I Have A Business Plan But No Money

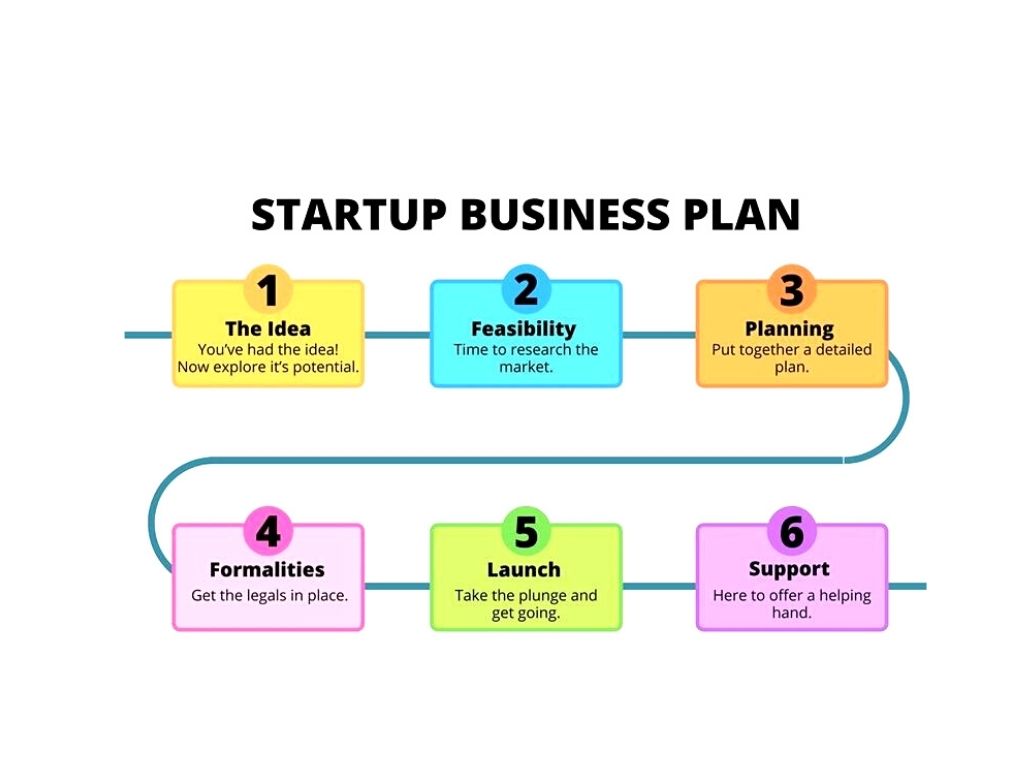

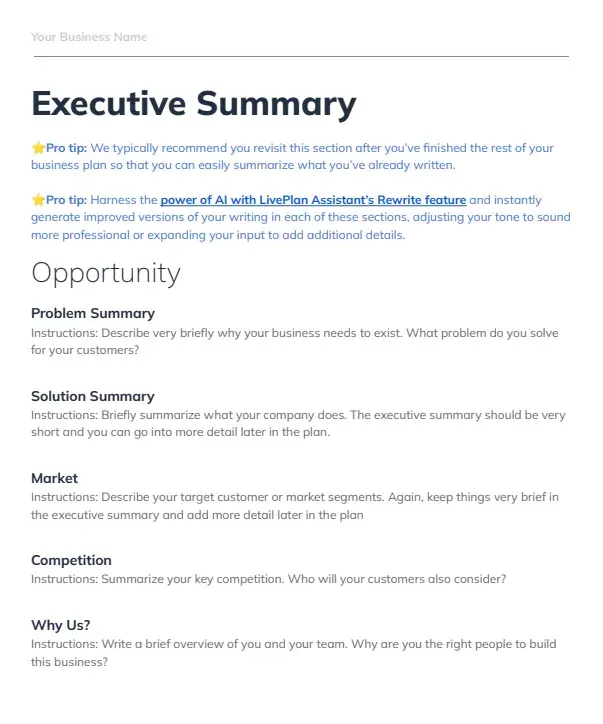

Dreams of entrepreneurship often begin with a carefully crafted business plan, a blueprint for success. However, for many aspiring business owners, the journey hits a major roadblock: a lack of funding.

This hurdle, while common, can be devastating, leaving potentially viable businesses grounded before they even take off. Securing capital remains a persistent challenge, particularly for startups and those from underrepresented backgrounds.

The Startup Funding Gap

The challenge of "I have a business plan but no money" is a widespread phenomenon. It highlights a significant gap in the startup ecosystem, where innovative ideas struggle to find the necessary financial backing. This funding gap disproportionately affects minority and women-owned businesses, according to data from the Small Business Administration (SBA).

A recent study by Harvard Business Review found that startups led by women receive significantly less venture capital funding compared to those led by men. This disparity contributes to a less diverse and innovative business landscape.

Exploring Funding Options

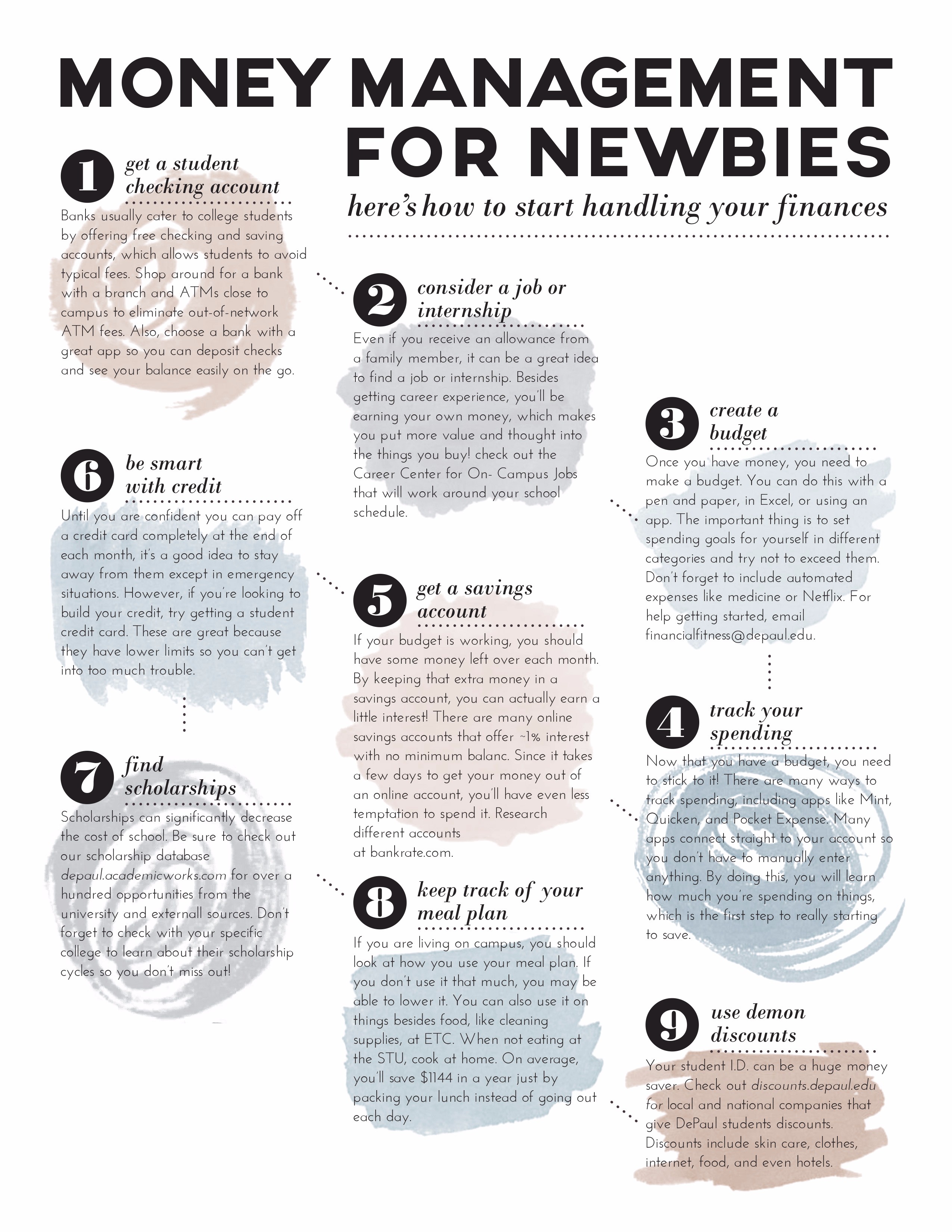

So, what options are available to entrepreneurs facing this challenge? Bootstrapping, or self-funding, is a common starting point. This involves using personal savings, credit cards, and revenue generated from early sales to keep the business afloat.

However, bootstrapping can be limiting and slow growth. Many entrepreneurs turn to external sources of funding, such as loans, grants, and investors.

Small business loans, offered by banks and credit unions, are a traditional option. However, securing a loan often requires a strong credit history and collateral, which can be difficult for new businesses to provide.

Government grants, like those offered by the SBA, can provide much-needed capital without the obligation of repayment. These grants are highly competitive and often targeted towards specific industries or demographics.

Angel investors and venture capitalists invest in early-stage companies with high growth potential. They typically seek a significant return on their investment and may require equity in the company.

"Access to capital is critical for small businesses to thrive and create jobs," said Isabella Casillas Guzman, Administrator of the SBA, in a recent press release. "We are committed to providing entrepreneurs with the resources they need to succeed."

The Rise of Alternative Funding

In recent years, alternative funding options have emerged, providing new avenues for entrepreneurs to secure capital. Crowdfunding platforms, such as Kickstarter and Indiegogo, allow entrepreneurs to raise funds from a large number of individuals in exchange for rewards or equity.

Peer-to-peer lending platforms connect borrowers directly with individual lenders, bypassing traditional financial institutions. These platforms often offer more flexible terms and faster approval processes.

Microloans, typically offered by non-profit organizations, provide small amounts of capital to entrepreneurs who may not qualify for traditional loans. These loans can be used to cover startup costs, purchase equipment, or expand operations.

Human-Interest Angle: The Story of Maria's Bakery

Maria Rodriguez, a single mother with a passion for baking, dreamed of opening her own bakery. She spent months developing a detailed business plan, perfecting her recipes, and scouting locations. However, she struggled to secure funding from traditional sources.

Undeterred, Maria turned to crowdfunding, sharing her story and her vision for Maria's Bakery. With the support of her community, she raised enough money to open her doors. Today, Maria's Bakery is a thriving business, providing jobs and serving the community with delicious treats.

Maria's story exemplifies the resilience and determination of entrepreneurs who overcome financial obstacles to pursue their dreams. It highlights the importance of alternative funding options and the power of community support.

The Road Ahead

The challenge of "I have a business plan but no money" remains a significant barrier to entrepreneurship. Addressing this challenge requires a multi-faceted approach, including increased access to capital, improved financial literacy, and a more supportive ecosystem for startups.

By providing entrepreneurs with the resources they need to succeed, we can foster innovation, create jobs, and build a more prosperous future. Overcoming this hurdle is not just about individual success stories; it's about unlocking the potential of the entire economy.

![I Have A Business Plan But No Money How To Make Money Online [6 #infographics]](https://3.bp.blogspot.com/-1xeKTJcqauI/U0z14WmyM1I/AAAAAAAAa0M/pqPZJRm427s/s1600/infographic-breaking-down-the-way-an-entrepreneur-goes-from-idea-generation-through-to-initial-public-offering-How-to-Start-a-Startup-and-how-to-make-money.png)