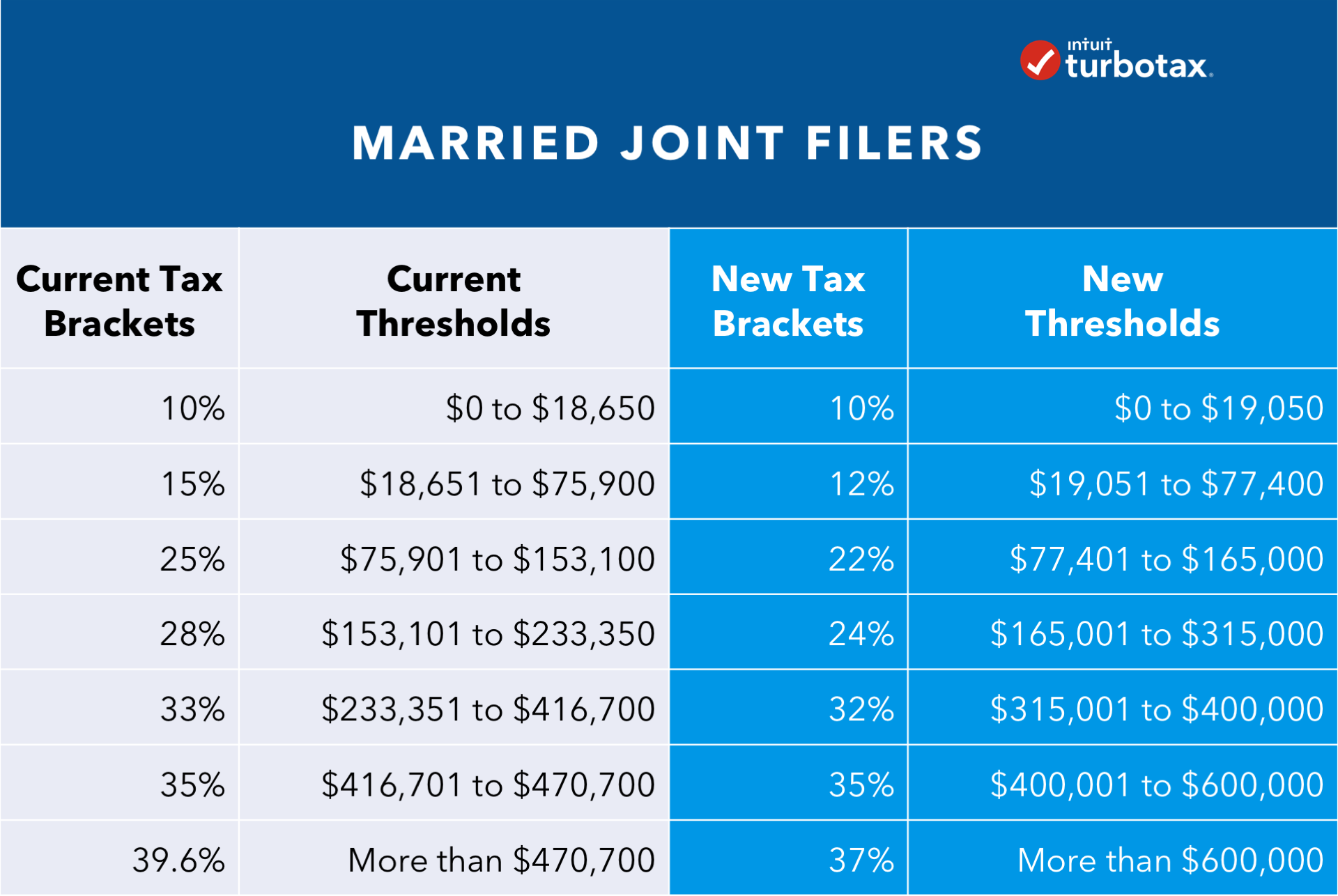

Navigating the Tax Brackets

Marriage also affects your tax brackets. The income thresholds for each tax bracket are generally higher for married couples filing jointly than for single individuals.

This means that you and your spouse can earn more income before moving into a higher tax bracket.

However, it's important to remember that these thresholds are not simply doubled. Combining incomes can push you into a higher bracket if one or both spouses earn a substantial income.

The Importance of Adjusting Withholding

After getting married, it's essential to update your withholding with your employer. This ensures that you're withholding the correct amount of taxes from your paychecks throughout the year.

The IRS provides a helpful Tax Withholding Estimator tool on their website to assist with this process.

Failing to adjust your withholding could result in owing taxes or receiving a smaller refund when you file your return.

Seek Professional Advice

Navigating the complexities of marital tax filings can be daunting. Consider consulting with a qualified tax professional or financial advisor to receive personalized guidance.

They can assess your specific financial situation and recommend the most advantageous filing status and strategies.

Investing in professional advice can ultimately save you money and ensure you’re compliant with tax laws.

Marriage is a beautiful journey, and while taxes might not be the most romantic aspect, understanding their impact is crucial for building a secure future together. By taking the time to learn about the tax implications of marriage, you and your spouse can make informed decisions, optimize your tax strategy, and focus on what truly matters: building a life filled with love and happiness.

.png)

:max_bytes(150000):strip_icc()/mfs.asp-final-92d6cd107fec480fa0bcbe2343401c9f.jpg)