How Depreciation And Accelerated Depreciation Can Affect Project Cash Flows

In the intricate world of project finance, where success hinges on precise forecasting and management of cash flows, depreciation often lurks as a seemingly innocuous accounting concept. However, its subtle yet powerful influence can significantly alter a project's financial trajectory, potentially making or breaking its viability. The choice between standard depreciation methods and accelerated depreciation techniques can create a dramatic divergence in a project's early and later years, impacting investment decisions and overall profitability.

This article delves into the nuanced ways depreciation and accelerated depreciation affect project cash flows. We will examine how these accounting methods shape financial statements, influence tax liabilities, and ultimately impact the net present value (NPV) of projects. Understanding these dynamics is crucial for project managers, investors, and financial analysts seeking to maximize returns and minimize risks in capital-intensive projects. We'll explore real-world implications and highlight the strategic considerations involved in selecting the most appropriate depreciation method.

Understanding Depreciation and its Impact on Cash Flow

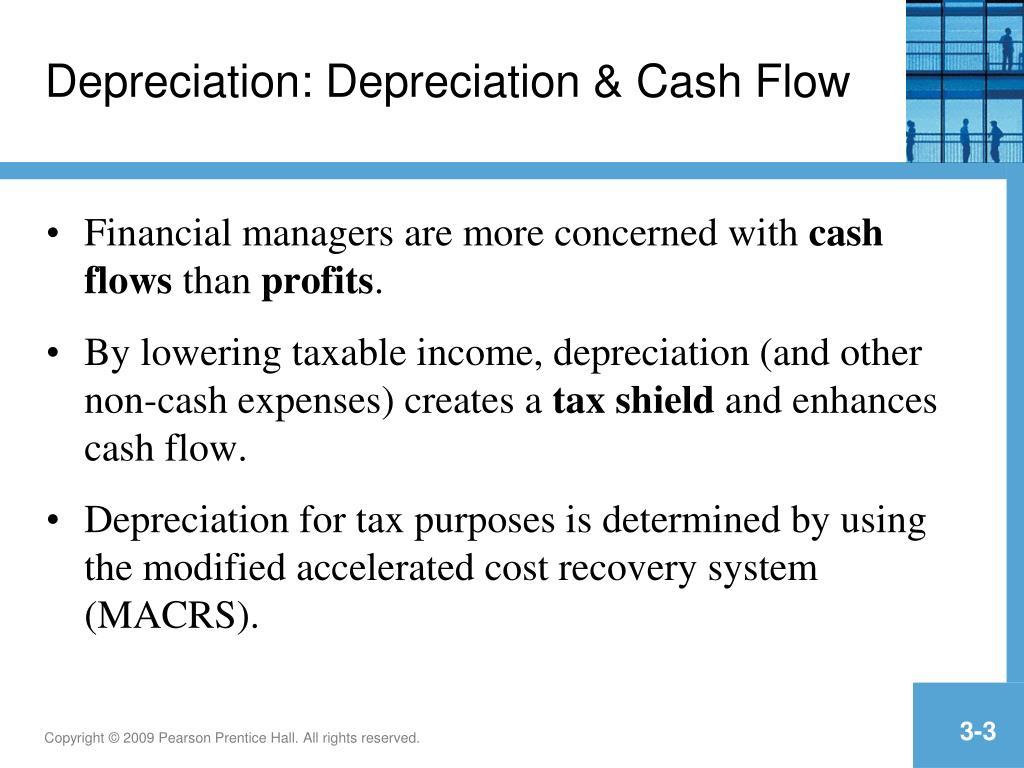

Depreciation, at its core, is the systematic allocation of the cost of an asset over its useful life. It represents the gradual decline in the value of an asset due to wear and tear, obsolescence, or other factors. While depreciation is a non-cash expense, meaning it doesn't involve an actual outflow of funds, it has a profound impact on a company's taxable income.

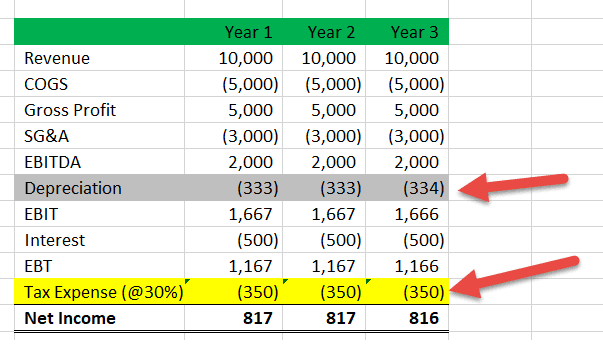

The key mechanism through which depreciation affects cash flow is through the depreciation tax shield. Because depreciation reduces taxable income, it consequently lowers the amount of income tax a company owes. This reduction in taxes translates directly into an increase in cash flow. Thus, even though no cash is changing hands related to the depreciating asset, the company benefits from a tax savings.

Straight-Line Depreciation: A Steady Approach

One of the simplest and most commonly used depreciation methods is the straight-line method. This method allocates an equal amount of depreciation expense to each year of the asset's useful life. The calculation is straightforward: (Asset Cost - Salvage Value) / Useful Life.

For example, consider a piece of equipment costing $100,000 with a salvage value of $10,000 and a useful life of 10 years. The annual depreciation expense would be ($100,000 - $10,000) / 10 = $9,000. This consistent depreciation expense leads to a stable and predictable tax shield, providing a steady stream of cash flow benefits over the asset's lifespan.

Accelerated Depreciation: Front-Loading the Benefits

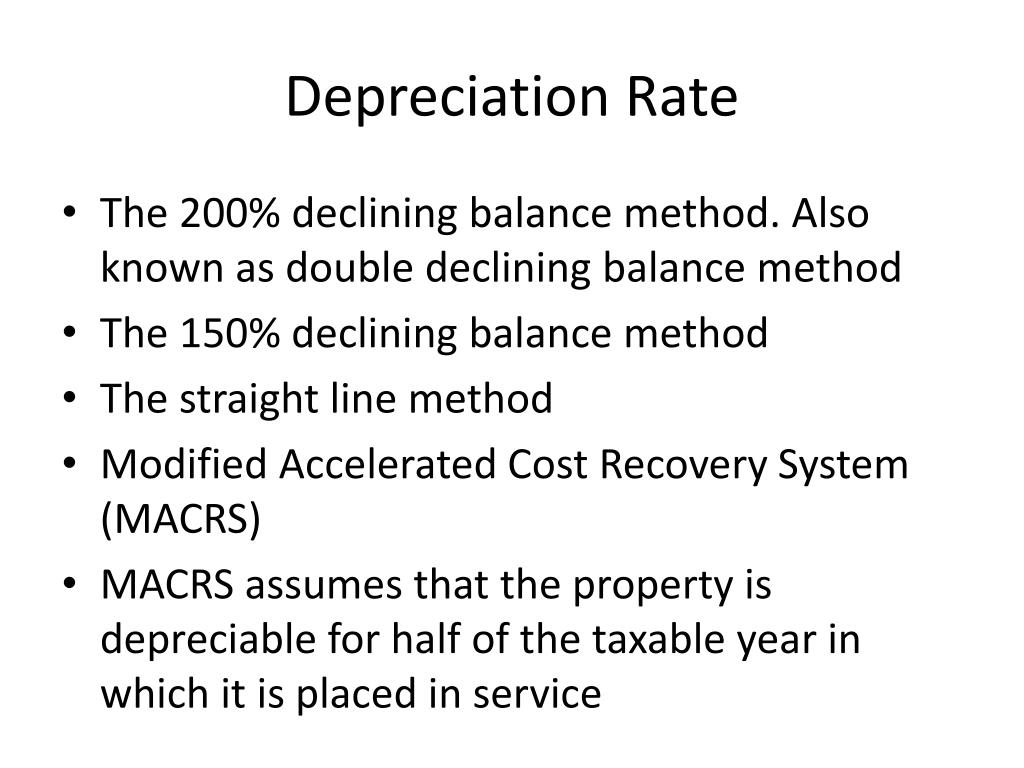

In contrast to the straight-line method, accelerated depreciation methods recognize a larger portion of an asset's cost as depreciation expense in the early years of its life and a smaller portion in the later years. Common accelerated methods include the double-declining balance method and the sum-of-the-years' digits method.

The primary advantage of accelerated depreciation is its ability to generate a larger tax shield in the initial years of a project. This boost in early cash flow can be particularly valuable for projects with high initial costs or those where the time value of money is a significant factor. The IRS allows businesses to use accelerated depreciation in many situations.

The Impact of Accelerated Depreciation on Project Cash Flows

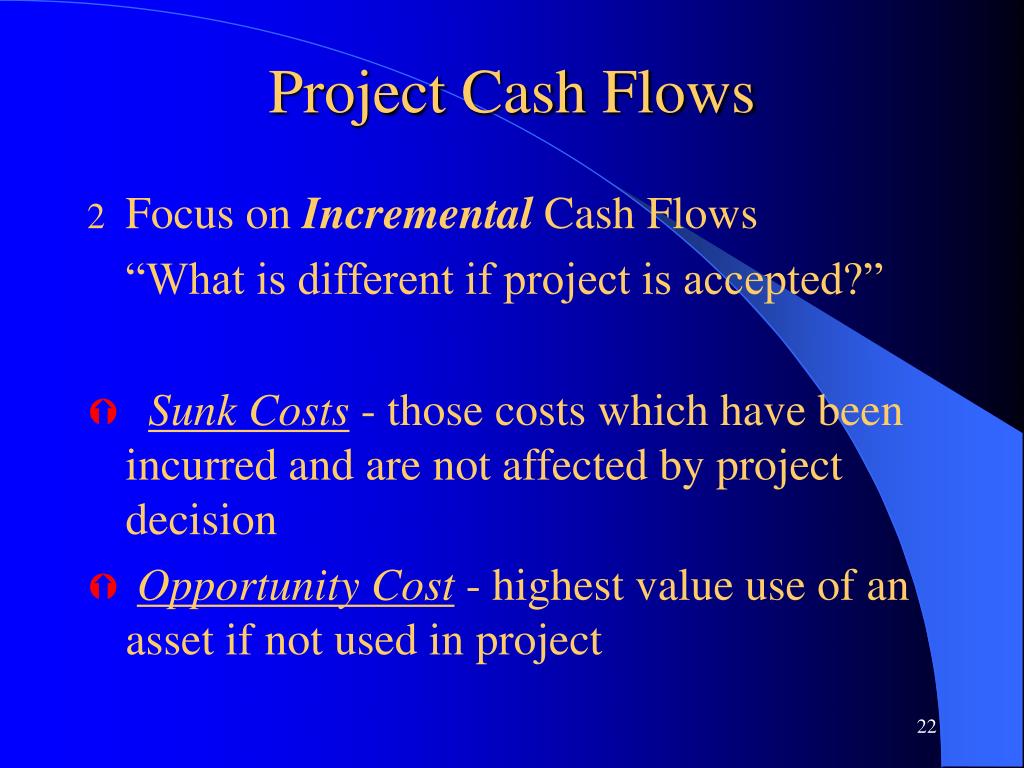

The use of accelerated depreciation can significantly alter the profile of a project's cash flows. By generating larger tax shields upfront, accelerated depreciation can increase the net present value (NPV) of a project, especially if the discount rate is high. This is because the present value of the early tax savings is greater than the present value of the later, smaller savings under straight-line depreciation.

However, it's important to note that the total depreciation expense over the asset's life will be the same regardless of the method used; only the timing differs. While accelerated depreciation boosts early cash flows, it reduces them in later years, potentially impacting long-term profitability assessments.

Example: Assume a project requires a $500,000 investment in equipment depreciated over 5 years. Straight-line depreciation yields $100,000 annually. An accelerated method might yield $200,000 in year 1, significantly reducing taxable income and boosting initial cash flow compared to the straight-line approach. Later years would see lower depreciation and less of a tax shield.

Strategic Considerations and Real-World Implications

The choice between straight-line and accelerated depreciation depends on several factors. These include the project's specific characteristics, the company's tax situation, and the prevailing economic environment. Companies with high current income may prefer accelerated depreciation to reduce their tax burden in the short term.

Moreover, some industries, particularly those involving rapidly evolving technologies, may favor accelerated depreciation. This approach reflects the faster obsolescence of their assets, resulting in a more accurate portrayal of their true economic value over time. The American Petroleum Institute has lobbied for depreciation rules that reflect the unique capital intensity and long-term investment horizons of the oil and gas industry.

On the other hand, companies with stable income streams or those seeking to maintain a consistent earnings profile may opt for straight-line depreciation. This method provides a more predictable and consistent impact on financial statements, which can be beneficial for investor relations and financial planning. The Securities and Exchange Commission (SEC) closely monitors depreciation methods used by publicly traded companies to ensure transparency and comparability.

Conclusion: Navigating the Depreciation Landscape

Depreciation and accelerated depreciation are powerful tools that can significantly affect project cash flows. Understanding the nuances of these accounting methods and their implications for tax liabilities is crucial for making informed investment decisions. By strategically choosing the appropriate depreciation method, project managers and financial analysts can optimize cash flows, enhance project profitability, and ultimately contribute to the success of capital-intensive projects.

Looking ahead, the evolving tax landscape and the increasing emphasis on sustainable investing may further influence depreciation strategies. Companies might explore "green" depreciation incentives for investments in environmentally friendly technologies, potentially altering the dynamics of project cash flow analysis. Staying informed about regulatory changes and embracing best practices in depreciation accounting will be essential for navigating the complexities of project finance in the years to come.