Dhanuka Laboratories Ltd Share Price

.jpg)

The recent performance of Dhanuka Laboratories Ltd's share price has been a subject of keen interest among investors, analysts, and industry observers. Fluctuations in the market, coupled with company-specific announcements, have contributed to a dynamic trading environment. Understanding the underlying factors driving these movements is crucial for making informed investment decisions.

This article delves into the recent trends in Dhanuka Laboratories Ltd’s share price, analyzing the factors influencing its performance, and providing a forward-looking perspective on the company's potential trajectory. We will examine key financial indicators, recent corporate actions, and broader market dynamics to offer a comprehensive overview. The analysis aims to equip readers with a clear understanding of the current situation and potential future scenarios surrounding Dhanuka Laboratories Ltd.

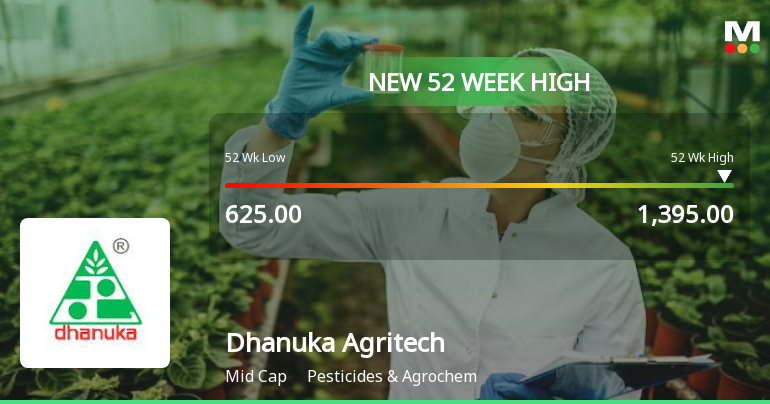

Recent Performance and Key Indicators

Over the past quarter, Dhanuka Laboratories Ltd's share price has experienced a period of volatility. Trading volumes have fluctuated significantly, reflecting varying investor sentiment. These fluctuations are particularly noticed after the recent board meeting.

Key financial indicators, such as the company's price-to-earnings (P/E) ratio and earnings per share (EPS), provide valuable insights into its valuation. The P/E ratio, which compares the company's stock price to its earnings per share, indicates how much investors are willing to pay for each rupee of earnings.

Analysts closely monitor these metrics to assess whether the stock is overvalued, undervalued, or fairly priced. Furthermore, the company's debt-to-equity ratio and return on equity (ROE) offer perspectives on its financial leverage and profitability, respectively.

Factors Influencing Share Price

Several factors have contributed to the recent movements in Dhanuka Laboratories Ltd's share price. Corporate announcements, including earnings releases and new product launches, have played a significant role.

For instance, a positive earnings report exceeding market expectations typically leads to an increase in share price. Conversely, disappointing results can trigger a sell-off. Regulatory changes and industry-specific developments also impact investor sentiment.

Broader market trends, such as fluctuations in interest rates and overall economic growth, can influence the performance of all stocks, including Dhanuka Laboratories Ltd. Sector-specific news, such as advancements in pharmaceutical technology or changes in healthcare policies, can also influence investors' perceptions of the company's prospects.

Impact of Recent Corporate Actions

Dhanuka Laboratories Ltd has undertaken several corporate actions recently that have directly affected its share price. These include dividend announcements, stock splits, and potential mergers or acquisitions. Each of these actions has its own effect in the market.

Dividend announcements can make a stock more attractive to income-seeking investors, potentially driving up its price. Stock splits, which increase the number of outstanding shares while reducing the price per share, can improve liquidity and accessibility for smaller investors.

Merger or acquisition news typically leads to significant share price movements, depending on the perceived value of the deal. These actions need to be followed very closely.

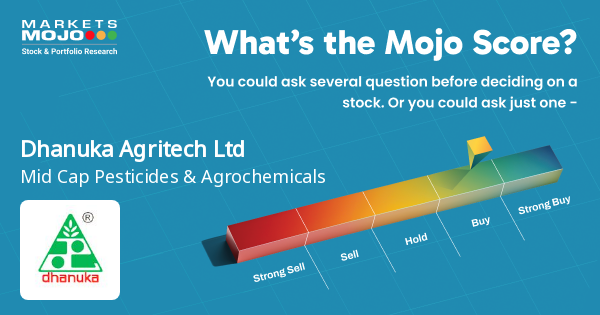

Analyst Perspectives and Ratings

Financial analysts offer diverse perspectives on Dhanuka Laboratories Ltd's future performance. Some analysts maintain a "buy" rating, citing the company's strong fundamentals and growth potential.

These analysts believe that the company is well-positioned to capitalize on emerging opportunities in the pharmaceutical sector. Other analysts have a more cautious outlook, assigning a "hold" or "sell" rating, citing concerns about market competition or regulatory headwinds.

It is important for investors to consider a range of analyst opinions when making investment decisions.

"Diverse perspectives are key to informed decisions,"says a recent report by MarketView Research.

Forward-Looking Perspective

Looking ahead, several factors could influence Dhanuka Laboratories Ltd's share price. The company's ability to successfully launch new products and expand into new markets will be crucial for its future growth.

The evolving regulatory landscape, particularly in the pharmaceutical sector, will also play a significant role. Effective management of costs and maintenance of strong financial performance are essential for sustaining investor confidence.

The broader economic environment and market sentiment will continue to influence the company's valuation. Careful monitoring of these factors is important for investors.

In conclusion, Dhanuka Laboratories Ltd's share price is subject to a complex interplay of factors. Understanding these dynamics is essential for making informed investment decisions. Continued monitoring of key financial indicators, corporate actions, and broader market trends is vital for navigating the potential risks and opportunities associated with this stock.

![Dhanuka Laboratories Ltd Share Price Homepage [dhanukalab.com]](http://dhanukalab.com/015 copy.jpg)